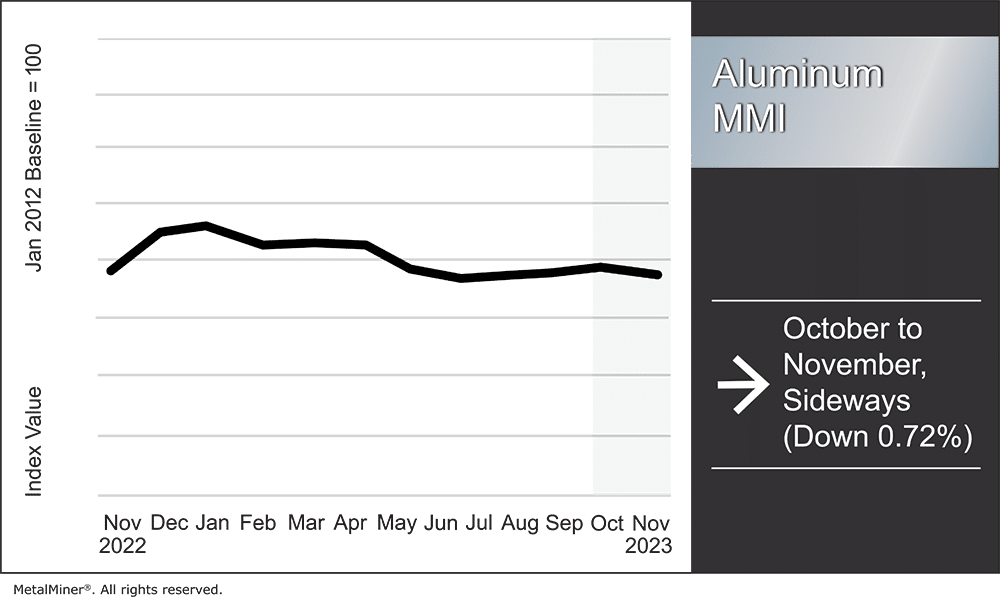

Although they fell 4.29% throughout October, aluminum prices remain trapped within a sideways trend established back in July. Prices retraced from their late-September spike but failed to create a lower low. Therefore, they continue to move within a tight range.

Overall, the Aluminum Monthly Metals Index (MMI) remained sideways, with a modest 0.72% decline from October to November.

Gain access to expert-driven market insight, ensuring your company is well-informed and prepared to tackle any aluminum market shifts. Opt into MetalMiner’s free weekly newsletter.

Aluminum Prices: Global Aluminum Premiums Move Lower Amid Demand Challenges

The aluminum market remains largely unchanged at the midway point of Q4. Aluminum prices remain range-bound, as they still lack the momentum to form a sustained up or downtrend. Despite relatively flat aluminum prices throughout H2, global aluminum premiums appear bearish. This suggests markets remain oversupplied amid ongoing demand challenges.

The Midwest premium has shown steady declines throughout the year. Since peaking in February, the Midwest premium fell over 35%. While the pace of declines appeared to slow in recent months, by mid-November, the premium nonetheless slumped to its lowest level since March 2021. As of this writing, it has yet to show any meaningful signs of a turnaround.

Europe’s duty unpaid premium also reflects a challenged market. Indeed, the premium has loosely mirrored its Midwestern counterpart over recent years. And while it found a peak later than the Midwest premium, it remains down on the year and currently sits at its lowest level since March 2021.

Compared to the West, demand in the East appeared relatively stable. The Main Japanese Port premium, which settles quarterly, held steady during the second and third quarters at $127.50 per ton. This is slightly below its two-year average of roughly $140 per ton. However, the MJP suggested a weaker market outlook by Q4, with a nearly 24% drop to $97 per ton.

Norsk Hydro Q3 Sales Plunge

Meanwhile, aluminum producers saw Q3 earnings reflect the challenged market environment. In its Q3 earnings report, Norsk Hydro revealed a sharp decline in sales. Indeed, bauxite and alumina sales plunged 89% from Q2, while aluminum sales fell by 57%. Although the company noted that demand from China’s EV and renewable energy sectors remained strong, it failed to offset the downturn of the global industrial and real estate markets.

Norsk Hydro, one of Europe’s largest producers, is far from alone in its current market woes. Although it managed to beat estimates, Alcoa also faced a Q3 loss. It seems higher energy prices continue to challenge margins despite lower raw material prices.

Tackle last-minute 2024 aluminum market Intel and strategies in MetalMiner’s December fireside chat: Metal Contracting Goldmine: Last-Minute 2024 Market Intel & Strategies. Click here.

CME Aluminum Contract Continues to Gain Market Share

Despite the down market, the CME aluminum contract continues to gain participants as volumes and open interest found new all-time highs last month. By the end of October, average daily trades showed a 170% year-to-date rise as they climbed to 6,800. Meanwhile, open interest jumped to 4,800 contracts.

CME aluminum futures have managed to built enough liquidity to serve as a viable contracting benchmark alternative to the LME. The two price points continue to show a strong correlation, and although they are not the same, the delta between them remains narrow.

Meanwhile, the LME’s challenges continue to attract competitors to its prized contracts. While liquidity remains largely stable for LME aluminum futures, markets continue to pay close attention to the impact of lower-priced Russian aluminum within its warehouses. After the volume of Russian-origin material retraced to 76% in September, stocks climbed to 79.5% throughout October. This is near where they peaked at over 81% in August.

Russian aluminum continues to benefit from ongoing demand despite self-sanctioning from some. While the differentials between Russian aluminum and material produced elsewhere remain a risk to LME prices, such risks have yet to translate to a meaningful bifurcation in aluminum prices between the LME and CME.

Biggest Moves for Aluminum Prices

- Korean commercial 1050 aluminum sheet prices rose 1.54% to $3.71 per kilogram.

- The Korean 3003 aluminum coil premium over 1050 sheet prices rose 1.53% to $3.86 per kilogram.

- Meanwhile, European 5083 aluminum plate prices fell 2.3% to $5,124 per metric ton.

- Chinese primary cash aluminum prices declined 3.91% to $2,589 per metric ton.

- European commercial 1050 aluminum sheet prices saw the largest decline of the index, with a 19.45% drop to $2990 per metric ton.

Get a visual prediction of where 2024 metal costs will land with MetalMiner Insights’ comprehensive short and long-term price forecasts. Chat with us.