Support CleanTechnica’s work through a Substack subscription or on Stripe.

Alstom’s announcement that it is pausing further development of hydrogen trains has landed with the weight of a company that has been at the center of Europe’s rail innovation story for decades. The firm will still complete existing hydrogen train orders, but R&D work has been halted after France withdrew national co-funding that was tied to an EU Important Project of Common European Interest. Alstom has begun redeploying hydrogen engineering staff to other projects and has acknowledged openly that the technology is not mature, and given the length of time and amount of money spent on it, means that it will likely never mature.

Decisions like this from major manufacturers are never abrupt. They usually mark the end of a long internal assessment of real-world results, market demand and capital priorities. Hydrogen rail was promoted heavily over the last decade as a way to decarbonize non-electrified regional routes without building new catenary overhead lines. When the manufacturer most associated with the technology signals that further development is no longer supported by economics or policy, it signals a turning point in how Europe will decarbonize rail corridors, and should outside of Europe, although the signal will undoubtedly be muted in North America and India, two other geographies attempting to deploy the bad idea.

Hydrogen trains were attractive on paper because they promised a way to remove diesel from regional routes without the large upfront costs of overhead wiring. The early framing positioned hydrogen as a flexible, drop-in replacement for diesel engines. If hydrogen could be produced from surplus renewable electricity at a reasonable price, delivered in a clean and reasonably priced supply chain and refueling was through straightforward pumps with the same reliability as diesel pumps, the regional passenger rail system could be modernized without major civil works. If, if, if. The vision appealed to policymakers and operators who faced public pressure to cut emissions while maintaining reliable service on lightly used lines. This narrative grew stronger as early prototypes like the Coradia iLint appeared and as European governments funded hydrogen infrastructure on the ground. For a short period, hydrogen seemed to offer a bridge between legacy diesel operations and a zero-emission rail future.

The real-world experience of hydrogen trains in Europe has been more difficult than these early concepts suggested. Lower Saxony’s Alstom Coradia iLint deployment was marketed as the first fully hydrogen-powered regional line. While the initial demonstration attracted global attention, the long-term operational record exposed issues that were not fully anticipated. Hydrogen supply chains were inconsistent, which forced operators to keep diesel units on standby. Fuel-cell systems required corrective work and replacement cycles that created downtime, with only four of fourteen trains currently operational, with backfilling by diesel trains.

As I noted recently, it’s quite likely that Alstom’s challenge is with getting fuel cells from Cummins in large part due to the problem of the platinum group metals required in fuel cells. Globally, there’s a 10% market shortage, leaking to higher cost platinum and major industries that can’t do without it buying up stocks, leaving little for tiny niches like the fuel cell market. While Cummins hasn’t exited the hydrogen fuel cell market, it’s written of $312 million due to it earlier this year and is undertaking a strategic review of its involvement in the segment.

RMV’s Alstom fleet in Hesse, which was supposed to be the largest hydrogen train order in the world, struggled to maintain service levels. 18 of 27 trains were taken out of operation for repairs recently. Italy’s FNM orders moved ahead, but the trains ran in limited service profiles and remained dependent on dedicated hydrogen production facilities that were challenging to operate at the scale required. France’s four-region demonstration programme did not reach sustained trial service even after years of preparation. These deployments were not failures in the sense of engineering experiments. They were operational lessons that revealed how difficult it was to make hydrogen rail reliable, affordable and scalable.

The structural problems behind hydrogen trains start with physics and cost. Hydrogen’s round-trip efficiency is lower than batteries or direct electrification, which means more energy must be generated in the first place. Fuel-cell systems require platinum-group metals and that creates exposure to raw material constraints. Hydrogen storage and compression require equipment that adds weight and reduces the flexibility of the train design. The fuel must be produced, transported and dispensed with a level of reliability that rail operators expect for daily service. Comparative cost analyses performed by regional authorities, including the well-documented work in Baden-Württemberg, concluded that battery-electric and overhead-wire options outperformed hydrogen on lifetime cost. They were also easier to integrate into existing rail operations. These are not small differences. They are systemic challenges that were always going to be difficult to overcome once hydrogen was forced to compete against technologies that benefit from the scale of the broader energy transition.

Battery-electric and electrified solutions are gaining ground because they align with the direction the rail sector is already moving. Modern battery-electric multiple units can handle routes with gaps of 80 to 120 km between electrified sections. This covers a large share of non-electrified regional lines in Europe. Strategic infill electrification, station-based charging and automatic pantograph systems allow operators to move toward fully electric service without wiring every kilometer of track. These approaches reduce capex, simplify maintenance and integrate clean traction into the broader grid. They also share components and supply chains with the rest of the electric mobility sector. The technologies that support electric trucks, buses and grid storage also improve battery trains. This cross-sector momentum shortens the development cycles and reduces risk for manufacturers. The rail sector is not adopting batteries because they are ideal for every route. It is adopting them because they are becoming the most reliable and cost-effective option for many of the routes that used to be candidates for hydrogen.

France’s decision to withdraw national co-funding for hydrogen train development became the immediate trigger for Alstom’s pivot. The funding was part of the EU’s hydrogen IPCEI programme, which required matching support from member states. Once France stepped back, Alstom no longer had access to the EU portion either. This was not a sudden political shift. It reflected years of experience with hydrogen pilots across Europe and a recognition that the operational and economic profile of hydrogen trains was not improving quickly enough to justify continued public investment. Regional governments have been shifting their rail decarbonization strategies toward electrification-first approaches, and national governments are increasingly skeptical of funding technology paths that do not demonstrate scale or clear performance gains. The withdrawal of support was the moment when the financial foundation for continued hydrogen rail development disappeared.

Alstom’s decision fits a wider strategic logic. When a manufacturer sees limited market demand, high ongoing R&D cost and regulatory uncertainty, redeployment of capital and personnel becomes necessary. Fulfilling existing hydrogen train orders, at least the ones that aren’t canceled given its announcement, is an obligation Alstom will meet, but investing in the next generation of hydrogen platforms requires confidence that future customers will materialize. That confidence is no longer supported by evidence. Rail operators are choosing wires and batteries. Policy support is shifting. Suppliers are optimizing for electric components instead of hydrogen systems. Alstom is not abandoning innovation. It is refocusing its engineering resources on technologies with clearer cost curves and more reliable demand. The decision signals that hydrogen no longer fits the strategic core of its traction portfolio.

This year’s hydrogen transportation deathwatch series has put a spotlight on the structural challenges facing hydrogen across mobility. Buses that relied on public grants are being replaced with battery-electric fleets. Hydrogen trucks in China experienced a sharp decline in orders during 2024 and 2025. Maritime hydrogen concepts have been scaled down or repositioned toward niche pilot projects. Hydrogen passenger cars have disappeared from most markets, and their refueling networks have been shrinking. Aviation startups that promoted hydrogen propulsion have pivoted to batteries or sustainable aviation fuels. Rail is now joining this pattern. Hydrogen trains were once seen as one of the few clear use cases for hydrogen mobility, but the lived experience has shown that cost, reliability and infrastructure challenges follow the same arc seen in other sectors. Alstom’s move is part of a broader recognition that hydrogen’s role in transportation is narrowing and that electric pathways are outpacing it in nearly every segment.

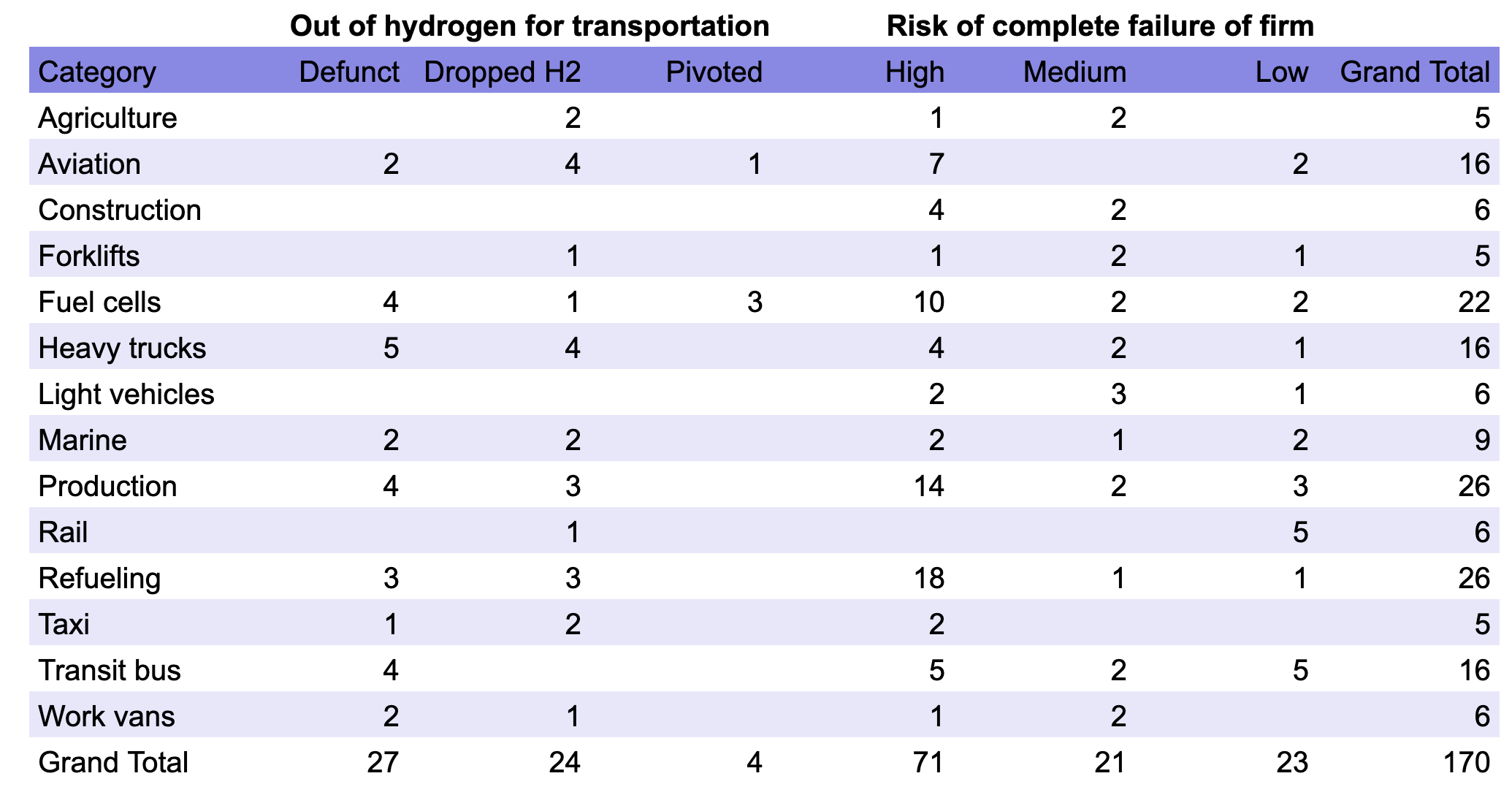

As a note on the above table, many of the firms still pursuing hydrogen in my list have been notably silent. It’s likely that many more have dropped H2, pivoted or are facing bankruptcy, but almost nobody advertises failure. I’ve been generous in my ongoing assessments of continuity of efforts, with typically two years without announcements regarding hydrogen required before I consider them to have pivoted.

Europe’s non-electrified routes still need a credible decarbonization path. Most are short regional corridors where passenger frequencies do not justify full electrification under traditional models. These routes can be covered by battery-electric trains that charge under wires or at intermediate stations. Light electrification at junctions and termini reduces the required battery size and aligns the entire system with existing electric traction standards. Some very low-density rural lines may require targeted solutions, but hydrogen has not demonstrated that it can provide reliable and economical service in those contexts. The success of rail decarbonization in Europe will depend on making choices that can be deployed at scale and maintained affordably over decades. The experience from the last five years shows that electrification-first approaches are able to meet that test.

The outlook for hydrogen rail is straightforward. No new hydrogen trains are likely to be ordered beyond the fleets already under contract. Operators with existing hydrogen trains will continue to run them, but maintenance challenges are likely to shorten their service lives. Fuel-cell modules, hydrogen supply equipment and storage systems may become harder to support as suppliers shift production to other sectors. This creates risk for operators who have yet to take delivery of hydrogen trains they ordered years ago. Some of these orders may be reconsidered or modified as the economics of hydrogen become clearer. Early retirement is a real possibility for the trains that are already in operation if maintenance cycles become too expensive or if spare parts become scarce. Hydrogen trains are now likely to follow the trajectory of hydrogen buses and hydrogen cars in Europe, where early enthusiasm gave way to operational headwinds and a transition toward electrified alternatives.

The lessons from this shift are relevant across the transportation sector. Rail operators need technologies that reduce emissions, maintain reliability and operate within constrained budgets. Policymakers need solutions that align with grid expansion and renewable energy deployment. Manufacturers need stable markets and scalable supply chains. Technologies that fit these needs will move quickly. Technologies that struggle with systemic constraints or high operating costs will slow down. Hydrogen rail was a bold attempt to bridge a difficult gap in regional mobility, but the real-world evidence has shown that battery-electric and electrified strategies are more likely to deliver consistent service with lower cost and fewer technical barriers. The transition now underway reflects an industry adjusting to evidence and choosing pathways that support long-term reliability and economic stability.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy