Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Zimbabwe’s national statistics agency, Zimstat, recently released its Transport Statistics Report for the 2nd Quarter of 2023. The report says as of June 30, 2023, light motor vehicles (up to 2,300 kg) accounted for 76.5% of the 1,583,700 registered vehicles in the country. Zimbabwe has a population of approximately 16 million people, according to the last census.

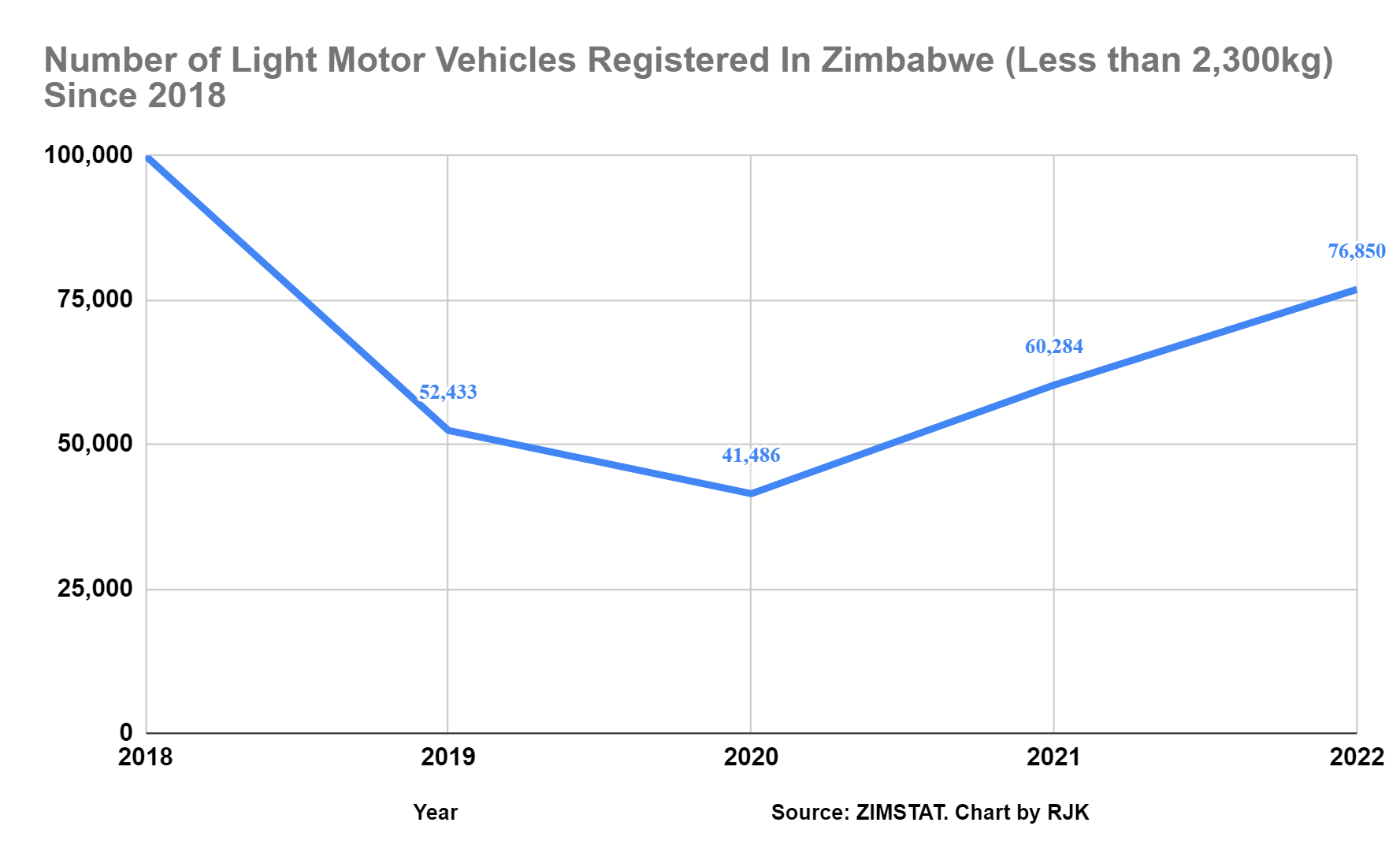

The Transport Statistics Report also shared the annual vehicle registration data since 2018 for the various vehicle segments. Here we will zone in on the light vehicle segment since it accounts for close to 80% of the registrations in the country.

Below is a chart showing how this segment has evolved since 2018. The dip in registrations in 2020 due to the COVID-19 pandemic is clear to see. However, there was also a slowdown in registrations in 2019 due to the periodic economic challenges in Zimbabwe (most probably). Registrations appear to be picking up again from 2022, and judging from the sales in Q1 and Q2 in 2023, registrations look set to grow again this year, as 34,085 light motor vehicles have been registered in the first 6 months of the year.

331,047 light motor vehicles have been registered in Zimbabwe since January 2018. 95% of these are used vehicle imports that are about 8 years old when first registered. Vehicles are mostly imported from Japan, and a smaller portion from the United Kingdom. 99% of these vehicles are still ICE vehicles.

Approximately 95% of these vehicles are imported as 8-year-old used vehicles from Japan and the United Kingdom. 99% of these vehicles are still ICE vehicles. A lot of them are bought by customers through small loans from banks paid over 3 years or so. A lot of consumers also save up and just pay cash. These customers may use these vehicles for 5 years or so and then resell them on the “local used vehicle market.” The vehicles would thus be about 13 years old. Being driven on the interesting local roads that are not as perfect as those in Japan and the UK, the vehicles will be in much worse shape at 13 years than they would be in their original home markets.

A good chunk of these cars are small hatchbacks such as the Honda Fit plugless hybrid or the Toyota Aqua, also a plugless hybrid. Car dealers import these types of vehicles from Japan and sell them locally from about $9,500 USD. Some other popular cars are larger, but also 8-year-old-or-so Toyotas, Mazdas, and Honda that start from about $17,000.

Some of these cars will have a lot of issues when they arrive from Japan, as you can expect from an 8-year-old ICE vehicle. One of my friends recently bought one and it had a big issue with the gearbox. He had to spend a lot of money to rectify this. This does not appear to be an isolated incident as a few people have told me that they had the same issue with these cars, which is a major inconvenience as these cars will obviously be out of warranty. Another issue that seems to be common as well is the issue of these hybrids’ batteries arriving with some degraded cells or other issues with the battery packs. There is now a growing network of mechanics that are offering services related to testing battery packs and then replacing the bad cells or the whole battery pack. This issue will only get bigger as the Japanese market is dominated by these plugless hybrids and therefore more of these vehicles find themselves in places like Zimbabwe.

A lot of people save some of their hard-earned cash to buy an 8-year-old vehicle and in no time find themselves having to spend quite a bit to service, maintain, and operate that vehicle. This sounds like a recipe for disruption to me. This is where I believe there could be a big opportunity for the new generation of small EVs that are starting to pop up in China. Here I only used Zimbabwe as an example, where an average of about 66,209 light motor vehicles have been imported over the last few years. If we add Tanzania, Zambia, Kenya, Ghana, and similar markets, you are looking a quite a large addressable market for competitively priced brand new small electric vehicles to break the cycle and to start to reduce the imports of these 8-year-old used light motor vehicles significantly.

Vehicles such as the Wuling Bingo and the BYD Seagull come to mind, and these types of EVs could really disrupt this sector and help catalyze the transition to electrics in the process. If these vehicles could land between $15,000 to $20,000 (depending on the type of vehicle) — including local import duties, taxes, and/or local assembly dynamics — there could well be a revolution in the auto sector on the African continent. Some new innovative financing models to help increase the customer base may also be needed to catalyze this, but even on the upfront purchase price, keep in mind the lower operational and “fueling” costs associated with EVSs — the choice of a brand new electric car for about $15,000 over a $10,000 8-year-old ICE vehicle seems pretty straightforward if these vehicles were made available in these African markets. Right now, consumers in these African markets in this price sensitive segment do not have any viable BEVs to go for. It would be great for the SAIC–GM–Wuling JV and BYD (and other Chinese BEV players with similar vehicles) if they prioritized some of these African markets.

The BYD Seagull was officially launched earlier in this year in China starting at 73,800 yuan ($10,690). Just under $11,000 for a compact hatchback with a 30.8 kWh battery is really impressive. The Seagull is based on BYD’s e-platform 3.0 and falls under the Ocean series, which also includes the Dolphin and the Seal. The Seagull has a single electric motor with 75 hp (55 kW) and 135 Nm of torque. It is front-wheel drive. It also has a top speed of 130 km/h, and acceleration from 0–50 km/h takes 4.9 seconds. The two Blade battery options of 30.08 kWh and 38.88 kWh give ranges of 305 km and 405 km (CLTC), respectively. The Seagull has fast charging, which takes 30 minutes to get from 10% to 80% battery.

The Wuling Bingo looks like another smash hit from the SAIC, GM, and Wuling joint venture. The Bingo’s dimensions are 3950/1708/1580 mm with a wheelbase of 2560 mm. It will have two options, one with a 30 kW (41 hp) motor and another with a 50 kW (68 hp) motor. These options will come in a 17.3 kWh and a 31.9 kWh version — with range ratings of 203 km and 333 km, respectively. The Bingo starts from just under $9,000 in China. I really hope these vehicles come to African markets as well as more markets around the world soon.

Featured image courtesy of BYD

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

EV Obsession Daily!

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

Tesla Sales in 2023, 2024, and 2030

CleanTechnica uses affiliate links. See our policy here.