Permission Now Required

Many years ago, as a newly hired consultant for a Big Four firm, I was on my first road trip along with my new office mate, Michel, to Montreal. Expense account travel was altogether new to me and as the more experienced consultant, Michel took it on himself to teach me the expense account ropes—adhering to the expense policy, handling receipts, and submitting claims.

Michel lived by four rules:

- Expense early, so that the accountants get used to seeing your claims.

- Expense often, so that your claims appear normal.

- Expense large amounts, so that the accountants reevaluate what constitutes acceptability for certain types of expenses.

- Beg for forgiveness, rather than ask for permission.

It was Valentine’s Day, and at Michel’s insistence, we booked a team dinner at one of the most expensive restaurants in a city well known for pricey haute cuisine. The menus offered to our group did not have prices, the wine list was as thick as a phone book, and the final bill was hundreds of dollars per person, which was excessive even by Michel’s high living. A few weeks later, I was subjected to my only expense audit in 29 years. I was hauled into the auditor’s office, where he asked me just one question:

Was Michel with you?

Shortly thereafter, the company tightened up its expense policy so that team dinners required explicit prior approvals, daily limits were imposed, and claims were due weekly. Michel wisely left the company, and I fled to Hong Kong.

Asking for Permission

Unlike Michel who preferred after the fact atonement, the energy industry is very accustomed to seeking permission to do things. It is the norm in industrialized societies to set out the acceptable parameters for investment actions that can impact others, and to have project proponents follow a set of established regulatory processes. These processes take time, but they could be trusted to yield a predictable outcome for project investors and proponents.

Until recently.

Deploying energy infrastructure is an increasingly fraught endeavour in many parts of the world.

The regulatory environment in many jurisdictions is now thick with rules and requirements. Frameworks are patchwork, siloed, constantly evolving, and difficult to navigate without a high degree of costly professional assistance. Regulations and filings prepared by market participants do not present as neatly tabulated numerical spreadsheets, but rather as structured and unstructured text. Moreover, governments continue to react to pressures of all types (accumulated GHG effects, water and wastewater, energy security, decarbonization), by layering on additional requirements. The number of regulators may be growing, with indigenous people now recognized in at least one jurisdiction as a bona fide environmental regulator.

Despite the growth in regulatory content in scope and specificity, the actual working regulatory processes, from how they execute, their means of communications, suffer from a lack of innovation and renewal. The digital tools that have transformed so many other industries are often lacking in the regulatory setting.

Project proponents do not always benefit from this stability. Stable processes tend to fall behind the technology curve, become dated, and rely on methods and practices that fall from favor. Faxes are a good example. And for any given project, the owner’s team will only seek regulatory approval once, leading to limited learning curve effects. Skilled professionals who are knowledgeable in these complex regulatory settings are scarce and expensive.

Market participants continue to see energy demand growth across all energy value chains. With an average yearly oil well decline of 6% per year, and a 2% market growth rate, the oil industry alone needs to discover, produce and deliver 8 million barrels of new production each year. Projects are becoming more interrelated and co-dependent. Yesterday’s simple oil production project is tomorrow’s oil project plus associated gas merchant power plus carbon capture and sequestration project.

Meanwhile the opposition to energy infrastructure is now well organized and very capable at mobilizing public opinion and political opposition. Social media tools provide the mechanism for previously disorganized and ineffective opposition efforts to become larger, more coordinated, and far more impactful. The best illustration of their impact is the opposition to pipeline projects that have stymied new development for the past decade.

Regulatory and opposition risk is now the single largest risk area for project proponents. Outcomes from regulatory processes are now unpredictable in terms of timelines, imposed restrictions and limitations, and any additional hurdles to confront. Intervenors of all stripes, including those with no direct or obvious exposure or interest in a project may be granted status.

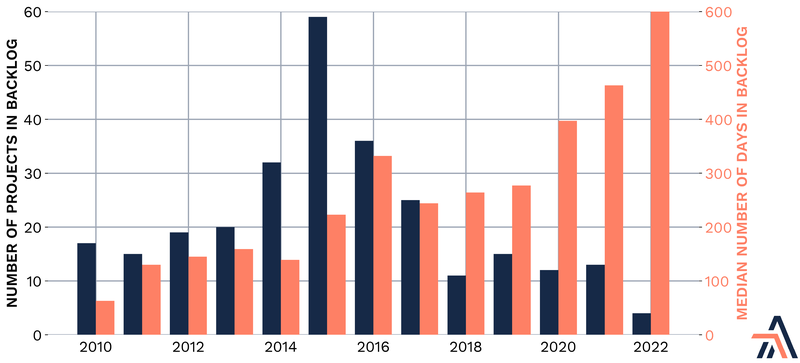

For example, a research article from Arbo shows the amount of time FERC (the regulating authority for interstate pipeline projects) takes to evaluate and issue certificate decisions — after all environmental reviews are completed — has increased steadily, even though the gas pipeline buildout has waned and the number of projects under consideration at any one time has significantly decreased.

FERC Backlog: Number of Projects and Number of Days

While the ability to get a FERC certificate becomes increasingly unpredictable and the process more lengthy, for developers, it may be the first of many obstacles to in-service.

The developers of Mountain Valley Pipeline (a project authorized by FERC in October 2017) originally stated it would begin flowing gas from the bottlenecked Marcellus Shale by the end of 2018. But anyone who follows industry news will recall the many headlines since, as the project has been stymied by repeated appeals of its federal permits. Legislation directing federal agencies to “continue to maintain” those permits was included in the recent debt limit bill (the Fiscal Responsibility Act of 2023). And, as an additional protection against the three-judge panel of the court that repeatedly voided them, it also stripped the courts of authority to review the required approvals, and directed any challenge to the statute’s constitutionality be heard in the DC Circuit. However, twice last week, the same court again issued stays of two of the pipeline’s required permits (ignoring the law passed by the other two branches of the U.S. government). MVP may well be the 4th pipeline case to reach the US Supreme Court in the last half decade.

Step Up The Pace

Over the past decade, the U.S. has taken note of a changing global view of energy transition, the successes of a resurgent China, and the possibility of losing its globally dominant position permanently in a whole range of fields, including renewable energies, clean energy products, energy storage technologies, battery electric and hybrid vehicles, and clean tech. In response the Biden Administration enacted the Inflation Reduction Act, which injected half a trillion dollars of incentives aimed at unlocking American innovation in these fields.

Globally, the amount of investment required in energy is massive, and the IRA is relatively modest, but the resulting inflows have juiced domestic demand, driving up competition in a range of fields, for products like clean hydrogen, carbon capture and storage, and related infrastructure.

The inflow of dollars aims to spur innovation on many fronts, including digital investments, new technologies, novel solutions, and creative commercial structures, at a pace not seen for almost 2 decades. The sheer volume of energy transition projects is dramatically elevated, driving up costs, clogging the regulatory approval mechanisms, and materially slowing down approvals.

There is now a frenetic race underway to secure the best projects with the best market positions, for the long term, in the face of a permitting timeline that exceeds the time available to avert the worst of climate effects. For proponents, chasing projects with high regulatory risk wastes both time and money in a race with little tolerance for error. Delayed in-service dates for projects reduce the value of their future revenue streams, exacerbated by the current higher interest rate environment. Such delays can result in promising projects falling in value and being canceled.

But just as there can be no energy transition without more power transmission, there can be no transmission pipelines without regulatory permission. Overcoming regulatory risk is now the singularly most important factor in project success.

Project proponents are asking themselves how they can more speedily and more thoroughly evaluate their growing portfolio of project investments around regulatory risk areas, so that only the best investment-grade projects proceed.

There are many factors that can help, including quality relationships with regulators and better connections with impacted communities, but one stands out: Improving the execution of the regulatory process, which is within the grasp of all proponents.

Help Wanted

Due to the complexity and fragmentation of the regulatory and compliance landscape, and limits on individual regulatory agencies to act within their mandates, no one regulator, including FERC, can overhaul the total regulatory and compliance setting. No single project proponent or owner can undertake the development of regulatory analytics because of the risk that the data or the engine will be used just once and fail to recover its costs.

However, one technology company HAS brought together the special combination of deep multi-faceted energy industry insight, permitting process, regulatory and legal knowhow, and technology capability to help infrastructure developers, operators, and investors crack the code on this problem.

Arbo is a specialist technology-and-advisory business that has delivered the new technologies, advanced analytics and algorithms to improve the ability of project developers to execute in this environment.

Arbo targets the regulatory setting precisely because of the characteristics of this domain and its potential gains in performance:

- Exceptionally large datasets for past, present, and future projects

- Complex multivariable analysis

- Sluggish human-centric execution

The first step that Arbo executes is to aggregate energy regulatory information into one place to ease search and analysis. This requires structured data capture integrations that tap into the thousands of applicable regulatory data sets and repositories. Arbo’s human expertise in regulatory filings and legal frameworks guides such work.

Next is the creation of a generalized data analytics engine that is tuned to respond to the contours of regulatory questions and analytic needs. This engine is the basis for the delivery of business intelligence that is useful for the commercial strategy teams, project finance, regulatory compliance, and the c-suite.

Once in place, the data and analytics engine can be extended to provide forecasting and greater predictability of regulatory outcomes. This kind of analysis is very common in plant settings, where events are tracked on a real time basis so as to detect emerging conditions that are outside planned boundaries. Applying this approach to regulatory analytics allows project proponents to flag the impacts of potential intervenors and their motivations.

The power of such technology and innovations affords Arbo and its customers the ability to anticipate regulatory changes and timetables, the possibility and likely impacts of litigation, emerging operating risks driven by changing regulations, and policy risks.

Driving Energy Commerce

Arbo’s vision is to enable America to build its needed infrastructure and retain its energy independence, now and in the future, by transforming energy regulatory data into business intelligence and insights which inform the strategic decisions of infrastructure developers and commodity buyers.

Project proponents seeking to gain an advantage in their approval processes, high grade their portfolios, or anticipate regulatory and opposition risks should definitely investigate how Arbo can assist their market development activities.

I drew the artwork for this week using an iPad and Procreate.

Share

Share This: