Each week, XI Technologies (“XI”) uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here.

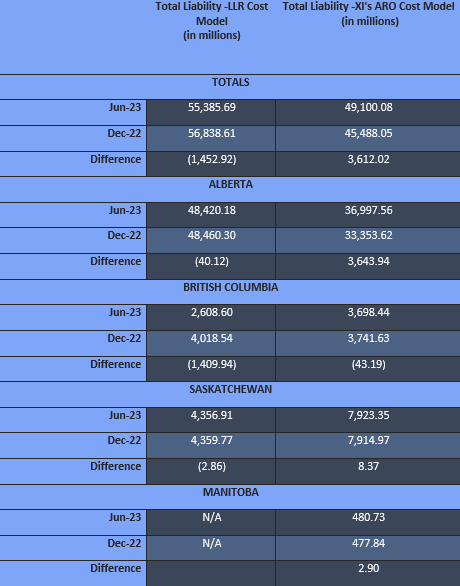

As we slowly approach the end of the year, we took the opportunity to review the progress on reducing liabilities within the Western Canadian Sedimentary Basin (WCSB) up to the end of June 2023.

XI conducted an analysis of liability values and reclamation totals with the aim of obtaining a comprehensive overview of the status of oil and gas liabilities, similar to the evaluation we performed last year.

LIABILITIES VALUE

The following information was compiled using XI’s ARO Manager with XI’s 2023 Cost Model (plus AssetSuite’s well and facility data). This was then compared with AssetBook’s LLR Module using the provincial governments’ cost models (derived from their various directives; for example Alberta LLR). Pipeline information was specifically excluded for this compilation as provincial calculations do not currently include those assets.

Figure 1 – Total Year Over Year Liabilities using XI’s ARO Cost Model vs Directive LLR Cost Model

Overall, based on the governments’ cost models, liabilities have been reduced by $1.45 billion. It is worth noting that, while certain reductions may not appear to have met initial expectations of reducing liabilities based on the increased mandatory closure spend targets set by the governments, we must consider the concurrent factor of ongoing drilling activities. In the first half of 2023 alone, 5,594 new UWI wells have been drilled. This development has resulted in a liability increase that nearly matches the rate of liability reduction.

For a look at five major differences between XI’s proprietary third-party cost model and regulator LLR costs, download this case study.

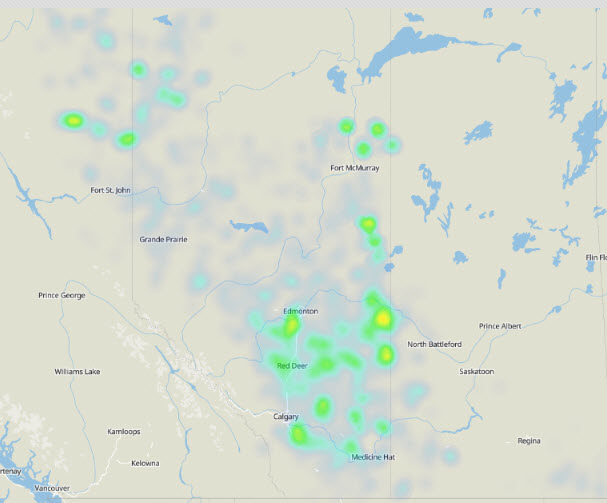

RECLAMATIONS IN WESTERN CANADA

There have been 4,445 well and facility licenses which have changed to Reclaimed or Rec Exempt status during the first half of 2023. Calculating the monies spent to get these licenses to a reclaimed status, there has been $245b invested over the past years (representing across 3,345 locations).

Figure 2 – Wellsite Reclamation between January & June 2023

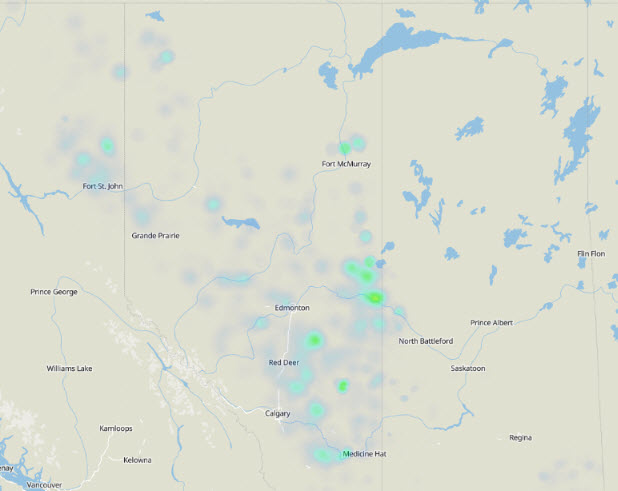

There have also been 4,573 licenses which changed to abandoned status (representing about $253 billion).

Figure 4 – Wellsite Abandonments from Jan to Jun 2023 across WCSB

Based on our 2022 blog article entitled “Abandonment and Reclamation across WCSB from 2021 to 2022”, the Average Cost for full reclamation was approximately $43,100 per site across all provinces in 2021 and $23,100 per site in 2022.

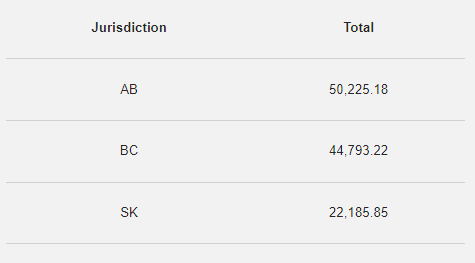

Costs from the first 6 months are a little different:

This data was calculated using XI’s liability software module called AssetBook ARO Manager. ARO Manager is the only standardized tool for estimating and monitoring asset retirement obligations in Western Canada’s oil and gas sector. It is ideal for over-the-fence evaluations of potential acquisitions and also for keeping track of your internal ARO, replacing cumbersome spreadsheets.

To learn how XI’s ARO Manager can help with the planning and reporting of liability management, visit our website or join us for our upcoming webinars:

AssetBook 101

When: Tuesday, October 3

Time: 10:00 a.m. MT

Where: Zoom – Register here

Estimating ARO

When: Thursday, October 19

Time: 10:00 a.m. MT

Where: Zoom – Register here

Share This: