Support CleanTechnica’s work through a Substack subscription or on Stripe.

BEVs represented 36% the total Chinese car market in October.

We saw plugins score another million-plus sales in September (1.3 million plugins, in a 2.2-million-unit overall market, down 1% YoY), but growth has been slowing down, with October showing only a 7% increase over October 2025.

Digging deeper into the numbers, while BEVs continued to grow, going up by 20% to 812,000 units, or 36% of overall sales, PHEVs were down again, this time by a significant 10% YoY, to some 470,000 units. And even EREVs are not escaping the plugin hybrid doom and gloom, as they were also down, by 8% YoY.

Counting both powertrains together, we get close to 1.3 million units, which is near a record level, only a few thousand units below the all-time high set last December. So, if this record does not fall in November, then it will surely happen in December.

With BEVs continuing to grow by double-digit percentages and PHEVs accumulating months in the red, have we reached a turning point in PHEV adoption?

Lately, we have been hearing conflicting narratives regarding the Chinese EV market, with some continuing to talk about surging sales, while others highlight the struggles that the market is experiencing now, and in the future.

In my opinion, both narratives can be right, depending on which part of the market you look into. As we will see here, the data shows that while some are continuing to grow fast, others are struggling, depending on which horse you have bet on.

For example, if you are a BEV maker and/or focussed on small to compact vehicles, you will probably be on your way up and ramping up production, while on the other hand, if you are focused on PHEVs and/or big SUVs, then you will likely be in trouble.

(And yet, many OEMs are still pumping out new big, fat, large SUVs and PHEV/EREVs…. Not because they know there is a market for them, but because those vehicles have big, fat margins.)

Back to October, this month’s result pulled the share to 57%, while the BEV share of the market rose to 36%. Expect to see plugins continue to grow their share in the last two months of the year. For now, plugins have 53% of the total auto market this year (33% just for BEVs), which means that most new cars sold in China this year have a plug!

(Could China reach 55% plugin vehicle share by year end? And be fully electrified before 2035?)

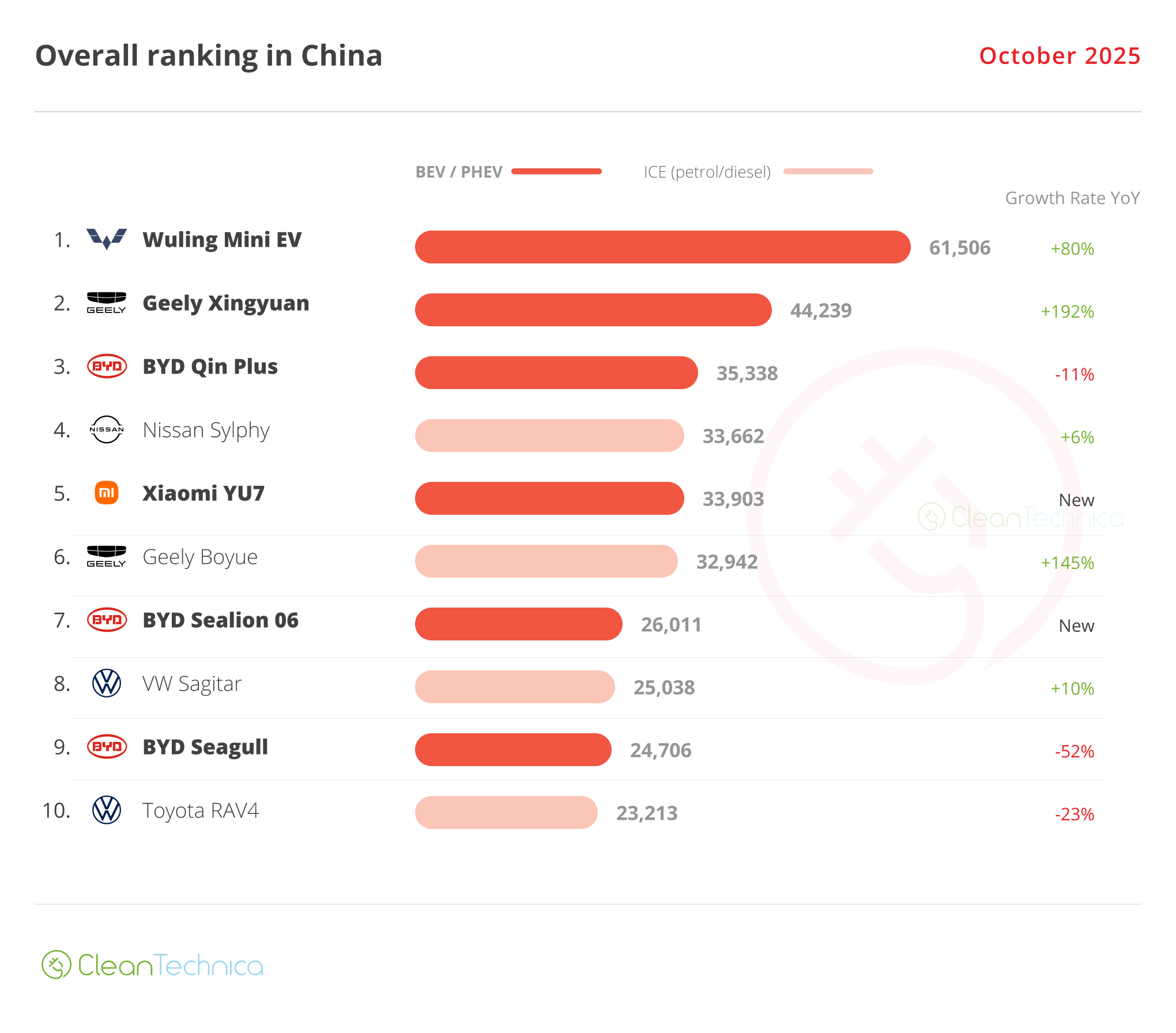

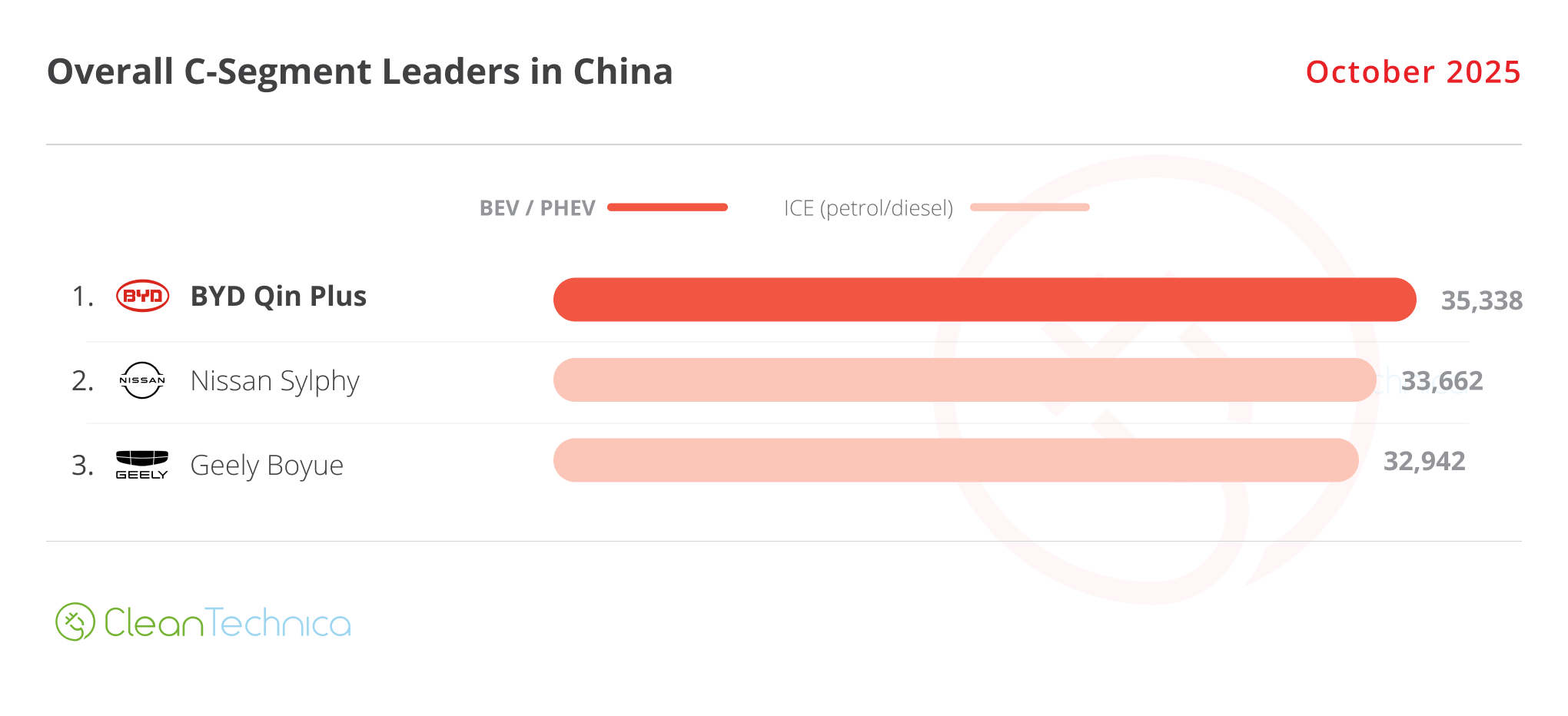

In the overall ranking, in October, fully fossil-fueled models had a rare good month, placing four representatives in the top 10. The best placed was the Nissan Sylphy in 4th, a surprisingly good standing for the compact sedan. The remaining ICE models were the #6 Geely Boyue, with the crossover profiting from a recent refresh, the #8 Volkswagen Sagitar sedan (a VW Jetta made for China), and the #10 Toyota RAV4.

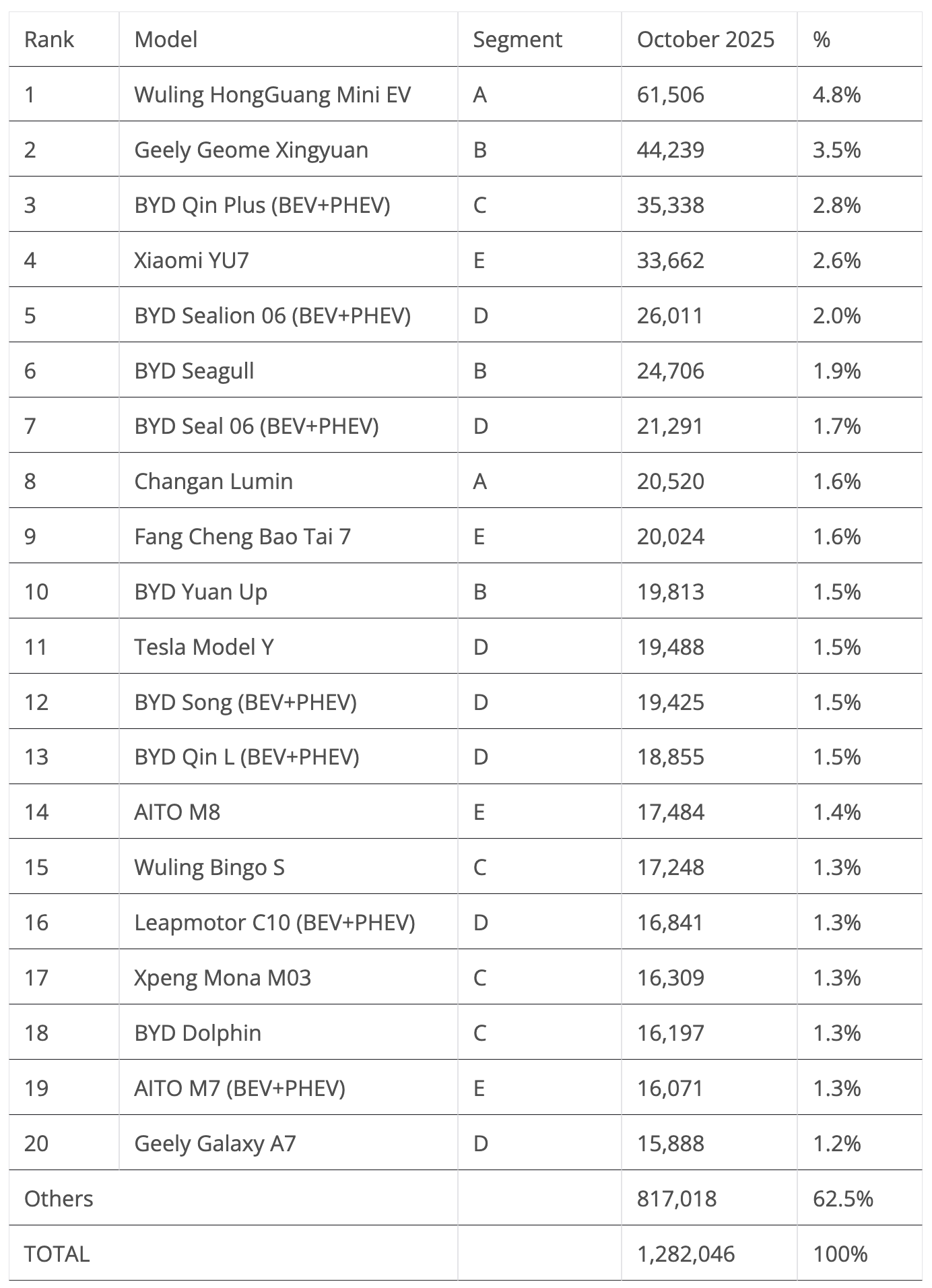

Still, the highlights belonged to the BEV field, starting with the surprising #1 spot of the tiny Wuling Mini EV and ending with the 5th spot of the new Xiaomi YU7. The sporty crossover, a sort of a lovechild between Ferrari and McLaren, ramped up production to a level that allowed it to reach the top 5 for the first time. And it was the best selling SUV on the overall market!

Looking at the best sellers in several size categories, besides placing representatives in the C segment (compact cars), ICE powertrains this time also placed one model in the midsize category. With the category’s best sellers (BYD Song, Tesla Model Y) experiencing slowing sales, there was an opening for the Geely Xingyue L to join the podium, in 2nd place. This allowed Geely to place representatives in four categories (A, B, C, D), which is as many as BYD had (B, C, D, E). BYD’s domination in China is weakening by the day….

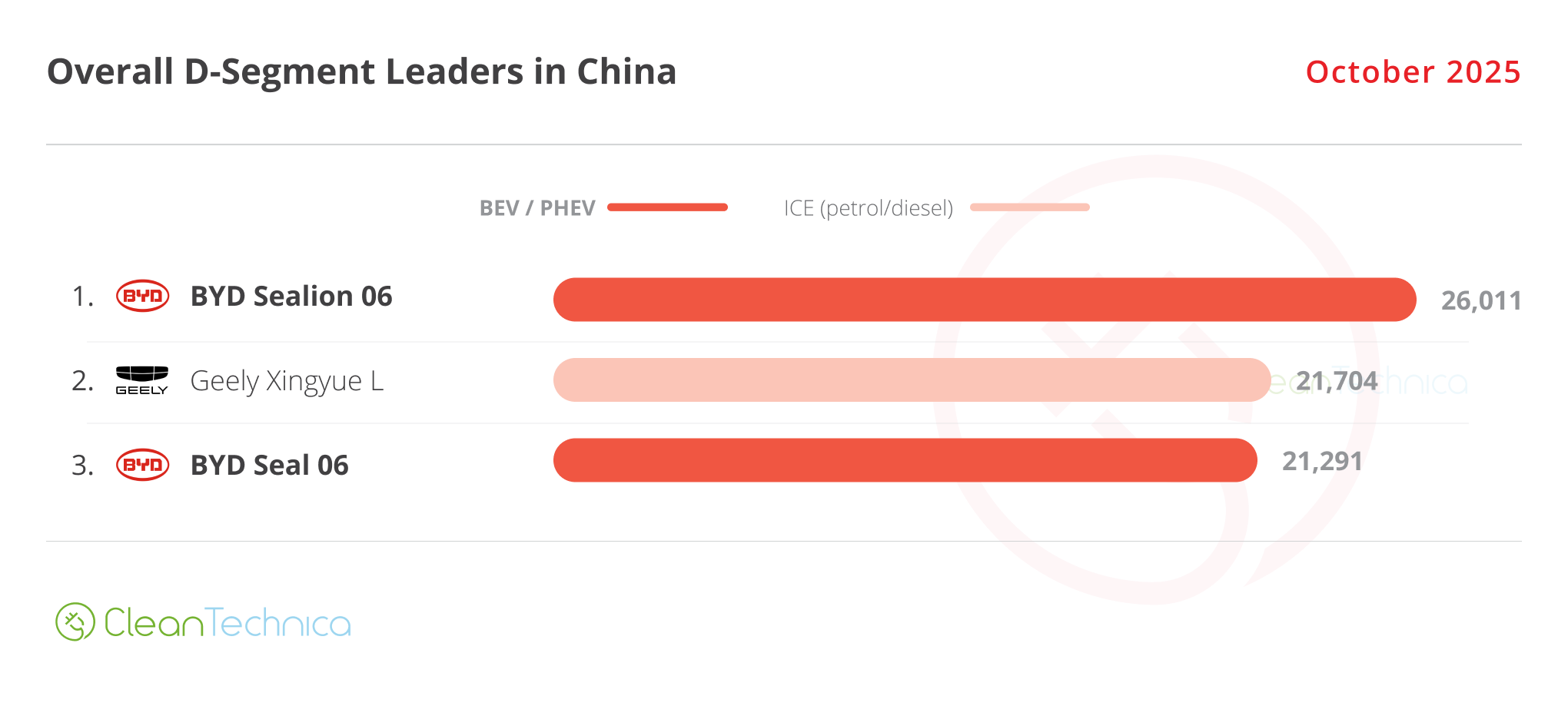

Looking at individual models, the biggest surprise was the podium for the midsize category. Besides the surprise appearance of the #2 Geely Xingyue L, the BYD Sealion 06 won the category title in October, while its sedan relative, the Seal 06, won the bronze medal.

With the BYD Song on its way out of China, while it goes abroad to continue its career for a couple more years (like some semi-retired soccer players), and the BYD Qin L failing to meet expectations, it is up to these two — the Seal 06 and the Sealion 06 — to defend BYD’s colours in the midsize segment.

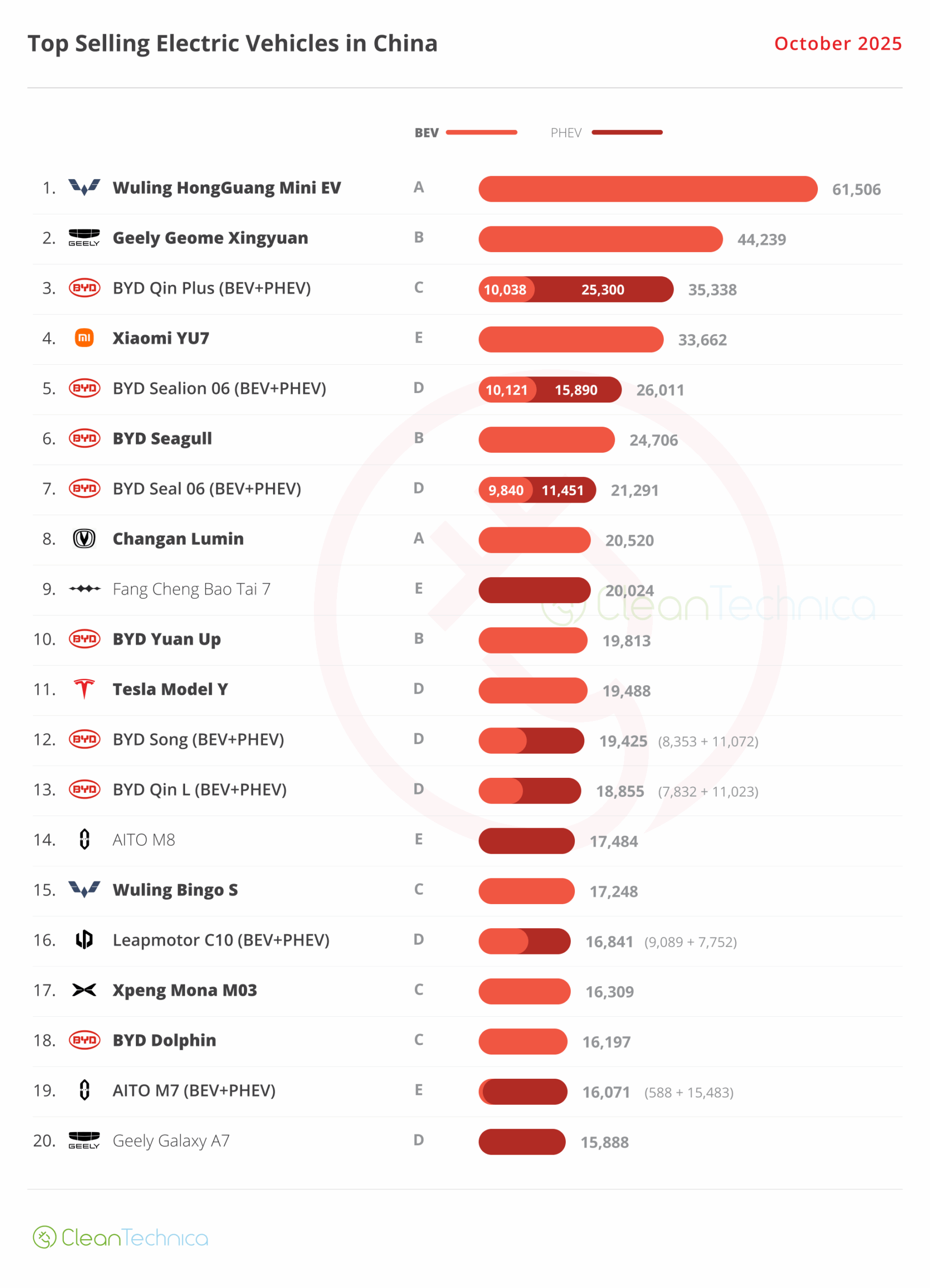

Elsewhere, while the Wuling Mini EV (A segment) and Geely Xingyuan (B segment) dominate their categories, Fang Cheng Bao, one of BYD’s premium brands, had a surprise podium presence in the full size category, thanks to surging deliveries of its new Tai 7 SUV.

Here’s more info and commentary on October’s top selling electric models:

#1 — Wuling HongGuang Mini EV

This tiny EV is taking full profit from its generation change, which happened late last year. It is now back among the top sellers, and in October it collected 61,506 registrations, a significant 80% increase year on year and a new monthly sales record for the tiny EV, allowing it to snap up the leadership position in that month at ease. Thanks to a more rounded design, which kind of reminds me of the face of a Panda, and upgraded specs and interiors, SAIC’s smallest hatchback has lost its barebones feel. It now looks more car-like. Wuling even offers a five-door version! Despite all of this, the price hasn’t increased that much, with SAIC’s star model starting at $5,500.

#2 — Geely Geome Xingyuan

Geely has struck gold with this one. After a number of failed attempts to launch models that would stay on the best sellers table (Galaxy L6, Galaxy E5, etc.), the Hangzhou make finally found the winning formula to not only beat BYD, but also win the leadership race in the fierce Chinese automotive market. With BYD owning most of the market segments, thanks to multiple popular models, the little Xingyuan profited from the fact that BYD was underrepresented in the lower segments, which had left a space between the A to B segment Seagull and the B to C segment Dolphin. With pricing and specs closer to the Seagull, but with interior space and quality closer to the Dolphin, the small Geely carved out a space of its own. This October, the small hatchback was second, and although it failed to continue the seemingly never-ending record streak, it still nevertheless delivered a not too shabby 44,239 registrations. With volume exports set to start in the coming months, Geely hopes to maintain enough domestic demand for its small hatchback, to not only win this year’s model title but also start next year as the strongest candidate for the 2026 title.

#3 — BYD Qin Plus (BEV+PHEV)

The old dog once again joined the top 5 in October, thanks to 35,338 registrations, a rather good performance. Its sales were down, although not as spectacularly as other BYD models, which allowed it to be once again the best selling BYD on the table. In the same period, its brother in arms, the Song, was down to less than half of last year’s sales! Troubles ahead for the Shenzhen make? Back to the Qin’s performance, this volume meant that it was the best selling sedan in China, all powertrains counted. The 7-year-old body might be showing some wrinkles, but the low prices still provide significant demand for the sedan.

#4 — Xiaomi YU7

This year’s most anticipated model, Xiaomi’s YU7, surged to 33,662 deliveries as its production ramp-up continued. The YU7 got hundreds of thousands of locked-in orders within hours. Those orders have to come from somewhere, and with the market already at 50% share, it won’t be just from ICE models…. Yep, all top EV players that have midsize to full size SUVs are feeling the gravitational force of the YU7, a model that will surely collect plenty of podium presences (and wins?) in the coming months. This 4th position is just the beginning….

#5 — BYD Sealion 06 (BEV+PHEV)

BYD’s new midsize crossover scored 26,011 registrations, allowing it to win another top 5 standing. With the BYD Song going into EV Heaven and the Song L failing to live up to the predecessor’s career, will the Seal 06 be the one to replace the Song on the top of the sales charts? It is positioned at around 150,000 CNY (around $22,000) and has the standard BYD qualities of value for money, design, and connectivity. On the EV specs side, the PHEV version has an above average 27 kWh battery, and the BEV version’s top battery has an unimpressive 79 kWh. Also, the 800V architecture is a plus at this price point. This means that the Sealion 06 has enough value for money to have a good career, but it will be difficult, if not impossible, to repeat the Song’s three-peat title streak (2022, ’23, and ’24), as the competition is increasingly more competitive and the Sealion 06 lacks standout features and specs.

Looking at the rest of the best seller table, despite not having the same peak form as it had a few months ago, the Shenzhen OEM still had nine representatives on the October table, with the highlight going entirely to the new Fang Cheng Bao Tai 7, which joined the table in 9th in its second month on the market thanks to 20,024 registrations. Will the Land Rover-inspired SUV become a success story? With the BYD Song’s star player role now up for grabs, BYD could use an SUV that can sell by the boatloads, especially one like the FCB Tai 7 that has some really nice profit margins….

Elsewhere, we have a few fresh faces. The brand new Wuling Bingo S joined the table at #15, in only its second month on the market. Wuling’s answer to the BYD Dolphin/Geely Xingyuan is promising to be a regular fixture in the top half of the table, maybe even becoming top 5 material. The Leapmotor C10 SUV profited from a recent refresh to win a rare top 20 presence, at #16, thanks to a record 16,841 registrations. At #19, we have the AITO M7 — thanks to an all-new generation, it has seen its sales surge to 16,071 units.

Finally, Geely placed a second representative on the best sellers table. The Galaxy A7 sedan scored a record 15,888 registrations. Geely’s answer to BYD’s midsize sedans is starting to become a force to be reckoned with.

Outside the top 20, we have a number of models ramping up. BAIC’s Arcfox T1 compact EV was the most impressive of them, not only because it closest to joining the table (at 15,050 registrations, it was only 800 units behind the #20 Geely Galaxy A7), but also because it is coming from the BAIC stable. BAIC is an OEM that has been outside the top positions in the past few years but has three Best Selling Model trophies in the bag (BAIC EC-Series in 2017 & ’18 and BAIC EU-Series in 2019).

The others were the Geely Galaxy M9, another large SUV coming from Geely’s spaceship after the luxurious Zeekr 9x, and the tech-focused Lynk & Co 900. The more budget-friendly and utilitarian M9 had 10,006 registrations in its 3rd month on the market.

NIO seems to have finally found a volume seller, with the Onvo L90 full size SUV likely benefitting from the current market’s shift into BEVs. The model continued racking up orders and reached 11,722 units in October.

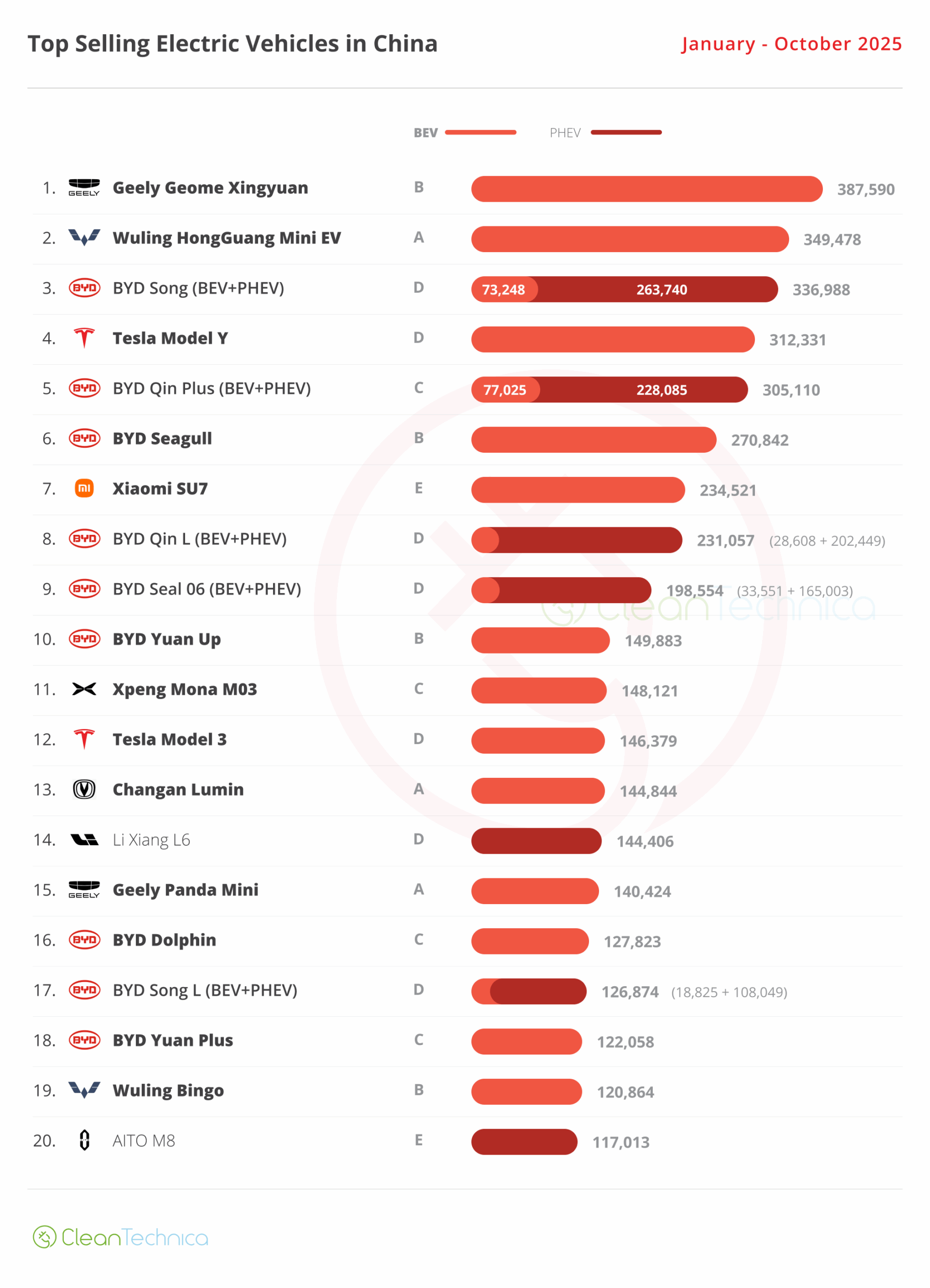

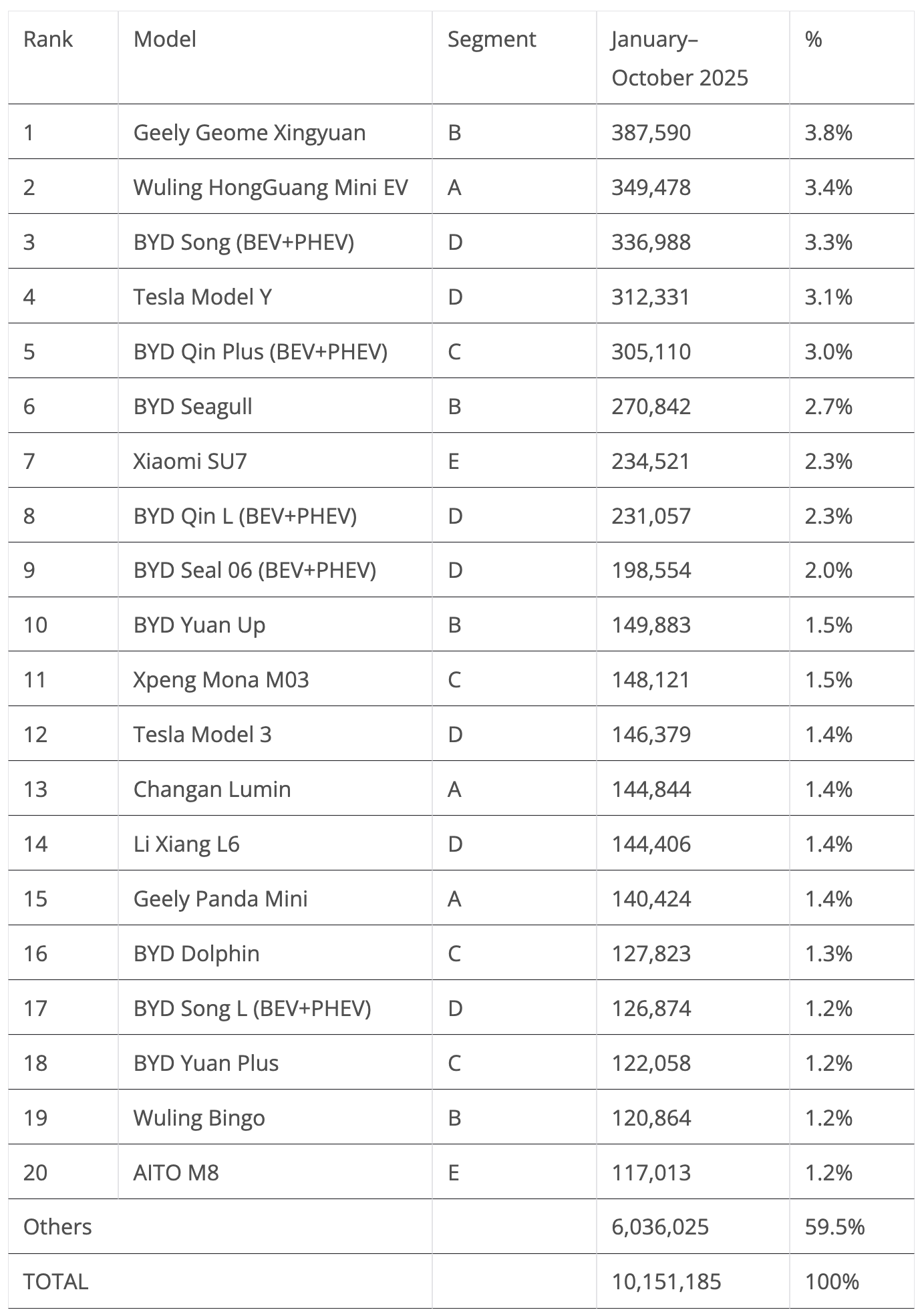

Looking at the 2025 ranking, the little Geely Xingyuan seems poised to succeed the aging BYD Song as the best seller in China, and considering current sales trends, it seems the Geely model won’t leave that position anytime soon.

If this trend gets confirmed and the Xingyuan wins the title this year, it will be a first for the Geely conglomerate, and the end of a three-year reign of the BYD Song. And to think that, up until this year, no model from the Geely mothership had even made it on the podium.

An important position change was the little Wuling Mini EV jumping two positions, into the #2 spot, and considering the current market dynamics, I would say the Wuling EV has a better shot at reaching the #1 spot (about 20% chance) than others have of stealing its silver medal.

Segment-wise, this would also be a significant change. After two years of podiums made up entirely of midsize models, 2025 will be the year that small cars regain protagonism on the podium. With a #1 plus #2 win, it will be the first time since 2017 that two small cars win silver and gold.

Now, regarding the 3rd position, #4 Tesla Model Y remains the favorite for the bronze medal. After all, the BYD Song is in phaseout mode, and the old-timer #5 BYD Qin Plus simply does not seem to have enough pace to surpass the US crossover.

Also interesting to see in the current standing is that we have four models from four different brands in the top positions! Hurrah for diversity!

Further down, there were a few position changes. Profiting from the expected slow month of the Tesla Model 3, the BYD Yuan Up and Xpeng Mona M03 climbed to 10th and 11th, respectively, while the cutesy Changan Lumin hatchback surpassed the Li Xiang L6 (9,680 units in October, down 63% YoY), with the SUV feeling the full strength of the current PHEV downturn.

Further below, there was good news for the BYD Dolphin. Despite having an average month (18th, with 16,197 registrations), it benefitted from a cascade of horrible performances of its direct competitors (the BYD Song L was down 73% YoY, the BYD Yuan Plus was down 72%, and the Wuling Bingo was down 64%). It therefore jumped three positions, into 16th, in October.

Interestingly, all models that went up in the table this month had two things in common:

- They were all BEVs.

- They ranged from city (A-segment) to compact (C-segment) models.

Broadly speaking, BEV and small are IN, while PHEV and large are OUT.

Looking at the overall manufacturer ranking (not just electrics), it seems BYD has found the demand ceiling in its domestic market. October was another month in red, as it saw its sales crash by a significant 38% YoY, to some 255,000 units, the fourth month in a row of drops.

With several models losing sales bigly (Song, Song L, Yuan Plus), the BYD Seal 06 and Sealion 06 are doing their best to keep the ship steady.

On the other hand, #2 Geely is in the opposite dynamic. Having seen its sales jump 50% in October, it surpassed the 200,000 unit mark for the first time. This was helped by the strong showing of the Geely Xinguan, but also record scores from several other models, like the Galaxy A7 (15,888 registrations), the Starshine 8 (10,191 registrations), and the Galaxy M9 (10,006 registrations).

And all of the sudden, BYD doesn’t look so untouchable anymore….

This is while most foreign representatives are either stagnating or seeing sales drop. (Most, but not all. Nissan(!) was 9th thanks to enviable 15% growth YoY.)

Even among Chinese makes, things do not look rosy, with two exceptions. Wuling, thanks to the second youth of the Wuling Mini EV and the success of the new Bingo S, is one exception. The other highlight of the month was fast-growing Leapmotor, rising to #8, its highest standing so far, thanks to some 63,000 registrations. That’s a 77% jump YoY. The startup is currently at the top of its game, with a few models breaking record scores (the C10 had 16,841 registrations; the B01 had 13,697 registrations). And now that it has become profitable, the Valley of Death is behind the 9-year-old startup. A top 5 position seems not only possible, but likely.

But Leapmotor’s startup leadership could be short-lived, because there are two unstoppable trains coming from behind Leapmotor. One is called Xiaomi (#12 in October, up 135% YoY), while the other is Xpeng (#17, up 82% YoY). Which one of them will be the best selling EV startup in 2026? Please place your bets.

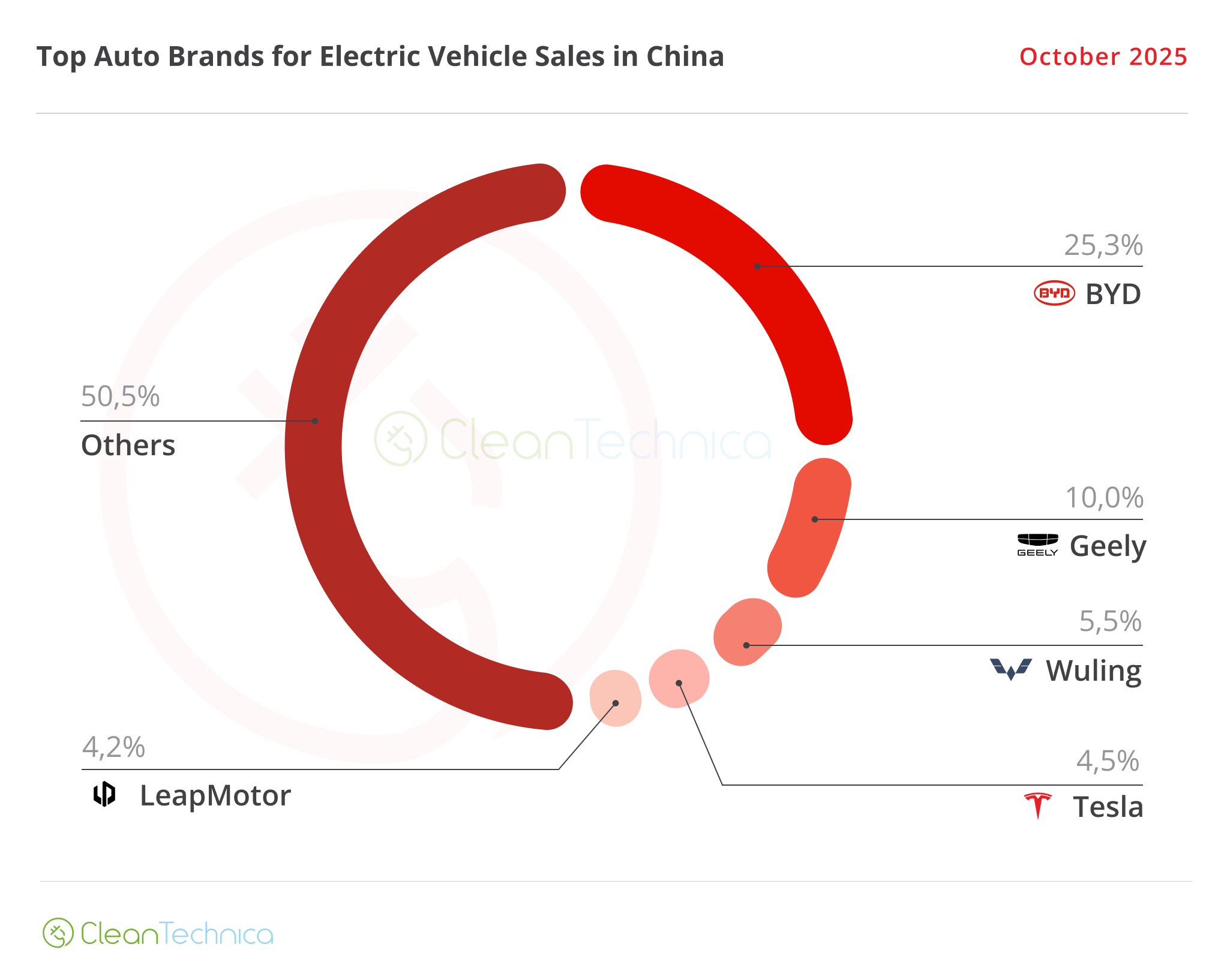

Auto Brands Selling the Most Electric Vehicles in China

Looking at the auto brand ranking for plugin vehicles, there isn’t much news. BYD (25.3%) continued its slow descent, but has its leadership position secured this year. #2 Geely (10%) is just too far behind to bother it in any way.

#3 Wuling (5.5%) gained significant advantage over Tesla, thanks to a record month, and could have already secured the bronze medal, which would mean that the Texas-based carmaker would be left off of the Chinese podium for the first time since 2019.

Elsewhere, a rising Leapmotor (4.2%, up from 4% in September) has not only secured its 5th position on the table, but can allow itself to dream of surpassing Tesla in 4th. With 44,000 units separating the two, and just two months to go, it will be hard to achieve it, but for next year, expect not only Leapmotor, but also Xiaomi and Xpeng, to surpass Tesla, kicking it out of the top 5.

Speaking of Xpeng, Li Auto continues to slide (3.2% now vs. 3.4% in September) and was surpassed by Xpeng in October, with the Guangzhou startup now the new 6th placed brand.

As for the other hot startup, Xiaomi, it went up to 8th, having replaced AITO in that position.

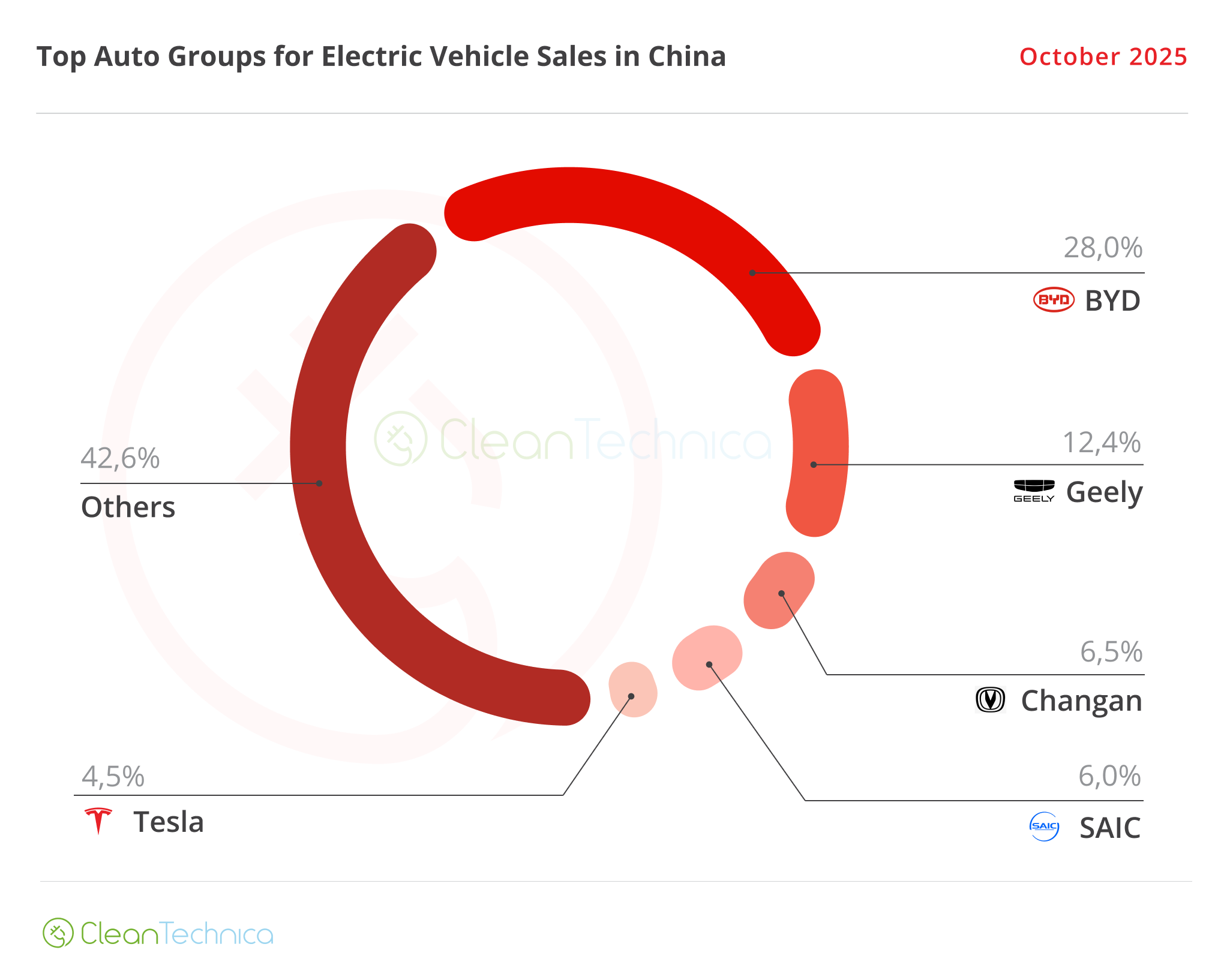

Auto Groups Selling the Most Electric Vehicles in China

Looking at OEMs/automotive groups/alliances, BYD is comfortably leading, with 28% share of the market.

#2 Geely is a distant runner-up, with 12.4% share, up 0.1% regarding September, but with #3 Changan having just 6.5% share, Geely is safe in the runner-up position.

As for #4 SAIC (6%, up from 5.7%), it is stable and should remain in 4th until the end of the year.

Tesla (4.5%, down 0.4% in October) remained in 5th, but Tesla’s 2024 #3 spot in the OEM ranking seems now impossible to achieve, and it could even be the case that there will be no Tesla on any podium — models, brands, or OEMs — for the first time since 2019!

Fortunately for the US brand, #6 Leapmotor (4.2%) seems too far behind to become a real threat to its #5 position.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy