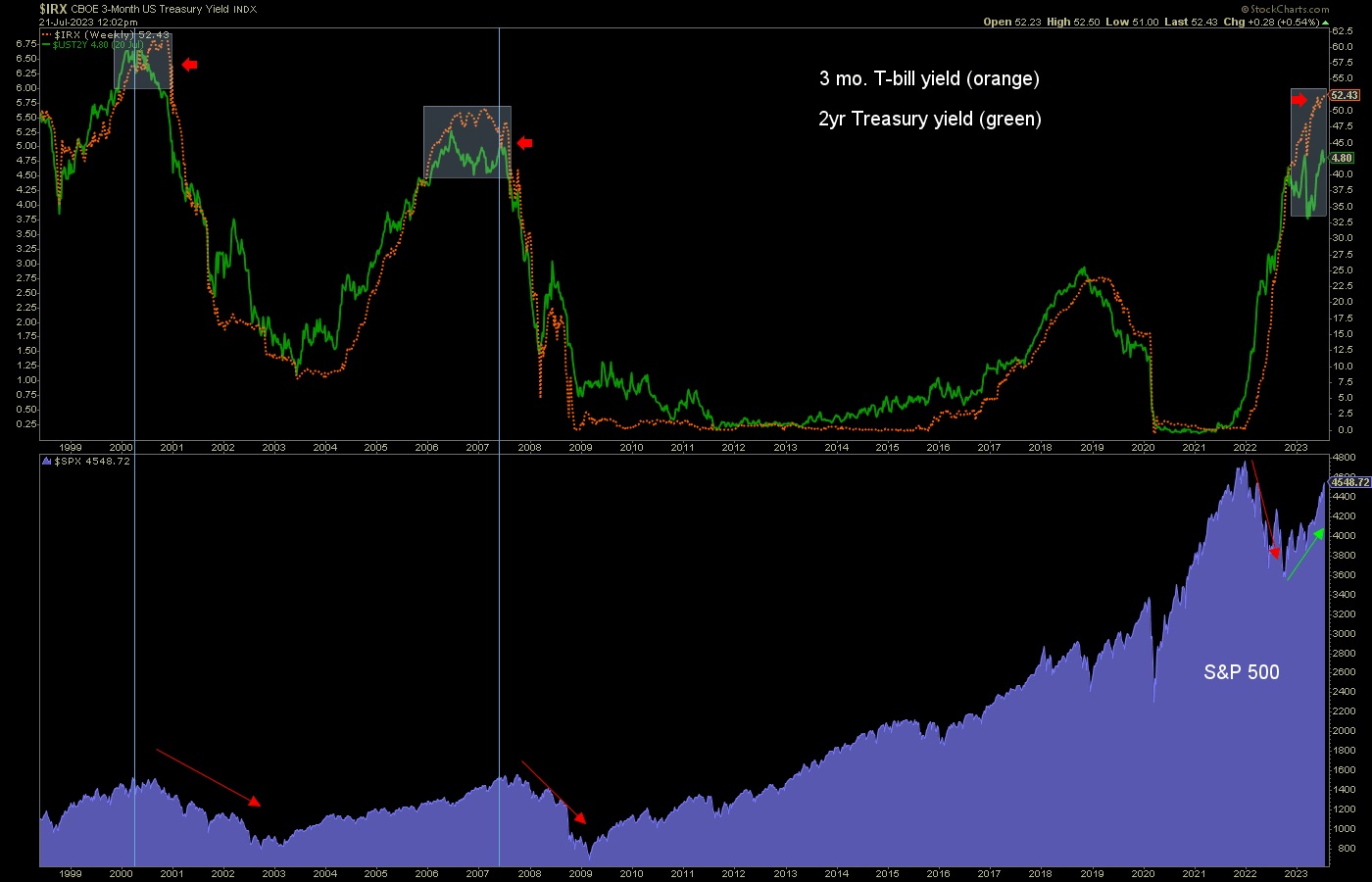

The 3 month T-bill yield is still excessively divergent from the 2 year Treasury yield

If the history of this chart holds true that means that despite whatever bullish fun we are having now, there is a signal in play (3 month T-bill yield grossly exceeds the 2 year Treasury yield) that would trigger a new bear market in stocks within about 1.5 years of the signal’s origin.

We are now about a year in to the current signal as SPX rises to correct its bear market false start last year.

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed market updates and NFTRH+ dynamic updates and chart/trade setup ideas. Subscribe by Credit Card or PayPal using a link on the right sidebar (if using a mobile device you may need to scroll down) or see all options and more info. Keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter@NFTRHgt.

*********