Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Heavy duty trucks are only 5 percent of all the vehicles on the road in the US but are responsible for 25 percent of vehicle emissions. Since emissions from cars and trucks are the single greatest source of the nation’s emissions, it is clear that having a larger electric truck fleet is the best way to significantly reduce carbon emissions from vehicles. Call it the low hanging fruit, if you will — the easiest and most cost effective way to put America in the forefront of nations when it comes to honoring the commitment made to each other in Paris in 2015.

Electric Truck Charging Hubs

There is a difference between electric trucks and diesel powered trucks, however. A diesel semi can go up to 2000 miles on a single tank of fuel (assuming it has a really big fuel tank. 900 miles is more typical). An electric semi is more likely to have a range of 200 to 300 miles. What that means is, an electric truck today is best suited for short to medium range operations, not transcontinental jaunts. Batteries will be more powerful, smaller, and lighter over time, but for today, it makes sense for there to be a place where an electric truck can recharge its battery about every 100 miles.

The Biden administration is expected to announce its plan to decarbonize the nation’s trucking fleet in the next few weeks. A big part of implementing that plan will be to have a system of high power charging hubs in place to keep those trucks charged up. But where is the best place to put them?

The US doesn’t need massive truck charging depots on every major highway to meet federal climate goals. It just needs enough on the right highways at the right time, Canary Media says. That’s why the Biden administration has launched a national strategy to identify the highest priority freight hubs and corridors and to get states, utilities, truck manufacturers, and freight operators on board. Several research studies show that this approach can help manufacturers and freight companies comply with the forthcoming rules.

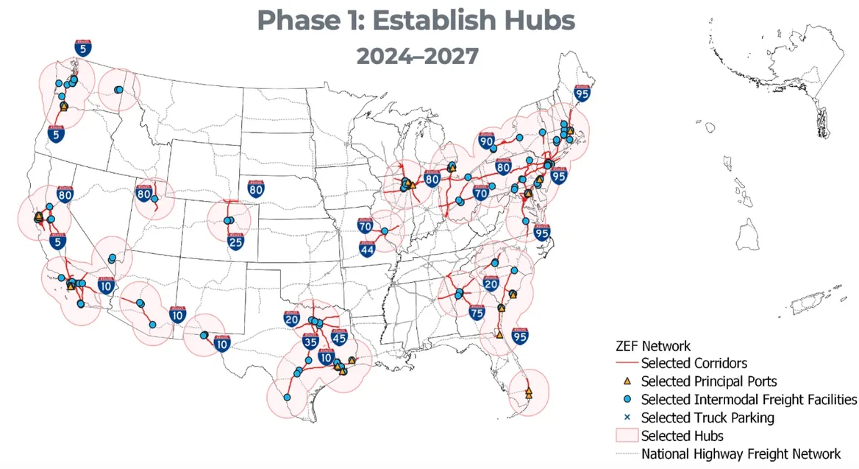

Last week, the Biden administration released its National Zero Emission Freight Corridor Strategy — a 15 year road map for developing the charging stations and hydrogen fueling stations needed to convert the country’s more than 20 million cargo vans, box trucks, short haul and long haul semi trucks to electricity instead of fossil fuels. It begins with more than 30 freight hubs near ports, train depots, and other concentrations of freight traffic within roughly 100 miles of each other. That’s the range that today’s electric trucks can effectively operate within on daily routes in a way that is cost competitive with diesel trucks.

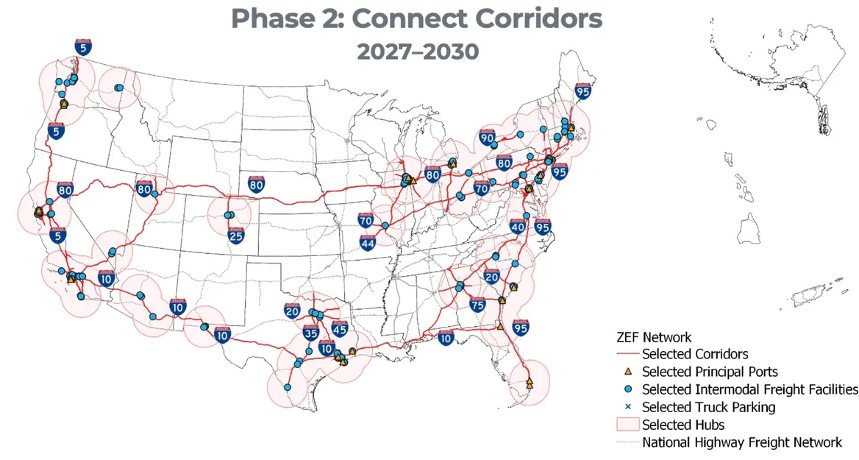

The next phase of the plan is to connect these hubs using designated roadways identified as National EV Freight Corridors. These arteries will be targeted for the deployment of more charging and refueling infrastructure to enable increasingly longer routes, including cross country routes eventually.

“All Of Government” Electric Truck Strategy

The new strategy, released by the federal Joint Office of Energy and Transportation in partnership with the Environmental Protection Agency and the federal departments of Energy and Transportation, calls for an “all-of-government approach to aligning investments and accelerating sustainable and scalable deployment of reliable” zero emissions infrastructure for medium and heavy duty electric truck routes.

That “all of government” approach aligns with what the trucking and freight industries are asking the Biden administration for, said Ray Minjares of the International Council On Clean Transportation. Last year, it published an analysis indicating that prioritizing early EV truck-charging investments in up to 10 key states, including California, Florida, Illinois and Ohio, can satisfy nearly half of the expected needs of zero emissions trucks by 2030.

“When I talk to truck manufacturers, what they tell me is, ‘We don’t need infrastructure everywhere to max out production volumes we’ve got in place today,’” Minjares said. Instead, they’re looking for a “build out of charging infrastructure in those places where the business case is strongest.” Guillermo Ortiz, clean vehicles advocate at the Natural Resources Defense Council, agrees. In a statement, he said, “We don’t need to build everything, everywhere, all at once. This phased approach will allow our nation to electrify the largest number of trucks along the most-traveled highways.”

The EPA proposed rule for trucks — officially known as the GHG Emissions Standards for Heavy Duty Vehicles – Phase 3 — was introduced last April and aims to reduce greenhouse gas emissions from heavy duty vehicles by 29 percent below 2021 levels by 2032. It will begin applying to new trucks in 2027 and is similar to the rule that EPA finalized for cars and light trucks last week.

Since the EPA introduced the proposed rule last year, there has been substantial push back from the trucking and truck manufacturing industries, much of it over fears that there will not be enough high power charging hubs to make electric truck routes possible. The Truck and Engine Manufacturers’ Association (EMA) and American Trucking Association trade groups asked the EPA to extend the deadlines for vehicles to comply with its rules to 2030. The groups have also asked the EPA to include an “off-ramp” that would weaken the standards if infrastructure deployment targets aren’t met.

In an April statement, EMA President Jed Mandel said that “adequate electricity charging and hydrogen fueling infrastructures is imperative, not only to power those vehicles so they can move the freight that fuels our economy, but also to give our customers the confidence to purchase [zero-emissions vehicles] and retire their older, higher emitting vehicles.” Major truck manufacturers and EMA members Daimler Truck and Volvo Group, both of which have pledged to rapidly expand their production of electric heavy duty trucks, have also asked EPA to delay compliance deadlines, citing concerns about adequate charging infrastructure.

In February, Ford, Cummins, BorgWarner, and Eaton broke ranks with other EMA members by issuing a statement in support of the EPA’s proposed rule, but also calling for the Biden administration to undertake “a ‘whole of government approach’ to partner with private industry to meet the new EPA standards,” with a particular focus on “electrification infrastructure.”

The latest federal zero emissions freight strategy “helps respond to those infrastructure complaints,” Minjares said. ICCT advocates for a national strategy that can bridge the gaps in cost and uptake between different states and help ensure that the interstate highways that connect them are considered as a whole, not in a state by state fashion. It is one of many groups studying how to prioritize how much charging should be deployed in which locations — decisions the national strategy has not yet made. But it’s likely that plans that focus investment in a handful of corridors could run into political challenges from states that feel left out of the federal funding if they’re not included.

Who Is Going To Pay For All This?

Canary Media says the announcement by the Biden administration last week left many questions unanswered, including how it would take the next steps with state governments, truck manufacturers, fleet operators, and charging providers to start to plan its approach to prioritizing its efforts across the hubs and corridors identified. It also did not address how much federal funding it expects to allocate to building charging hubs for electric truck use. The $5 billion in National Electric Vehicle Infrastructure program grants for the states created by the Bipartisan Infrastructure Law concentrates on EV charging for passenger vehicles along highways.

Another $2.5 billion in funding from that law is available for grants to support charging in disadvantaged and sparsely populated communities, as well as for heavy duty freight corridors. In January, the administration approved $623 million in grants from this program to 47 applicants in 22 states and Puerto Rico, including several large scale truck charging projects in California, Texas, and other states. A new report from the Clean Freight Coalition estimates that it will cost roughly $620 billion to fully electrify the country’s commercial truck fleet over the coming two decades.

Where Will The Electricity Come From?

Another question is how the federal strategy will coordinate the expansion of electric truck charging depots with the utilities that will supply the megawatts of power they will need. It can take a year or more for utilities to build and expand power grid capacity to serve those hubs.

Britta Gross, transportation director at the Electric Power Research Institute has been meeting regularly with Joint Office representatives to discuss how freight companies and charging providers can share data with utilities to plan for future expansions of the grid to meet the need for electric truck charging hubs. Just designating National EV Freight Corridors is a useful start, she said, since it indicates “how they expect the corridors to be built out [and] where there’s more bang for the buck in investment. I always think that putting a stake in the ground and saying, ‘This is where we’re going to be going,’ is a good way to help.”

Dawn Fenton, vice president of public affairs for Volvo Group North America and chair of Powering America’s Commercial Transportation, a consortium launched in January, told Canary Media there is significant urgency to identify where high power charging hubs should be built. The ICCT predicts the US will need nearly 600,000 high-speed chargers to serve medium- and heavy-duty vehicles by 2030. [That seems like an awful lot of high power chargers, but who are we to question the “experts?”

“If we’re going to meet the deadlines that policymakers have put in place, there needs to be a different way of doing things,” Fenton said. “Usually utilities won’t build out the capacity and service until the demand exists — but if that remains the case, there’s the chicken-and-egg problem. There are customers who are canceling (electric truck) orders when they learn about how long the wait for charging infrastructure is.”

The Takeaway

What is only hinted at here is that the plans by the Biden administration include hydrogen refueling hubs as well as high power charging hubs. Michael Barnard has penned many articles about hydrogen that suggest it may be the biggest boondoggle in human history. If hydrogen is made from methane gas, it will be about as dirty as coal. If it is made by electrolysis, it requires massive amounts of electricity. If those electrons come from thermal generation, once again the supposed clean energy advantage of hydrogen is nullified.

But there is a huge push for hydrogen, mostly from fossil fuel companies who want to see only the positive aspects of using hydrogen as a fuel and ignore the negatives. In order to make the electric truck infrastructure a reality, it may be necessary to ditch any investments in hydrogen refueling infrastructure and just concentrate on charging infrastructure. But when most of the people in Congress are in the pocket of fossil fuel companies, it is hard to ignore their entreaties, not matter how lame, misguided, or flat out wrong they may be.

The bottom line is that moving America’s freight by electric truck is essential for the environment but will be a costly undertaking. Lots of interest groups will want that money to support their own pet projects and will fight to slow the transition to moving the nation’s freight by electrons rather than molecules.

It is important to have a plan, which the Biden administration has now put in place. It is best not to start vast projects with half vast ideas. The plan is scheduled to take place over 15 years and that leaves lots of time for human ingenuity and new technologies to create newer and less costly ways to make the transition to electric transportation possible. With luck we will look back on all this in 2039 and wonder what all the fuss was about.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica TV Video

CleanTechnica uses affiliate links. See our policy here.