Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

In Part 1 of this series, we addressed the anticipated impact of robotaxis on the regular taxi market. In case you missed it, here is the link.

In Part 2, we will now explore the impact of Transportation as a Service (TAAS) on the general automotive market and the transportation landscape in general. This is a long article, so grab a coffee.

In Tony Seba’s 2017 RethinkX report “Rethinking Transportation 2020–2030,” Seba suggested a 3.3× reduction in vehicle production (90 million/year to just 27.3 million), despite a 50% increase in vehicle miles driven. Please note this prediction did not imply the distance driven for every driver will increase. What it meant was more people worldwide will travel using Transportation as a Service (TAAS) instead of other options, and that perhaps some people may travel a bit more since travel will become cheaper. The 3.3× reduction in vehicle production assumes many people will give up their personal vehicles in favor of TAAS. But will they, though?

In Part 2, we will try to answer the following critical questions.

- Can robotaxis take market share from the other ground transportation options? (In addition to disrupting regular taxis as we saw in Part 1.)

- If so, how many people would adopt TAAS?

- Will TAAS accelerate the shift to BEVs from internal combustion vehicles?

- What are the implications? What will our roads and the world’s automobile market look like once BEVs and TAAS are fully in place? When will this happen?

To answer these questions, we need to understand why people choose cars vs buses vs taxis in the first place. Cost is clearly one factor, but it is not the most important factor for everyone since, if it was, everyone would take public transportation (since it is by far the lowest-cost option). The fact is people buy cars and/or use taxis for many reasons, including for convenience, utility, and for other personal benefits. We need to understand all these factors!

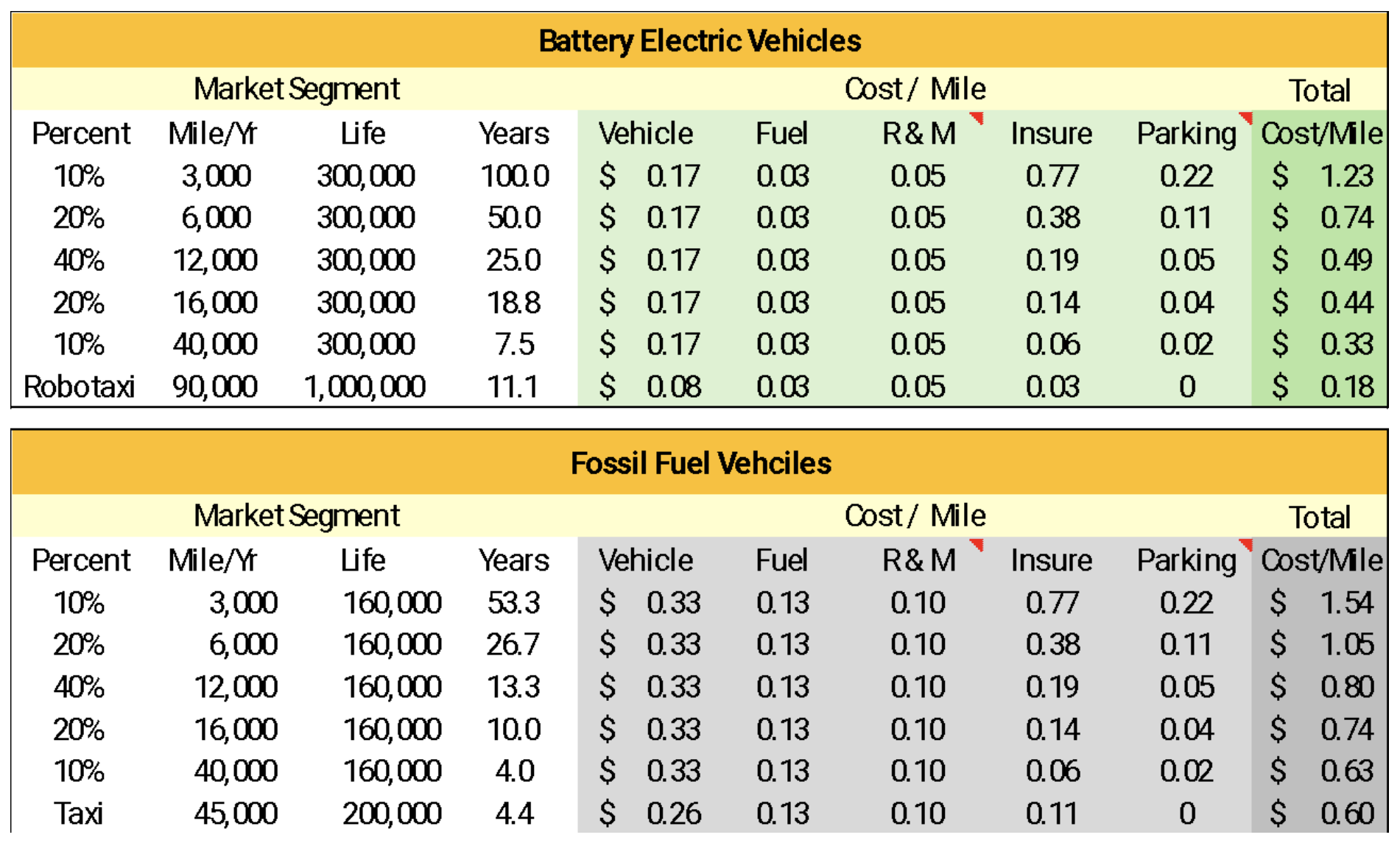

Let’s start by exploring vehicle cost. For this article, we are specifically interested in the vehicle’s lifetime cost/mile. Cost per mile allows us to compare options. Cost per mile for this analysis will be the average cost of the vehicle across all owners from when the vehicle was purchased to when it is completely worn out. We will break down cost/mile for all major costs including the purchase price of the vehicle, fuel cost, maintenance/repairs, insurance, and even parking.

The cost/mile for the purchase price of the vehicle, for example, is simply the new purchase price divided by the number of miles the vehicle will last. A vehicle that lasts longer will therefore have a lower cost per mile than one that does not last as long. Some costs are quite “fixed,” and others are more “variable.” Fuel consumption, for example, is a variable cost, meaning the more you drive, the more you use, but the cost/mile for fuel remains about the same — how much you drive and how long the vehicle lasts does not affect your “fuel cost”/mile. Other items like insurance and parking are more “fixed” in that you may pay about the same amount per year whether you drive your vehicle much or not. This means the cost per mile for “fixed” costs goes up quite a bit for low-mileage drivers. This point will matter a lot later in the analysis.

Let’s dive in and look at some of the background variables and assumptions that will affect this analysis.

Background Considerations

Vehicle Longevity

Modern fossil fuel cars average about 160,000 miles over their life. If these cars were driven the national average of 13,500 miles/year every year, they would last just 12.2 years before needing to be replaced. Given the average age of vehicles in the US is 12.6 years, and the upper limit is about 20 years, clearly many people do not drive that much. About 20 years seems to be the upper limit in age, and about 160,000 miles the upper limit in distance for fossil fuel vehicles.

We discussed in “A New Era in Transportation — Part 1” how vehicles can be designed and built to last as much as 1 million miles, and we know this to be true since they exist today. Commercial vehicles like semi trucks can achieve million-mile duty cycles. The reason today’s cars “only” average 160,000 miles is because this is the duty cycle (maximum miles) that consumers want. This is clearly true since automakers could design cars like they do semi trucks — but they don’t. The reason automotive manufacturers do not make cars last longer is simple — consumers do not want to pay more for a vehicle that lasts longer when they (and second/third owners) have no hope of making use of it a reasonable timeframe. It would, in fact, take average drivers 74 years to mileage out a million-mile vehicle. The bottom line is very few people even want to drive a 20-year-old vehicle — since technology changes and these older vehicles become obsolete. I’m going to suggest that this “20 year” age and 160,000-mile life cycle is about the limit the market will support for today’s fossil fuel vehicles.

So, the question becomes: will vehicles be built to last longer in the context of BEVs/TAAS?

I think so. For starters, today’s BEVs already seem to be lasting longer than fossil fuel vehicles. While the data is not conclusive yet, since good BEVs have only achieved significant sales in the last few years, the data we do have seems to support a 50–100% longer life out of a BEV. The reasons are due to the simplicity of BEVs (motors have one moving part), brakes are used much less due to regenerative braking, and because there is no transmission, exhaust system, and complex cooling system. I’m going to boldly suggest 300,000 miles as the new average lifecycle for consumer-grade BEVs, since, if they are not there yet, they will be soon. I’ll address why in a moment.

Million-mile robotaxis — As mentioned, when manufacturers decide to make a vehicle last a million miles, they can do so. Tesla, and I assume others, are in the planning stages for these million-mile commercial vehicles, and researchers including Jeffrey Dahn have already demonstrated cheap lithium-iron batteries that can last 4 million miles and 50 years. This was achieved 2 years ago in fact. With many commercial electric motors lasting decades, all technological pieces are in place to make these million-mile vehicles a reality.

How much different groups of people drive

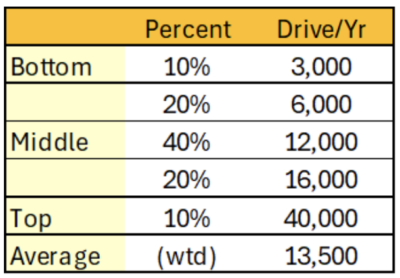

This table on the right segments drivers into 5 groups based on how many miles each group drives per year.

This table on the right segments drivers into 5 groups based on how many miles each group drives per year.

We know the average driver puts on 13,500 miles/year, so the weighted average (wtd) of the table is this average.

I was able to find a credible report from the New York Times that suggested the top 10% of drivers drive 40,000 miles. I was not, however, able to find any detail on the bottom and middle groups, but given what we do know, we can use reason and a little basic math to fill in the blanks to come up with a reasonable EWAG (educated wild-ass guess) to segment these groups into five categories.

Please note it doesn’t matter if this table is perfect, as it is the trend that we are interested in. Also, I should note that the middle group in this table is not the simple average — since the math returned nonsensical results when I tried to use the average as the middle. I suspect the real-world miles driven for the middle group is probably a bit lower, and the upper 20% is probably a little higher than shown. These numbers are close enough, however, to see trends and implications of the trends.

How much the world drives

A convenient and simple way to project current world miles driven is to calculate production × average vehicle life in miles. This works as a rough proxy since producing too many vehicles would flood the capacity of the market to use them up and producing too few would result in a shortfall of capacity on the market over time.

Automotive manufacturers today produce about 90 million vehicles/year, and these vehicles last about 160,000 miles on average, over 20 years or so. If we calculate 90 million × 160,000 miles, we find each year of production offers the world 14.4 trillion miles of service capacity. Since older cars are retired at roughly the same pace as new ones are made, a stable manufacturing rate of 90 million per year offers the planet 14.4 trillion miles/year of capacity.

As mentioned in Part 1, RethinkX suggested world production will drop about 3.3× to 27.3 million vehicles while also predicting a corresponding increase in total miles driven by 50%.

To achieve these numbers, vehicle duty-cycle (average miles driven/year) and vehicle longevity (lifetime miles) would need to go up quite a bit, and many people would need to abandon private car ownership in favor of using TAAS. Let’s break down the problem to see if this is even plausible.

I want to start by talking about Seba’s prediction of 50% growth in total miles travelled as I have no idea where this number came from. It could simply be a WAG (wild-ass guess), but I would not be surprised if it is an “EWAG” based on assuming the cost of TAAS, while still higher than public transportation, will prove low enough to attract a significant number of bus users. Cost as we know is not necessarily the only (or best) predictor of people’s transportation choices. Since I’m not fully confident in the 14.4 trillion miles/year figure, I will do the math and look at 3 different mileage scenarios including:

- 14.4 trillion miles (how much the world travels today)

- 18 trillion miles (25% higher)

- 21.6 trillion miles (50% higher — the RethinkX prediction)

At this point, we have determined that it is reasonable to project vehicle life for consumer-grade BEVs at 300,000 miles, and robotaxis at 1 million miles. We have also segmented drivers into 5 different groups based how much each group drives/year, and we now have 3 different projections on how many miles the world will drive in the future. We will make use this information in the analysis in a moment.

Why People Choose Different Transportation Options

For this section of the analysis, I’m going to segment the reasons people choose different transportation options into three categories, including cost, utility, and personal benefits. I’ll start by exploring cost in detail. Cost is a little tricky since it varies a lot based on where you live, how much you drive, and they type of vehicle you choose. Once we are done with cost, I’ll do a pro/con analysis to address how utility and personal benefits, along with cost, affect our transportation choices.

Lifetime Cost of Ownership

At this point we have segmented the market by how different groups of people drive per year. Our task now is to try to figure out the cost per mile for each of these groups. As mentioned, I am suggesting personal-use BEVs will have a life of 300,000 miles (up from 160,000 for fossil fuel vehicles), and that commercial robotaxis will be designed to last 1 million miles (up from 400,000 today). I think the idea of 300,000-mile EVs is becoming fairly well accepted amongst most analysts now since we are seeing this in real life and, since EVs are so simple, how could they not last longer? We also have great information from the likes of Jeffrey Dahn, who demonstrated 2 years ago how new-generation lithium batteries can last 4 million miles and 50 years. It seems clear that if it is easy and cheap to achieve this longevity, it is only a matter of design and demand for manufacturers to make it happen.

The goal of the table below is to outline vehicle cost/mile for these different types of owners (market segments) based on how much the person drives.

Table assumptions & definitions:

- Vehicle purchase price was set at $45,000, with financing at 6% ($52,200 total), for all except the robotaxi. I set the cost of the robotaxis at $25,000 but I also added the $400/month TASS charge that we expect TAAS companies to charge for using this technology. For example, while Tesla’s robotaxi may cost $25,000, reports suggest Tesla will charge at least $400/month to use TAAS, bringing the total cost of their robotaxi to $78,280 over its life.

- Percent and Miles/Year: This much different groups of people drive per year. In the table, 10% of drivers drive 3,000 miles/year.

- Life: This is the number of miles a vehicle will last. I estimated 300,000 miles for BEVs, 1 million miles for BEV robotaxis, 160,000 for fossil fuel vehicles, and 200,000 for fossil fuel taxis.

- Years: This is how long in years the vehicle would last if mileged out by each group (vehicle life in miles divided by miles driven/year). This figure highlights how low mileage drivers really can not wear out their vehicles.

- Vehicle (cost/mile) – This is the purchase price of the vehicle divided by the vehicle’s life including financing costs (purchase price / lifespan in miles = cost/mile).

- Fuel (cost/mile): This is based on national average fuel prices of about 12 cents/kWh for electricity and gas at $3.50/gallon.

- R & M (repairs and maintenance cost/mile): This number is from an American Automobile Association’s cost study for gas cars. I simply estimated BEVs at ½ this rate as a WAG. This figure is an average over the life of the vehicle. In reality, older vehicles cost more to maintain than newer vehicles, but since this is a life-cycle cost study this detail does not really matter.

- Insurance (cost/mile): This is estimated at $2,300/year (the national average), with fossil fuel taxis at $5,000 for commercial insurance (yearly cost / yearly miles = cost/mile).

- Parking (cost/mile): This is an important cost many analysts leave out since it is so variable. I used what I think is a conservative WAG guess of $650/year for all drivers. Considering some condo owners spend $25—$150 or more a month at home, plus paying for parking at work, I am drastically underestimating this cost for many and overestimating it for others.

- Total Cost: As mentioned earlier, the benchmarking study I am using as a reference suggested it costs $12,000/year (89 cents/mile) on average to own a fossil fuel vehicle (including parking). Likewise, the weighted average cost in the table below matches this study at 89 cents/mile across all groups, with the BEV average 59 cents/mile.

Cost/Mile Analysis

- While these numbers can not describe any one driver’s specific situation, they do describe trends. The trend is clear — low-mileage drivers spend a lot more/mile than high-mileage drivers.

- Low mileage/year ICE drivers today spend over $1/mile. This amount is higher than the cost of a TAAS robotaxi at the expected introductory rate of $1/mile fare. Even if these low mileage/year drivers switched to BEVs, many would still find their costs to be close to, or higher than, TAAS.

- As discussed in Part 1 of this analysis, robotaxi fares could potentially drop to as low as 50 cents per mile and still be profitable. If this happens, it would be cheaper for all ICE drivers to drop their cars in favour of TAAS. This rate may also be low enough to tempt up to 70% of even BEV drivers to use TAAS if cost was the only consideration (which of course it isn’t).

- It is interesting to note how this cost table shows why very low-mileage drivers are often not motivated to buy EVs, and why EVs make so much sense for high-mileage drivers. For high-mileage drivers, the cost of driving a fossil vehicle is close to double that of an EV. For a low-mileage driver, the difference is just 18%.

- Parking is a real wildcard in this analysis, as some drivers do not experience this cost at all and some experience even higher costs. Lower-mileage drivers may be disproportionately impacted by this variable.

- Total Cost/Mile: It is interesting to note how drivers who do not drive very much pay a lot per mile to own a car, and this is especially true for fossil fuel drivers. Low-mileage drivers as a group are clearly going to be the most motivated to give up their personal vehicles as their costs are disproportionately high. People who drive a lot, on the other hand, can pay 3–4× less per mile vs low-mileage drivers.

As we discussed earlier, most people do not make transportation choices based on cost alone. Our choices consider three things — cost, utility, and personal benefits. Utility includes things like vehicle type, class, having it always available, etc. Personal benefits include things like cleanliness, ability to store things in your vehicle, etc. This next section will look at the pros and cons of personal vehicles, busses, taxis, and robotaxis based on their cost, utility, and personal benefits.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Pros & Cons of Different Transportation Options

Personal Vehicles

Pros

- Cost

- ICE vehicle cost ranges from 63–150 cents/mile (average 89 cents). This is 2–6× cheaper than a regular taxi.

- BEV vehicle cost ranges from 33–125 cents/mile (average 59 cents). This is 3–10× cheaper than a regular taxi.

- Utility

- Door to door service if parking is available.

- The vehicle is available when you need it.

- Personal

- Having your own space (personal and cleanliness).

- Comfort — having the level of size & luxury you want.

- You can store personal incidentals in your vehicle.

Cons

- Cost

- Time cost to take your vehicle in for repairs and maintenance.

- Downtime cost when the vehicle is in for repairs/maintenance.

- Having to pay for parking potentially both at home and at your destination.

- 5× higher cost compared to taking a bus.

- Utility

- Having to walk from your parking area to your destination.

- You are locked into one vehicle class — unless you own multiple vehicles.

- You must drive yourself.

- Personal

- Having to clean your vehicle.

- Having to oversee and monitor your vehicle’s maintenance.

Busses

Pros

- Cost

- Low cost: Cost is typically about $5.00 per day in many US cities. At 2 trips of 15 miles a day, the cost would be just 16.7 cents/mile — 5× cheaper than a car.

- No cost for parking or vehicle downtime.

- Utility

- Most regions of a city are served by public transportation.

- Busses run reliably during most hours of the day.

- You do not have to drive.

- Personal

- Worry-free transportation from a vehicle standpoint.

- Less likely to be injured in an accident.

Cons

- Cost

- No issues, as busses are the cheapest option next to walking or riding a bike.

- Utility

- Some areas may not be served by public transportation.

- No door-to-door service (having to walk from your bus stop to your desination).

- Having to wait at bus stops, especially if multiple transfers are required (inclement weather can exacerbate this issue).

- Bus hours may not coincide with your needs if you need them very late or very early in the day.

- Users may not be familiar with the routes offered and/or transfers needed for unfamiliar routes.

- Busses are best suited for personal transportation — they are a poor option for larger loads/items.

- Personal

- Overcrowding: Overcrowding can be uncomfortable and/or can result in having to wait for the next bus.

- You may not enjoy being around strangers (safety and/or cleanliness issues — perceived or otherwise).

- Comfort is generally lower for buses, and you may even need to stand.

- It is difficult to transport heavy and/or bulky items on a bus.

Regular Taxis

Pros

- Cost

- No cost for parking or vehicle down time for maintenance, etc.

- Utility

- You can order the class of vehicle you need.

- Door to door service

- You do not have to drive.

- Personal

- Having your own space (no strangers other than the driver).

- Not having to clean the vehicle.

- You do not need a driver’s licence

Cons

- Cost

- Highest cost option at about $3.50/mile.

- Utility

- Wait times during high-demand periods.

- Personal

- Not fully having your own space, as you still have a driver.

- The cab may not be clean enough by your standards and/or it isn’t “your dirt.”

- No ability to store your gear in a taxi.

- Not trusting the driver to take the most efficient route.

BEV Robotaxis

Pros

- Cost

- BEV robotaxi fare cost is estimated to range from 50–100 cents/mile. Depending on a person’s situation (how much they drive/vehicle class), this option may be less expensive than owning a vehicle — which ranges from 33–125 cents for EVs.

- No time or downtime cost for vehicle repair/maintenance.

- Not having to pay for parking.

- Utility

- Door to door service.

- Not having to find a parking spot.

- Ability to access different types and classes of vehicles.

- Flexibility to book vehicles for different lengths of time, including booking access for minutes (in the case of short in-city trip(s)), or for longer bookings including hours, days, week(s), or even potentially month(s).

- You do not have to drive.

- Personal

- Not having to clean your vehicle.

- Not having to monitor your vehicle’s maintenance.

- Comfort — being able to book a vehicle of the size/class/luxury you want.

- No need to have a driver’s license.

Cons

- Cost

- Cost is higher compared to taking the bus — at 50–100 cents vs 16.7 cents.

- Utility

- Potential wait times during high-demand periods.

- Personal

- The robotaxi may not be clean enough by your standards and/or it isn’t “your” dirt.

- You can not store personal incidentals in the vehicle.

Analysis

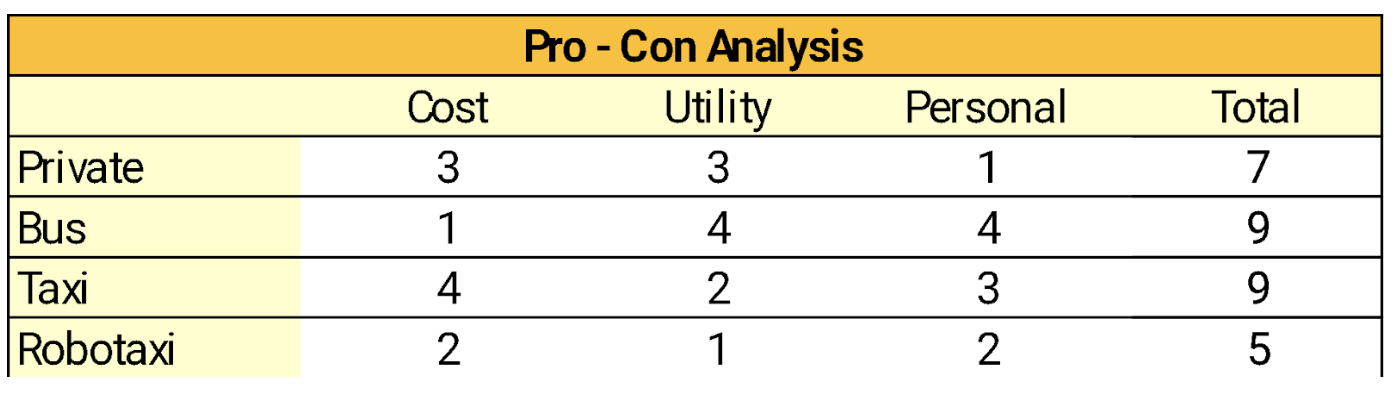

Different people want and need different things depending on their personal situation. For some people, they simply can not afford a car or a taxi as a regular transportation option — so these options are not relevant period. For others, cost is less of a factor, and utility and personal benefits are more important. Recognizing there will be wide individual differences, the chart below outlines how I think most people would rate each category from best (1) to worst (4). I’ll get into the reasons below.

Cost: This one is easy, as busses are clearly the least expensive option, and regular taxis are the most expensive option. I scored robotaxis as cheaper than privately owned vehicles since they should come in cheaper than all ICE cars and about ½ of BEVs, depending on how much you drive.

Utility: I scored robotaxis and regular taxis high here since they ticked the most boxes in this area and beat private ownership for better door to door service (no parking), no maintenance issues, and since any class/type of vehicle would be available to rent. Busses scored the worst since they are restricted to personal transportation and since they offer the fewest conveniences.

Personal: Private vehicles scored best here since the owner is the sole person using the vehicle. Robotaxis scored next best since there is no driver involved, making the experience quite private. Regular taxis and busses are least private, so they rounded out the scoring in the bottom positions.

What This Means

- Robotaxi vs regular taxis: As we found in Part 1 of this series, robotaxis will outcompete regular taxis and replace them as fast as they can be built. This means 18 million taxi drivers worldwide will be forced out of the market.

- Robotaxis vs busses: Robotaxis are likely to take some ridership away from public transportation. We learned that the only reason people take the bus is price. Since the price of a robotaxi will be much less than a regular taxi, and substantially less than the cost of private ownership (for low-mileage drivers), it is very likely that some people who currently take the bus will switch to robotaxis. This is inevitable really, considering how people greatly value utility and personal benefits when making transportation decisions. The only real question is how many people will switch.

- Robotaxis vs privately owned vehicles: While we do not know how much TAAS operators will charge/fare, this analysis suggests that robotaxis can be priced cheaper than all gasoline vehicles and between 30–70% of BEVs. The analysis suggests only higher mileage drivers will have a cost advantage over robotaxis.

When it comes to utility, this analysis also suggests robotaxis may prove to be better overall than personally owned vehicles! The reasons include being able to call up any class or size of vehicle based on your needs that day, better door to door service — as you do not need to park them, and you can book them for any length of time. The issue of potential wait times (if robotaxis are in high demand when you need one) was the only negative in this area. I suspect privately owned vehicles will address this issue since they will be used as robotaxis as well. It may be quite profitable for these owners to list their vehicles on a TAAS system whenever there is strong demand and “surge pricing” is available.

The only area that private ownership held an edge over robotaxis was in “personal benefits.” When you own your own vehicle, you can store your personal items in your car, and you can maintain it at the level of cleanliness you are comfortable with.

Potential Issues

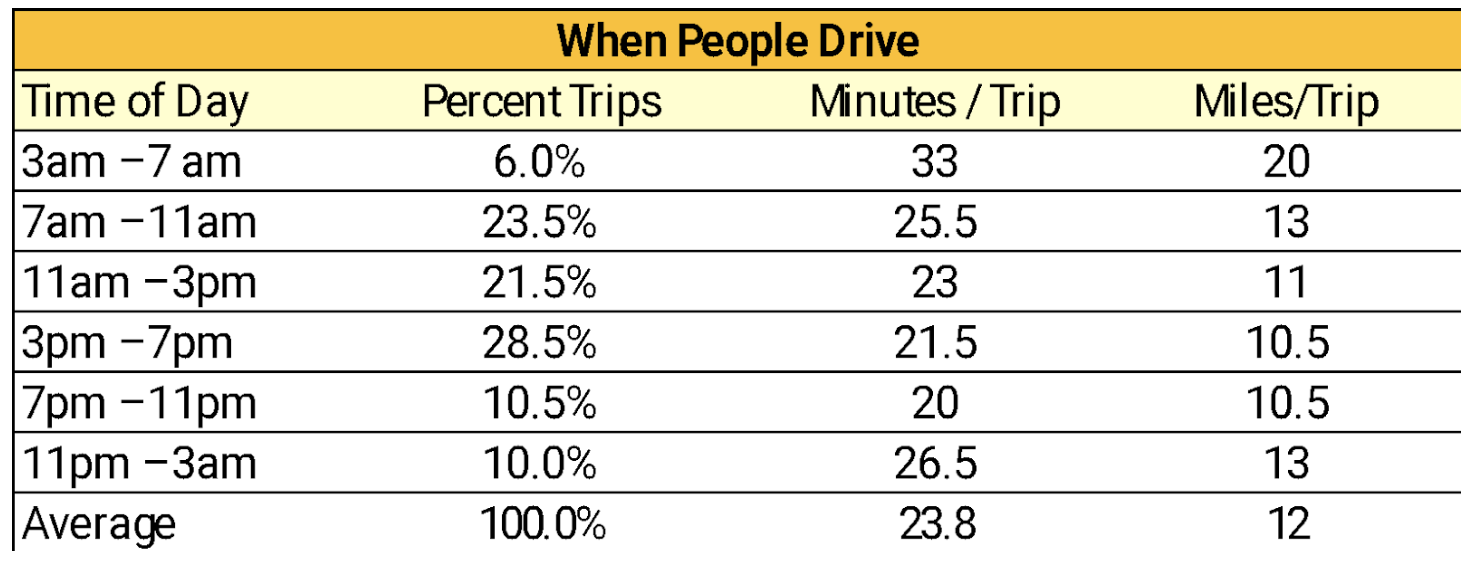

One criticism that is often mentioned when it comes to arguments against robotaxis is the problem of “rush hour.” The thinking is everyone wants to get to work at the same time, so there will not be enough taxis to fulfill this demand. When you look at the data on when people drive, however, it becomes clear that this “issue” is only a perceived issue — it is simply not based on data.

The table below is from the 2022 American Driving Survey, and it offers data on vehicle trips, including when people drive, how long the trip takes, and miles per trip. Based on this data, “rush hour” is actually 12 hours long, starting at 7:00 am and ending at 7:00 pm. This means “rush hour” is not really an issue at all, we simply need more robotaxis operating during the entire day vs the evening. This data means robotaxis will charge almost exclusively at night, and probably on cheaper L2 chargers. Note: I also have hour-to-hour data from other studies that show the same thing.

This table also supports how there is enough demand across the day for robotaxis to reasonably achieve their 250 mile/day target (90,000 miles per year) of service. The reason for this is robotaxis will be in service for 20 hours of the day, including all high and all medium demand hours, with most charging their batteries at the lowest demand period (3:00–7:00 am).

Implications for world automobile production

How many cars does the world need?

I was unable to find good data on how much the world drives per year. That said, it is fairly easy to make an EWAG guess to calculate how many miles the world drives in a year. Here is the thinking.

Today, 90 million cars are produced yearly, and each vehicle has an average lifespan of 160,000 miles. If you multiply 90 million × 160,000, you get 14.4 trillion miles of potential “service” from each year of production. As long as this production rate (and everything else) remains stable, and older vehicles are retired at the same rate new ones are made, this 90 million/year production rate would meet 14.4 trillion miles of demand.

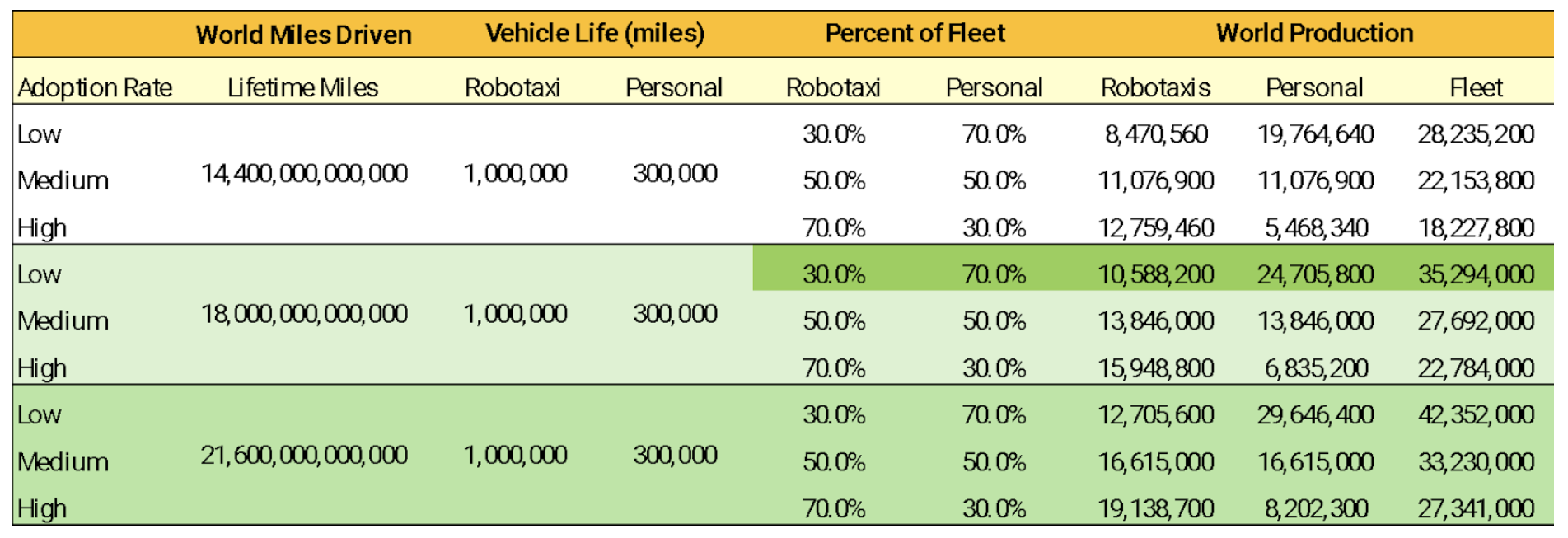

As vehicles last longer, fewer are needed to meet this 14.4-million-mile demand. If we accept regular BEVs will last 300,000 miles and robotaxis 1 million, we can calculate how many of these vehicles would be needed.

The table below calculates the number of vehicles (robotaxis vs personally owned vehicles) needed assuming 3 different TAAS adoption rates (Low 30%, Medium 50%, and High 70%). The table also calculates 3 different growth scenarios for how much the world will drive/year including no growth (14.4 trillion miles), 25% growth (18 trillion miles), and the RethinkX projection of 50% growth (21.6 trillion miles).

Implications

- No growth: If the world continues to travel 14.4 trillion miles per year and just 30% of current owners drop their vehicles and start using TAAS, world vehicle production would drop to about 8.5 million robotaxis and 20 million personally owned vehicles/year. If more people defect to TAAS, the fleet shrinks proportionately.

- 25% growth: If the world started to travel 25% more (18 trillion miles/year), and 30% of owners dropped their vehicles, world production would drop to 10.6 million robotaxis and 24.5 million personal vehicles.

- 50% growth: This is the RethinkX scenario, and it suggests the world will increase travel to 21.6 million miles. To achieve this and RethinkX’s 27.3 million vehicle/year projection, it implies 70% of buyers would have to drop their personal vehicles in favor of TAAS. There would be 19 million robotaxis produced per year plus just 8 million personal vehicles under this scenario.

Summary Analysis

At this point, we can answer our questions.

Question 1 — Can robotaxis take market share from the other ground transportation options?

I think we definitively answered this question with a resounding yes! Robotaxis will eliminate regular taxis, and they have the potential to take market share away from public transportation due to their reasonable cost, their better utility, and much better personal benefits. Robotaxis also seem to have the potential to impact private vehicle ownership due to their lower costs for some drivers, while offering better utility and adequate personal benefits.

Conclusion: Robotaxis will take market share from all transportation options.

Question 2 — How many people would adopt TAAS?

- Regular Taxis: I think we have adequately addressed that basically all regular taxis will be quickly replaced by robotaxis. Statista estimates the value of this market to be about $140.7 billion dollars with about 1 billion users worldwide.

- Busses: Busses will continue to cost much less than other transportation options. The question is whether TAAS will offer enough value in utility and personal benefits at a price that is affordable enough for people in this group to make the switch. The number of people who will switch is impossible to predict with any accuracy, but it seems reasonable to assume a significant portion of this group, perhaps up to 25% (WAG), would make the switch. If so, this change would certainly help support RethinkX’s prediction of a substantial increase in global miles driven by 2030!

- Prediction: Between natural population growth and bus users switching to TAAS, global miles travelled will increase 25% over the next 10 years.

- Private Vehicles: This analysis supports that dropping personal vehicle ownership and switching to TAAS may be acceptable for many people since cost, utility, and personal benefits may be adequately met by this option. In fact, a solid case can be made that many private vehicle owners in the 30% “low-mileage driver groups” and arguably even some in the 40% mid-mileage driver group would be willing to switch due to cost savings and better utility. Furthermore, given there are roughly 60% of households with two or more vehicles, these households may be motivated to drop some of these vehicles for the same reasons as the low-mileage-driver group. It may be much cheaper/better to simply call up a TAAS vehicle for low-use vehicles period.

- It would be reasonable to assume the people who will move to TAAS will be those who drive their cars the least, and those who pay the most for parking and/or insurance. That said, I very much doubt all drivers in these mid to lower mileage groups will drop their personal vehicles since utility and personal benefits are clearly very important to people. As consumers, all of us buy low-use items all the time for their utility and convenience without caring much about the cost. I see no reason consumers would act that much differently when it comes to their vehicles.

- Prediction: 30% of private vehicle owners will switch to TAAS within 10 years of it being approved and implemented at scale.

Question 3 — Will TAAS accelerate the shift to BEVs from internal combustion vehicles?

Interestingly, as we noted in the Vehicle Cost Analysis section of this article, the cost difference between ICE vehicles vs BEVs becomes much greater the more you drive. This means the low-mileage drivers, the same ones we are predicting will drop their vehicles in favor of TAAS, are also the ones most likely to still be driving ICE vehicles (since the cost difference between BEVs and ICE vehicles is much less for this group). Once TAAS becomes available, this group of fossil fuel drivers will be very motivated to drop their personal vehicles.

While we did not address this point, it is quite clear that global charging infrastructure will also be much more mature in 10 years, and BEVs will be cheaper, better, and available in all classes by this date.

Prediction: Essentially the entire light vehicle market will shift to BEVs.

Question 4 — What are the implications? What will our roads and the world’s automobile market look like once BEVs and TAAS are fully in place? When will this happen?

- World automotive production will fall from 90 million units/year to about 35 million (55 million fewer vehicles will be sold). Global production will include about 10.5 million robotaxis and 24.5 million privately owned vehicles.

- Since automobile production is currently geared toward privately owned vehicles, the impact of TAAS, from the perspective of the world’s automobile manufacturers, is world demand will drop from 90 million vehicles/year to just 24.5 million (a 65.5 million — 73% — drop). Robotaxis in turn will be seen as a new market segment/opportunity with a demand of about 10.5 million units/year.

- Legacy manufacturers who have been slow to move to BEV production, and those with high financial obligations will not survive a 73% drop in production — few will be able to in fact.

- More cars will be on the road: Counterintuitively, while total number of vehicles is predicted to go down substantially, the number of vehicles on the road at any one time is predicted to go up. While robotaxis will form just 25% of registered vehicles, they will be on the road 5× more — they will not be parked. Also, we are predicting that privately owned vehicles will be primarily registered to higher-mileage drivers. This means the world’s fleet in general will be driving a lot more and these vehicles will not parked.

- Congestion? Maybe — maybe not! Many analysts predict our roads will become even more congested since robotaxis are likely to drive empty 25% or more of the time while picking up fares. While this is a legitimate observation and concern, offsetting this fact is the predicted decrease in number of vehicles parked. Considering vehicles are often parked on roads (as opposed to off-road parking lots), it would be reasonable to reduce or even eliminate on-road parking — opening up additional lanes and capacity on our roads.

- Robotaxi options will include regular cars equipped with self-driving systems. While this article focused on city-type robotaxis, the fact is any personal vehicle equipped with a self-driving system can be used, albeit at a higher cost. Being able to “call up” any class of vehicle will be a major benefit for any TAAS fleet, and I suspect many private vehicle owners will be tempted to earn extra income by registering their vehicles on a TAAS network whenever they are not needed.

- Robotaxis will be used as regular taxis are today, for short trips, but also for longer trips ranging from minutes, hours, days, to even weeks — eliminating today’s car rental market.

- When will this happen? Now. It has already started, in fact. For starters, longer-lasting BEVs are now being produced by the millions. The only reason their increased longevity has not impacted markets is because there are not enough to have an impact … yet. The impact of longer-life vehicles will not be easy to even notice over short time frames. What people will notice is a soft automotive market that just keeps getting softer and softer, year after year.

As far as robotaxis, these have of course started as well, with Waymo being among the first, along with brands in China. Cruise just announced a relaunch, and Tesla has its event on October 10th. Tesla’s event will be one to watch, as it could decide to launch robotaxis quite soon. What? I’m serious. I think Tesla “could” … decide to launch its service quite soon in select cities. This could be done by either limiting Cybercab to easy/limited routes, or by using human drivers. If Tesla used human drivers, they would most likely launch using the Model 3/Y. This would allow Tesla to launch its TAAS app while gaining experience with FSD in a low-risk, supervised manner. I’m probably wrong on this point, but either way, October 10th could prove interesting.

Conclusion

This article was fun to write, but I want to be clear that these are still just “educated wild-ass guesses” and, by definition, will almost certainly be wrong — with some items and impacts likely over-estimated and some under-estimated. The value of this analysis is mostly that it suggests a clear trend and that TAAS will almost certainly have a massive impact upon the world’s automotive manufacturers and upon our transportation system.

I also want to point out that this analysis mostly confirms Tony Seba’s 2017 RethinkX report and Tesla’s predictions. The main difference between these reports is RethinkX was much more aggressive in its prediction of a 50% increase in global miles driven by 2030 (vs my 25% prediction), and its 70% prediction of TAAS adoption for private vehicle sales vs my 30% prediction. If Tony Seba/RethinkX is correct, the impact on vehicle manufacturing and society will be even more profound.

What do you think?

By Luvhrtz

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy