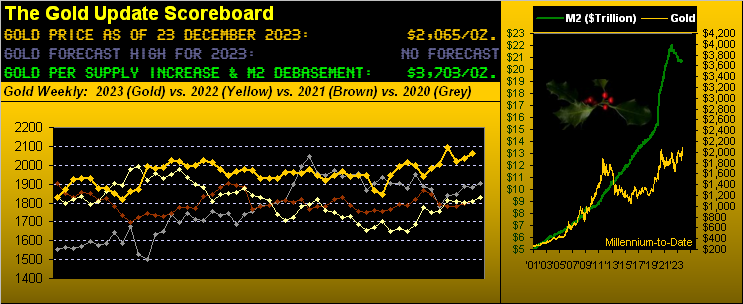

You likely shan’t glean this from anywhere else, so here we go. In this 23rd year of the 21st century, for these past five trading days leading up to Christmas, Gold recorded a net weekly gain of +1.5%, settling yesterday (Friday) at 2065. For the same five-day stint in past years, percentage gains of better than +1.0% have occurred seven times, which begs the question, courtesy of our good man Squire:

“So then, how well does Gold do the next year, mmb?

The answer is in the following gift box for Gold:

Therefore — at least historically so far this century — for the five-day run up to Christmas when price has netted a gain in excess of +1.0%, Gold’s “Average Maximum Gain” at some point through the end of the ensuing year is +23.9%, which from the present 2065 level suggests 2557 during 2024. ‘Twould be a welcome, healthy step toward the current Gold Scoreboard’s valuation level of 3703.

“But, mmb, that valuation has been over 4000 in past, no?

Yes it absolutely has, Squire. And ’tis based on Dollar debasement as mildly mitigated by the increase in the supply of Gold itself. But as many-an-astute reader here knows, the U.S. liquid money supply (“M2”) from 15 April 2022 through today has shrunk from $22.05T to now $20.71T (-6.1%) whilst total Gold tonnage has simultaneously increased from 206,942 to 211,537 (+2.2%). Such combined effect has thus been serving to reduce the Scoreboard’s valuation of Gold. ‘Course given — again historically — that Gold’s actual price has eventually reached up to prior high valuation levels, one has much to look forward to by holding/increasing one’s pile.

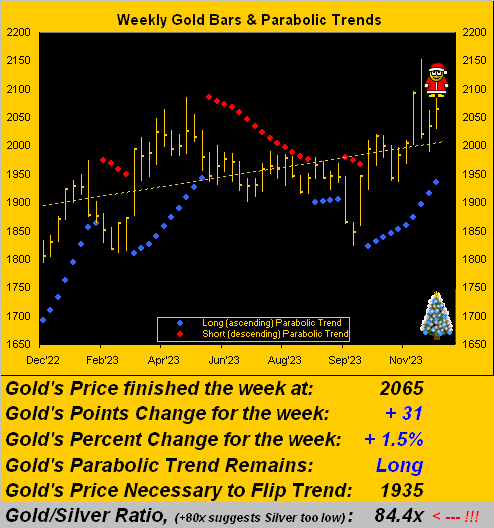

Piling up too is Gold’s price per the weekly bars from one year ago-to-date, the blue-dotted parabolic Long trend now 10 weeks in length. The Shorts (should there be any left following their having been all but obliterated two weeks ago) may see the rightmost few bars as “too high” above the positive dashed trendline, such as to warrant a ShortSide shot. But given our foregoing on price’s firm follow-though upon gains into Christmas, we instead are broadly focused on Gold looking well up into next year … and beyond!

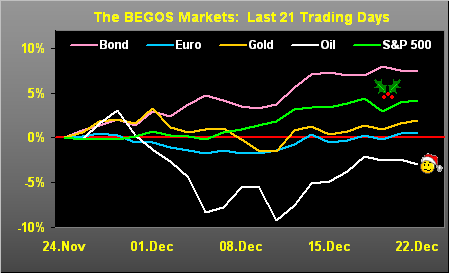

Then from the “(Almost) Everything is Up Because the Dollar is Down Dept.” — which as you know from our purview is due to the FinMedia (the boss) already having instructed the Federal Reserve (the stooge) to cut rates — here we’ve the five primary BEGOS Markets’ respective percentage tracks from one month ago (21 trading days)-to-date. The Bond having been left for dead in October is clearly the winner whilst in the basement obviously is Oil as in mere years it shan’t be used any more. “These food containers made out of wind are really cool!” But we digress… Here’s the graphic:

Blown down on balance certainly since October, albeit having lately garnered a bounce, is the Economic Barometer. But did you catch on Thursday the Conference Board’s lagging indicator called “Leading Indicators” for November? -0.5%, (no surprise as the Econ Baro is always leading such report). Slipping too were the month’s New Home Sales, December’s Philly Fed Index (which has scored only two positive readings across the last 19 months), and Q3’s Gross Dometic Product getting finalized down a few pips.

Still, Personal Income and Spending both increased their paces during November, and the month’s so-called “Fed-Favoured” Core Personal Consumption Expenditures Index came in again at just a +0.1% pace. The latter’s 12-month summation is +3.2%, the lowest since that as of April 2021. Indeed for the Baro’s significant collection of 17 metrics this past week, 10 improved period-over-period. Thus we’ve this:

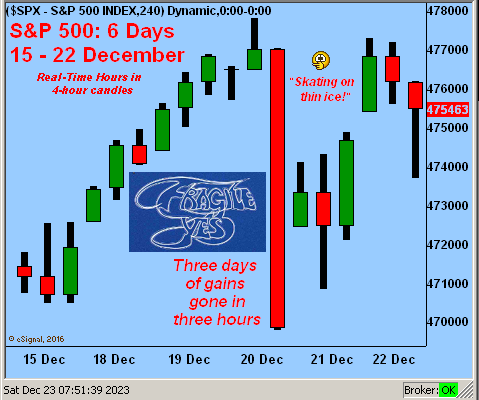

And therein note ole St. Nick pointing down at the top of the S&P. We’ve documented beyond ad nauseam the bazillion reasons for a major S&P correction, (e.g. “Stocks Suicide Mission” from just a week ago). Further, we witnessed on Wednesday (as tweeted @deMeadvillePro) a microcosm of how swiftly it can go. From Friday (15 December) into Wednesday (20 December) the S&P 500 garnered three successive days of “higher highs” … then late-session Wednesday, those three days of gains were gone in just three hours. Deeper into the numbers: the pace at which stocks hit downside bids was nine times the pace they’d previously been hitting upside offers. That is a fear-filled, comparatively monstrous downside pace. True, it didn’t last long, and the S&P then rather messily tried to recover to close its week. But it shows us just how thin is the ice on which the S&P is now skating. Or to cue the popular Yes album from back in ’71:  “Fragile”

“Fragile” Oh yes, indeed:

Oh yes, indeed:

We shan’t futher belabour the point of the unconscionably high S&P other than to (yet again) say: the current “live” P/E is 45.6 (nearly double that of a decade ago); the market cap is $41.6T … the money supply is $20.7T; the yield is 1.479% (all-risk) … for the U.S. T-Bill ’tis 5.208% (no-risk); and just in case you’re scoring at home, the Index is now 33 consecutive trading days “textbook overbought”.

(Oh, and this too on the off notion that for some silly reason you don’t have protective stops in place: first S&P futures “limit down” is -7%, then -13%, then -20% … all on the same day).

Funny how through these recent years, broadly speaking the S&P (given unsupportive earnings) trades at double its value whereas Gold (given currency debasement) trades at half its value. ‘Course, we’ll see who laughs last upon “means reversion”.

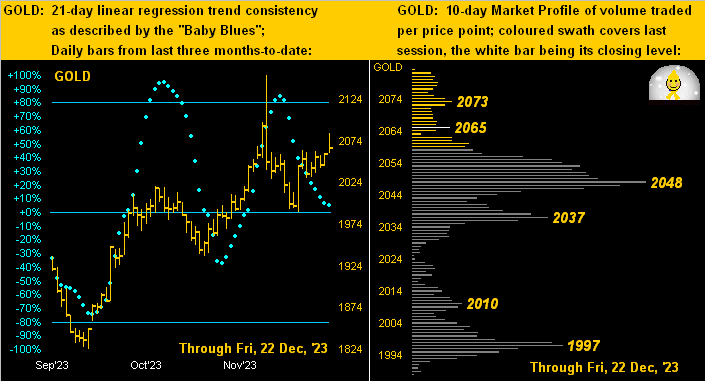

As to the “now”, here next is our two-panel display of Gold’s daily bars from three months ago-to-date on the left along with the 10-day Market Profile on the right. ‘Twould appear Gold’s baby blue dots of trend consistency are nearly halting their fall; and in the Profile, present price appears protected by the 2048 level:

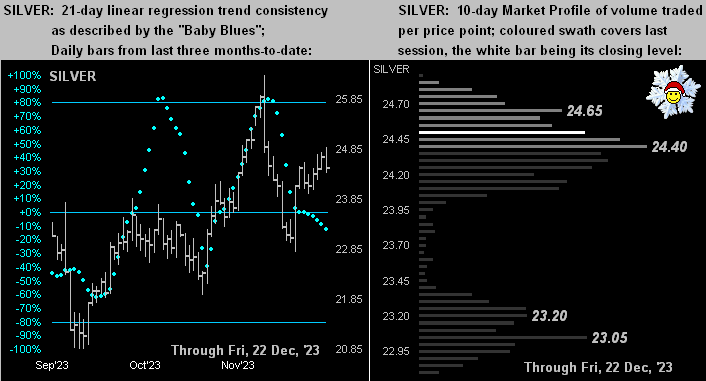

As for the same drill with Silver, her “Baby Blues” (at left) need to apply a bit more brake pressure, with her Profile (at right) indicative of trading support at 24.40 just below her 24.47 weekly settle. “Hold that line”, Sister Silver!

Thus there we are with but four trading days remaining in 2023. And as entitled, Gold’s pre-Chirstmas five-day gain at least by historical comparison is a great gift for the yellow metal going into next year. ‘Course, next week we’ll be here with our wrap for the year and as to how 2024 may well appear.

So with a tip of the cap to our IT crew for voluntarily creating this lovely card from us…

…as they say ’round these parts: “Joyeux Noël !” And give the gift of Gold!

Cheers!

…m…

www.TheGoldUpdate.com

www.deMeadville.com

and now on Twitter(“X”): @deMeadvillePro

*********