Yesterday’s gold market action was disappointing, but from a technical perspective the recoil from the $2790 cash market highs was expected and normal.

Gold, silver, and mine stock investors should be prepared for more discomfort, as this week features the Fed meet tomorrow, the US GDP report on Thursday, the PCE inflation report on Friday, and the Indian budget on Saturday. It’s a big week!

These events often bring downside pressure to the price. Gold could easily trade well under Monday’s low but there is some potential news of significance in play…

News that could be the most significant since US citizens had their gold confiscated by their diabolical “Gmen” in 1933.

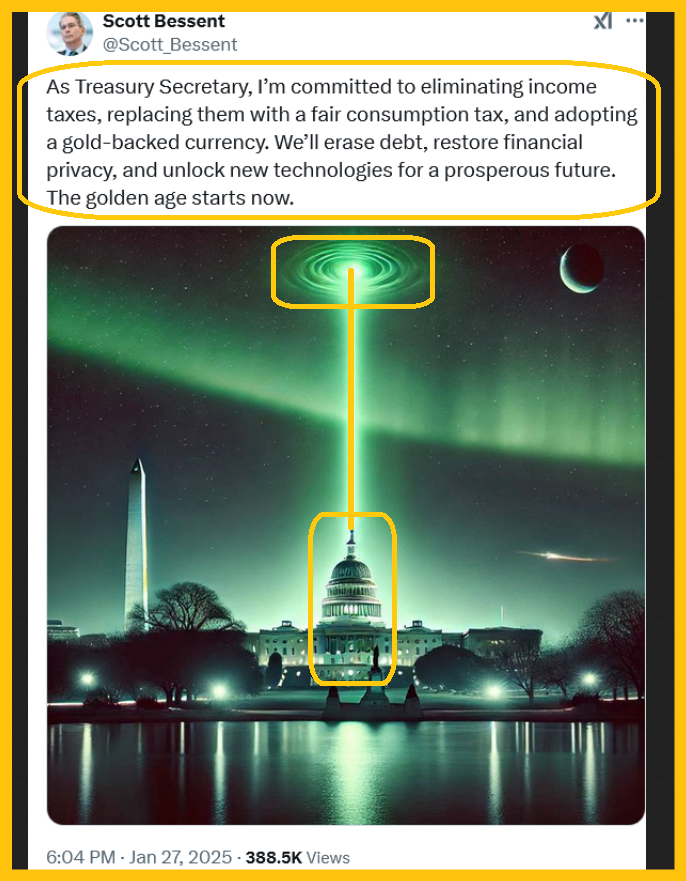

Is it real? The post appears to be valid, and if so, I’ll dare to ask all gold, silver, and mine stock investors to rise… and give new Treasury Secretary Scott Bessent the most thunderous standing ovation in the history of America! Even if the X post isn’t Scott himself, the actions mentioned are exactly what America needs.

The next golden age begins, and in time an ounce of gold could have more purchasing power than a bitcoin has now, but investors still need to use Grade A tactics… to prosper with professionalism.

This is the daily gold chart. Stochastics (14,7,7 series) is overbought. It can stay overbought, but eventually it will dip.

For gold, a pullback to the demand line or the apex of the continuation triangle is likely as this week progresses. From there, a huge rally should see gold surge to the triangle target, which is at least $3000!

The dollar’s technical action is in sync with gold, meaning some short-term strength for the dollar is likely as this week’s events play out… but from there it likely takes a major hit.

What about rates?

The US rates chart also looks toppy. A small H&S top is in play and the neckline is being tested. Longer term, government tariff taxes and ramped-up deportations are going to put upwards pressure on US domestic prices and wages. Trump’s agenda involves a lot of new spending and the cuts in government size are unlikely to be enough to reduce the debt very much.

That means Scott Bessent is probably going to make some kind of gold revaluation a priority.

Mainstream media focuses on Scott’s pro-bitcoin stance, but during his confirmation he mentioned nothing about it and then the glorious X post on gold appeared.

The bottom line: Bitcoin is like a toy piggy bank. It’s a math equation reward and an exciting way to store wealth (until “beyond quantum” computers render it worthless?) but transactions are far too slow for it to work as actual money. No customer or business will wait for 10 to 60 minutes for proof of a transaction, which is how long they must wait with bitcoin.

Scott understands the superiority of gold as money and the key role it can play in restoring sanity to the American government.

In the East, all gold bugs own gold. In the West, some only own silver or mining stocks, based on a scheme to “outperform gold” and make “big fiat profits”. Silver and the miners do outperform gold at times, and often quite significantly, but the main plan of action should be to use them to accumulate more and more supreme money gold rather than more failed fiat.

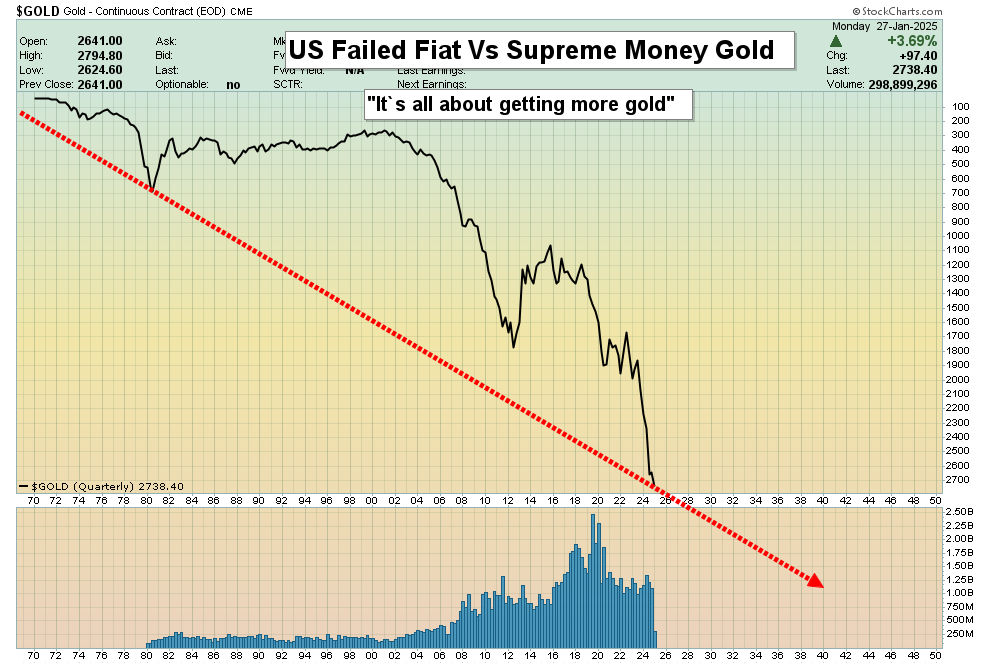

For a big picture view of gold versus fiat:

This is likely the most important chart in the world. As the sign says, “It’s all about getting more gold!”

Gamblers can buy the $2740-$2700 range, and investors could buy the $2600-$2550 zone. That’s about a 5% price sale from the $2800 area high.

A daily focus on the big picture is critical for investors as inflation, a wildly overvalued stock market, debt ceiling horror, and empire transition dominate the investing landscape. I cover this big picture 5-6 times a week in my flagship Galactic Updates newsletter. At $199/year, investors feel the price is too low, but I’m offering a $179/15mths “special offer” that investors can use to get in on the winning action and meticulous analysis. Click this link to get the offer or send me an email and I’ll get you a payment link. Thanks!

For a look at silver:

This is an enticing daily chart. As noted, there’s a nice bull wedge in play and within it an inverse H&S pattern is developing.

What about the miners?

This is the GDX daily chart. Like gold, Stochastics is overbought and likely to pullback.

If that happens, the pullback would create the right shoulder of a significant inverse H&S pattern. That pattern could unleash a rally that targets the $43 area highs. Gamblers (and investors with no miners) should buy any potential right shoulder low.

As noted, Trump’s tariffs and mass deportations will put significant upside pressure on US product prices. Until “Tman” Scott ushers in the next golden age with his revaluation play, the rising US government debt and Mainstreet inflation will cause interest rates to also rise quite significantly.

That rise will essentially annihilate the US stock market, which is probably already in the final throes of a massive Elliott “Super Wave Five”. It would also create an institutional tidal wave into gold and silver mining stocks… a tidal wave that is likely to make the 1970s bull run look like a warm-up act.

This is the GDX weekly chart. It’s arguably the most glorious of all market charts at the current time. There’s a massive C&H pattern with a bull wedge as the handle, and within that there is inverse H&S action. Stochastics (14,5,5 series) is flashing a thunderous buy signal. The bottom line: It’s a glorious time for gold, silver, and mine stock investors of the world. In China, it’s the year of the snake, and this awesome chart shows GDX coiled… and ready to launch a strike at the $60-$65 area all-time highs!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********