The average American investor holds a diversified portfolio of stocks… and their government holds a diversified portfolio of debt-funded wars.

The horror in Gaza will likely become regional, but by then it may already be overshadowed by US neocon meddling in the China Sea going “off the rails”.

Got gold?

Double-click to enlarge this key weekly gold chart. The hefty consolidation of the 2020 breakout appears to be ending. Also, gold is typically strongest during the November to February timeframe… and this joyous season begins now.

Double-click to enlarge this short-term gold chart. The $2000 price is a big round number and gold has rallied from my $1810 “All bugs buy zone” with almost no pause.

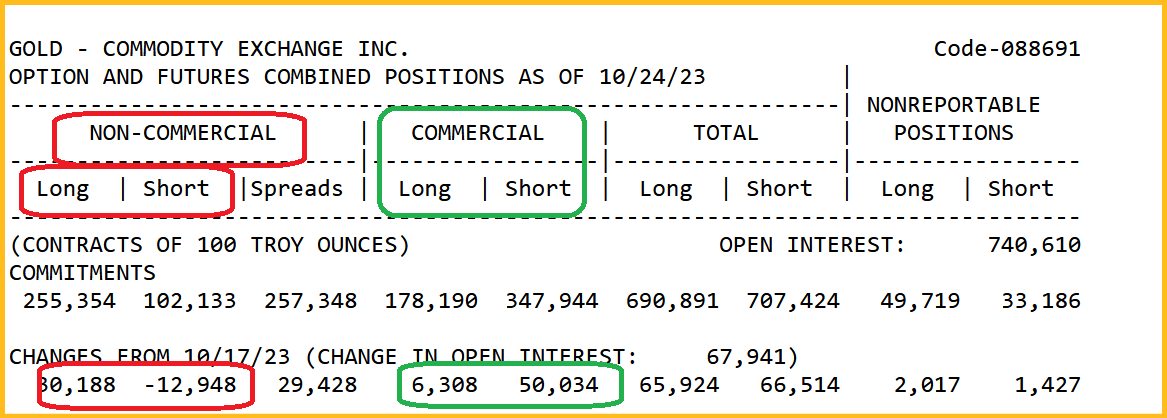

Commercial traders are piling on short positions and my suggestion has been for gold stock enthusiasts to book partial profits but only…

On individual miners that are showing 20%+ profits.

It’s not a top call, but the commercial trader track record is strong, and no investor loses money by booking great profits.

The rally in rates has stalled and a potential H&S top is forming.

There’s significant resistance at 5%-5.25% on the long-term chart and that zone is also targeted by the Fed as a likely peak.

Interestingly, tomorrow features the Fed’s interest rate decision and an important speech from Chair Jay.

The DXY dollar index mirrors the US rates chart; the rally has stalled, and while there could be a push to 108 on a final hike from Jay, the next big move is likely a drop to 103.

After hitting my $93 profit booking zone, oil has formed a loose H&S top pattern and…

The neckline broke yesterday. A drop in the price of oil would likely indicate failing global growth and perhaps a lull in the numerous wars that are promoted by deranged US government workers.

Still, US GDP growth remains decent (albeit mainly because of $2 trillion in fresh government debt). That means Jay could still do a “one and done” hike tomorrow.

A hike would fit with a final 10yr rate push to 5.25%, a gold pullback to $1950-$1930, a drop for oil, and more losses for the stock market.

Gold bugs who bought gold, silver, and/or miners at $1810 won’t be bothered by a tiny pullback to $1950.

Regardless of whether it’s a fiat rate hike trick or a golden Halloween treat from Jay… the next big move for gold is likely a rally to $2200, enroute to $2480.

A consistent focus on gold is critical for investors. I cover the big gold and major markets picture 5-6 times a week in updates just like this one, in my flagship Galactic Updates newsletter. At $199/year, investors feel the price is too low, and I’m doing a $179/15mths special offer that investors can use to get in on the winning action. Click this link to get the offer or send me an email and I’ll get you a payment link. Thanks!

What about silver?

There’s a nice inverse H&S pattern on the silver chart now, and it suggests gold could make it to $2080 before there’s a more significant dip.

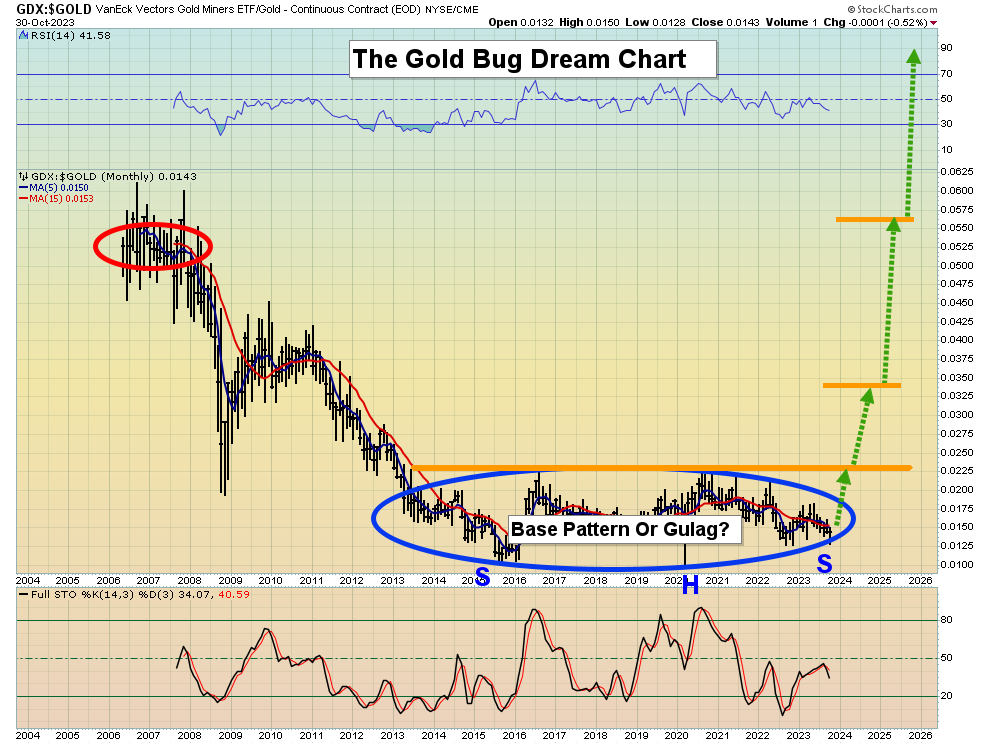

For some gold stock bugs, the dream of miners permanently outperforming gold has perhaps become more of a gulag than a dream.

Is the situation set to change? Well, the massive inverse H&S pattern suggests that it will, and soon.

Double-click to enlarge this short-term GDX chart. On the one hand, GDX has again failed to take out a recent high ($30 in this case) while gold pushes through its equivalent high ($1985) with ease.

On the other hand, falling oil, especially relative to gold, is going to help drive down the all-in sustaining costs for the miners… and the end of the current hiking cycle is likely to play a very helpful role.

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********