After a Fed rate pause (or “skip” as they’re billing it) in June, July will be the key meeting

As noted in yesterday’s post, a Fed rate pause for June is the overwhelming expectation after inflation – as measured by mainstream economists – increased at its slowest rate in 2 years. All to plan, folks.

But the market is mind reading the eggheads to the tune of a possible, if not likely rate hike in July.

In checks the MSfM with everything you need to know about this great drama. Click Jerome, get article.

The article pretty well chronicles the situation, with the usual pap, “growth outlook will likely improve” this and “soft landing” that. But the best quote is in the final paragraph, from Ed Yardeni:

“The risk in continuing to raise interest rates is something will break more structurally than it has so far,” said Ed Yardeni, head of Yardeni Research. “Then they would have to lower interest rates if they cause a recession. In the past, we’ve had very few periods where the fed funds rate went up then plateaued. Usually, the Fed overdoes it.”

Usually, the Fed overdoes it. Indeed, Doctor Ed.

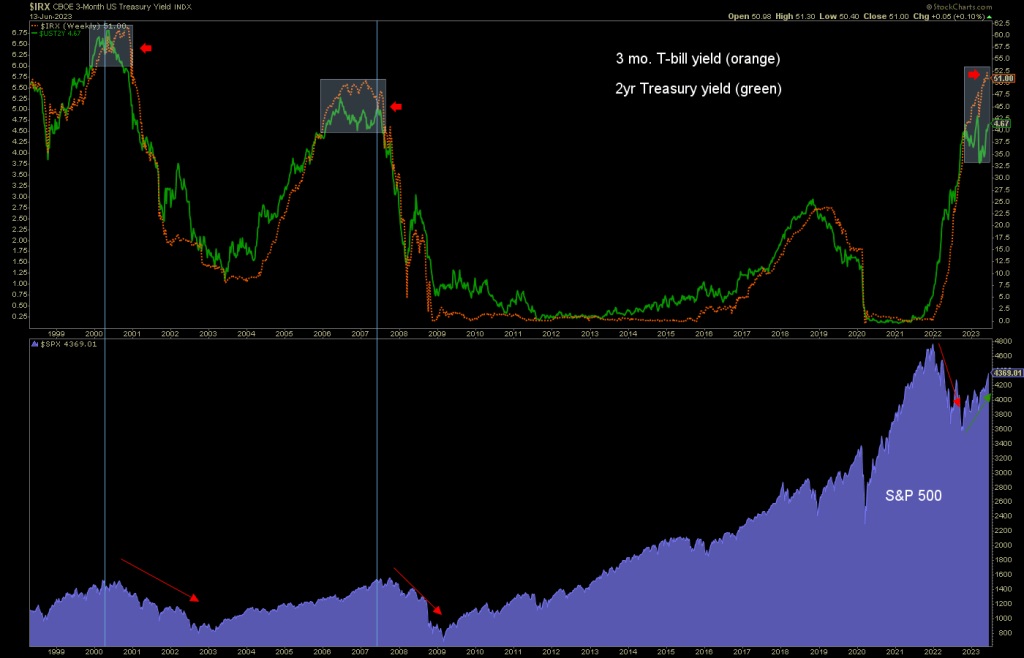

My view is and has been that the stock market is seeing to the discrepancy between 2022’s supposed bear market and previous bear markets, which were preceded by significant upside overshoots by the Fed (as indicated here by the T-bill yield) relative to the 2 year Treasury bond yield. 2022 was a stock market correction and nowhere near a major bear market.

Today, as a Fed rate pause is most likely, the options for the stock market, as I see them, are:

- This week is a false ‘sell the news (of a pausing Fed)’ bull trap breakout above resistance prior to prompt resumption of what will be a major bear market.

- The stock market will drive higher, and make a lower ‘suck ’em all back in’ high (we have the next target for SPX in view), before resuming a major bear.

- The stock market will drive higher, and tick a slight higher high, as it did in 2008, to ‘suck ’em all back in’ before topping into a major bear market.

- The Good Ship Lollipop will sail on, soft landing in hand, Fed having done a bang up job and gold bugs banished back into their worst nightmare; one where the printing press saves the day, is put in the shop for routine maintenance and saves many more days in the future on and on, into perpetuity.

And three of those are actually realistic.

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed market updates and NFTRH+ dynamic updates and chart/trade setup ideas. Subscribe by Credit Card or PayPal using a link on the right sidebar (if using a mobile device you may need to scroll down) or see all options and more info. Keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter@NFTRHgt.

********