The promise of low-cost EVs has been one long awaited. It was here on CleanTechnica that I first read about it, in 2018 or so, when the Osbourne effect started to be mentioned and estimates for price parity were presented, the most pessimistic of which claimed 2027 would be the date BEVs would cost the same as ICEs.

Even if COVID-19 and its disastrous impact on the automotive supply chain were impossible to predict back then, by and large EV companies have delivered, and as ICE car prices have risen through the whole mess of 2021 and 2022, EVs (particularly Chinese-made EVs) have either sustained their prices or lowered them. This has given way to a tsunami of Chinese exports arriving in markets worldwide (save for the protectionist US market) while legacy automakers scramble to offer competitive vehicles, some with more success than others.

And yet, more and more, I’m getting the feeling that here in Latin America this is something we’re watching from afar, as the trend in 2023 is for “affordable” EVs to arrive at prices well over those of Europe, the US, Australia, and of course China. As entry ICE vehicles in the region tend to be relatively cheap, this has made it very difficult for EVs to compete and all but guarantees that they’ll remain a rarity. Sadly, this seems to be the case for every EV that arrives here. Let’s look at some examples:

General Motors: The Luxury Chevy Bolt

We all know and love the Chevy Bolt, a practical hatchback (and more recently CUV) with decent range that stands as a great value-for-money option, starting at an MRSP of $27,800.

In the US, that is.

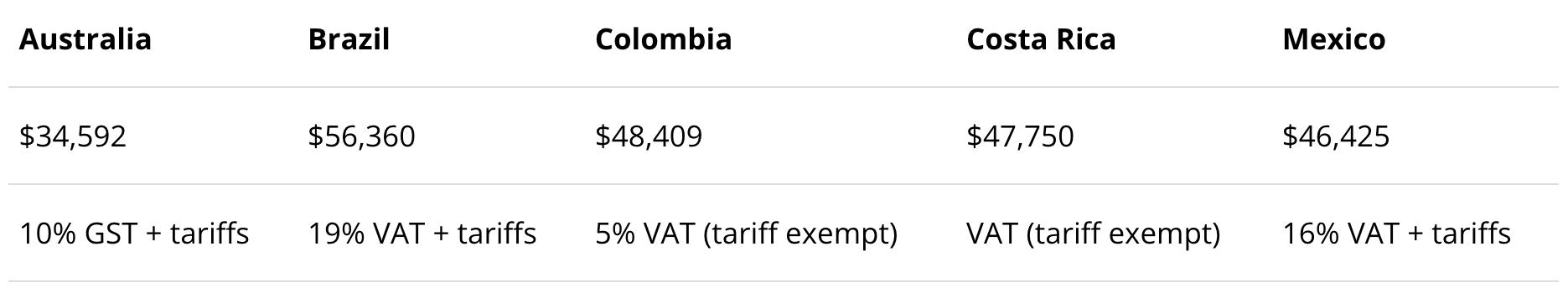

Here in Latin America, everywhere it’s being offered, the Bolt EUV has a significant markup, even if we consider the taxes included in the final price (as shown in the last column).

In the best of cases, the Chevy Bolt doubles the cost of its closest ICEV equivalent (in this case, the Chevrolet Tracker) and stands well above the average car sold in any of these countries. It’s impossible for any vehicle in these conditions to sell in anything other than token amounts.

BYD: The Promise That Wasn’t

BYD, the Chinese Giant, has been at the forefront of the EV revolution, offering very competitive vehicles at affordable prices — to the point of undercutting some ICE options … in China at least.

Even in foreign markets, such as Australia, BYD offers very good value and even competes head-to-head with ICE alternatives.

That is not the case in Latin America. For this comparison, we will focus on one of its more popular models: the BYD Atto 3 (in Australia) or BYD Yuan Plus (in China).

As in the case of the Chevy Bolt EUV, this means that the BYD Yuan Plus at best doubles the cost of its direct ICEV competitors, making it far less competitive that in Australia. This is the norm for all BYD vehicles currently being sold in the region: we’ll have to wait and see if the BYD Seagull also arrives at such high prices.

Dacia/Renault: The Cheapest, But Still Too Expensive

The Dacia Spring is, by far, the most affordable EV in Europe. Affordability was the name of the game as well for its Latin American brother, the Renault Kwid E-Tech: a vehicle that I had high hopes for in the Colombian market (claiming that, if priced right, it could take BEV market share to 5% on its own).

Well … even if it’s not as bad as the others, it still wasn’t priced quite in line with the European version, which is a shame, as the current price doubles the entry ICE Kwid cost (making it, again, very hard for the electric model to compete).

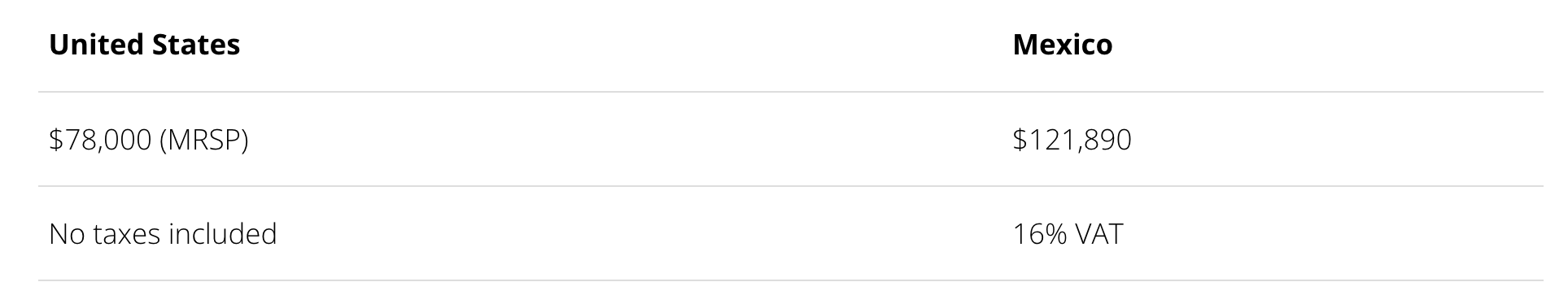

Ford Mustang Mach-E: More Expensive In Its Home Country

Last of all, I bring here the Ford Mustang Mach-E, built in Ford’s Cuautitlan plant in Mexico. Despite being manufactured locally, the Mach-E is only sold in Mexico in its most expensive version — GT Performance — and at a significant markup compared to the same version in the US:

Why Is This Happening?

Even if I have my own hypotheses, this is the question I’m bringing to you, dear readers: Do any of you have any idea why this is happening?

As for me, several probable culprits come to mind:

Lack of EV mandates: Europe, the US (well, CARB states), and of course China have very stringent regulations aimed at promoting BEVs. This makes it a requirement for companies to offer them at prices that guarantee at least some volume in sales. This is not the case for any Latin American country, where EVs may receive tariff and tax exemptions, but they’re not required to be sold in any specific numbers.

Supply issues: Even if automakers can make EVs at compelling prices, what’s the point of selling them at those prices if they won’t be able to keep up with demand? If all automakers have to sell are a few hundred units a year, perhaps it’s worth it for them to keep prices high, at least until automakers can adequately supply these markets.

Low volumes: Related to the prior issues, fixed costs are still an issue for distributors, and amount to a far larger toll per vehicle sold when they only sell a few dozen vehicles a month (instead of thousands).

Lack of competition: At last, the fact that only a few models are being offered in most countries probably allows distributors to overprice them.

In any case, I had ample expectations for 2023 and hoped the arrival of many Chinese models would increase competition and reduce the gap between ICE vehicles and their equivalent BEV models. So far, this hasn’t been the case, and BEVs remain between two and three times more expensive than their equivalent ICE competition. In developing markets, where even these entry ICE vehicles could be considered a luxury, it’s inevitable that expensive BEV sales will struggle to be reach high numbers and achieve significant market share.

Yet, the future still brings hope, and if the reasons I quote are accurate, perhaps we can still achieve price parity before 2027. What do you think?

Addendum

It’s only fair to add that I have found one company — Morris Garages — with very similar pricing for its MG ZS EV in the UK, Chile, Colombia, and Costa Rica. Thumbs up to them!

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Have a tip for CleanTechnica, want to advertise, or want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Former Tesla Battery Expert Leading Lyten Into New Lithium-Sulfur Battery Era — Podcast:

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …