Björn Jonsson has been appointed Global Business Line Manager for Mining & Materials within ABB’s Process Industries division – IM Editorial Director Paul Moore recently had the chance to sit down with him to talk about his background– and of course some aspects of the mining market including electrification

Q As of October 1, you assumed the role of Global Business Line Manager for Mining & Materials within ABB’s Process Industries division – can you tell us a bit about your background?

A: I’ve been with ABB for over 22 years. That has been 22 years of continuous growth and development, starting as a commissioning engineer in 2003. Since then, I’ve had the chance to grow and held various leadership roles, from Global Service Manager for Paper, Metals and Cement to HUB Division Manager for Process Industries North Europe, and most recently, Global Business Line Manager for Hoisting. My career has spanned multiple industrial segments, with increasing focus on mining over the past nine years. While I’ve spent six years abroad, most of my time has been in Sweden, home of diverse process industries. I’ve also naturally been actively involved with Svemin, the Swedish Association for Mines, Mineral and Metal Producers.

IM Editorial Director Paul Moore with Björn Jonsson, Global Business Line Manager for Mining & Materials on a visit to the Boliden Rävliden battery trolley project

Q Can you expand on the business line structure and what is behind it?

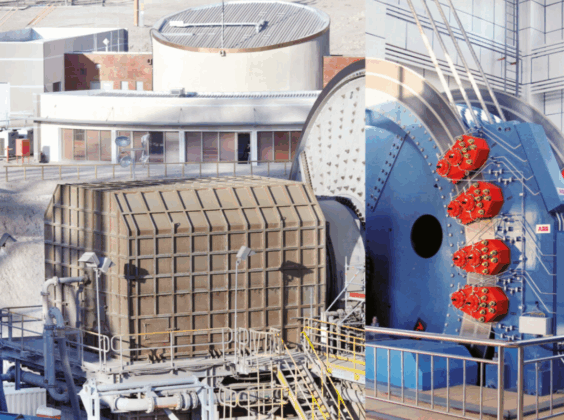

A: The business line Mining & Materials that I am leading consolidates ABB’s mining solutions under one roof, including electrification, automation, digital, hoists, grinding solutions, such as our gearless mill drives, and material handling. This means we can find a lot of synergies internally to become more efficient in many ways and offer one unified interface towards customers in mining, whether we are talking about hoists, gearless mill drives, digital, automation or trolley mining trucks. Take eMine, for example, our ‘grid-to-wheel’ electrification concept. It integrates electrical infrastructure, automation, and digital solutions. As mines electrify, production planning must align with electrical infrastructure. You plan the power loads based on battery truck charging scheduling, production hoisting etc and at the same time look at availability and real time cost of energy and have that all integrated in one system, in real time. At the end, you plan your production in a different way, and that’s where ABB’s integrated approach helps customers rethink production planning from the ground up. I think the role of ABB and companies like ABB is becoming increasingly important for our customers going forward.

Q What does that mean in terms of when ABB gets involved in a mining project and who you collaborate with?

A: ABB is involved in mining projects much earlier than before. Previously, ABB typically joined projects after initial planning. Now we have to be there at the beginning of the planning of the mine, and the same applies to customers who have existing brownfield mines and are about to transform and expand. Our Mining’s Moment report showed that around half of mining customers want to make their mine electric with an incremental approach. I mean, taking it step by step, because they want to phase the costs, without too much production disruption. But even if you are electrifying in small steps you still need to think about the full electrical infrastructure implications. For ABB, this is reflected in some of the strategic partnerships we have put in place – both with major mining customers like Antofagasta Minerals, but also with key OEMs like Epiroc and Komatsu for example – it’s all part of that vision of working more closely from the beginning. We’re working together collaboratively over a number of years, and on a number of solutions, as no single company can build the fossil free mine themselves in isolation. You need competence from different parties, and it’s also important that each focuses on the areas where they have core competence, and for us that is automation, electrification and digitalisation. For the pieces we are not experts in, such as the trucks themselves, we need other partners to innovate.

The new ABB Business Line Mining & Materials consolidates ABB’s mining solutions under one roof

Q Technology moves at a rapid pace – how will ABB make sure it stays ahead of the curve in its solutions for mining?

A: Through innovation and investment. Our ambition is to support our customers with not only the solutions that are available today, but also the solutions that will be available tomorrow. This means looking at our R&D and roadmap pipeline to ensure that when a mine project is ready to start, they will get the best technology, for that mine, at that time. In 2024, ABB invested around US$1.5 billion in R&D. Our goal is to lead with technology and be the market leader in our active segments. And if you’re the biggest in the segment, you have the revenue needed to make the key R&D investments to support the future needs of our mining customers. As long as you do that, you can continue to lead that evolution. Co-creation is also a win-win approach for the industry to move forward. Taking the example of Sweden, especially in the mining segment, we have a strong mining cluster that has evolved around this way of collaboration. A lot of the innovations that we have done are co-created with other leading suppliers in the mining industry, together with strong end users like Boliden and LKAB. In the end, it benefits them, because then they have the latest and greatest technology. At the same time, we also get a chance to export them to other miners globally, and that also helps the industry to share development costs and keep prices competitive.

Q Are there any notable in-depth collaborations from your previous roles that stand out?

A The Sustainable Underground Mining (SUM) project – which was set up by LKAB in 2018, has been a key collaborative project in my career. ABB was a part of it, along with Epiroc, Sandvik and Combitech. I was part of leading that and we really achieved a lot, building new standards for underground mining, with interoperable solutions across multiple OEMs, creating in the end an autonomous, electric and high productivity underground fleet. ABB has provided much of the digitalisation, automation and electrification expertise. And if you go above ground, ABB has been very much involved in the HYBRIT green steel project – we supplied a full electrification and automation package for the pilot plant in Luleå. Another interesting one is our EcoHoist collaboration – we are working with them on a subscale demo facility. While ABB is the global leader in skip based hoisting systems, other vertical material transport solutions are likely to have a place going forward. We don’t have the capacity to look at all innovations in-house. So as a company, part of our strategy is to collaborate with starts ups – exemplified by ABB’s SynerLeap startup accelerator program. We have supplied mining hoists since 1891, and our experience and reach means we can help them to industrialise their idea faster, and ultimately bring more options to our customers as well.

Q How do your technologies achieve more energy saving wins and contribute to sustainability that way?

A Milling operations are a good example – the largest 40 ft SAG mills are massive energy consumers. Gearless drives are about 3.6% more efficient than geared ones – this might seem a small percentage, but it has a big impact over time in your operational costs but also in your climate impact. At the same time, gearless technology has similar benefits in the largest mining conveyor belts. For these and other applications we use state-of-the-art synchronous motors. The Chuquicamata copper mine gearless driven conveyor has 11 x 5 MW synchronous motors totaling 58 MW – they bring maximum uptime and efficiency. And in this application, conveyors enable to take large numbers of mining trucks off the road, so it comes with big potential of fossil fuel savings as well. This year we also set a new world record by achieving 99.13% energy efficiency with a motor destined for an Indian steel customer – it will save around 61 GWh of energy and $5.9 million in electricity costs over a 25-year lifespan – equivalent to four days of peak output from the world’s largest offshore wind farm.

Q Looking finally at eMine – what are the main challenges of pushing the electrification envelope further? Is it remaining conservatism and not wanting to take on more risk?

A Electrification in mining is no longer a distant vision. Electrification has progressed and is inevitable. It’s just taking a little bit longer than maybe people would have expected five or even ten years ago. One challenge is having access to green energy and having that at the right price – in many mining regions that remains a major stumbling block. Looking again at our Mining’s Moment report, there’s a couple of other things that our customers also say are barriers to electrification. One being access to the right people and skills. I actually think that a way of attracting people to work in mining is to make it more technologically advanced. At ABB we can help by introducing new digital and automation technologies related to electrification, and that includes AI. Another issue is the scale of investment required to electrify mining operations, which spans the new equipment but also the new infrastructure – you have to build a production system that you can live with for a long period of time, meaning you want to have low risks. And of course, if you want to have low risk, it might mean that you don’t want to be one of the first to test new technology. That’s why pilot projects are crucial to remove barriers. Our underground battery trolley project with Boliden’s Rävliden is a good example. We’ve done six trolley projects globally, with a seventh underway, and at all those projects, while there is an initial cost, we have also seen even better productivity improvements than expected. We are also doing a lot of studies together with customers that show going electric is feasible from a technical and economical point of view. Underground, for example, it means less ventilation and cooling requirements along with lower maintenance costs. When you add it all up, the case for going electric is stronger than ever.