The Federal Reserve’s decision to cut interest rates by 50 basis points boosted US stocks and has some observers wondering whether we are gliding towards an “everything rally”.

CNN reported on Friday that investors were moving into riskier assets from bitcoin to tech stocks. The S&P 500 on Thursday marked its 42nd record-high close in 2024, while on Wednesday, the Dow chalked up its 31st record high of the year. All three major stock indexes were on pace for a positive week.

Hedge fund manager Eric Jackson of EMJ Capital told CNBC the current environment of economic growth and interest rates resembles the early days of the 1982 bull market, the first 10 months of which the stock market gained 107%.

Jackson pointed to the fact that, like in ’82, the yield curve has switched from an inverted to an uninverted position.

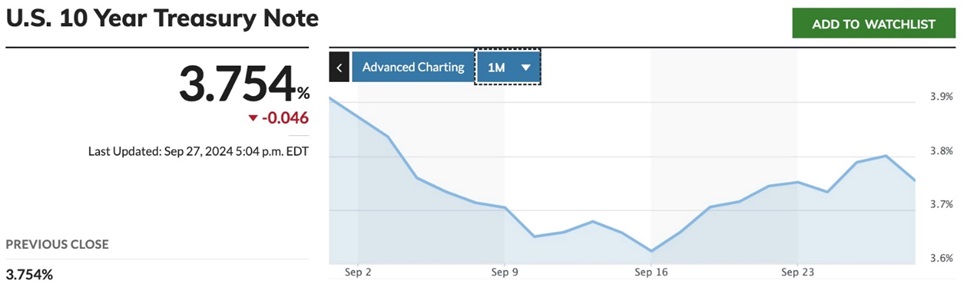

In a typical healthy market, the yield curve (typically the spread between the US 10-year Treasury note and the 3-month or the 2-year note) shows lower returns on short-term investments and higher yields on long-term investments. This makes sense, as investors earn more interest for tying up their money for longer. The yield curve is said to “invert” when short-term yields are higher than long-term yields.

Typically a recession follows six to 12 months after the yield curve inverts.

“The last time that the yield curve was inverted for so long and then finally broke out to the upside the way that we’ve seen recently, in a benign economic environment where rates are coming down, was August of 1982,” Jackson said.

He added: “And when that happened, there was a stock market rally which lasted 10 months. Nasdaq went up 107% over those 10 months. So I think we could be in for an everything rally.”

That could mean everything from small-cap and junior mining stocks to major miners and the big tech stocks all rise together.

The combination of interest-rate cuts from the Federal Reserve, resilient economic growth, and the un-inversion of the yield curve is overall a favorable environment for risk assets, especially if inflation stays subdued.

When a similar scenario played out in the summer of 1982, the S&P 500 launched a five-year bull market that delivered a total return of 229% and annualized gains of 26.7%, the second-highest annualized gain on record, according to data from FirstTrust.

The un-inversion of the two-year and 10-year US Treasury yield curve is significant because it has been in negative territory for about 26 months, the longest in history.

The yield curve finally went positive earlier this month.

The yield curve flashing between positive and negative and positive is considered a reliable recession indicator, but with the economy still in good shape, this time appears to be different, as it was in 1982.

Global mining index soars

The comparison with 1982 is instructive with regards to the overall direction of mining stocks — majors, mid-tiers and juniors.

The Northern Miner reported on Wednesday that the S&P/TSX Global Mining Index has gained 14% since Sept. 6, its biggest jump this year. A trifecta of reasons were given: central banks cutting interest rates; the United States signaling more battery metal funding; and China stimulating its sluggish economy.

The index includes some of the largest mining companies in the world, including BHP, Rio Tinto and Freeport McMoRan. On Tuesday the index reached 203.6 points compared to 177 points 19 days earlier — as shown on the graph below. Tuesday was also the biggest one-day increase so far this year, reports Northern Miner.

Source: MarketWatch

The article backs up its three points by mentioning that Washington conditionally handed out some of its $7 billion in funding for the domestic electric vehicle supply chain; and that the Department of Energy said it may grant $225 million to Standard Lithium’s and Equinor’s South West Arkansas joint venture project. South32’s Hermosa manganese project in Arizona and Element 25’s manganese sulfate monohydrate plant in Louisiana are also in line for financing.

Kamala Harris, the vice president and Democratic presidential nominee, has vowed to create a US critical minerals stockpile and expand the existing depleted National Defense Stockpile by spending $1 billion.

Bloomberg said the plan is part of a broader industrial policy vision Harris’ campaign laid out Wednesday. It also called for new incentives and the use of emergency government powers under the Cold War-era Defense Production Act to increase domestic processing of critical minerals, which includes lithium, graphite, cobalt and rare earths.

The announced new critical minerals stockpile follows a House committee recommendation in December for creating a reserve of critical minerals “to insulate American producers from price volatility” and protect against China’s “weaponization of its dominance in critical mineral supply chains.”

China has moved to cut interest rates by 50 basis points, which could benefit 50 million households; and China’s National Development and Reform Commission, responsible for five-year plans, approved several new infrastructure projects in August after loosening restrictions.

Commodity supercycle

Sprott earlier this year pointed out that A new copper supercycle is emerging, built on several rising geopolitical and market trends, including electrification, national security concerns, environmental policy, supply constraints and deglobalization.

While no two supercycles look the same, they all have three indicators in common: a surge in supply, demand and price. The new commodity supercycle, however, could look a bit different from the previous ones for one reason — the focus on attempts to limit global warming.

The commodity supercycle revisited — Richard Mills

According to S&P Global, a more aggressive commitment to the energy transition across G-20 nations could also create the conditions for a sustained surge in demand, supply and prices.

Like in the past, commodity supercycles are usually driven by strong demand for raw materials, manufactured materials and sources of energy. The energy transition serves as a major catalyst for all the key inputs to our renewable energy infrastructure, taking demand to levels never seen before.

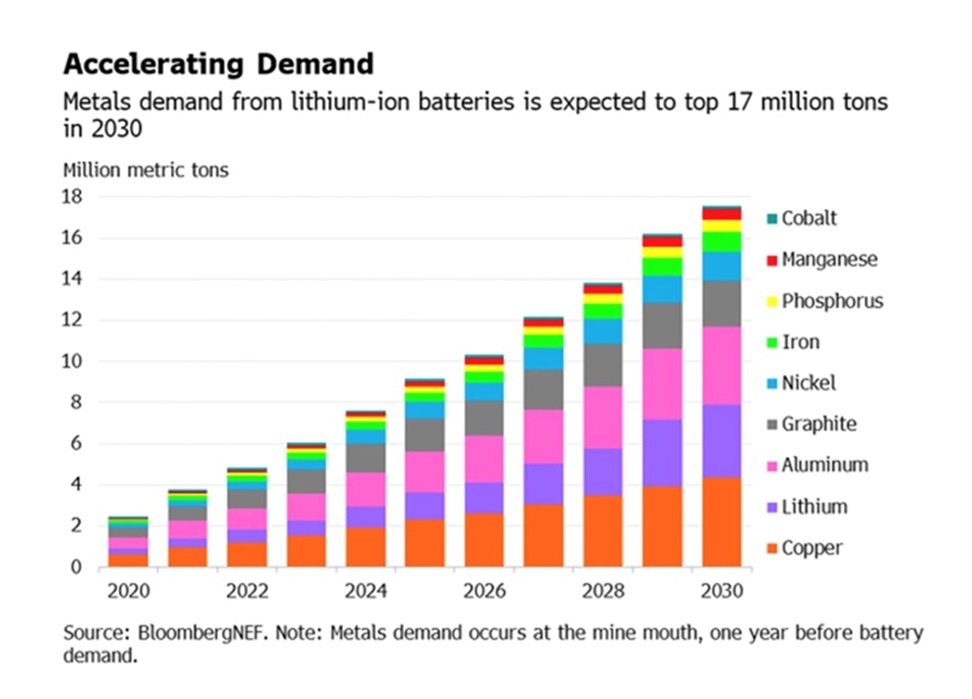

Demand for copper — the cornerstone for all electricity-related technologies — is set to grow by 53% to 39 million metric tons by 2040, according to BloombergNEF. Battery metals like lithium, cobalt and nickel will see even faster growth, reaching more than three times the current demand levels by 2030, says BNEF, with lithium rising the fastest with a seven-fold increase.

Source: BloombergNEF

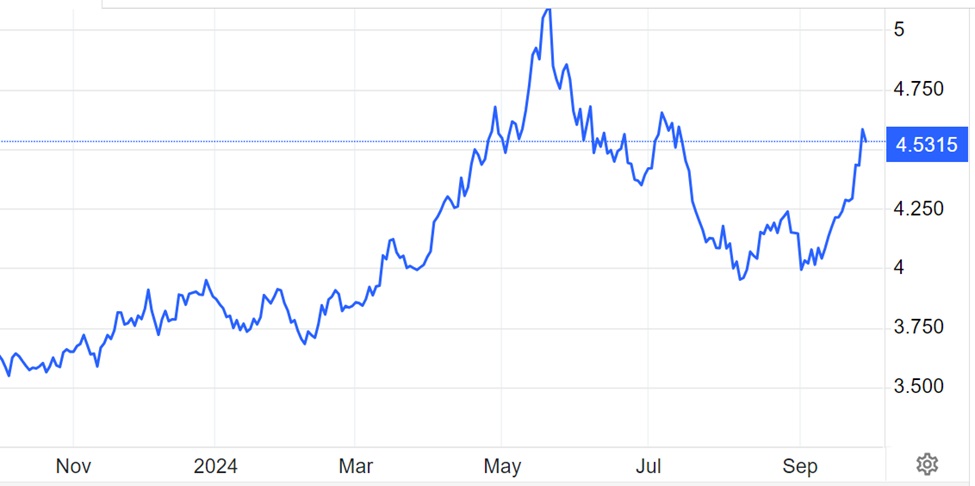

Copper prices may have come off the boil recently (from a high of $5.11/lb in May) due to problems in China but the structural supply deficit is real and keeping prices elevated.

Benchmark Mineral Intelligence (BMI) forecasts global copper consumption to grow 3.5% to 28 million tonnes in 2024, and for demand to increase from 27 million tonnes in 2023 to 38 million tonnes in 2032, averaging 3.9% yearly growth.

Yet the US Geological Survey reports supply from copper mines in 2023 amounted to only 22 million tonnes. If the copper supply doesn’t grow this year, we are looking at a 6Mt deficit.

One metal that has already plunged into deficit territory is silver. While often bought for investment purposes, silver is primarily used for industrial applications such as electronics and automotive. It’s also a key ingredient in solar panels, and as the world moves towards renewables, demand from that sector has grown exponentially.

The Silver Institute reported a 184.3 million-ounce deficit in 2023 on the back of robust industrial demand.

SI expects demand to grow by 2% this year, led by an anticipated 20% gain in the PV market. Industrial fabrication should post another all-time high, rising by 9%. Demand for jewelry and silverware fabrication are predicted to rise by 4% and 7%, respectively.

Total silver supply should decrease by 1%, meaning 2024 should see another deficit, amounting to 215.3Moz, the second-largest in more than 20 years.

Silver is in the fourth year of a shortage, with mined supply seemingly unable to keep up with demand, which is strongly influenced by the solar and electronics markets.

Admittedly the iron ore price has taken a beating of late, mostly due to the negative outlook for Chinese demand, which has been hit by a protracted property crisis.

Earlier this month, however, the steelmaking ingredient was back above $100 a ton. Traders are seeing China’s drop in inventories as a tentative sign that the period of oversupply is starting to ease.

China imports the most iron ore of all countries, followed by Japan and South Korea.

Commodity prices have stayed buoyant despite relatively high interest rates, high bond yields and a high dollar — all headwinds for commodities.

The 0.5% reduction in US interest rates has made an impact on Treasuries and the dollar, with both falling.

Source: MarketWatch

Source: MarketWatch

Bond yields and bond prices have an inverse relationship. Could this be the start of a bull market for commodities once the triad of lower rates, lower bond yields and a lower dollar takes effect?

First, second, third movers

Back to mining stocks, when commodity prices rise, there is a definite pattern to which type of mining company leads the sector, and which ones follow.

As commodities rise, major mining companies see an almost immediate lift in their share prices, which makes sense; their profits increase from realizing higher metals prices.

Over time, money trickles down to mid-tier producers, which generally trade for lower prices but can rise quickly in a bull market, bagging handsome returns for shareholders.

Finally, investment capital makes it down to the smallest mining companies — the explorers, aka the juniors. While juniors are the most speculative and most risky, they also historically offer the best leverage to rising commodity prices.

A junior resource company’s place in the food chain is to acquire projects, make discoveries and hopefully advance them to the point when a larger mining company takes it over. Discoveries won’t be made if juniors don’t have boots on the ground, if they aren’t out in the bush poking around and busting rocks.

Investing early in the development cycle of the right gold junior, one that has an excellent project in a safe jurisdiction led by experienced management with the ability to raise money, can reap huge rewards — 5, 10, even 20 times your money isn’t uncommon.

Juniors are extremely important to major mining companies because they are the firms finding the deposits that will become the next mines. In this way, juniors help the majors to replace the ore that they are constantly depleting in their operating mines. Put another way, juniors find the resources for majors to turn into mineable reserves.

Junior resource companies own the world’s future mines — Richard Mills

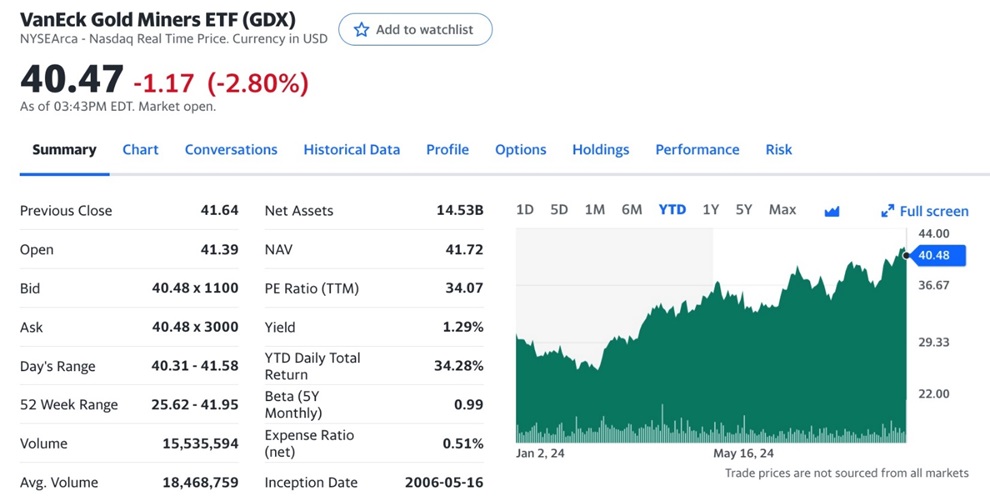

Take a look at where we are in this cycle by consulting the following charts.

GDX and GDXJ are considered proxies for the senior gold miners and the junior gold miners, respectively. Year to date, the VanEck Gold Miners ETF (GDX) is up 32%. The VanEck Junior Gold Miners ETF (GDXJ) has gained 33%. An equivalent junior gold mining proxy, the Sprott Junior Gold Miners ETF, has risen 29% so far this year.

Source: MarketWatch

Source: MarketWatch

Source: Google Finance

Note that these three ETFs invest in gold equities only. The junior mining equities likely to rise even more than gold’s 30% YTD gain — the ones exploring for commodities that feed into the energy transition like silver and copper — could easily exceed GDX, GDXJ and SGDJ.

Remember at the beginning of the article when we talked about the possibility of an “everything rally”, precipitated by central bank interest rate cuts (not only the US but other developed nations) and the uninverting of the yield curve? As investors become more risk-on, at AOTH we believe they should be taking a look at adding junior mining stocks to their portfolio.

Crane Data points out that, up until the rate cut, the focus among investors was on short-term deposits like money-market funds. And that makes sense. Why risk your investment capital on a stock when you can get 5% risk-free in a savings account, or more in a money market fund? That may have been the best use of capital during inflation’s peak in 2022, offering a haven while stocks and bonds plummeted in value, but times have changed. Crane Data states:

All that cash sitting on the sidelines is about to be unleashed. Again, any day now. Well, now the day is here so we will see if they are right.” The FT says, “It is hard to ignore the size of this asset class. Added together, money market funds hold easily north of $6tn in the US…

The mining sector in comparison to the rest of the stock market is small. It doesn’t need $6 trillion to move prices; even a billion dollars flooding into resource orientated stocks would be enough to wake up sleeping mining equities.

Conclusion

Majors, mid-tiers and juniors all look ripe for a rebound in what is increasingly a risk-tolerant environment now that “the punch bowl” of monetary easing/ lower interest rates is back on central banks’ agendas. Lower rates should put pressure on bond yields and the US dollar, which normally fall as commodity prices rise.

The majors as seen by the recent performance of the S&P/TSX Global Mining Index have already started moving. It’s only a matter of time before the money trickles down to the mid-tiers and the juniors, which offer the best leverage to rising commodity prices and to own the world’s future mines.

The majors have been consolidating as a way of increasing their metal reserves but they are running out of companies to merge with or acquire. The only way for them to get new resources to turn into mineable reserves is to buy juniors or partner with juniors. That, along with the return of investors to junior mining, are two trends that we at AOTH are following.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

*********