Metals and Miners are in the timing window for cycle lows and prices may be very close to bottoming.

Metals and Miners are in the timing window for cycle lows and prices may be very close to bottoming.

Gold needs to close above Wednesday’s $2358 high to reverse the post-Fed breakdown and support an immediate bottom.

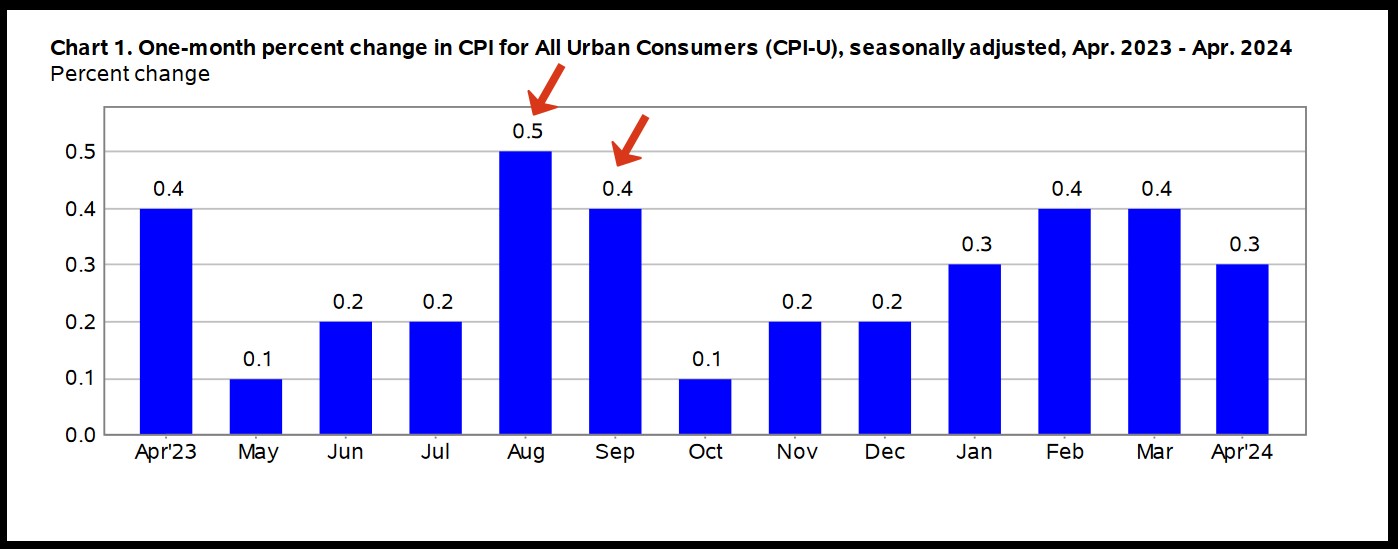

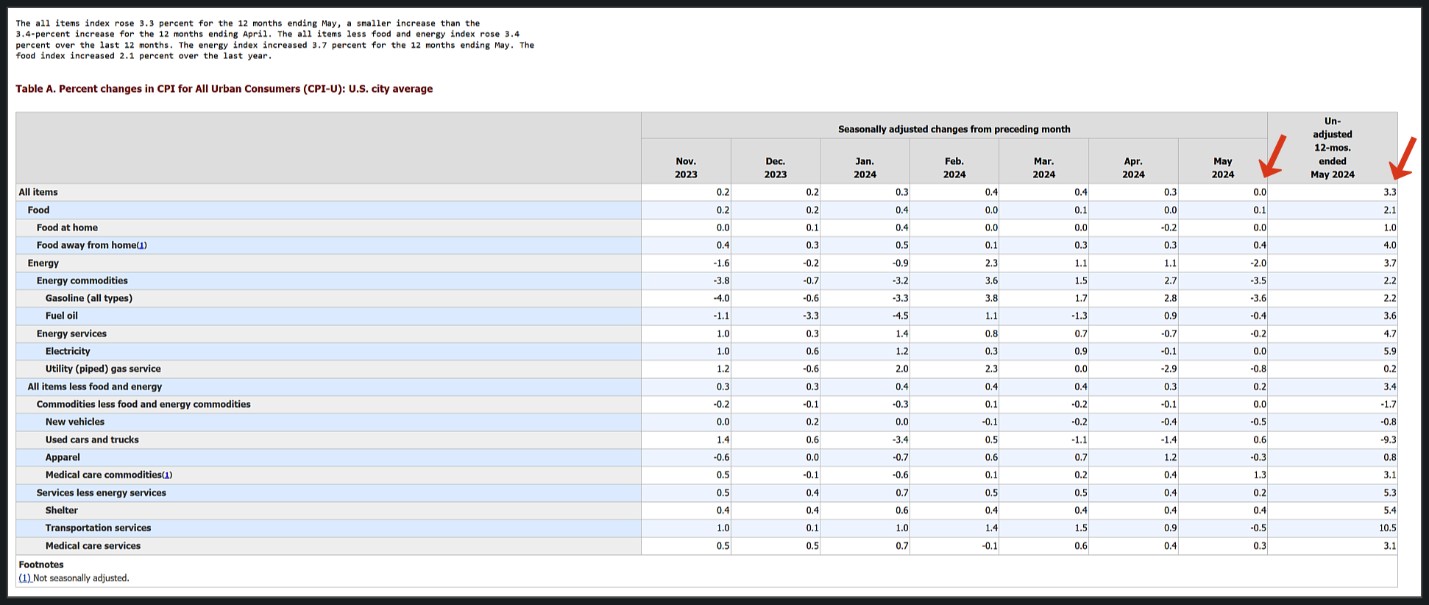

Headline inflation continues to decelerate and at this rate CPI could move towards 2.5% by October; provided we don’t get a spike in oil.

Base Effects

The strong inflation prints of 0.5% and 0.4% last August and September are set to expire in the coming months. May CPI was flat at 0.0%, and June is projected at 0.1%. If monthly inflation remains tame at 0.2% or lower, the headline number could be nearing 2.5% by October, giving the Fed the green light to start cutting.

Cycle Update

GOLD DAILY- Gold officially closed below the 50-day EMA and finished inside our cycle target box. A daily close above Wednesday’s high ($2358.80) would reverse the post-Fed breakdown and support a bottom. Once a bottom is confirmed, our work supports a strong rally into August.

SILVER- Silver tagged the 50-day EMA and finished inside our target box. Closing back above $30.00 would support a cycle low. The setup remains strong, and we think silver could shoot much higher from here.

GDX- Miners dipped to fresh lows and closed progressively below the 50-day EMA. We remain in the June target box. A daily finish above $34.06 would support a bottom.

GDXJ- Juniors are well within the June target area, and a close above $42.65 would support a cycle low and new advance.

SILJ- Silver juniors closed well below the 50-day EMA, reaching the mid-range of our target box. Prices need a close above $11.59 to support a bottom. Otherwise, the decline could extend into next week.

Conclusion

Metals and miners are very close to completing cycle lows. From here, we expect aggressive upside into August or September with a $2800 target for gold.

********