Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Some interesting things crossed my path recently regarding Tesla shareholders and the vote regarding Elon Musk’s pay compensation package. And it got me thinking — the bigger issue may not be the vote, but what happens after the vote.

But let’s start with the vote.

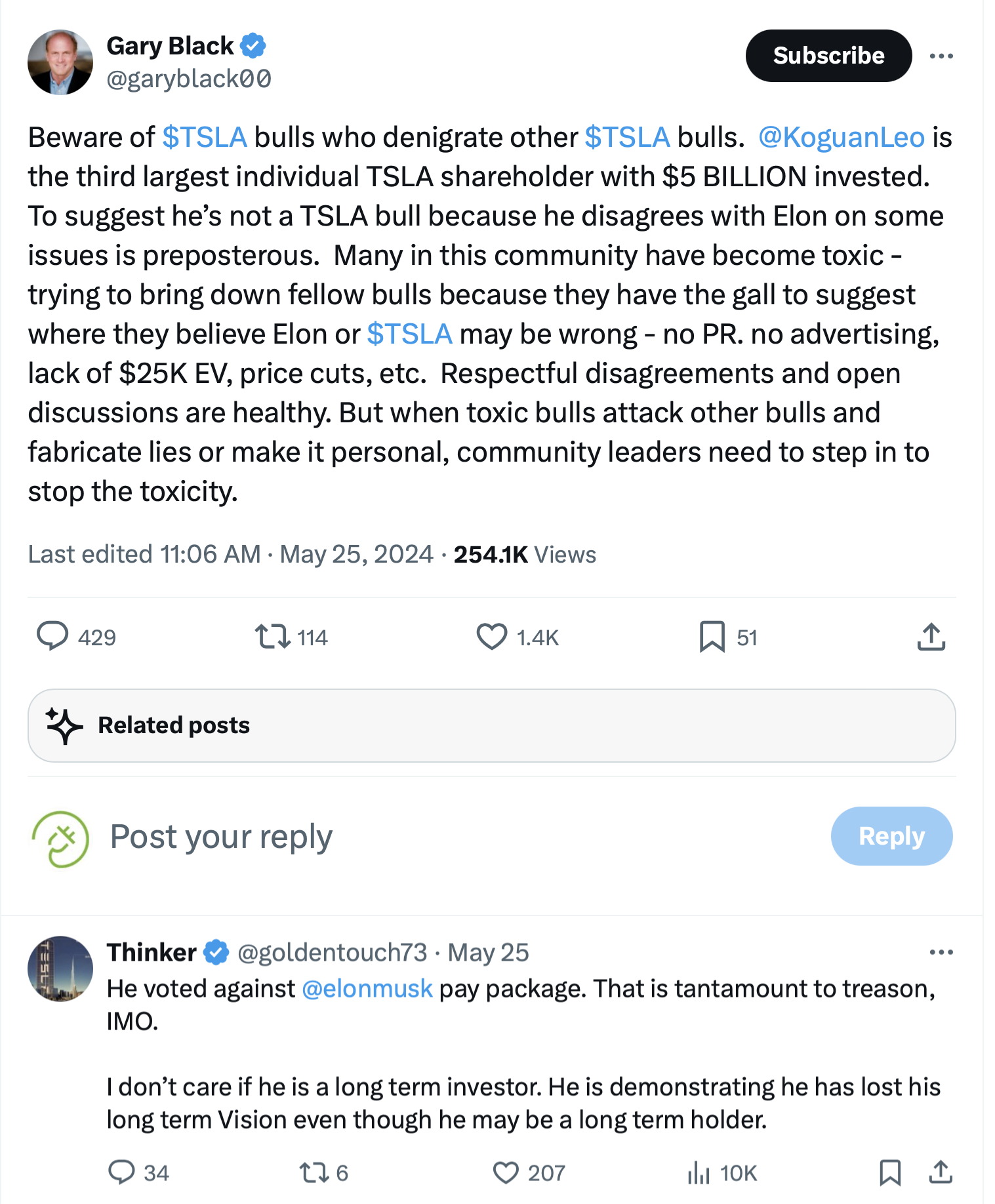

For starters, I learned that Leo Koguan is voting against Elon Musk’s compensation package, and he is the third-largest individual shareholder of Tesla stock. He holds about $5 billion worth of Tesla stock. Naturally, as I think we all know now, some Tesla shareholders are strongly in favor of voting for Musk’s new pay package to make up for the one that was cancelled by a Delaware court, while other Tesla shareholders are strongly against it. But such a large shareholder going against it seems like a big deal.

Personally, I don’t have a very strong opinion on this (so, maybe there are more like me), but I would say that he should get the pay package because I think the original one was clearly supported by Tesla shareholders at the time and I don’t even recall there being much or any controversy from them over it. I get the points the Delaware judge made, but I do think Tesla stockholders were strongly behind the package initially, so I don’t really think it’s right to cancel the deal now, years later. Frankly, the compensation was based so heavily on the stock soaring that stockholders were largely giddy about the possibility. If there was controversy around it, that was externally from non-shareholders.

That said, I also agree that Musk has repeatedly made serious moves counter to his fiduciary duty as the CEO of Tesla, that he hurt Tesla shareholders massively by quickly selling billions of dollars of Tesla stock to buy Twitter (and went against what he said previously about selling Tesla stock), and that he has hugely hurt consumer demand for Tesla vehicles in the US and a bit abroad from his inane tweeting about far-right-wing conspiracy theories and ideas. So, I definitely understand the gripes of shareholders who want to keep him from regaining the massive pay package that the Delaware court voided. And, of course, there are the issues of his brother (who I like a lot) being on the board and other board members being more or less useless as independent checks on his power and ideas. Furthermore, there’s now a question of insider trading, there’s controversy over whether Musk has been using Tesla staff and resources to support other companies he runs, and there’s a question of whether he’s developing AI outside of Tesla that should be developed inside of Tesla. So, even though I think his comp package should be approved, it’s clearly a very messy matter and I see why many, including Leo Koguan, think it shouldn’t be.

But that’s not the point of this article.

The point of this article is more about what happens after the vote, but this is informed by the heated debate leading up to the vote. The fundamental split seems to come from two very different types of shareholders.

On the one hand, you’ve got shareholders who still have an enormous amount of faith in Elon Musk to lead the company forward. These shareholders believe Tesla’s rapid innovation and future breakthroughs rely primarily on Musk remaining the captain. The belief is that the more power and compensation you give Elon, the more he’s focused on Tesla, and the better Tesla does. If the vote goes against Musk’s proposed compensation package, these shareholders are likely to have their faith in the company shaken to some degree, and if Musk decides he’s had enough running Tesla and wants to focus on a separate AI company, X, or something else, one could imagine these stockholders bailing (to varying degrees). Frankly, in the most extreme, if Musk stepped down from his CEO role or was removed from it, I think there’s be a mass exodus of Tesla stock.

On the flip side, many shareholders think Elon Musk is harming Tesla, perhaps even on a daily basis. Research showing Democrats are much less interested in buying Teslas, lack of sales growth despite dramatic price cuts and leasing deals, and lack of new models and innovation have many stockholders concerned that the company can’t grow as needed without new leadership. Constant sh**posting on X has not been contained, and shocking swings in strategy (like cutting almost all of the Supercharging division) have led to many people selling their shares and others on the verge of it. If shareholders vote to give Elon Musk billions of dollars in stock again, I imagine a lot of these shareholders could abandon ship. Would Leo Koguan leave his $5 billion in? Would he take some out, or all out? What about big institutional shareholders who may have seen enough?

As you can see, in either case (whether a yea vote or a nay vote), you could imagine a large portion of Tesla shareholders getting disillusioned and pulling their money out.

In other words, it almost seems like Tesla stock is set up for failure either way.

Maybe I am reading too much into the debates, and stockholders on either side would mostly hold no onto their shares matter what happens. However, it’s hard to believe that, especially when considering the heat and passion included in these debates. Aside from the X screenshots included above, I read through a lot of back-and-forth comments from both sides, many of whom seemed to have very strong feelings about the matter. And perhaps that comes down to the fact that this vote could have a big effect on how much longer Musk remains CEO or steps back a bit from Tesla and moves on.

What do you think?

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.