The sideways correction continues for gold and most bank analysts remain positive on the metals.

For a look at Goldman’s take on the matter:

Is their bullish posture justified… is gold really headed towards $2700 this year?

For some insight into the matter:

Elections have taken place in Mexico and India and the EU is next.

Most of them are good for gold.

It’s only a matter of time before the entire BRICS group launches their own version of the SWIFT money transfer system.

That’s a significant accelerant for de-dollarization… which of course is good news for gold.

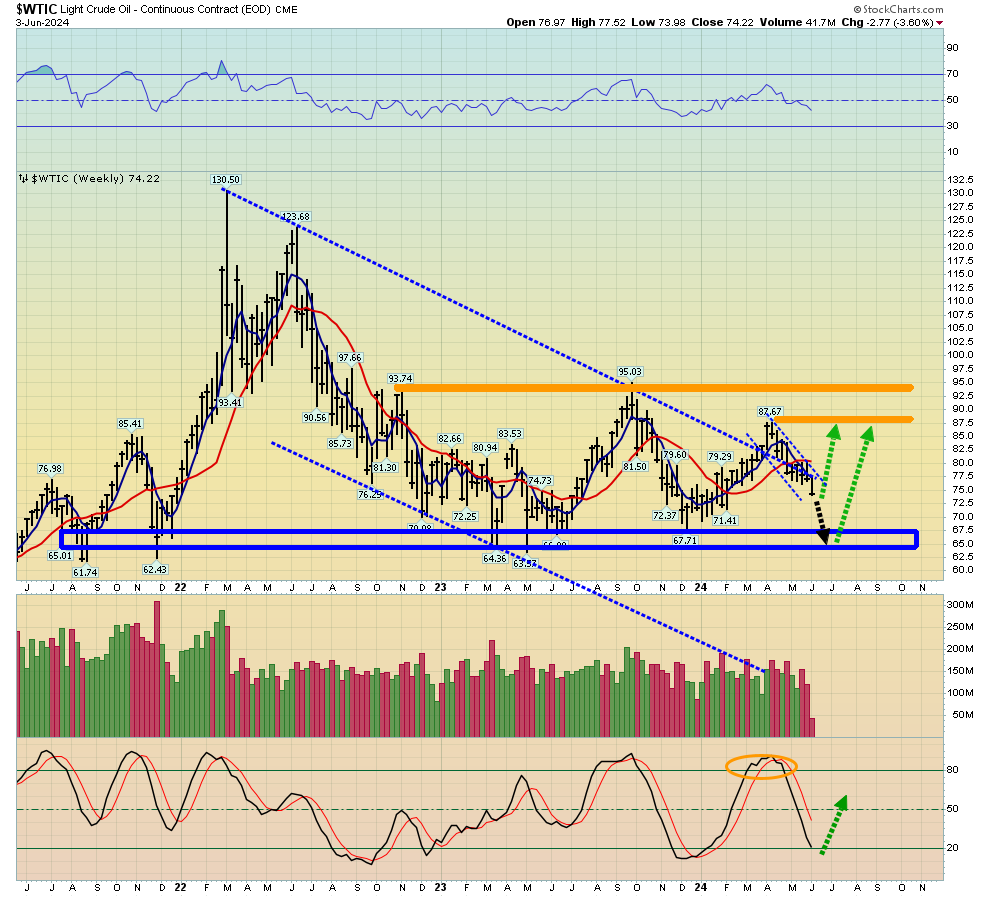

This is the weekly oil price chart. A drop in oil reflects the fade in debt-funded growth in the West.

It also could cause concern for the governments of nations like Russia and Iran who rely on oil sales to keep their economies growing.

This is the daily oil price chart. Note the fascinating synergy between oil, the dollar index, and US rates. Sometimes oil trades in sync with gold, and at other times it trades in sync with the dollar and rates, as it is right now.

Does the collapse in the price of oil indicate a US stock market crash is imminent.

This is the Dow Industrials chart.

Basis Dow Theory, there’s a bearish non-confirmation in play. The Dow Transports have made a new intermediate trend low, while the Industrials have not, and for both a relief rally is in play now.

The bottom line: If both the “Trannies” and the Industrials break their April and May lows, a bear market is probably confirmed.

The most likely time for this to happen is the month of August… but given how close both indexes are to their 2024 lows, it could happen as early as this week.

This is the short-term chart for gold. From a technical perspective, the world’s greatest metal (and money) appears to be consolidating rather than forming a top.

I’ve laid out a big $2300-$2365 buy zone for gold and the price is almost there now. Given the overbought condition on the weekly charts of most mining stocks and silver bullion, my suggestion is to buy those items in the buy zone for gold… but with very modest size.

Double-click to enlarge this daily gold futures chart. With the Indian election over today, the citizens there are ready to focus on getting more gold.

That’s likely the fundamental driver for a floor at $2330-$2265.

A daily focus on the big picture (fundamental, cyclical, and technical) is critical for investors as inflation, recession, the 2021-2025 war cycle, a wildly overvalued stock market, debt ceiling horror, and empire transition dominate the investing landscape. I cover this big picture 5-6 times a week in my flagship Galactic Updates newsletter. At $199/year, investors feel the price is too low, but I’m offering a $179/15mths “special offer” that investors can use to get in on the winning action and meticulous analysis. Click this link to get the offer or send me an email and I’ll get you a payment link. Thanks!

A lot of analysts are trying to figure out where gold would go if $2285 “breaks”. That’s a mistake. A key rule of investing is to always focus on the buy zone at hand.

It’s gold. It’s the world’s most awesome investment and investors who get too finicky with their price projections usually end up missing key zones to buy.

Double-click to enlarge this “Memory Lane” chart. Back in 2003, gold suddenly declined to the buy zone of $337. Analysts who failed to buy and instead tried to project the exact low were left behind.

It happened again the following year. In 2004, gold suddenly declined from $433 to the key buy zone of $384. Most citizens of India raced to buy with joy, while Western analysts wasted their time trying to predict what would happen next.

With $2300-$2265 coming into focus, the situation is identical today; there’s nothing to predict but there is a key zone to buy!

On the daily chart, the Stochastics oscillator (14,7,7 series) is almost oversold and RSI sits just above 50 (the momentum zone). A gold price dip to $2300-$2265 would see that Stochastics oscillator become oversold. Let’s hope that all mine stock enthusiasts are ready to buy!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********