In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason (President and CEO of Money Metals Exchange) and JP Cortez (Executive Director of the Sound Money Defense League) shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.

Analyzing the Precious Metals Market

The conversation began with an examination of the recent price action in gold and silver. Stefan Gleason noted that central bank gold buying has been a significant catalyst, particularly in response to geopolitical tensions and economic sanctions, such as those against Russia.

This has sent a strong signal worldwide, resulting in increased gold purchasing by central banks, particularly in Asia. “Demand outside of the country, not necessarily US demand, has been a driving force,” Gleason explained, pointing out the trend of gold flowing eastward through Switzerland and being remelted into kilo bars for Asian markets.

Discussing the retail participation in precious metals, Gleason observed a dichotomy where U.S. retail demand has not paralleled the high prices, with more selling than buying occurring at the retail level. However, recent price spikes have begun to attract more retail interest. “It’s an interesting dichotomy between U.S. retail and global flows,” he stated.

Efforts by the Sound Money Defense League

JP Cortez provided an overview of the Sound Money Defense League’s initiatives, which focus on legislative changes to facilitate the use of gold and silver as money. He highlighted the cumbersome tax implications that currently hinder the transactional use of precious metals. “In some states, you’re hit with triple taxation,” Cortez pointed out, underlining the need for legislative reforms to eliminate such financial barriers.

The league has successfully advocated for the removal of sales taxes on precious metals in several states and is pushing for further legislative changes to protect and promote gold and silver as part of a sound monetary system. These efforts include encouraging state treasurers to invest in physical gold and silver and establishing in-state depositories.

Future of Gold and Silver as Transactional Currencies

The conversation with host Jesse Day also touched on the potential for gold and silver to be used more broadly as transactional currencies. Both guests agreed that while there are innovative products emerging, such as digital gold and fractional gold, widespread adoption as everyday currency is unlikely in the near term. Traditional investors in gold and silver value the physical possession of their assets, which presents a challenge to digital solutions that lack privacy and physical tangibility.

However, both Stefan Gleason and Jp Cortez see these innovations as important steps toward reintroducing gold and silver as practical, everyday money. They also emphasized the educational value of these innovations in helping the public understand the true nature of sound money.

Key Questions and Answers

What are the main catalysts driving the current price actions in gold and silver?

Stefan Gleason: Central Bank gold buying is a major driver, spurred by geopolitical tensions and economic sanctions, such as those imposed on Russia. This has led to increased demand for gold, particularly in Asia. The market movements were also influenced by declarations from U.S. officials about seizing Russian assets, which triggered additional waves of buying.

Are we in the early stages of a precious metals bull market, or is this the top?

Stefan Gleason: We may be seeing a peak for the early part of the year, typically a seasonal high in spring. In the long term, the breakout of gold over $2100 is significant, indicating a strong upward trajectory, but silver still has a long way to go to reach its historical highs.

What role does geopolitical uncertainty play in the price of gold?

JP Cortez: Geopolitical risks are significant drivers as they lead to instability, which in turn prompts central banks and nations to hedge their risks by buying gold. The uncertainty in the global financial system, particularly concerning the dominance of the U.S. dollar, is prompting countries to consider gold-backed alternatives to establish more stable currencies.

What are the current trends in retail buying in the West compared to the East?

Stefan Gleason: In the West, particularly the U.S., there has been more selling than buying at the retail level, which contrasts with strong buying trends in the East, like China and India. The U.S. market has seen outflows from gold ETFs and a general decrease in retail purchases despite high gold prices.

What legislative efforts are underway to promote gold and silver as sound money?

JP Cortez: The Sound Money Defense League is actively working to remove sales taxes on precious metals and push for legislation that recognizes gold and silver as legal tender. They are also advocating for state treasurers to include physical gold and silver in state reserves and pension funds, aiming to protect state finances from inflation and financial instability.

How might gold and silver be used as transactional currencies in the future?

Stefan Gleason: For gold and silver to become widely used as transactional currencies, issues such as high transaction costs and taxes must be addressed. Innovations like digital gold and fractional gold are making headway, but widespread adoption is limited by traditional investors’ preference for physical assets and privacy concerns.

What can people do to support sound money initiatives?

JP Cortez: Individuals are encouraged to engage with the Sound Money Defense League, participate in grassroots efforts, and stay informed about legislative battles related to sound money policies. This involvement is crucial for advancing legislation that supports the use of gold and silver as money.

Important Points

In the interview on the Vancouver Resource Investment Conference podcast, several important points were raised concerning the Federal Reserve, the purchasing power of the dollar, and the future of currency, especially in relation to gold and silver.

-

Federal Reserve and the U.S. Dollar:

- Weaponization of the U.S. Dollar: Stefan Gleason discussed how recent actions by the United States, such as removing Russia from the SWIFT banking system, have demonstrated a willingness to weaponize the U.S. dollar in international relations. This has broader implications for the trust and stability of the dollar as the world’s reserve currency.

- Weaponization of the U.S. Dollar: Stefan Gleason discussed how recent actions by the United States, such as removing Russia from the SWIFT banking system, have demonstrated a willingness to weaponize the U.S. dollar in international relations. This has broader implications for the trust and stability of the dollar as the world’s reserve currency.

-

Purchasing Power of the Dollar:

- Devaluation and Inflation Concerns: Both speakers touched on the declining purchasing power of the dollar, driven by inflation and federal monetary policies. The ongoing devaluation has sparked a reevaluation among central banks and nations about relying too heavily on the dollar.

- Implications of U.S. Fiscal Policy: JP Cortez highlighted concerns about the U.S. fiscal discipline, or lack thereof, which contributes to ongoing devaluation and diminishes the dollar’s reliability as a store of value. This has led to increased interest in alternatives like gold.

- Devaluation and Inflation Concerns: Both speakers touched on the declining purchasing power of the dollar, driven by inflation and federal monetary policies. The ongoing devaluation has sparked a reevaluation among central banks and nations about relying too heavily on the dollar.

-

Future of Currency:

- Rise of Alternative Currencies: The discussion included the notion that geopolitical tensions and concerns about the dollar’s stability are pushing various countries to explore alternative currency systems, potentially backed by gold. This is seen as a way to create more stable and trustworthy monetary systems.

- Digital Currencies and Privacy Concerns: There was also mention of the emergence of digital currencies, including Central Bank Digital Currencies (CBDCs), which are seen as potential competitors to traditional fiat currencies like the dollar. However, there are significant privacy concerns with digital currencies that may deter their adoption among traditional gold and silver investors who value anonymity and control over their assets.

- Rise of Alternative Currencies: The discussion included the notion that geopolitical tensions and concerns about the dollar’s stability are pushing various countries to explore alternative currency systems, potentially backed by gold. This is seen as a way to create more stable and trustworthy monetary systems.

-

Role of Gold and Silver:

- Gold and Silver as Safe Havens: Amidst these uncertainties, gold and silver are increasingly viewed not just as investment assets but as fundamental components of a more stable monetary system. This view is driven by their historical role as sound money and their historic value, which is not dependent on the policies of any single government.

- Gold and Silver as Safe Havens: Amidst these uncertainties, gold and silver are increasingly viewed not just as investment assets but as fundamental components of a more stable monetary system. This view is driven by their historical role as sound money and their historic value, which is not dependent on the policies of any single government.

-

Legislative Advocacy for Sound Money:

- Sound Money Defense League Efforts: The Sound Money Defense League’s legislative advocacy aims to make gold and silver more accessible and practical for use as money by eliminating taxes on their purchase and recognizing them as legal tender. This is part of a broader effort to restore their role in the economic system, providing a counterbalance to the risks associated with fiat currency.

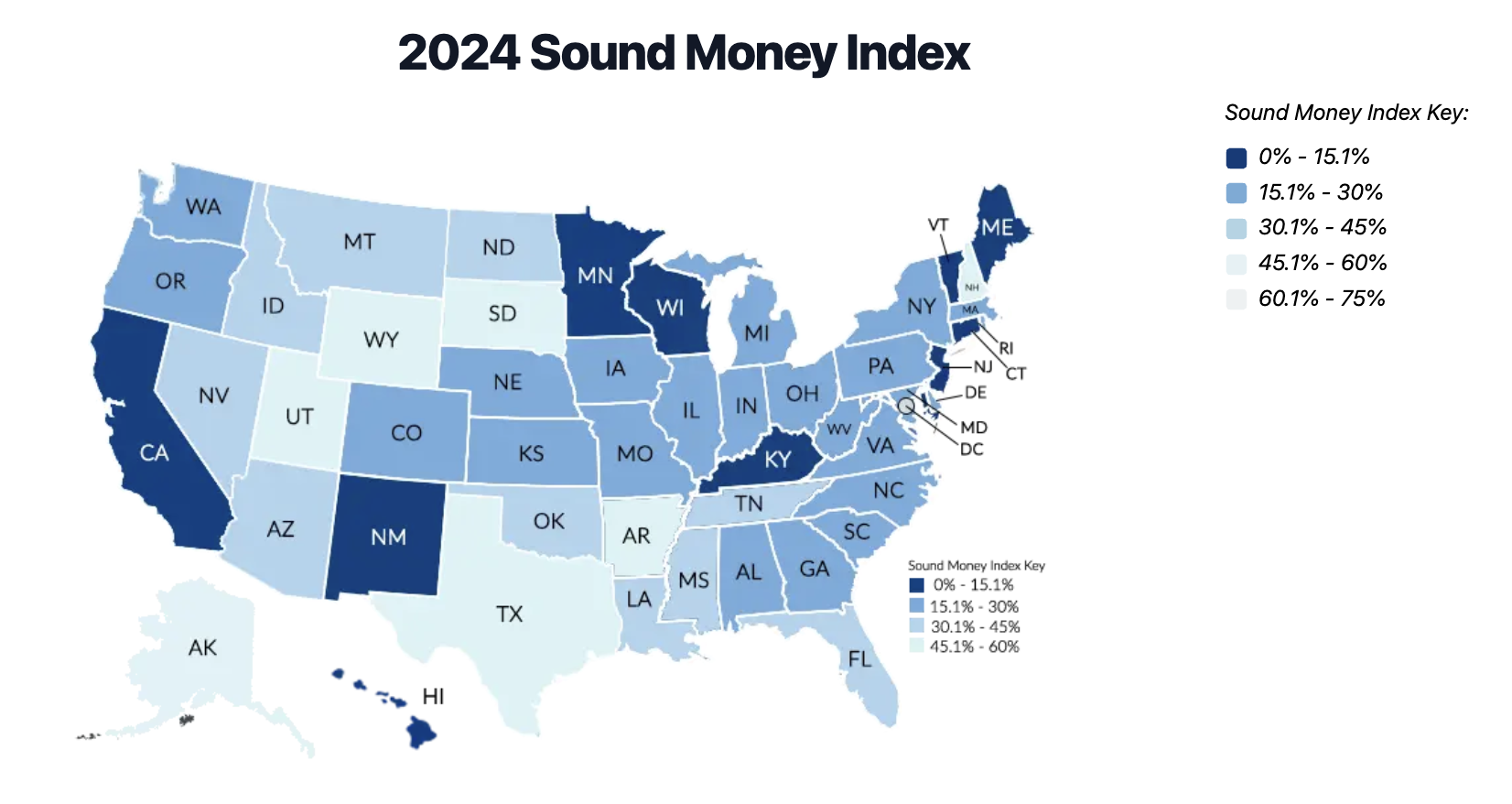

During the interview on the Vancouver Resource Investment Conference podcast, JP Cortez provided detailed insights into the Sound Money Index, an initiative of the Sound Money Defense League.

Purpose of the Sound Money Index

The Sound Money Index is designed to evaluate and rank each U.S. state based on how friendly their laws and regulations are towards gold and silver. The index uses 14 different indicators to assess the extent to which states support sound money principles.

These principles include the absence of taxes on the purchase and sale of gold and silver, the legal recognition of these metals as money, and other related legislative measures that reduce friction for using precious metals as money.

Highlights from the Sound Money Index:

- Top Performing States: JP Cortez mentioned that states like Wyoming, South Dakota, Alaska, New Hampshire, and Arkansas rank highly on the Sound Money Index. These states have enacted robust laws that reaffirm gold and silver as legal tender, eliminate capital gains on precious metals, and provide strong protections for contracts denominated in gold and silver.

- Legislative Achievements: Many of these top-ranked states have proactively passed legislation that supports the use of gold and silver. For example, Wyoming was one of the first significant wins for the Sound Money Defense League, successfully removing all tax liabilities on metals and ensuring protections against future taxes.

- Ongoing Efforts in Other States: The discussion also touched on efforts in states like Alaska, where legislation is being considered that would prohibit local taxes on precious metals and encourage the state to explore alternative currencies that might incorporate gold and silver.

- Struggles and Successes: Cortez discussed the challenges and successes in various states, including the introduction of bills in states traditionally less friendly to sound money policies. He highlighted recent legislative efforts in New Jersey, where a bill to remove sales taxes on precious metals was unanimously approved in the legislature but was ultimately vetoed by the governor.

Impact and Importance of the Sound Money Index

The Sound Money Index plays a crucial role in providing transparency about the monetary environment across the U.S. and acts as a tool for advocacy and reform. By highlighting how states compare in their treatment of gold and silver, the index helps inform residents and policymakers about where improvements can be made.

The Sound Money Index also serves as a benchmark for legislative efforts by the Sound Money Defense League, guiding their initiatives to enhance the acceptance and practical use of gold and silver as money.

In summary, the Sound Money Index is a strategic part of the Sound Money Defense League’s efforts to promote gold and silver as sound, constitutional money across the United States, supporting legislative changes that align with this goal.

Conclusion

The insights from Stefan Gleason and JP Cortez in this interview by Jesse Day shed light on the complex interplay of market dynamics, geopolitical factors, and legislative efforts that shape the precious metals landscape.

Their discussion with host Jesse Day underscored the growing importance of gold and silver not only as investment assets but also as foundational elements of a more stable and secure monetary system. As legislative victories continue to mount, the path toward reestablishing gold and silver as sound money appears increasingly viable, reflecting a significant shift in public and governmental attitudes toward these timeless assets.

********