Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Tesla is the best selling brand in Europe, but Volkswagen Group is the #1 OEM

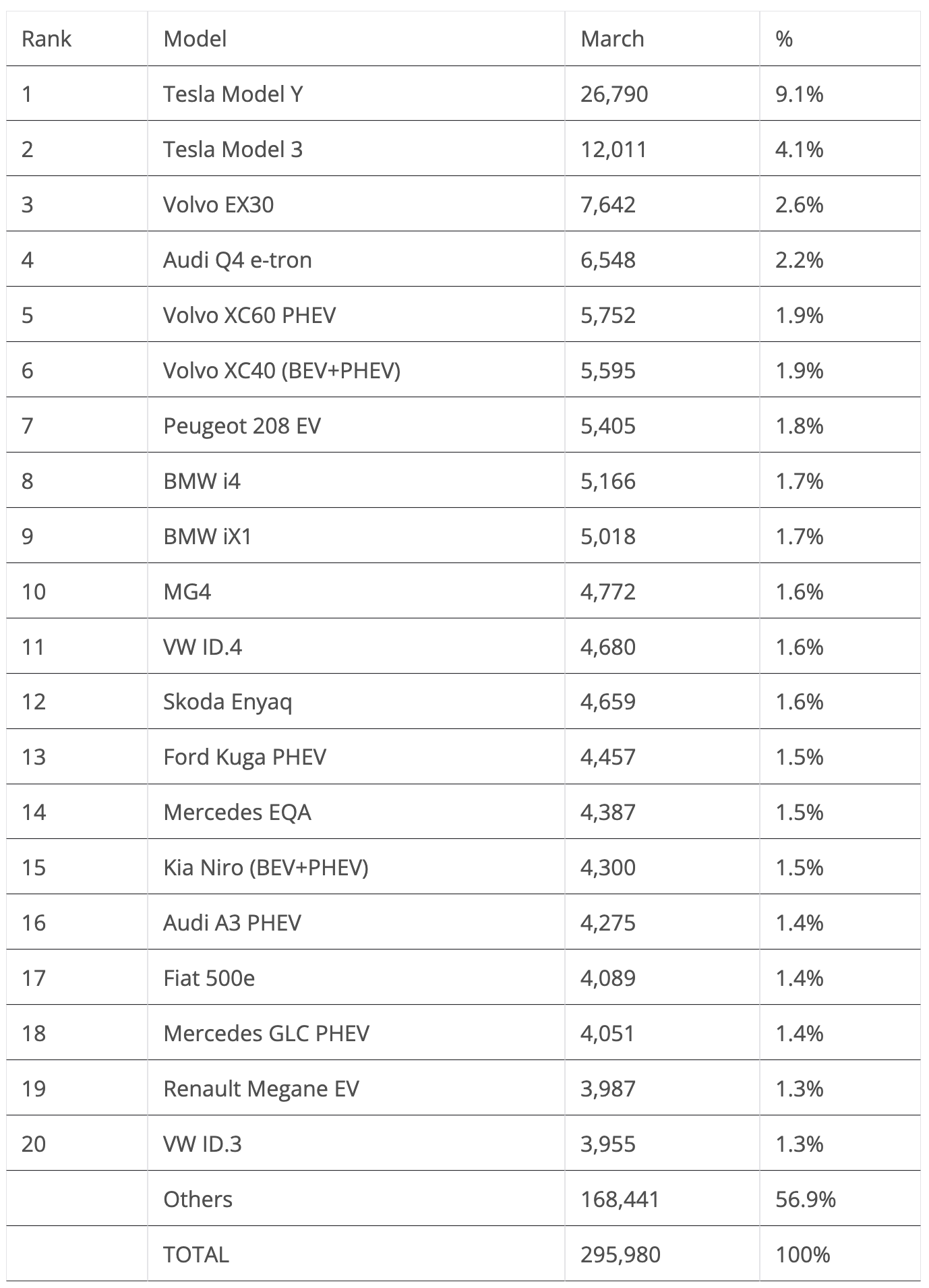

Some 296,000 plugin vehicles were registered in March in Europe — which is down 3% year over year (YoY). Unfortunately, plugins were down even more, by 8%, but there is a simple explanation for this: Tesla’s usual last-month-of-the-quarter peak was far less intense (in fact, Tesla’s deliveries were down a staggering 35% YoY in March).

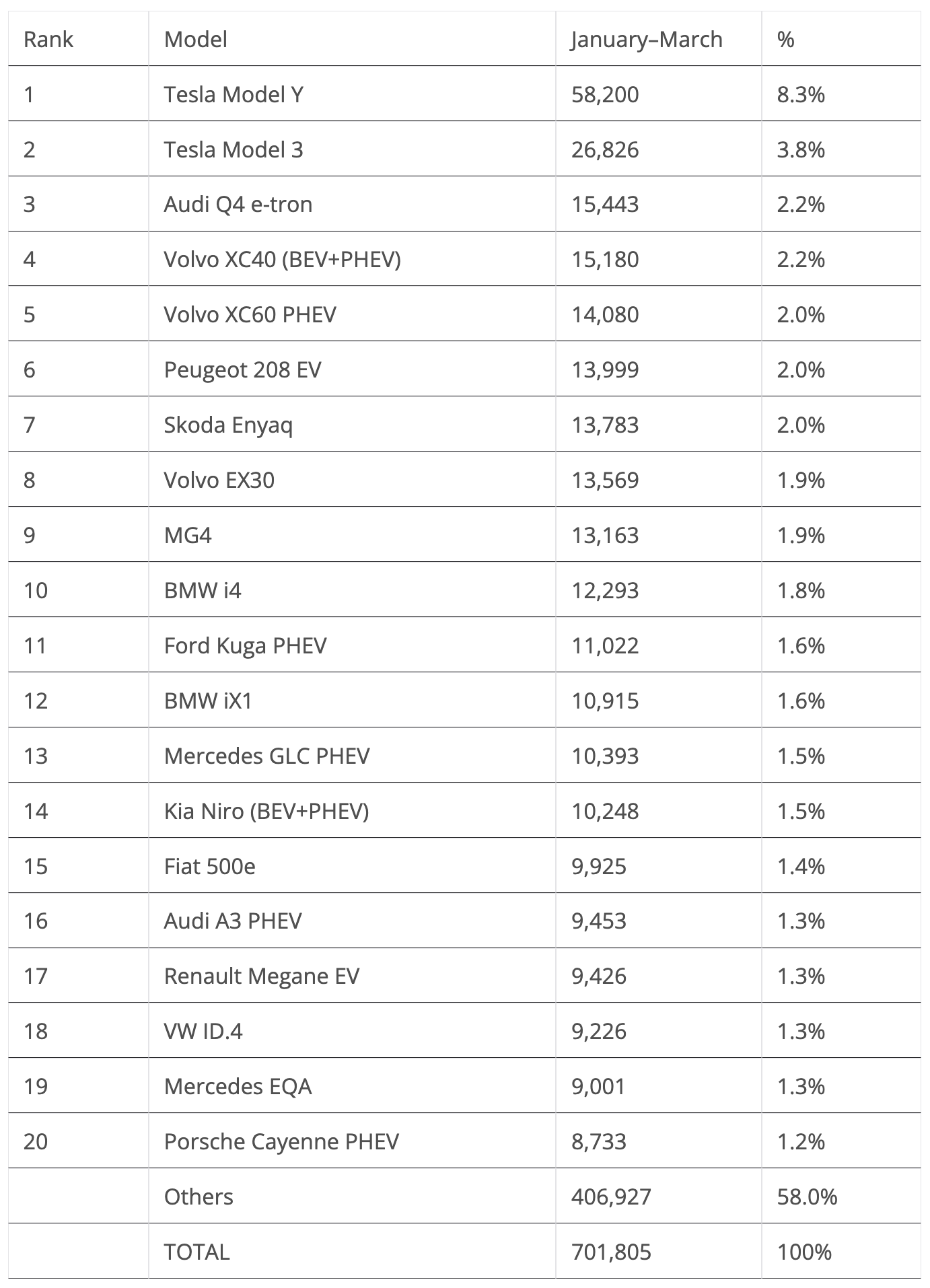

Taking a more balanced examination of the market, which means looking at the whole quarter, plugins had the same growth rate as the overall market, +5%, so there were no real gains or losses when it comes to EV market share.

March’s plugin vehicle share of the overall European auto market was 21% (14% full electrics/BEVs). That result pulled the 2024 plugin vehicle share from 20% at the end of February to 21% (13% for BEVs alone) by the end of March.

Still looking at Q1, BEVs (+3%) grew slower than PHEVs (+10%), as the BEV market is currently in a sort of no man’s land. It is still feeling the pain of the end of incentives in a number of countries, especially in Germany. On the other hand, new mass-market EVs (the Renault 5, Citroen e-C3, etc.) are still not on the road. Expect this to ease in Q2, but significant growth should only come in the second half of the year.

Looking at the other powertrains on the market, plugless hybrids are the fastest growing technology (+20% YoY) in 2024, and they represented 30% of the total market. Added to the 21% of plugin vehicles, one can say that over half (51%) of the European car market is already electrified … in some way. But for some to grow, others must come down, and diesel (-11% YoY) is the starkest example. Diesel vehicles had only 11% of the European passenger car market in 2024, a far cry from the 50% share it had in 2015 or the 55% average it experienced before that. At this rate, in this category, diesel will be dead by 2027, well before the 2035 ICE ban….

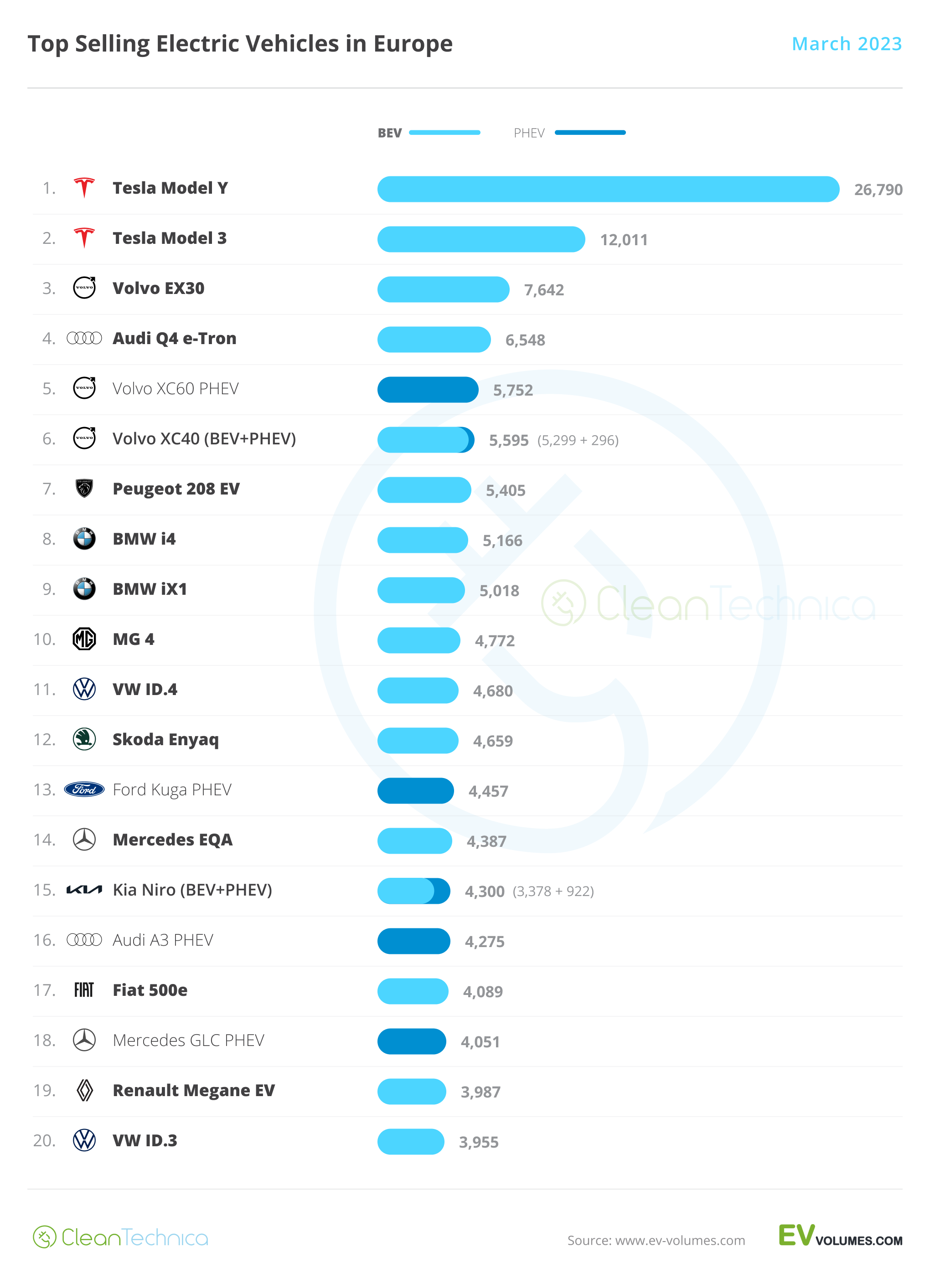

The highlight of the month was the recently introduced Volvo EX30 jumping into 3rd. But let’s look closer at March’s plugin top 5:

#1 Tesla Model Y — For the nth month in a row, Tesla’s crossover was the best selling EV in Europe. In March, the midsizer had 26,790 registrations. Remember when I mentioned that 2023/24 would be considered the “Peak Model Y” period in Europe? It is starting to show. The midsized crossover’s deliveries were down 19% YoY in the first quarter of the year in Europe, as the market’s natural limits are starting to bite. Add the refreshed Tesla Model 3, which is stealing sales in some markets, and the Model Y’s performance is not as amazing as it was last year. Twelve months ago, the Tesla crossover was the best selling model in the overall European market, while now it is just 4th, below the Dacia Sandero, VW Golf, and Peugeot 208. Interestingly enough, only the French hatchback is significantly electrified. And here lies one of the contrasts in Europe: While the 2024 overall market podium has three models from mainstream brands (Dacia, Volkswagen, Peugeot), the first non-premium model on the plugin table, the Peugeot e-208, is only 6th…. But before I digress into how EVs are being entangled in culture wars because of opportunistic politicians and greedy OEMs, let’s go back to the Model Y’s performance. Regarding last month’s performance, the Model Y’s biggest European markets included the UK (5,590 units), Germany (3,244 units), and France (3,045 units), with the Netherlands (2,386 units), Sweden (2,011), Norway (1,993), Belgium (1,717), and Switzerland (1,507) being the remaining countries posting four-digit results.

#2 Tesla Model 3 — The Tesla sedan won another podium position in March thanks to 12,011 registrations. With demand recovering, due to the recent refresh, the Model 3 is well positioned to stay in the #2 spot in 2024. The sedan has even managed to bring a rare positive performance to Tesla — Model 3 deliveries were up by 36% YoY in the first quarter of this year. It seems that Europeans were more welcoming to the refresh than other markets. Regarding the Model 3’s March performance, its main markets were the Netherlands (1,510 registrations), France (1,388 registrations), the UK (1,375 registrations), and Belgium (1,362 registrations).

#3 Volvo EX30 — The China-made (but with a Swedish passport) crossover is starting to live up to the hype, jumping to the 3rd spot on the table in only its 3rd full month on the market. The model had 7,642 registrations in March. Note that its slightly bigger, but much older, sibling, the XC40 (recently renamed EX40), does not seem affected by this, with the Belgian-made SUV scoring its best result in 10 months (5,595 registrations in March). Expect the EX30’s sales to continue strong in the coming months, maybe even crossing the five-digit barrier (fingers crossed). Currently Volvo’s cheapest model(!), starting out at 39,000 euros vs. the 40,000 euros of the gasoline XC40, the EX30 is Volvo’s smallest model — the size of a VW ID.3. While it cannot be considered cheap (for that it would have to cost less than 35,000 euros), it can nevertheless be considered well priced, especially considering the premium standing it holds. Regarding the EX30’s March results, the distribution of deliveries show a push in three markets, with the UK (1,510 units), France (1,388 units), and the Netherlands (1,173 units) being the only ones above 1,000 deliveries, followed from afar by Sweden (652 units).

#4 Audi Q4 e-tron — Although it didn’t reach record sales levels, the compact crossover had a positive month, allowing it a top 5 presence, a rare event for a Volkswagen Group model in 2024. With 6,548 sales, it seems the Q4 is immune to the sales blues that are generally affecting the MEB-platform models, probably due to its premium positioning in the market. Looking into the near future, it will be interesting to see if the upcoming Q6 e-tron midsize SUV will steal sales from its smaller sibling. Something to follow throughout the rest of the year…. Looking at March’s performance, the highlight is the UK (2,113 registrations), but Germany (1,115 registrations) and Belgium (570) also deserve a mention.

#5 Volvo XC60 PHEV — Volvo was full of surprises this month. Not only did the EX30 jump to 3rd, but the veteran plugin hybrid SUV (the current generation dates back to 2017) scored a record performance! With 5,752 sales, the XC60 PHEV helped the Swedish brand to place three models in the top 6, which is no small feat. The future EX60 is sure to be a hot seller…. Regarding the XC60’s March performance, its main markets were Germany (1,324 registrations), its native Sweden (1,010 registrations), and the UK (701 registrations).

Looking at the rest of the March table, the highlights go to two models, both of them plugin hybrids. The #16 spot of the Audi A3 PHEV was celebrated with a record 4,275 sales, while the Mercedes GLC PHEV ended the month in #18, with 4,051 sales, the nameplate’s best result since December 2021 and a record for the current generation GLC.

This is a symptom of the end of BEV incentives in some markets, namely Germany. Without the incentive, some people turn to PHEVs, which helps to explain the recent good results of some PHEVs, like the Volvo XC60, Audi A3, and Mercedes GLC. In 2024, PHEVs are 3% above the 2023 result (36% plugin share vs. 33%), and expect the second quarter to keep the share around these values, with BEVs only recovering once the new, cheap(ish) EVs like the upcoming Renault 5 are delivered en masse.

A reference goes out to the VW ID.4’s return to the best sellers list, in 11th, and also the VW ID.3’s return, in 20th. True, it’s still not the places we are used to seeing the two of them, but at least it seems the tide has turned and they are returning to form … after the incentives blues.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Below the top 20, there was much to talk about, with the highlights being 1) the Renault Twingo’s best result since December 2022, 2,694 sales (merci to the new French EV incentives), and 2) the Japanese awakening — the Toyota BZ4X and Honda e:NY1 (aka Electric Honda HR-V) scoring record results in March (3,868 units and 2,283 units, respectively). By the way, why have Honda and Toyota decided to name their EV models after passwords?… Even the Nissan Ariya had its best result in 15 months, with 1,561 sales!

Another highlight is the BEV ramp-up of Stellantis, with the BEV versions of the Peugeot 308 and Opel Astra scoring record results (622 and 667 units, respectively) and the Peugeot e-2008 crossover reaching a record 3,303 sales. Meanwhile, Mercedes saw its EQB compact 7-seat SUV deliver 3,242 units, a new personal best.

Speaking of Mercedes, the long-running reign of the Audi Q8 e-tron (2,322 sales in March) in the full size category is under attack. Not only is the refreshed Porsche Cayenne PHEV tearing it to bits (3,394 units), but even in the BEV category, things are pretty hard, with the Mercedes EQE finally starting to fulfill expectations (a record 2,258 sales). The recently released BMW i5 (2,184 sales) is also at record levels. So, expect an entertaining race for the title in the full size category.

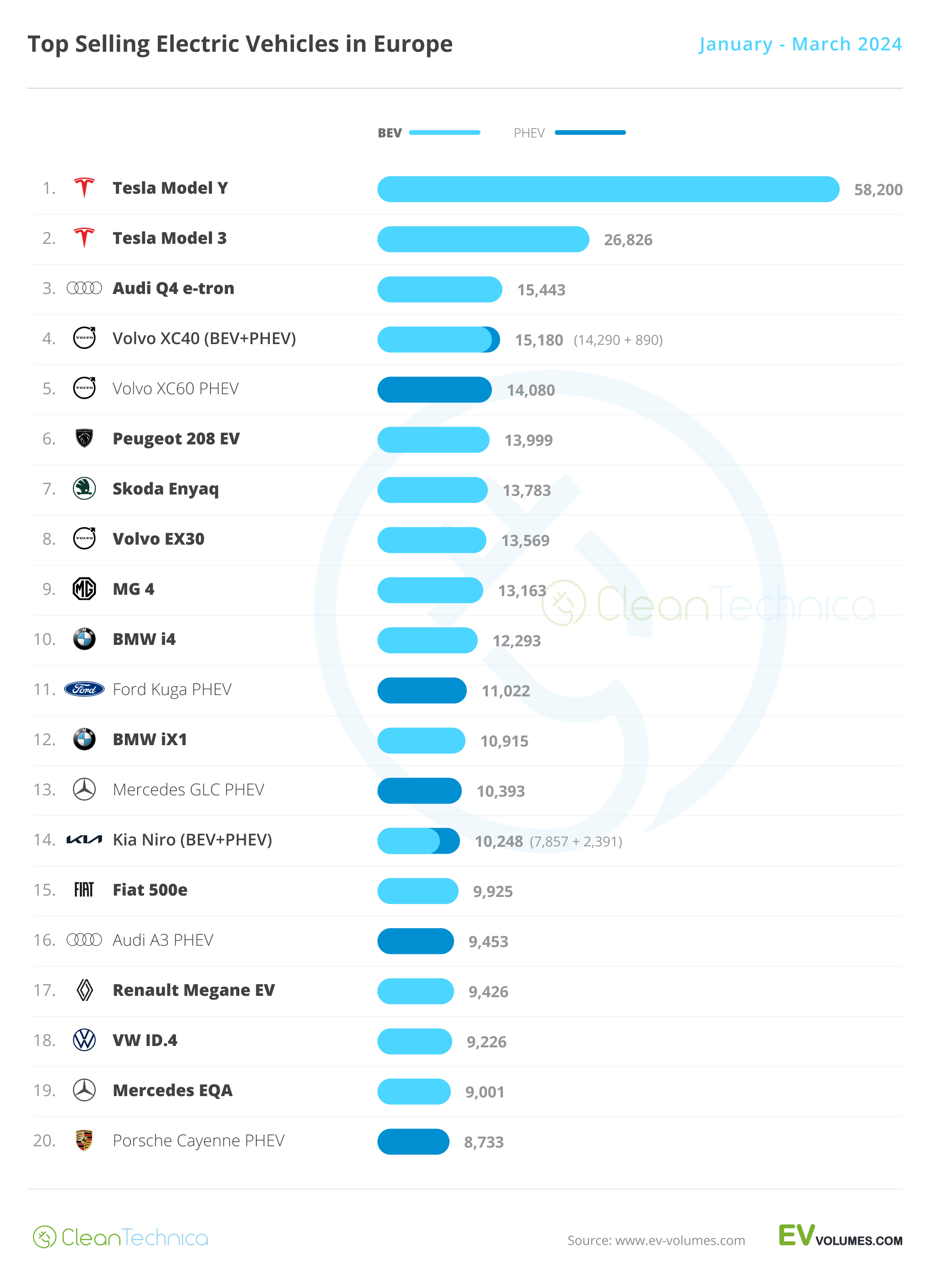

Looking at the 2024 ranking, with the leader Tesla Model Y having almost twice as many deliveries as the runner-up Tesla Model 3, and the midsize sedan having an 11,000+ unit lead over the new 3rd placed Audi Q4 e-tron, the attention is now focused on the remaining podium position.

On that topic, the list of candidates is long, but I would say the strongest candidate right now is the #8 Volvo EX30, which jumped eight positions in March. Overall, Volvo is looking to take the 3rd, 4th, and 5th positions, after Tesla’s #1 and #2 spots at the top.

Elsewhere, the BMW iX1 jumped three positions, to 12th. The German is set to climb a couple more positions in the following months and try for a top 10 position. The Fiat 500e climbed to #15, while the Audi A3 PHEV jumped three positions, to #16.

In the last positions on the table, there were two new/(re-) entries, with the VW ID.4 joining the table in #18 while the Mercedes EQA was up to #19.

Just outside the top 20, the VW ID.3 is just 235 units below the #20 Porsche Cayenne PHEV, so expect the German hatchback to return to the best sellers table soon.

In the 2024 overall brand ranking, the two biggest growers in the top 20 were two heavily electrified brands, with #17 Volvo growing 32% YoY to 92,000 units (it was #18 a year ago) while SAIC’s MG was up 31%, to 59,000 units, climbing to #20 in 2024. That’s up from #21 in the same period of 2023.

On the other hand, the two biggest falls in the top 20 were Ford, down 16% YoY, dropping the US brand from #10 in Q1 2023 to its current #12 spot, and Tesla dropping 9% YoY, to 85,000 units, forcing it to drop two positions, from 16th in Q1 ’23 to its current 18th position.

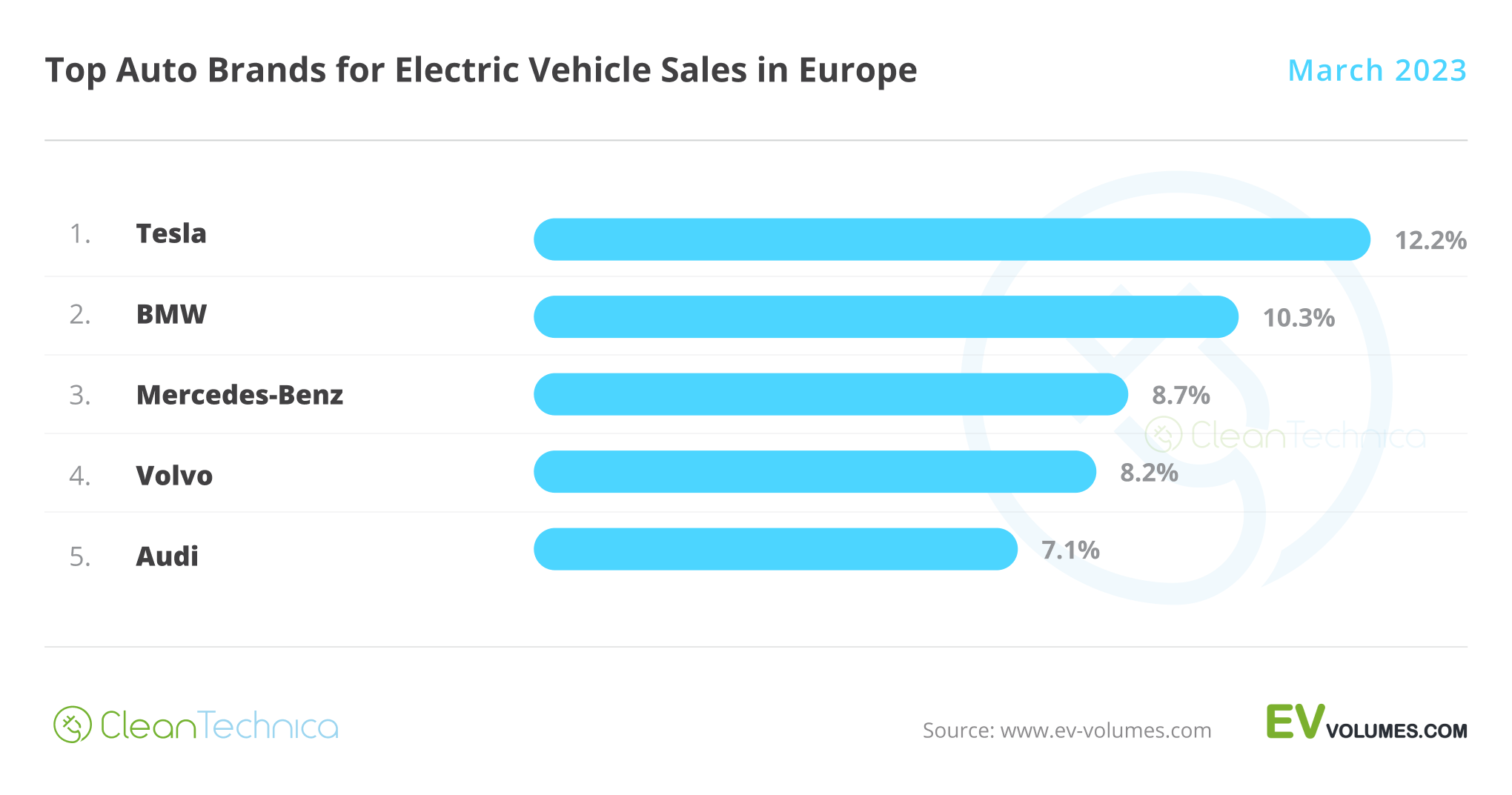

As for the plugin auto brand ranking, Tesla is leading with a comfortable 12.2% share of the plugin market, while BMW is in the runner-up position with 10.3%, up 0.1% compared to the previous month.

3rd placed Mercedes (8.7%) has remained stable in its podium position, but the lead over #4 Volvo (8.2%) has decreased, so a lot can still happen between them.

Finally, Audi (7.1%, down from 7.2%) is in a comfortable 5th spot.

Still, we might see #6 Volkswagen (5.1%) return to form soon and surpass it sometime in the future.

A sign of the current times, all top 5 brands are premium makes, with the best selling mainstream brand, Volkswagen, only in 6th.

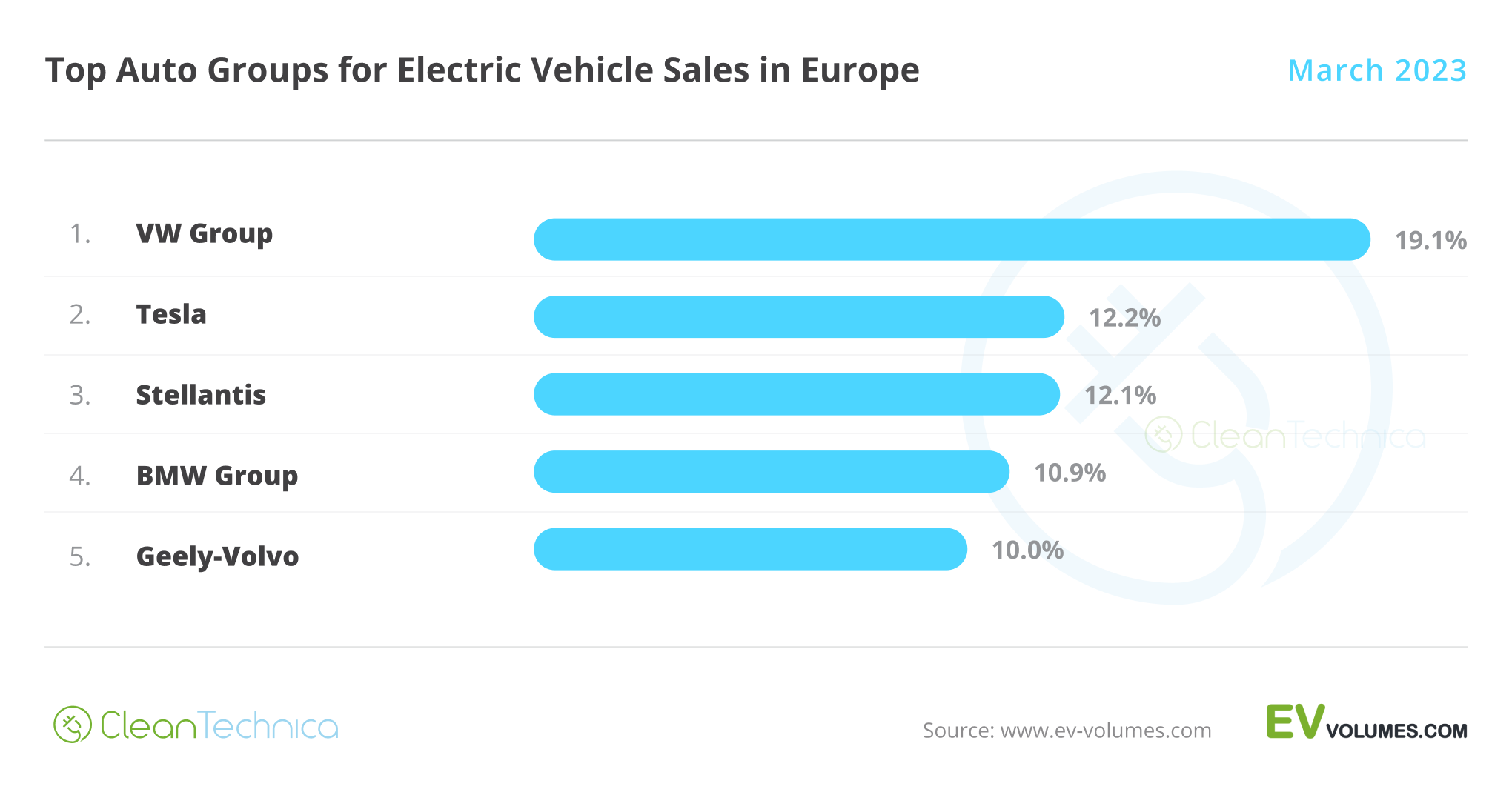

Arranging things by automotive group, Volkswagen Group was down to 19.1%, from 19.5% in February, but the German OEM is keeping a comfortable lead over the competition.

There was a position change regarding the second position, with previous runner-up Stellantis (12.1%, down 0.1% from the previous month) losing the position to Tesla (12.2%, up 0.6%). The US brand benefitted from its peak month to surpass the multinational conglomerate.

#3 Tesla had 11.6% share, and expect the US automaker to try to go after the #2 position in March, looking to profit from Stellantis’ apparent weakness.

Off the podium, #4 BMW Group was stable at 10.9%, while #5 Geely–Volvo continued on the rise, gaining 0.1% share and climbing up to 10%.

With #6 Mercedes-Benz Group (9.2%) unable to recover share, Geely is comfortable in its #5 spot, and could think about reaching BMW Group in the next few months.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.