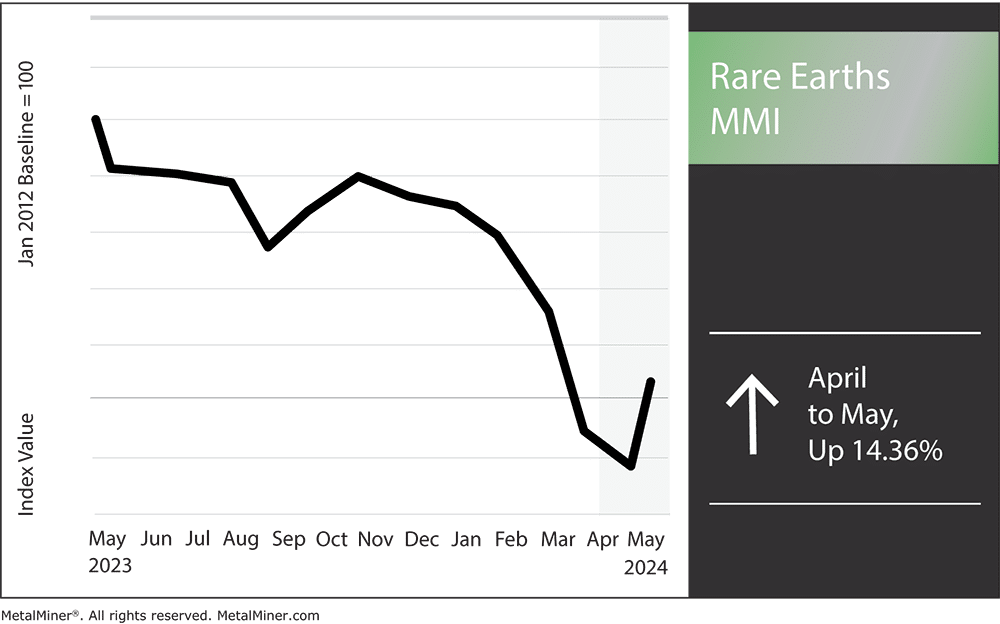

The Rare Earths MMI (Monthly Metals Index) saw a massive rebound after four months of sharp declines. All in all, the index rose by a whopping 14.36%. This enormous increase could indicate that prices for rare earth metals finally found a bottom between March and April.

Chinese Rare Earth Metals Profits Still Declining

China’s mining and processing industries continue to experience a drop in profitability despite the nation’s attempts to keep its grip on the critical rare earths market. A key state-owned company, China Rare Earth Resources and Technology, reported a 45.7% decline in net profit and a 5.4% decline in sales in 2023. Revenues from other Chinese manufacturers of rare earths similarly decreased by 60–79%.

The primary causes of this decline in profits are China’s economic problems and other nations’ readiness to establish their own supply chains for rare earth elements. China has long held a commanding position as the world’s largest producer of rare earths. But the nation’s industry ministry recently admitted that rare earths now remain “undersold” and “wasted” as a result of “vicious competition.”

China’s rare earth sector continues to experience a “fundamental stage” of fast growth and structural alterations in response to these issues. Meanwhile, the industry ministry seems to want stricter rules, including a requirement that importers and exporters comply with export control and international trade legislation, as part of the nation’s attempts to preserve market dominance.

Expert sourcing strategies, right at your fingertips. The Monthly Metals Outlook report is your guide to sourcing success. Check out a free sample copy and secure your subscription.

Despite Challenges, China Remains the Top Global Rare Earth Producer

Despite these setbacks, China remains at the top of the global rare earths market. The nation still has around 40% of the world’s stocks of rare earth elements, with Myanmar, Australia, Russia, and India next in line. Even if other countries progress in building their own rare earth capabilities, China’s well-established infrastructure and rare earth processing capacities remain ahead of the rest of the globe.

Lynas Rare Earths Tighten Costs Amid Falling Chinese Demand

To withstand a precipitous decline in rare earth pricing and waning demand in China, Australia’s Lynas Rare Earths company is buckling down on prices and expenses. The firm recently announced a 74% decrease in net profit for the first half of the year, primarily due to declining pricing for neodymium and praseodymium (NdPr), its two primary products.

“As we’re looking to a market with softer pricing, it is essential that we keep a laser-like focus on our cost performance,” said Amanda Lacaze, Lynas’ CEO and managing director. However, the company remains “very positive” about the long-term picture, estimating that supply will need to increase by 81% to fulfill projected demand by 2035.

Don’t wait until it’s too late to plan around low rare earth metal availability, prepare now. Stay ahead of the game with MetalMiner’s weekly newsletter.

Ramifications for Rare Earth Metal Sourcing Companies

The decline in Chinese rare earth demand and Lynas’ subsequent tightening of prices could negatively impact companies relying on rare earths as key product inputs. Given this, rare earth metal sourcing companies should look out for the following:

- Cost increases for rare earth buyers – Businesses that acquire rare earths like neodymium and praseodymium may have to pay more for inputs due to Lynas tightening its pricing during the market slump. This could pressure their profit margins or compel them to raise prices on customers.

- Possible supply chain disruptions – The worldwide supply chain for rare earths might experience disruption, particularly if Lynas is their origin source for rare earth metals. This might result in further price hikes and supply problems for consumers of rare earths outside of China.

- Increased reliance on China’s dominance – Roughly 80% of the world’s rare earth market is controlled by China, so any problems with the supply chain outside of China could impact rare earth buyers. The absence of diverse supply sources leaves these purchasers open to the influence of China’s market.

- Challenges for clean energy transitions – Worldwide implementation of eco-friendly technology may slow due to market disruptions or volatility in rare earths prices

Rare Earth Metals: Noteworthy Price Shifts

Don’t settle for stagnant rare earth savings. MetalMiner’s custom price forecasting unlocks the true potential of your volume commitments, ensuring you maximize profit. View our full metal catalog.

- Dysprosium oxide rose by 8.06%, bringing prices to $264.30 per kilogram

- Rare earth carbonate traded flat month-over-month, remaining at $5,124.40 per metric ton

- Neodymium rose by 7.67%, leaving prices at $64,639.74 per metric ton

- Finally, terbium metal experienced the most drastic change out of all the components of the index. In total, prices rose by 20.3% to $1,084.19 per metric ton