Australian Mining shines a light on Argent Minerals, Kalamazoo Resources and Falcon Metals – three companies looking to become precious metals producers.

Gold and silver have differing but equally robust economic outlooks.

Gold is set to continually benefit from factors such as sustained geopolitical uncertainty and growing central bank activity. The precious metal typically surges in popularity in times of global unease, a seemingly perpetual modern reality.

Silver has become a largely ubiquitous raw material, with applications including, but not limited to, electronics, soldering, chemical production, jewellery and photography.

This commodity is expected to grow in importance as the energy transition ramps up given its importance in electricity-based systems. Solar panels and electric vehicles (EVs) are expected to drive greater silver demand in the years to come.

Australian Mining spotlights three companies who, through their own strategies, are looking to become precious metals producers.

Argent Minerals

Owner of one of Australia’s most promising polymetallic projects, Argent Minerals hopes to become a key supplier of high-grade silver, gold and base metals for global markets.

The Kempfield project in the Lachlan Orogen region of NSW has a mineral resource of 38.9 million tonnes at 102 grams per tonne (g/t) silver equivalent (AgEq) for 127.5 million ounces AgEq, containing 42.8 million ounces (Moz) of silver, 149,200oz of gold, 181,016 tonnes (t) lead and 426,900t zinc.

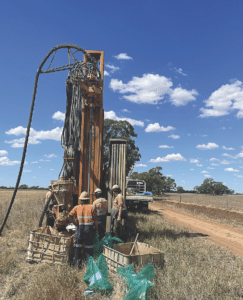

Image: Argent Minerals

Argent recently announced what it believes to be a major silver-base metal discovery north-east of the main Kempfield deposit, with surface sampling returning assays of up to 177g/t silver, 1.89 per cent lead and 1.21 per cent zinc.

“Surface assay results have confirmed the discovery of mineralised extension zones along strike from the main Kempfield deposit,” Argent managing director Pedro Kastellorizos said.

“These exciting new zones host the same geology and geochemical signatures as the main mineralisation over the Kempfield deposit.”

The extension known as Kempfield NW Mineralised Zone is approximately 1.72km along strike of the main Kempfield deposit with an average width of 100m. Three distinct silver-lead-zinc zones have been delineated here.

Image: Argent Minerals

Kastellorizos said Argent will be focused on aggressive drilling programs in 2024 as the company continues to build out the Kempfield resource, along with an economic scoping study to further understand the viability of the project.

“I believe we’ve got something quite a lot more expansive than is currently known at Kempfield,” he said.

“On the basis of that, we will be continuing drilling throughout this year, and outside of the main resource area as we’re looking to potentially delineate more tonnes and grade proximal to the current orebody.”

The Kempfield project belongs to a group of Paleaozoic volcanic-hosted massive sulphide (VHMS) deposits in the Lachlan Orogen. Other VHMS deposits in the region include Woodlawn, McPhillamys and the recently mothballed Thalanga mine.

Eastern Australian Paleaozoic VHMS deposits have been a major source of lead, zinc, silver and gold for over a century, and Kastellorizos believes no NSW silver deposit matches Kempfield for grade.

“The average grade of a silver deposit is … 62 grams per tonne silver equivalent, whereas Kempfield is 102 grams per tonne silver equivalent,” he said. “The mineralisation also starts almost at the surface at Kempfield, which means you’re literally digging into paid dirt rather than having to strip back material.

“So when you start looking at the economics of the project, Kempfield can definitely be a very profitable operation.”

Kalamazoo Resources

Kalamazoo Resources’ ‘project generator’ model has grown the company’s liquidity on the ASX in recent years.

The explorer’s objective is to ‘identify, acquire, discover, enhance and create value’, which has been proven through the sale of a 50 per cent stake in the Queens gold project in Victoria to Novo Resources for $1.5 million, and an option agreement to sell the Ashburton gold project in WA to De Grey Mining for up to $33 million.

In January 2024, Kalamazoo completed its spin-out of Kali Metals, retaining 20.2 per cent of Kali’s issued capital in the process. Chris Ellison’s Mineral Resources (MinRes) also owns a stake in Kali, with a 14 per cent share of the lithium play.

Kali holds a suite of lithium projects in Tier 1 jurisdictions, including its Higginsville project located adjacent to MinRes’ Mt Marion and Bald Hill lithium mines. The company’s Dom’s Hill and Marble Bar projects are located nearby Pilbara Minerals’ Pilgangoora lithium operation and MinRes’ Wodgina operation.

“The shareholder returns from the Kali spin-out alone amounted to about $16 million,” Kalamazoo chief executive officer Luke Mortimer told Australian Mining.

“And the 20 per cent equity we’ve retained in Kali Metals is currently the equivalent value of our current market cap. Then if De Grey chooses to exercise the option to acquire Ashburton in 12 months’ time, we will receive $30 million over two tranches.

“So shareholders are seeing plenty of value from their investment in Kalamazoo.”

Mortimer said Kalamazoo now has a good history of generating shareholder returns through its ‘project generator’ model.

“We find good projects, we do good work, we add value and we’ll either fund more exploration activity or generate liquidity, and monetise and return value to shareholders,” he said.

“Recent transactions prove this model is working.”

In parallel with advancing exploration activities across its Victorian and WA gold projects, Kalamazoo is constantly on the look-out for new acquisition and value-generation opportunities, with only the best projects under consideration.

“We prefer projects that already have some proven drill intersections,” Mortimer said. “Or it could be an unloved resource or project.

“Most importantly, it needs to be something where we believe we can add value.”

Falcon Metals

Initially spun out from Chalice Mining as a pure-play gold explorer, Falcon Metals has diversified its commodity profile, adding mineral sands and nickel to the mix.

The addition of mineral sands has come as a bonus for Falcon, with a recent 77-hole aircore (AC) drilling program returning encouraging levels of heavy minerals including zircon, rutile and ilmenite at its Pyramid Hill project in Victoria.

“We’ve got a very large ground position that targets the Murray Basin, which was primarily pegged for gold,” Falcon managing director Tim Markwell told Australian Mining.

“The Murray Basin is also known to host multiple very large mineral sands deposits, including VHM’s Goschen project, Iluka’s Wimmera project, and Astron’s Donald asset.

“We have two permits to the north-west of Bendigo that have quite a long east-west trend, and they go right across several mineral sands deposits.”

Image: Falcon Metals

Falcon’s EL006864 block includes WIM Resource’s Wedderburn heavy mineral sands project within it, demonstrating the potential for mineral sands prospectivity across Falcon’s tenements.

With AC drilling returning hits of up to 18m in length and up to 21.6 per cent in total heavy mineral (THM) grade, Falcon plans to advance mineral sands drilling in parallel with its gold exploration.

While Pyramid Hill and the Mt Jackson gold project in WA continue to be Falcon’s priorities, the company recently discovered a 1km gold trend at its Bamganie gold prospect near Meredith in Victoria.

The Bamganie prospect is unique in that Falcon believes it is located within a forgotten goldfield.

“While Bamganie was mined in the early 1900s, it has never had any proper exploration,” Markwell said. “It’s got a decent-sized footprint – it’s not a small goldfield where you’ve only got a couple of 100m of strike.

“Because Bamganie appears to shallow in depth and covers a footprint of a couple of kilometres, it makes us think, ‘Could there be another Fosterville? Could Bamganie be an area that’s been worked previously, but if you drill deeper, maybe it will improve at depth?’”

Agnico Eagle’s Fosterville gold operation in Victoria is considered one of the lowest-cost gold mines in the world, in part due to its very high-grade mineralisation.

Falcon is advancing infill and reconnaissance AC drilling across its Pyramid Hill project, which spans more than 5000km2 predominantly in the Bendigo region of Victoria.

The company is determining continuity across a range of prospects, with infill drilling currently focused on the EL6669 block near Kerang, EL6960 near Eddington, as well as the Wandoo prospect.

Other significant Pyramid Hill prospects include Karri, Ironbark and Banksia.

Falcon Metals has also been active on other fronts including the recently announced deal where the company vended two of its applications in the Kimberley region of WA to Stavely Minerals, adjacent to Stavely’s Hawkstone nickel-copper project.

Stavely can spend $500,000 to earn an 80 per cent stake in the two Falcon applications.

Markwell said the earn-in enabled Falcon to secure a “strategic entry” into the emerging West Kimberley magmatic nickel province.

“The IGO/Buxton Dogleg nickel sulphide discovery demonstrates the potential for new nickel discoveries, and we believe there is outstanding potential to discover more high-tenor magmatic nickel sulphide mineralisation across this district,” he said.

Diversification can be a critical differentiator in today’s mining industry, providing companies with more levers to attract investment and generate shareholder returns.

While Argent Minerals, Kalamazoo and Falcon Metals aim to be precious metals producers first and foremost, each company has diversified their portfolio to gain exposure to a range of commodities, some of which will be essential to the clean energy transition.

This feature appeared in the May 2024 issue of Australian Mining.