A quite bizarre piece of news has recently hit the investor community which is not really being addressed by the financial media. I assume the reason that it’s not being covered by the financial media is because it deals with a complex issue involving bank regulators which is beyond the average investor’s ability to understand. But we will try to outline the issue.

According to the Financial Times, the FINMA, which is the Swiss financial regulator, blocked the disclosure of key documents to the former holders of Credit Suisse’s AT1 notes who are suing FINMA for the write-down of CS’s AT1s. This directed write-down went outside the published order of priority for debt/equity holders. Clearly, this affected the investment value of the former holders of CS’s AT1 notes. And, in our view, such a move by the regulator may potentially have further undermined confidence in global banking regulators.

First, let’s review how the CS drama developed. The bank released its 2022 annual report on March 14, 2023, and it noted that it had found a significant flaw in its reporting practices that raised the possibility of misstatement risks. The chairman of the Saudi National Bank, which was a significant shareholder in CS’s equity, disclaimed any further increases in the bank’s stake the following day. The share price of the bank dropped once more as a result, and the U.S. Treasury Department began examining the financial sector’s exposure to CS. At least four sizable banks reportedly restricted trade with CS. The French bank BNP Paribas informed clients that it would no longer accept requests to take over their derivative contracts where CS is the counterparty. On March 19, 2023, UBS Group AG (UBS) announced plans to acquire CS.

FINMA then instructed CS to write down all the bank’s AT1 instruments ($17B) while equity shareholders received their payouts from the deal with UBS. According to many legal experts, this decision clearly contradicted the global banking supervision rules, which were created after the Great Financial Crisis of 2007-2009 and were designed to avoid major banking crises.

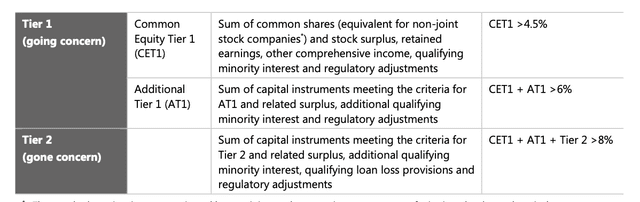

According to the Basel global banking supervision rules, a bank’s total available regulatory capital is the sum of the following two elements: Tier 1 capital, comprising common equity Tier 1 capital (CET1) and additional Tier 1 capital (AT1), and Tier 2 capital.

FINMA

The Basel framework clearly says that CET1 absorbs losses immediately when they occur, and only after the AT1 capital is converted into equities. Yet, this is not the priority of action directed by FINMA to CS as they directed CS to write down the AT1 capital instead of converting it into equities.

As a result, the holders of CS’s AT1 filed $9B of legal claims (the amount of the write-down). The lawsuit identified three legal targets: The FINMA, the Swiss Government, and UBS, with the FINMA being the main target of the lawsuits. The investors requested the disclosure of the documents that led to FINMA’s decision to write down the AT1s. However, the Swiss regulator made what some may view as a potentially ridiculous move and blocked this disclosure. The FT cited the rationale behind this decision, which was in the FINMA’s letter:

“The transmission of confidential procedural documents to the plaintiff could permanently undermine the confidence of those subject to Finma in the confidentiality of the information they share with Finma and thus seriously undermine Finma’s supervisory activities… This would greatly increase the risk of uncontrolled circulation of the procedural documents and that these documents would be used against the Swiss Confederation or the bank (Credit Suisse) in arbitration and civil proceedings, circumventing the procedural rules applicable to civil proceedings”

And here is a quote from one of the claimants cited by the FT:

“This of course is a joke in any civilized country, but the Swiss authorities seem to enjoy these petty tactics of frustration.”

Bottom line

In our view, the FINMA’s decision is another wake-up call for those who are relying on FDIC protection and for those who believe that the largest U.S. banks will be saved by the regulator when the next major financial crisis develops. Make no mistake about it: Regulators can and will make any decision in a crisis environment, even the most unexpected and bizarre ones, which may often benefit their position rather than those whom they are designed to protect.

So, the best course of action for investors is to find the safest banks possible. To this end, I want to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States.

Moreover, if you believe that the banking issues have been addressed, I’m sorry to inform you that you likely only saw the tip of the iceberg. We were able to identify the exact reasons in our public article which caused SVB to fail well before anyone even considered these issues. And I can assure you that they have not been resolved. It’s now only a matter of time.

At the end of the day, we’re speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you’re relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years.

It’s time for you to do a deep dive into the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Our due diligence methodology is outlined methodology outlined here.

*********