Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

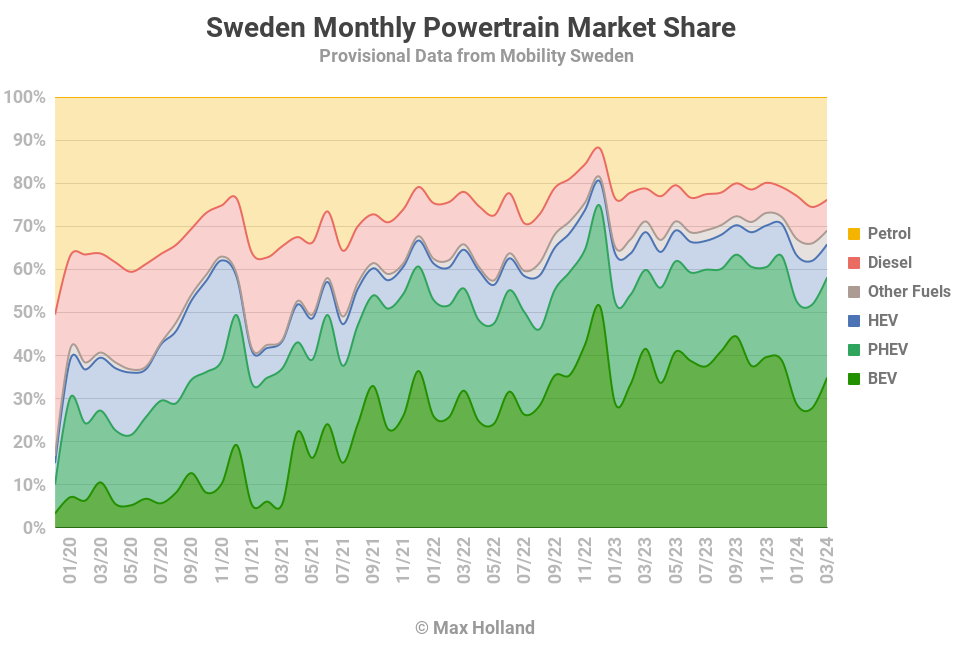

March’s auto market saw plugin EVs at a 58.1% share in Sweden, down YoY from 59.9%. Plugin volumes were down YoY for BEVs, but up slightly for PHEVs. Overall auto volume was 23,891 units, down some 21% YoY. The Tesla Model Y was March’s bestselling BEV.

March saw combined EVs at a 58.1% share in Sweden, with full battery-electrics (BEVs) at 34.9% and plugin hybrids (PHEVs) at 23.2%. These figures compare with 59.9% combined in March 2023, 41.6% BEV, and 18.3% PHEV.

BEV unit volumes were down by a significant 33% YoY (more than the 21% overall average), and down by over 4,200 units. Due to the incidence of weekends and public holidays, there were actually 13% fewer registration days in March 2024 (20 days) compared to March 2023 (23 days). That’s significant and impacts all vehicles, potentially explaining most of the 21% YoY drop in overall auto volumes. BEV registrations saw an even bigger drop than that, however. How can we understand this BEV shortfall?

Recall that March 2023 still had most BEVs covered by the (steadily fading) purchase incentive, which had been cut in November 2022 for new orders. Most March 2023 deliveries were ordered prior to that cutoff, so still qualified for a contribution of typically €4,000 in my understanding (please jump in the comments if incorrect). This was a reduction from the €6000 contribution in place until December 31st, 2022.

The contrast in incentives between March 2023 and March 2024 couldn’t be greater — the former incentives are now entirely gone. On top of that, the country’s economic recession had not yet fully hit consumers a year ago (though there were signs), but is now firmly in effect. More on the economic factors below.

The March 2024 BEV volume drop was spread across most brands, suggesting mostly a demand-side drop, rather than a temporary supply-side shortfall. However, Tesla has recently said that ship transit delays through the Red Sea have impacted its global deliveries. Some mild delay in parts supply could also potentially be impacting some European brands, though only to a limited extent. The shipping route around the Cape adds 10 to 14 days to transit time.

While the overall BEV volume drop was 33%, some brands suffered more than others. Stellantis’ brands dropped almost 98% of volume YoY (and a shortfall of some 390 units). MG Motor was down around 80% in volume, with a shortfall of 644 units.

Tesla, and Volkswagen Group brands — by far the biggest contributors to the Swedish BEV market — were both down in volume by around 33% YoY (in line with the overall BEV drop), a combined shortfall of around 2,200 units.

BMW fared slightly better than average, at 29% down, a 174-unit drop. Volvo was down by around 7.5% (and some 100 units), thanks to burgeoning EX30 sales mostly offsetting the halving of XC40 sales.

Mercedes’ volume, though modest, was up by some 42% YoY, and by almost 140 units. Polestar did even better, up YoY by 55%, and by some 137 units. Toyota Group brands (whose BEVs were still ramping a year ago) were up almost 2x YoY, though to a still modest 167 units (from a low YoY baseline).

This pattern — especially the lower priced BEVs suffering more heavily — hints at a consumer spending squeeze. Premium and luxury buyers are usually less affected by a recession than regular folks, and some of the brands appear to reflect this with VW and Tesla having a median fate, matching BEVs typical shortfall. BMW and Volvo fared slightly better than average. Mercedes fared well, and its BEV prices are scarcely priced higher than their Mercedes ICE peers. Mercedes is amongst the auto brands least affected by recessions.

MG and Stellantis BEVs, albeit “relatively affordable” within the BEV spectrum, still cost a good 50% to 100% or more above the equivalent ICE models of their respective brands. This makes these brands’ BEVs a big “extra stretch” for the regular folks who may be shopping for these brands, and who are not immune to the recession. This is the kind of purchase decision that gets quickly shut down when the overall economy suffers.

Now add in the fact that the cut in incentives is a relatively bigger hit for lower-priced BEVs (those priced closest to the €24,000 optimum % subsidized) than for higher priced BEVs. With all these factors combined, the YoY fall in BEV volumes, felt most heavily by the low-to-mid priced brands, is not too surprising. Let’s keep an eye on this in the coming months to see if this pattern endures.

PHEV sales were essentially flat YoY, but the share increased due to outperforming the shrinking overall market. HEV sales were down 31% in volume YoY, not unlike BEVs.

Combustion-only vehicles combined were somewhat down on volume YoY, but with BEVs and HEVs down even more, their combined market share actually increased from 29% to 31% YoY. The growth in share was fueled by the petrol-only side, as diesel-only was fractionally down in share.

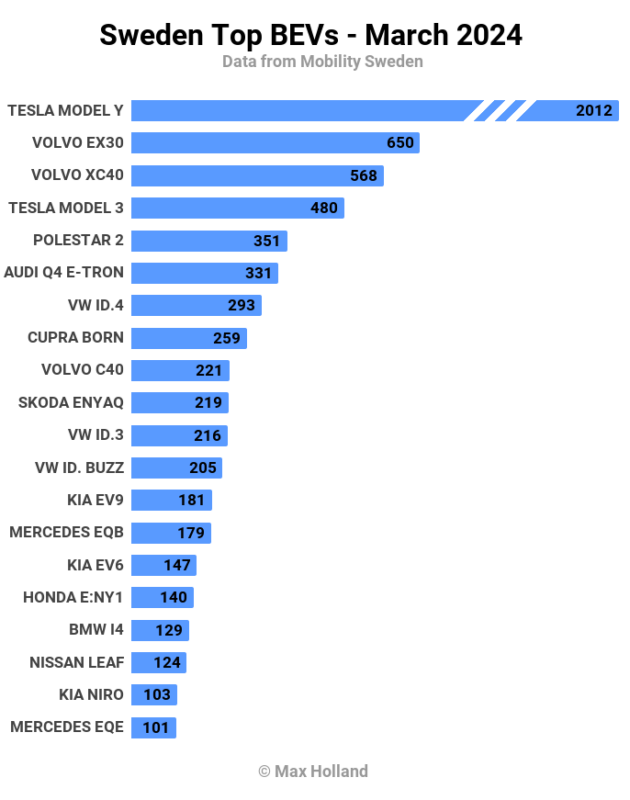

Bestselling BEVs

March saw the Tesla Model Y again at the top of the Swedish BEV rankings, for the third consecutive month. The relatively new Volvo EX30 has had an amazing rise from its debut in December, and has now reached second place!

The EX30 has displaced its older sibling, the Volvo XC40, from its habitual runner up position, and the older model now falls back to third.

The Tesla Model 3 came in fourth place, the same position as a year ago, although with volumes down by 33%. This is an improvement on its December rank, where it came in 6th.

Most of the other top 20 showed only minor movements. The VW ID. Buzz scored its highest position yet, in 13th, with 205 units. Its previous best was 22nd (April 2023).

The Honda e:Ny1 saw its strongest volumes yet, with 140 units, and 16th spot (previous best was 43rd spot). Honda may be making irregular batch deliveries, so this is likely a high water mark, let’s see.

In terms of newer BEV models, the Zeekr 001, which debuted in February with 52 units, increased to 89 units in March. The Peugeot 308 (also a February debut) didn’t move beyond single-digit deliveries.

In terms of all-new BEV models, there’s just one significant entry, the BMW iX2. This had seen a handful of dealer samples in January and February, but jumped up to customer delivery volumes in March, with 74 units. The iX2 is priced from SEK 659,000 (€56,900), about the same as the i4 sedan, and about 14% more expensive than the iX1 (currently the least expensive BMW BEV).

There are a few near-debut models that are seeing testing (or dealer sample) volumes registered, like the Renault Scenic (4 units), Volvo EX90 (1 unit), and Polestar 3 (9 units). We will look out for customer delivery volumes of these models in the months ahead.

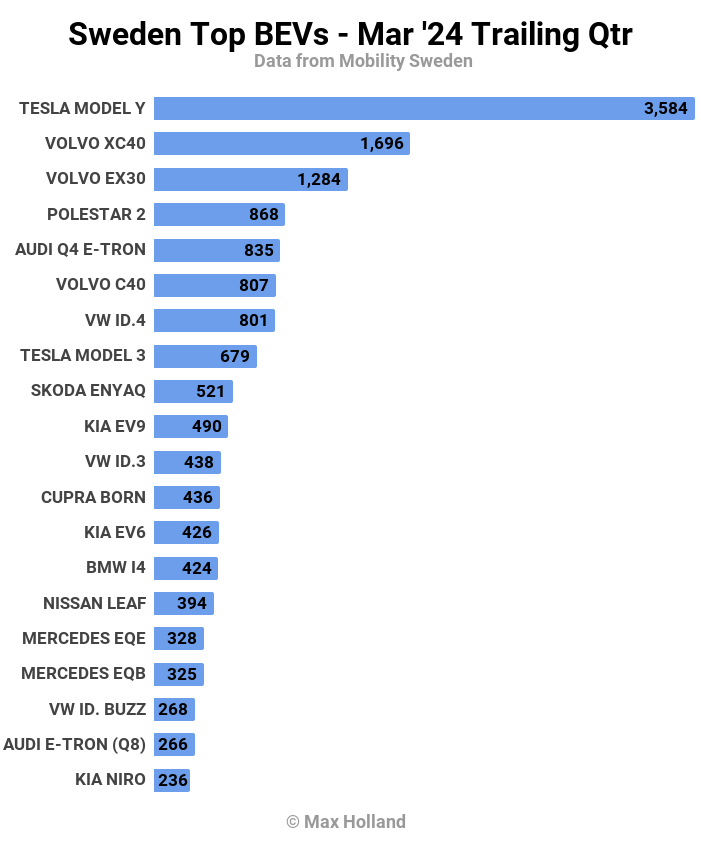

Let’s turn to the 3-month picture:

The Tesla Model Y still has a tremendous lead in the broader view, almost equal to the next three models combined.

The Volvo EX30, after 3 strong months, has already climbed to 3rd place, and is trending to make second place within the next two months, pushing out its older sibling, the XC40. Although there may be some cannibalization between the Volvo siblings, over time, their combined volume will certainly increase. Notice that the C40 is also strong, in 6th spot.

The Volkswagen ID.4 has fallen from the 1st spot in Q4 2023 down to the 7th spot now. Let’s see how much of this is just an allocation blip by keeping an eye on it in the coming months.

There was no other big news in the top 20 rankings, but surely the meteoric climb of the homegrown Volvo EX30 is enough to celebrate!

If you’re wondering how the fleet transition is going, take a look at the fleet update in last month’s report.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Outlook

In the broader economy, Sweden’s GDP annual growth rate trajectory eased to negative 0.2% in Q4 2023, from negative 1.1% in Q3 (official figures from Statistics Sweden were slightly adjusted over the past month). The inflation rate lowered in February (latest data) to 4.5%, from 5.4% in January. Interest rates have remained flat at 4% since September. Manufacturing PMI improved to 50 points in March, from 49.2 points in February. These are overall mildly positive signs for the mid term outlook, relative to recent performance.

Mobility Sweden points out that while business and fleet purchases made up 75% of Sweden’s BEV sales in March, the share of BEVs as a proportion of the private buyers nonetheless was 32%, an improvement over recent months.

Recent Riksbank plans to lower interest rates soon may help BEV sales slightly recover in the near term, though the overall economy may also need to turn positive before we see much growth.

In my view, the biggest problem is that even simple BEVs are ridiculously overpriced in Sweden (and most other parts of Europe). The MSRP for a petrol ICE Peugeot 208 starts from SEK 239,900 (€20,782). This is already a high baseline, compared to €18,300 in France and to the historical price of this vehicle.

Meanwhile, the starting MSRP for an e-208, the BEV version, is an incomprehensible SEK 489,900 (€42,470). Over €21,500 more for a BEV powertrain with a 54 kWh (gross) battery!

As I discussed in a recent in-depth analysis, LFP batteries are currently priced at around €51 per kWh at the cell level. This cell price should translate to around €64 at the pack level from the large suppliers like CATL, BYD, Gotion, CALB, EVE, and others. Such prices allow highway capable cars with 30 kWh packs (bigger than Dacia Spring) to cost well under €9,000 in China.

The Peugeot e-208’s 54 kWh battery pack could potentially be sourced for not much over €3,200 using LFP cells, and imported as a component into the EU for under €4,000. The remainder of the powertrain should be able to be imported for well under €3,000.

How does a (generous) €7,000 in BEV component costs, and minus the foregone cost for the ICE, ancillaries, and transmission (together at least €2,000) somehow translate into an extra charge for the e-208 of €21,500? Please jump in to the comments if you have thoughts on this, and we can discuss.

Until the foot-dragging and price gouging changes, Europe’s BEV transition will be stuck in the slow lane, with only wealthy folks able to afford new BEVs, and automakers continuing to make record profits, with competition kept out.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica TV Video

CleanTechnica uses affiliate links. See our policy here.