Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

You might not know if it you live in the United States where anti-EV fervor is rampant, but the EV revolution is alive and well in many parts of the world. In those places, it has zoomed past the 5% of sales mark that is commonly understood to be an important milestone on the so-called S curve. If you are not familiar with the term S curve, here’s a primer.

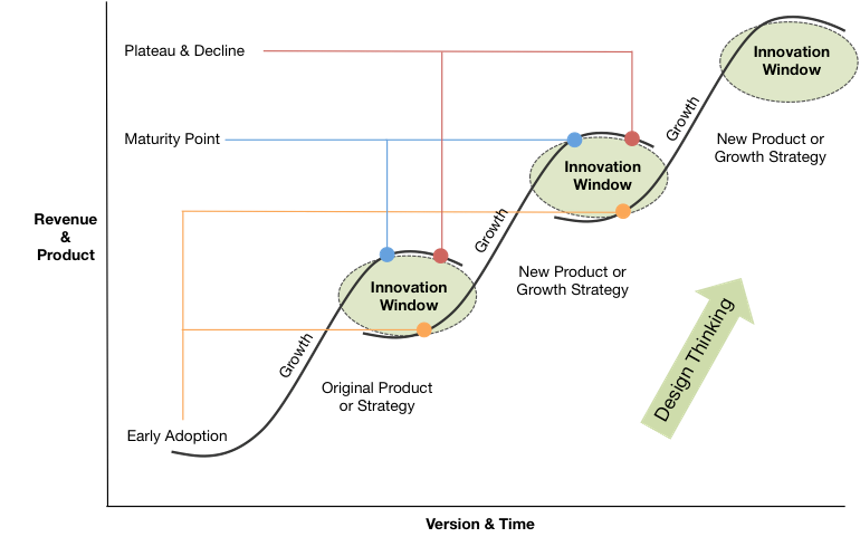

An S curve comprises four stages, which all have different growth rates. According to Future Business Tech, each stage offers its own opportunities, so identifying the current growth stage can help businesses prepare for the next. The first phase is known as “slow growth,” a time when only early adopters are willing to take a chance on a new technology. But when sales reach about 5% of the market, more and more people adopt the new technology and it starts to appeal strongly to mainstream customers. That is the second stage of the S curve, the phase that is associated with explosive growth.

Notice that the S curve is not a hard and fast rule. Rather it is a graphical representation of how new technologies have impacted the market in the past. It is commonly assumed that when a new technology reaches 5% of the market, that is the point where stage one ends and stage two begins. And that, Bloomberg Hyperdrive says, is precisely where the EV revolution is today when you look at it from a global perspective.

5% Or More In 31 Countries

By the end of last year, sales of electric cars reached 5% or more of the new car market in 31 countries. This threshold signals the start of mass adoption, after which technological preferences rapidly flip. When Bloomberg first completed this analysis in 2022, only 19 countries had passed the 5% tipping point. Last year, the number soared as EVs spread across four continents. For the first time, some of the fastest growing markets were found in Eastern Europe and Southeast Asia. The trajectory laid out by countries that came before them shows how EVs can surge from 5% to 25% of new cars in under four years, Bloomberg says.

According to Bloomberg reporter Tom Randall, when new technologies like televisions or smartwatches achieve 5% market penetration, they are well on their way to mainstream acceptance. The transition often depends on overcoming initial barriers such as cost, a lack of infrastructure, and consumer skepticism. The tipping point signals the flattening of these barriers. While each country’s journey to 5% plays out differently, timelines converge in the years that follow.

“Once enough sales occur, you kind of have a virtuous cycle,” said Corey Cantor, an EV analyst at BloombergNEF. “More EVs popping up means more people seeing them as mainstream, automakers more willing to invest in the market, and the charging infrastructure expanding on a good trajectory.”

Several countries crossed the tipping point last year in spectacular fashion. Thailand emerged as Southeast Asia’s EV pioneer, surpassing the 5% threshold in the first quarter of 2023 and then rising to nearly 13% of new car sales by the last quarter. The transition was supercharged by the opening of Thailand’s first domestic EV factory, owned by China’s Great Wall.

A similar story played out in Turkey, a country that was barely on the radar for EV adoption a year ago. The Turkish auto company known as Togg released its first battery-powered car — the T10X — an SUV that competes squarely with Tesla’s Model Y, Bloomberg says. CleanTechnica readers may quibble with that characterization. Battery-electric vehicles from Togg are now selling at a blistering pace, helping Turkey cross the 5% tipping point in the third quarter. By the fourth quarter, it was the fourth largest EV market in Europe.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Gains Are Not Guaranteed

While this market share approach to EV tipping points shows how fast the transition to electric cars can take hold, it doesn’t preclude slowdowns or setbacks due to supply chain disruptions, economic downturns, bankruptcies, and politics. Analysts at BNEF expect fully electric and plug-in hybrid vehicle sales to increase about 22% this year globally, decelerating from the last several years, though not dramatically changing the long-term outlook for EV adoption.

The US tipping point didn’t arrive until the end of 2021, which is relatively late for a country with the economic clout of America, but US drivers demand EVs with longer range than the earliest models offered, and the US preference for pickup trucks and large SUVs required bigger batteries than the nascent supply chain could handle.

Two years after crossing the tipping point, the US continues to lag the countries that came before it. Fully electric cars accounted for 8.1% of US auto sales last quarter, far short of the 18.1% average for 20 countries at the same point on the adoption curve. The only country with a lower share of EVs at the two-year mark was South Korea, a nation whose range anxiety rivals that of the US. Not a single country thus far has taken more than three years to go from 5% to 15% EVs — which means the US and South Korea will either break from the trend in 2024, or will require a sudden acceleration in sales to catch up, Bloomberg says.

The countries that have now passed the EV tipping point account for two-thirds of the world’s auto sales. That still leaves large segments of the global population waiting for the EV revolution to arrive. A tipping point may be approaching for India, Indonesia, and Poland, significant auto markets where EVs have been on the rise. In South America, a major push by China’s BYD could provide the spark for widespread adoption, beginning with Brazil.

Applying this framework to the entire planet, the 5% EV tipping point was crossed in 2021. In the fourth quarter of 2023, fully electric models accounted for roughly 12% of new vehicles sold worldwide. The same forces that drove so many car buyers to try their first electric model — falling battery prices, more chargers, better performance — continue to make EVs competitive in new markets.

The Takeaway

The competition to reduce the cost of electric vehicles is fierce. Most of the world’s automakers are focusing on new manufacturing techniques to drive down the cost of their electric cars, and battery manufacturers are finding ways to lower their prices on an almost monthly basis. If you listen to the fossil fuel lobbyists and lunatics, you may get the impression that the EV revolution is over in the US, but that would be a mistake.

The Biden administration is driving massive support for expanding America’s EV charging infrastructure, which will go a long way to lower the concerns people have about charging an electric car when away from home. The EV revolution is alive and well all over the world as the dynamic of the S curve continues to apply. A few years from now, people will be wondering what all the fuss was about as EV sales begin to approach and then surpass sales of cars with infernal combustion engines.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica TV Video

CleanTechnica uses affiliate links. See our policy here.

.jpg)