Summary

- Brent forecast raised to $82.33 a barrel for 2024

- WTI projection lifted to $78.09 a barrel

- First upward revision in 2024 price forecasts since October

(Reuters) – Oil prices will gain some momentum this year as demand picks up and output curbs by the OPEC+ producer group continue to squeeze supply that is already being pressured by military conflicts, a Reuters poll showed on Thursday.

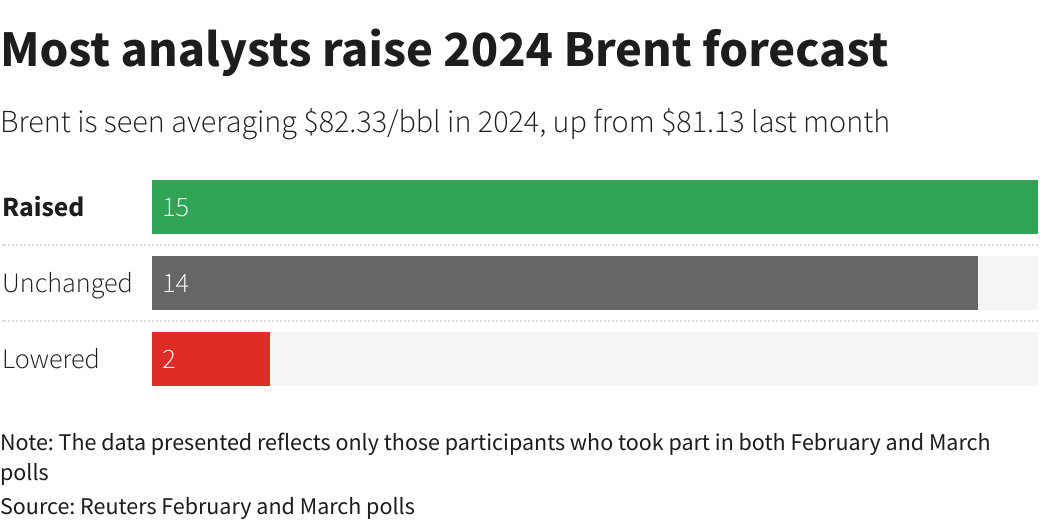

A survey of 46 economists and analysts forecast that Brent crude would average $82.33 a barrel in 2024, up from the $81.13 consensus projection in February. U.S. crude expectations were raised to $78.09, up from the $76.54 forecast last month.

This was the first upward revision in 2024 consensus forecasts since the October poll.

“We see the oil price rally going further until the summer months,” said Florian Grunberger, senior analyst at data and analytics firm Kpler. “This is due to the geopolitical risk premium and the interests of OPEC+ members, coupled with increasing demand in China.”

Oil prices have added more than 12% in the quarter so far, fuelled by geopolitical tensions in the Middle East, Houthi attacks on Red Sea shipping and recent Ukrainian drone attacks on Russian refineries.

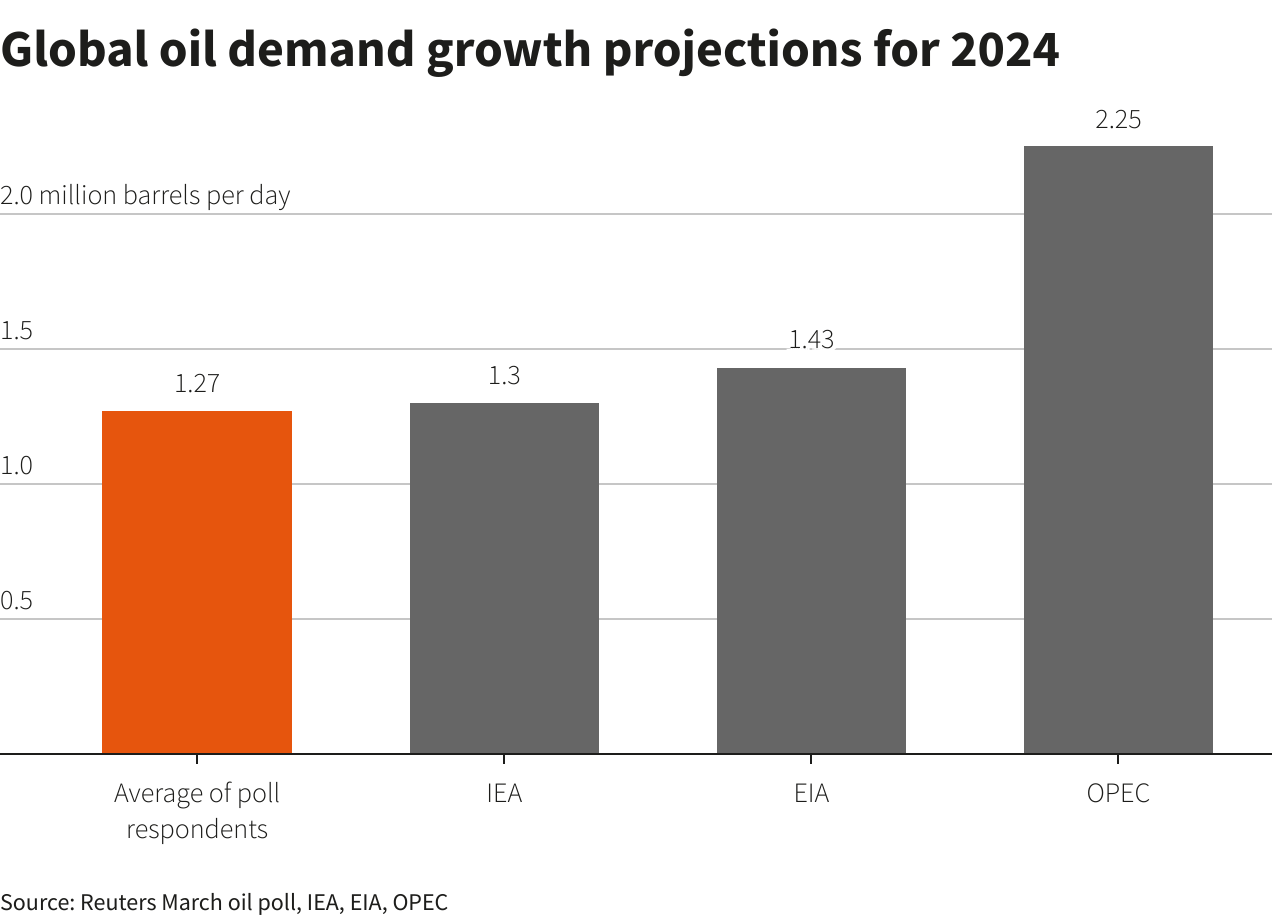

On the demand side, the overall consensus was roughly in line with the 1.3 million barrel per day (bpd) rise for 2024 projected by the International Energy Agency.

The IEA’s forecast was far less bullish than that of OPEC, which expects demand growth at 2.25 million bpd this year and said the 2024 and 2025 growth trajectories of India, China and the United States could exceed current expectations.

“Traders have now fully absorbed the implications of the OPEC+ supply cut extensions at a time when demand is proving more robust than expected,” said Matthew Sherwood, lead commodities analyst at the Economist Intelligence Unit.

00:10Can onboard carbon capture tech clean the shipping sector?

The video player is currently playing an ad.

OPEC+ members led by Saudi Arabia and Russia are unlikely to make any oil output policy changes until a full ministerial gathering in June, three OPEC+ sources told Reuters.

“Convincing OPEC+ members to under-produce as a group to maintain oil prices above a certain level is not going to be easy,” said Suvro Sarkar, energy sector team lead at DBS Bank, pointing to rising surplus capacity and the loss of OPEC+ market share to non-OPEC+ producers such as the United States.

Reporting by Sherin Elizabeth Varghese and Swati Verma in Bengaluru Additional reporting by Harshit Verma Editing by David Goodman

Share This: