The announcement of the week award goes to BoJ that just hiked rates for the first time in 17 years. Not without impact on gold.

Yen on Verge of Breaking

In the aftermath of the decision, the Japanese yen fell in value, which might seem surprising unless one knows about the specific way in which the markets react to news.

The market moves on rumor and then moves back when something does indeed take place. The move by the BoJ had been widely communicated before it took place, so everyone could have prepared. The yen rallied based on that. And when the rates were raised, the yen moved back down.

This is interesting from both fundamental and technical points of view. Let’s start with technicals first.

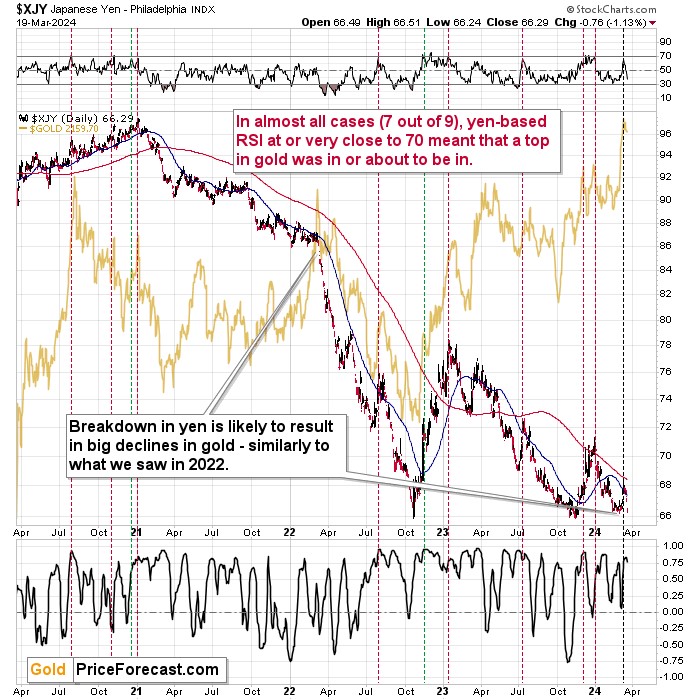

The yen is on verge of breaking to new lows. The 2023 attempt resulted in a countertrend rebound, and the early 2024 attempt resulted in a much smaller rebound. This time, the yen likely doesn’t have enough strength to bounce back in any meaningful way, and it seems that it’s going to sink.

The RSI based on it confirms that. Due to the recent sharp upswing, the RSI moved very close to the 70 level, and those cases very often marked local tops for the Japanese currency. The shape of the recent upswing in both: yen and the RSI are particularly similar to two cases from the recent past: the mid-2022 rally and the mid-2023 rally. Also, in both cases, yen moved slightly above its 50-day moving average.

In both above-mentioned cases, the yen then declined significantly.

Now, the most interesting thing for us – gold & silver investors and traders – is that the tops in yen were usually aligned with tops in gold – or the tops in yen preceded tops in gold. I marked the moments when RSI moved to 70 or close to it with vertical, dashed lines, and I marked those lines with colors depending on the follow-up action in gold.

In seven out of nine cases, gold then declined either immediately or soon. Since we saw the sell signal from yen’s RSI once again, things don’t look good for the yellow precious metal.

What Do Fundamentals Say?

From the fundamental point of view, the situation is also interesting and bearish for gold. We just saw the last of the world’s monetary authorities ending the negative interest rate policy.

This means that beforehand, it was possible to borrow one of world’s main currencies, make some money thanks to borrowing that currency and using it to buying gold. Pretty sweet deal, right? Especially if you apply enormous leverage as the big banks often do.

This deal just stopped being so lucrative. If the rates move even higher, it might cease to be beneficial at all. But the key thing already happened – there is no more the possibility to get free money and then use it to buy gold.

Technicals confirm what fundamentals justify. Also, here’s a crystal-clear sign from gold stocks.

Even though the GLD ETF was down by just $0.11% (and the SPY ETF was up by 0.56%), the GDXJ ETF was down by 2.26%.

Miners’ extreme weakness is back, and you know very well what it means – the precious metals sector is about to slide!

Especially the junior miners.

In my March 13 Gold Trading Alert, I summarized the situation in the following way:

(…) it looks like gold is topping here and the same goes for mining stocks.

That was indeed the case. In fact, everyone who shorted the GDXJ after March 6, 2024 is now profitable, and those who went long… Not so much.

It’s not too late to enter the short positions at this point, but it will very likely be too late soon – of course I can’t promise that; it’s just my general opinion only.

********