Here are today’s videos and charts. The videos are viewable on mobile phones as well as computers. Double-click to enlarge the charts.

SGS Key Charts, Signals, & Video Analysis

Super Force Signals (SFS) is being rebranded as Super Gold Signals (SGS at https://supergoldsignals.com), to reflect the growing global importance of gold.

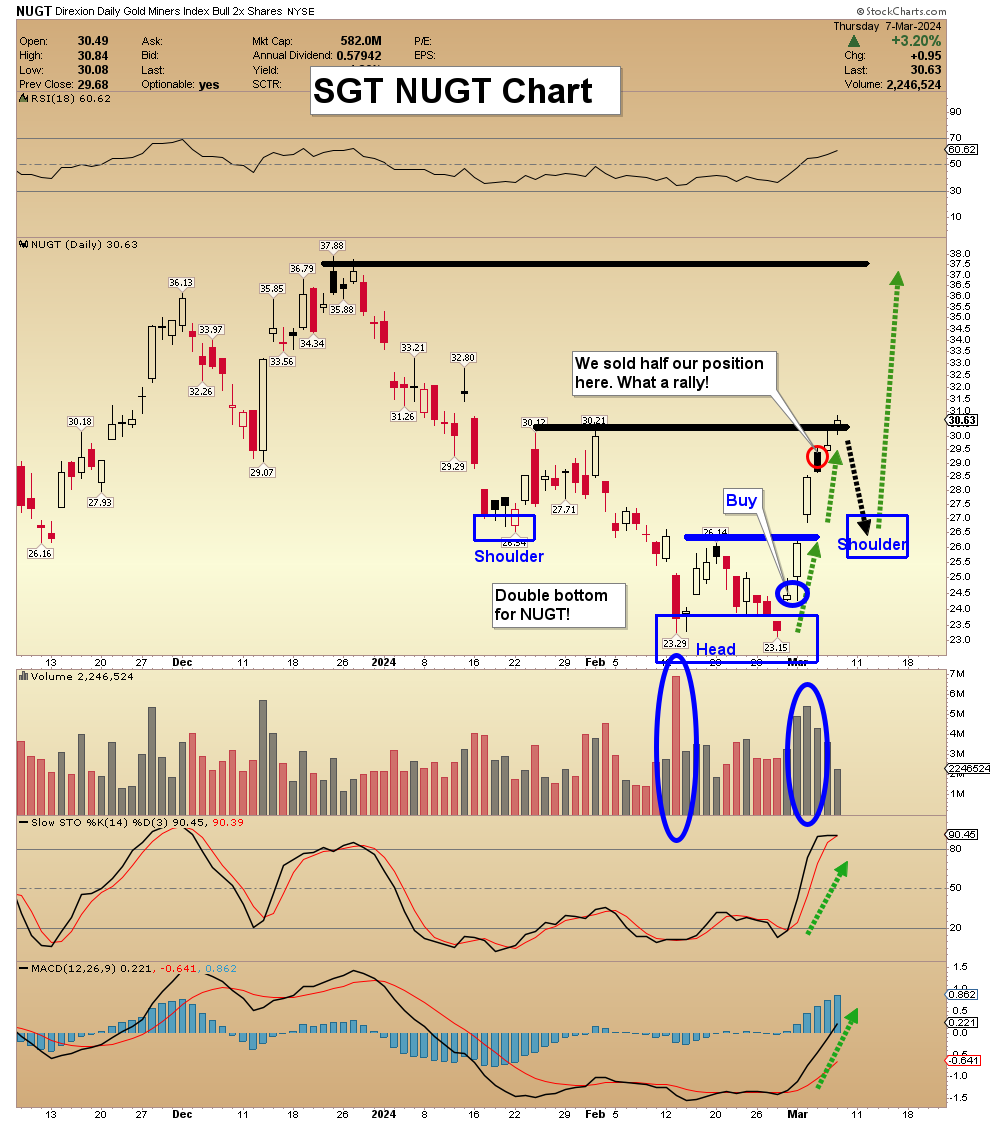

We are looking very good with our positions. My SGS flagship newsletter has 3 portfolios: Gold, commodities, and Dow stocks. All are green. I got the SGS buy signal for the gold stocks that was elusive in recent weeks. Investors who are light on positions can buy now or wait for the US jobs report volatility to subside, and then buy. At $229 a year, subscribers love the SGS newsletter value. It’s my big assets newsletter, with senior miners, gold and silver ETFs, big oil stocks, and commodity-oriented Dow stocks too. I’m doing a special SGS offer this week of just $199 for a full 14 months! Please send me an email or click here if you want the offer. Thanks!

SG60 Key Charts, Signals, & Video Analysis

SGT Key Charts, Signals, & Video Analysis

SGJ Key Charts, Signals, & Video Analysis

Thanks,

Morris

Unique Introduction For Gold-Eagle Readers: Send me an email to [email protected] and I’ll send you my free “Inflation Thunder Now!” gold stocks video report. I’ll also include 3 of my next Super Force Surge Signals free of charge, as I send them to paid subscribers. Thank you!

Stay alert for our Super Force alerts, sent by email to subscribers, for both the daily charts on Super Force Signals at www.superforcesignals.com and for the 60 minute charts at www.superforce60.com

About Super Force Signals:

Our Super Force signals are created thru our proprietary blend of the highest quality technical analysis and many years of successful business building. We are two business owners with excellent synergy. We understand risk and reward. Our subscribers are generally successful business owners, people like yourself with speculative funds, looking for serious management of your risk and reward in the market.

Frank Johnson: Executive Editor, Macro Risk Manager.

Morris Hubbartt: Chief Market Analyst, Trading Risk Specialist.

Email:

Mail:

1276 Lakeview Drive

Oakville, Ontario L6H 2M8

Canada

********