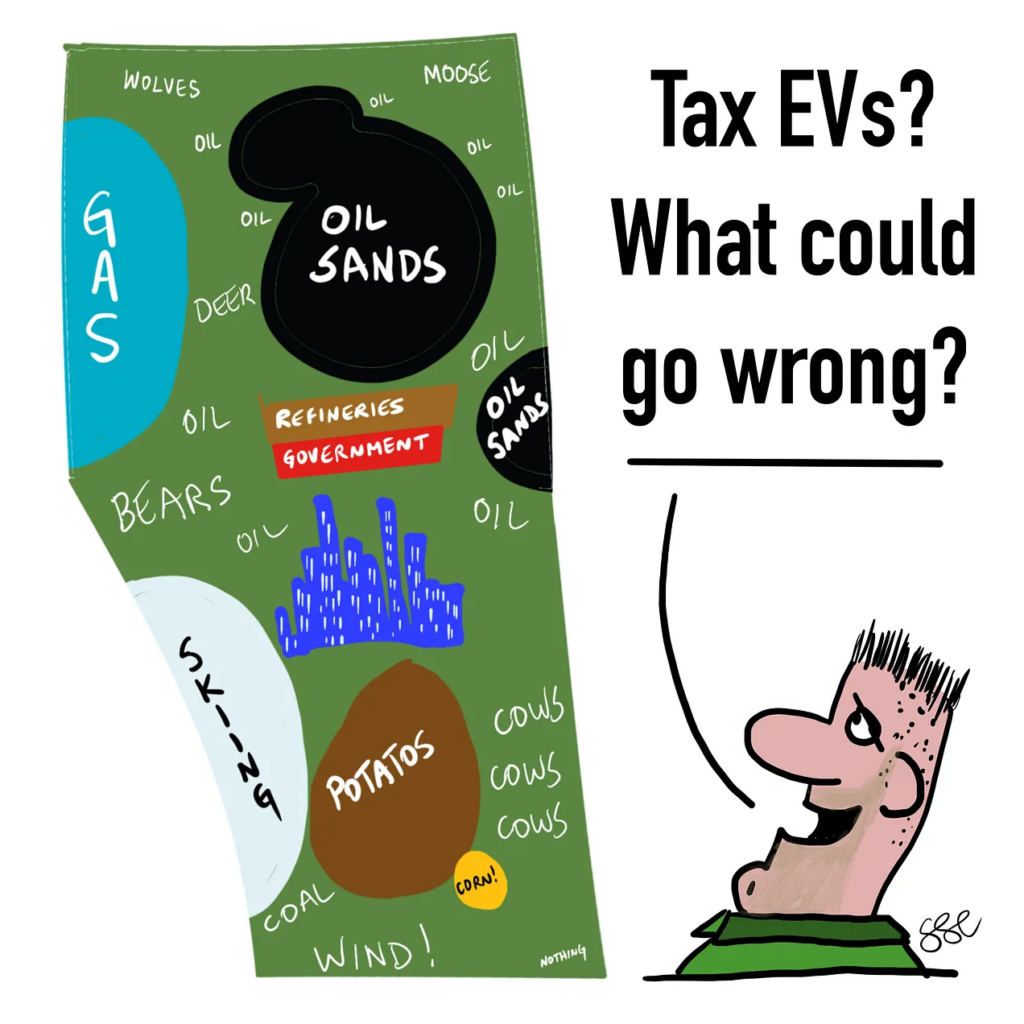

How a fossil fuel-dependent jurisdiction taxes battery vehicles says a lot.

Another fossil fuel-dependent jurisdiction has decided to tax electric cars because they exist. This is lazy and unambitious tax policy-making at its finest.

How To Gaslight A Province

I’ve written a couple of articles about energy transition and its unanswered questions, one of which was how governments might replace taxes on gasoline at the pump in a world of electric vehicles. In many economies, vehicle fuel tax is a reliable revenue generator for government, and is used (in theory) to pay for road building, maintenance and upkeep. Electric cars don’t need gasoline, but still use the road system, leading to a free-rider effect—gasoline car owners paying fuel tax subsidize electric car owners’ use of a public good (the road system).

This past week Alberta joined other jurisdictions by announcing a tax on battery electric vehicles. It might be a new government, but it has the same old, not very ambitious, thinking.

The Alberta tax tax authority noted tax dollars from gasoline will erode over time as more consumers buy electric cars. To get ahead of the problem, they have decided to place an annual levy on electric cars of $200, 25% higher than next door in Saskatchewan.

This seems like a small amount, and frankly, given the costs of today’s electric vehicles and the few electric vehicles in the province, you can easily dismiss this as a tax on Alberta’s few greenies, nerds and the rich. However the tax will eventually raise a lot of money. There are around 3,151,000 vehicles under 4500 kilograms registered in Alberta, and they will progressively turn over and likely become battery electric. At $200 each, this future electric fleet will generate $630.2 million for the provincial coffers.

But how does it compare?

Of the 3.1 million registered vehicles in Alberta, I reckon the majority are SUVs and pickup trucks, which have notoriously lousy fuel economy. The IEA, in a study from 2017, reported Canada’s fleet as sporting the lowest fuel economy of any country in the world, at around 8.9 liters/100 km, owing to our enthusiasm for large heavy vehicles. Even considering the age of this data, there’s no reason to assume Alberta is now dramatically better than this average, and very good reasons to believe it’s probably worse.

Assuming gasoline vehicles drive around 15,200 kilometers per year each (an estimate from several sources, including the Alberta government), consuming 8.9 litres of gasoline per 100 kilometers driven (taken from the recent IEA study on global fuel economy), with a $0.09 per litre tax, Alberta drivers generate $383 million in gasoline tax revenues today.

My calculations show that an annual EV levy of $200 is 40% more than the equivalent tax take at $.09 per litre.

The Alberta government is gaslighting the population by claiming that the annual levy is equivalent to what a gasoline vehicle pays in fuel tax. It isn’t. The gasoline tax needs to be around $0.15 per litre to be equal to the $200 EV levy.

Additionally, as a policy matter, governments continually tune tax rates to suit their needs. I would not be surprised to see levies on other electrified transportation that uses roads (bikes, motor cycles, scooters, delivery vehicles, drones), and levies to applied on those assets that will eventually become electric (off road vehicles, farm equipment, mining and forestry kit, yellow goods, boats, snow machines, etc).

Flat Tax vs Variable Tax

The wrinkle in this new tax model is that it replaces a consumption tax (you pay a little tax for every litre of fuel you use) with a flat tax (you pay in advance per vehicle you own). This might be fine in some instances, but this tax policy will almost certainly introduce some unintended consequences.

All kinds of perversions exist when changing tax models and formula so dramatically. Here’s just a few.

The Government Win

The government will capture a wind fall. By collecting $200 per vehicle annually, the government will have a guaranteed revenue stream that is not sensitive to consumer behaviour or the economy. I might choose to drive less (as has happened in the pandemic) but the revenue take by the government will not go down. If I choose to drive less, I’ve still paid for my road miles in advance, which is pretty irritating, and unfair. Use it or lose it.

The government will become less economically competitive because its revenues are based on private assets and not economic activity. Government revenues will show less volatility or uncertainty, and mandarins will be relieved of having to manage within the economic activity level of the province. This isn’t a good thing.

At a personal level, Alberta’s residents can’t easily adjust their family cost structures when they want to, or need to. Most own cars to get around because population density is low and public transit is under invested. If you lose your job, you can choose to drive less, but selling your car isn’t really an option.

High Mileage Vehicles Win

A flat rate tax per vehicle means high mileage vehicles win. The more you drive the lower the cost. From a road tax standpoint, this doesn’t make a lot of economic sense. Encouraging people to drive more means means more road wear and tear against a fixed income.

The government’s argument to justify the tax is that electric cars and trucks are heavier on average than gasoline cars. Batteries are heavy things, and heavy vehicles are hard on road surfaces, bridge decks, level crossings, and intersections. Then again, most of the vehicles in Alberta are already very heavy and inflict the same degree of harm to infrastructure.

This logical sleight of hand, shifting the blame for road damage to EVs, and by charging them more, rewards the real culprits, heavy truck and SUV owners who don’t pay for their fair share of the damage.

Demand for ride sharing and taxi services will go up, because it will be cheaper to run taxi services with a fixed annual levy and not a mileage-based levy. Taxi services based on electric cars are already growing because the maintenance costs of electric vehicles is already much lower than for comparable gasoline vehicles. A flat tax just reduced their costs hugely. A 100k km/year Uber in Calgary just saved $600 in gasoline tax by converting to electric and paying $200, not to mention avoiding an annual gasoline fuel bill of $13,000. Fleets win big.

Home delivery services will benefit as delivery costs will fall. This isn’t good for retailers who are dependent on things like drive in traffic. Then again, property tax tends to be local to the community and not a provincial matter, so the impacts on retail may not be that material to the province. Did the province really intend to reward Amazon and punish the downtown cores of Calgary and Edmonton?

Private car ownership becomes less attractive since the costs of car hire, purchase delivery, and ride sharing will go down while the costs to own and drive a little go up. Owning an electric car also requires an investment of $5000 to retrofit the garage or parking spot with a high voltage line for the car battery. Not sure I would want to own a car dealership under this model.

Fuel Prices to Rise

Fuel prices will have to rise again. The costs to administer fuel tax collection at the pumps is fixed regardless of how much fuel is purchased because the fuel retailers are highly automated, but the technology and equipment still requires regular maintenance, the costs of which must be spread out over fewer gasoline car owners and less fuel revenue.

The tax policy has created an arbitrage opportunity at the border between Saskatchewan and Alberta. It will make economic sense to register a vehicle in Saskatchewan with the lower annual tax and drive it when you need to in Alberta.

Finally, Alberta’s power utilities were always going to win in an electrified world, but a tax like this, to tilt the playing field in favour of gasoline vehicles, makes planning more challenging than it needs to be.

A Digital Tax Solution

This tax policy is out of step with a fast-evolving future. It is data poor where it could be data rich. It is regressive when it could have been progressive. It leaves the province bereft of consumer insight, when it could have been used to harvest very valuable information about true road usage and road condition, for free. It leads to fewer EV cars driving a lot more for a lot less tax, and in the end a possible revenue shortfall. It runs the risk of setting the province back on its agenda to be an investment destination.

Meanwhile, automakers are furiously competing for shrinking vehicle sales in a digital world. China’s world-class new battery vehicles are winning the long race over the western incumbents. Electric cars are becoming whizzier because their capabilities are now in the software and not the hardware. Even Apple, who for a decade has been experimenting with creating a thoroughly reimagined vehicle, has abandoned the cause because it can’t capture its usual margins of 30% or better.

Alberta should have retained its consumption tax based on mileage by tapping into the road mile data collected by electric vehicles. Many of the building blocks for creating an alternative tax that mimics the existing tax are in place:

- Cloud computing provides the data storage and analytical horsepower.

- Blockchain provides the mechanism for trusted record keeping.

- Smart phones in the pockets of drivers and in car apps can capture the necessary data about usage.

- Encryption technologies can hide the identity of drivers, routes and timing to keep hackers at bay and meet confidentiality rules.

- Wireless networks cover much of the province, and certainly in the cities where electric car owners are likely congregated.

- GPS technology can determine if the miles driven were on or off road, where they were driven, and where charging technology could be deployed.

- Billing can be fully automated via Visa and PayPal.

- Global communities and investors are keen to see these trials and possibly raise funds for them.

- Many vehicle owners already record vehicle mileage so as to qualify for mileage allowances for tax purposes.

For a province with ambitions to diversify its economy and be seen as a digital innovation leader, it’s missed an opportunity to lead. I’m sure the local digital ecosystem is well-placed to build out the solution trials and very keen to play a role in building it out. Such a system could eventually become an export revenue generator as this problem becomes apparent to other jurisdictions.

Conclusions

Electric car owners are right to call into question the thoughtfulness of this tax policy, but fossil fuel car owners shouldn’t cheer either, nor should car dealerships, land owners, and small retailers. Sadly, the winners are Amazon and Uber, which is frankly a very odd tax policy.

Artwork is by Geoffrey Cann, and cranked out on an iPad using Procreate.

Share This: