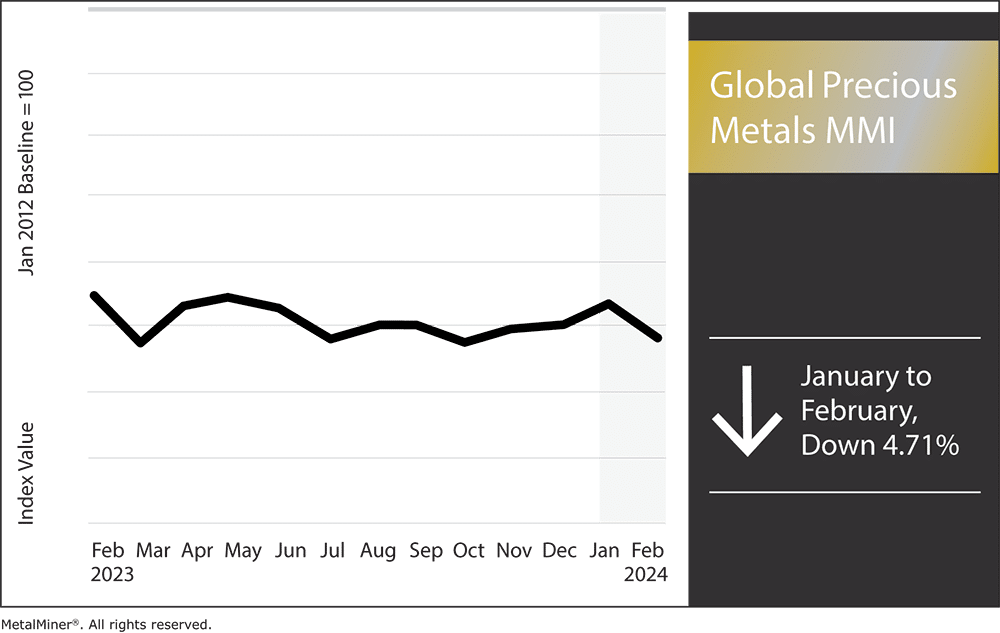

After almost a year of sideways movement, the Global Precious Metals MMI (Monthly Metals Index) broke its trend, declining by 4.71%. Despite the break in sideways movement for precious metal prices as a whole, most individual commodities still lack strong bullish or bearish movement as they move through Q1.

Most gold and other precious metals investors saw their hopes for the Fed lowering interest rates sooner than later dashed. This clearly impacted precious metals markets, particularly gold. And though some recession concerns still remain, there is not enough fear to give precious metals stronger bullish momentum. As a result, many precious metal prices remain close to their support zones.

Time is metal, don’t waste it searching for money-saving insights. Get MetalMiner’s weekly newsletter delivered straight to your inbox.

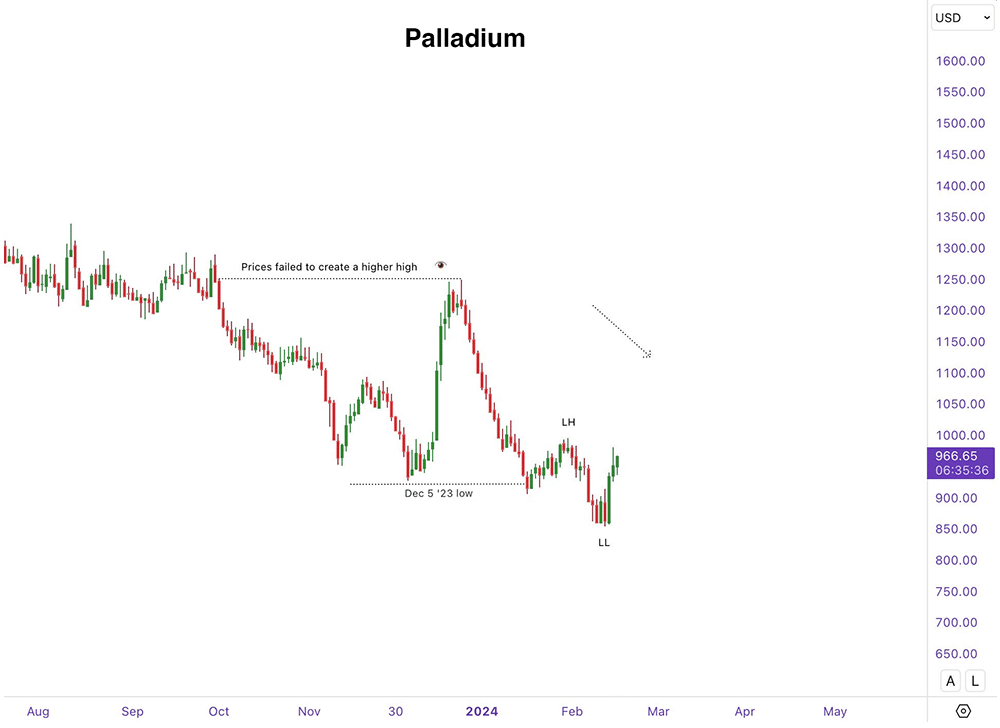

Precious Metal Prices: Palladium

Palladium markets continued to show overall bearish momentum as prices failed to create a higher high, slumping from their December peak. Palladium markets continuously show strong month-over-month bearish declines, with prices creating both new lows and lower highs. Back at the start of the Israel-Hamas conflict, palladium prices began descending into a strong bear market. Such price action generally indicates a high level of volatility and uncertainty in the face of ongoing geopolitical conflict.

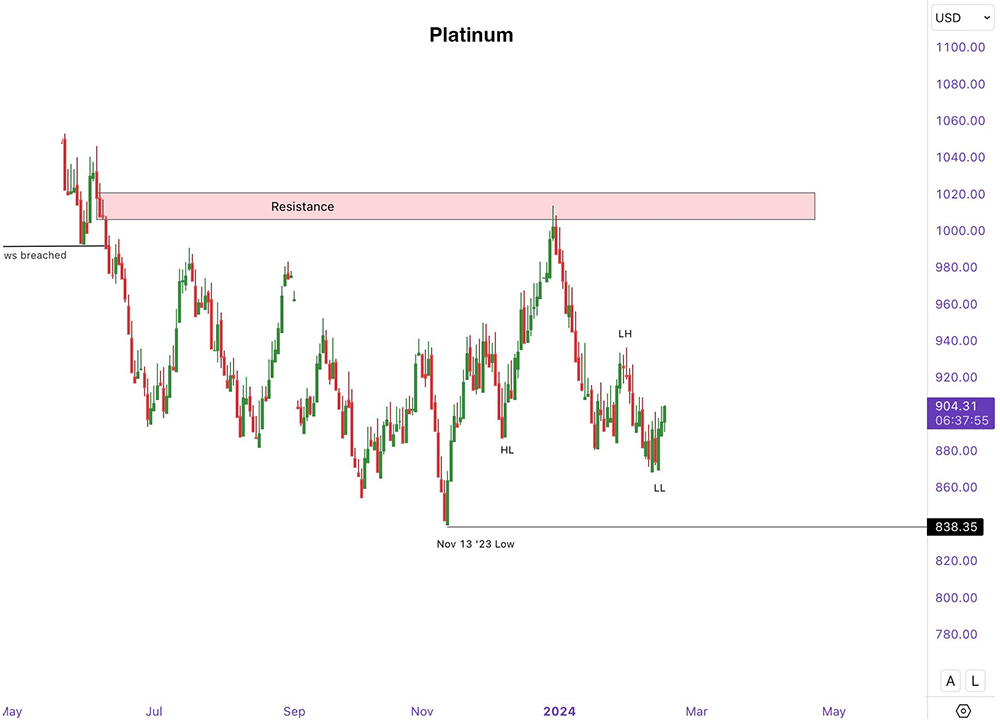

Platinum Prices Remain Within Range

Like other precious metals, platinum prices failed to breach their range, which caused prices to slump from their December highs. Since then, platinum markets have failed to create bullish patterns such as higher highs. This indicates a lack of bullish momentum within the index, which tends to cause uncertainty for future outlooks. As new lows form, platinum prices could experience a new bearish trend.

Subscribe to MetalMiner’s free Monthly Metals Index report and leverage it as a valuable resource for tracking and predicting precious metal price trends.

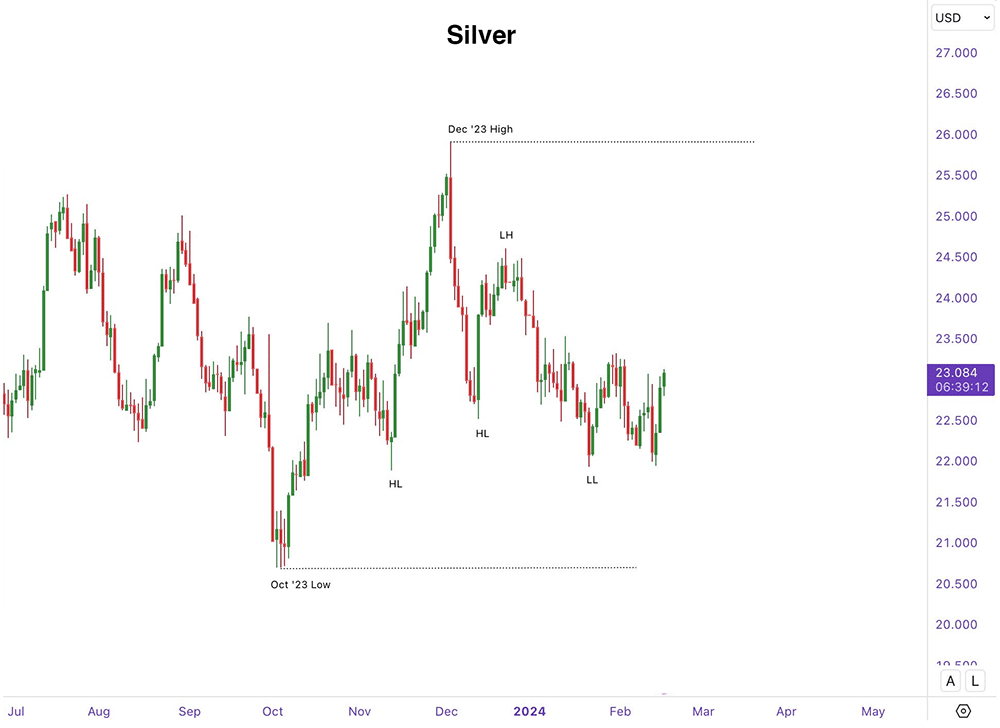

Precious Metal Prices: Silver

Silver markets experienced relatively high volatility over recent months. However, recent price action has so far failed to break out of range. This leaves the current overall trend unclear. Indeed, silver markets are yet to show any significant momentum, indicating uncertainty and a lack of long-term trend direction.

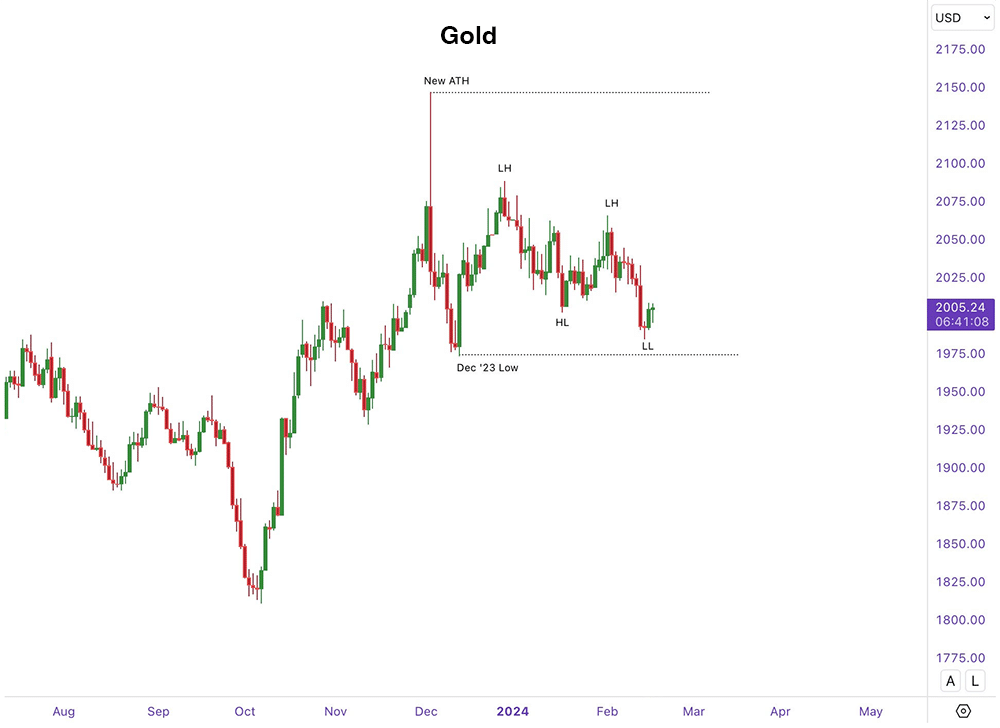

Gold Outlook Remains Uncertain

Although gold prices remained volatile throughout recent months, prices continue to stay above the $1900/oz mark. This high range only further increases volatility, as does the fact that prices show no real strength to either the bullish or bearish sides of the market.

Global Precious Metals MMI: Noteworthy Price Shifts

MetalMiner Insights equips you with the tools and insights to make calculated precious metal price forecasts, securing optimal prices and unlocking long-term savings. Learn more.

- Palladium bars declined the most month-on-month, dropping 12.25%. This left prices at $953 per ounce.

- Platinum bar prices fell 7.59%, which left prices at $913 per ounce.

- Silver ingot fell 4.29%, bringing prices to $22.76 per ounce.

- Finally, gold bullion prices moved sideways, only dropping 1.14%. This left prices at $2039.50 per ounce