Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

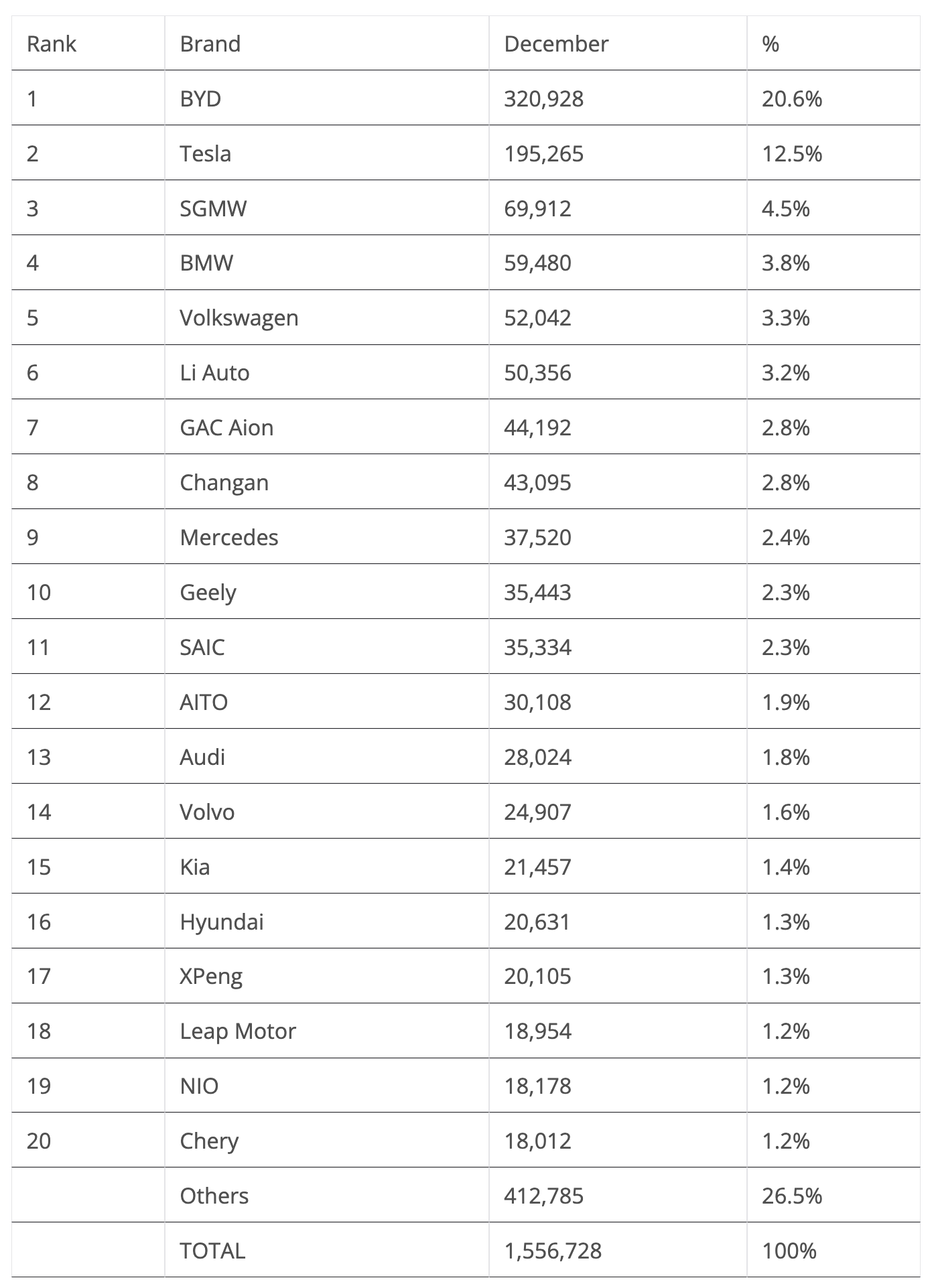

In the last stage of the 2023 race, BYD had another record month, this time with 321,000 registrations. It again beat Tesla, which had 195,265 deliveries.

Below the two galactics, the SGMW joint venture was 3rd in the last month of the year, thanks to a record 69,912 registrations. Three models (the Mini EV, Bingo, and Starlight) contributed decisively to this performance. Interestingly, all came from the Wuling side, while the more premium and less utilitarian Baojun sub-brand seems to be slowing down.

#4 BMW had a record month in December, thanks most of all to the success of its i4 fastback (11,203 registrations), but also thanks to the iX1 (8,775) and iX (7,027).

Just below #5 Volkswagen, we have a surprising performance, with Li Auto once again reaching new heights. Li Auto had a record 50,356 registrations. In the same month last year, it had 21,233 registrations. That was thanks to the success of its big, fat, Three Musketeers (L7, L8 & L9). In the end, the automaker ended December in 6th.

In #8, we have Changan scoring 43,095 registrations, its second record performance in a row, much thanks to the cutesy Lumin (12,484 units) and Deepal S7 (11,360).

In the bottom half of the table, there were a few more records, with a highlight being #11 SAIC, which scored a record 35,334 registrations. That was on the back of its star player, the MG4/Mulan, reaching record heights.

The current shooting star of the table is the #12 AITO. Thanks to the raging success of its M7 full size SUV and the introduction of the even larger M9 (think Li Auto L9), AITO has seen its sales jump lately, reaching a record 30,108 units in December. Are we witnessing a second edition of the Li Auto story? To be continued in 2024….

#13 Audi also registered a record month, thanks to 28,024 sales, which is built on the good results of the Q4 e-tron. Among legacy makes, it is interesting to see that the only ones reaching record results were of the premium variety. A sign of things to come?… Are mainstream legacy brands bound to disappear? Discuss!

Near the bottom of the table, but also with impressive results, we have #17 XPeng. Thanks to volume deliveries of its G6 midsize SUV (7,673 units in December), XPeng reached 20,105 registrations in December, almost catching #18 Hyundai, which ended just some 500 units ahead.

And finally, in #20, we have Chery. Thanks to the good results of the QQ Ice Cream (7,462 sales), Chery has managed to join the table this month.

Just outside the table, in #21, we have the best selling US legacy brand — Jeep — which is also at this moment Stellantis’ best selling brand. It got 17,723 registrations, a new record for the brand. Much of this had to do with the continued success of the Wrangler PHEV and Grand Cherokee PHEV, so expect Jeep to remain a strong candidate for some top 20 appearances in 2023.

In #22 we have Lynk & Co, with a record 17,505 sales. The 08 SUV accounted for the bulk of the sales (10,055), allowing the Chinese hipster brand to end close to the table.

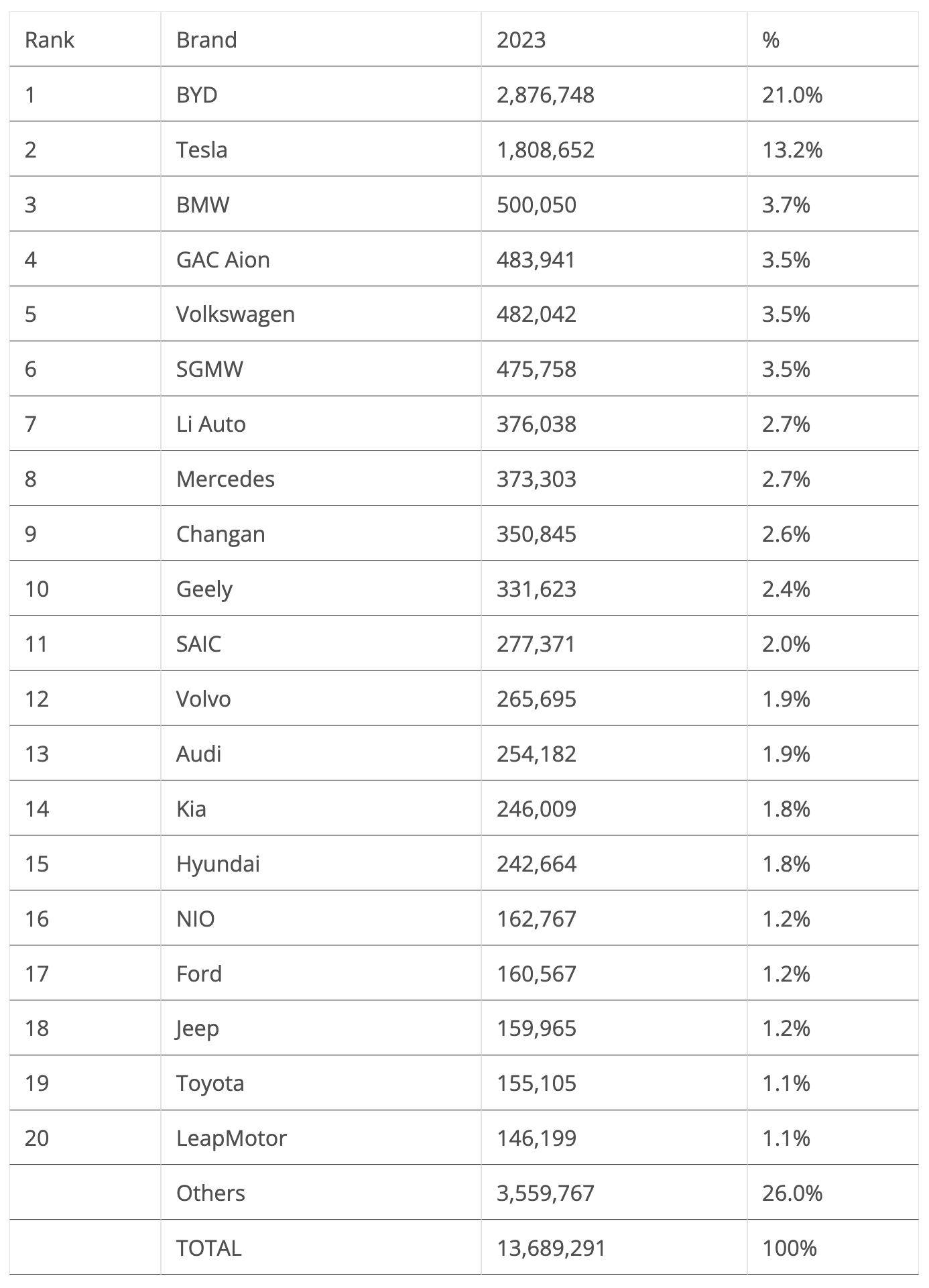

After a return to the top in 2022, BYD beat Tesla by a significant margin this time. With a 56% YoY growth rate, the Shenzhen company was the fastest growing make on the podium, thus allowing it to increase its lead to over a million units in 2023.

Still, do not expect it to grow in 2024 as fast as in 2023. BYD’s room for growth in its domestic market is small, now that it is already the best selling brand. This means the demand ceiling is already close. On the other hand, BYD is said to be betting heavily on overseas markets in 2024, with factories going online in places like Brazil and Thailand. Sales abroad are the intended path for growth for the brand. There is a chance this could work, but it is far from being a sure thing. The rate of BYD’s expansion overseas will be one of the most important stories of 2024. In 2023, the Chinese brand started to export its electric vehicles in significant volumes, like to Israel (15,000 units), Brazil (18,000), and Thailand (30,000).

On to Tesla. With its market share slowly eroding (17% in 2019, 16% in 2020, 14% in 2021, 13% in 2022 and 2023), it could possibly stabilize around 10% in the future. The US automaker will need to diversify its lineup if it ever wants to have a shot again at #1. Expect the future (2025?) platform for cheaper, compact vehicles to offer the volume and diversity needed to return to the leadership position.

Due to a slow first half of the year, SGMW lost its podium position and ended in 6th. Replacing it on the podium, we have BMW. After winning the bronze medal in 2016, BMW returned to the podium and won another bronze. It will be difficult for the German brand to keep the podium position in 2024, particularly considering the pack of fast growing Chinese brands behind it. BMW’s goal is surely not to be #1 in the overall market, but to keep the lead in the premium one.

Right below BMW, we have one of those fast growing Chinese makes. GAC’s Aion brand grew 78% in 2023, to some 484,000 units, but next year it will be difficult for it to sustain that growth rate. Exports are irrelevant (for now, at least), and so far GAC hasn’t found a way to replicate the Aion S and Y success with other models. This means that the Guangzhou make will also be within the target range of the fastest growing brand in this table, Li Auto, which took the opportunity in the last month of the year to rise yet another position, in this case to #7.

The hot startup’s performances never cease to amaze. In 2023, it jumped 11 positions in the table, having transformed itself from #19 in 2022 and the status of “just another Chinese startup” to a podium candidate for 2024. With its three current models all reaching maturity in 2024 and the upcoming launch of the Mega Cybervan next March, together with the launch if its first midsize model, the L6, sometime during 2024, expect Li Auto to end the year at some 600,000 to 700,000 units, which could (should?) allow it to reach the last place on the podium.

Speaking of startups, NIO was also one of the brands to climb in the last month of the year, benefitting from Toyota’s slow month. The Chinese make was able to end the year in #16, a five-position jump over its final standing in 2022. Having said that, with no fresh metal in 2024, it will be difficult for the startup to keep that spot, especially considering that the brand hasn’t exactly been successful in export markets…. For reference, its biggest export market was Germany, with 1,250 sales.

The other two brands to benefit from the Japanese maker’s downfall were Ford, climbing one position to #17, and Jeep, which was also up one spot, to #18. The Stellantis brand ended some 600 units behind the Dearborn company.

Actually, out of all the legacy makes in this table, Jeep was the fastest growing one, having seen its sales jump 53% compared to 2022 — to almost 160,000 units. It ended at touching distance of the best selling USA legacy make, Ford, and ended as the best selling brand from the Stellantis stable, with a 23,000 advantage over #22 Peugeot.

And Jeep’s performance in 2023, just like the one of Li Auto and AITO, helps to explain why I include PHEVs in the tally. Unlike what many BEV purists say, PHEVs do play a significant role in the EV transition, and ignoring them is like looking at a certain landscape with just one eye. Sure, you see most of it, but there are important details that you end up missing. After all, if Nissan had sold 376,000 LEAFs (Leaves?) in 2023, people would be praising Nissan as a top EV maker, right? With Li Auto’s PHEVs having a battery the size of a Nissan LEAF’s, why should we erase its 376,000 sales from the table? Just because they have an ICE engine as range extender? And what about all the EV kilometers those models traveled?

Furthermore, with the EV market now in search of new audiences, far beyond the early majority, you now need to convince those more conservative buyers. It is easier to convince them to buy a PHEV that has the safety net of an internal combustion engine, something they’ve known for decades, instead of forcing them to go full EV and experience the anxiety of something completely new, which can leave them feeling uncomfortable.

And you know what? For many, if taking out the PHEV option and forcing them to choose between ICE and BEV, they would rather keep going ICE than going BEV.

(Now you can start burning the torches and shout: “Go BEV or go home!”, “Stop ICE!”, etc., etc…)

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica TV Video

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

CleanTechnica uses affiliate links. See our policy here.