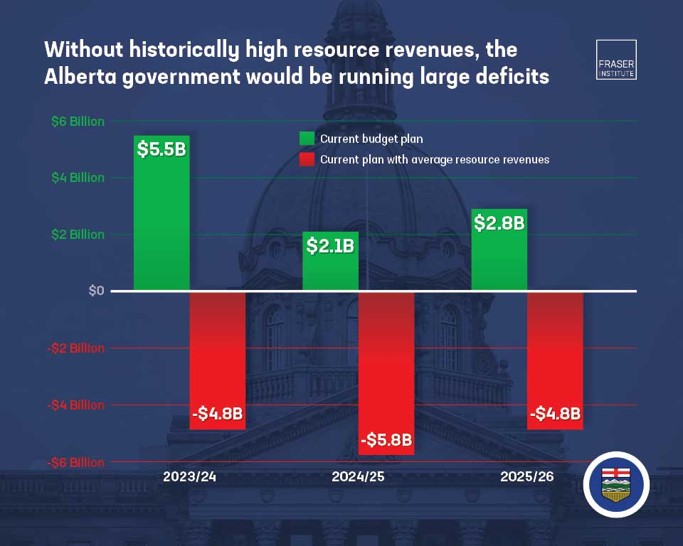

- The Alberta government projects a $5.5 billion budget surplus in 2023/24, fuelled by historically high resource revenue. However, Alberta’s surplus could quickly spiral into a deficit when resource revenue declines.

- This fiscal risk is the result of a familiar pattern. During periods of relatively high resource revenue the provincial government increases spending, but does not commensurately reduce spending when that revenue declines. This leads to a structural problem wherein ongoing government spending exceeds stable and ongoing levels of provincial government revenue.

- To better understand the risk Alberta currently faces, this research bulletin estimates the province’s budgetary balance if the government were to rely on stable ongoing levels of revenue for the budget, namely stable resource revenue. This bulletin does this by calculating Alberta’s budgetary balance from 2023/24 to 2025/26 if resource revenue sat at the average of the last two decades ($9.3 billion) in 2023/24 and was inflation-adjusted each year after.

- In this scenario, Alberta’s $5.5 billion projected budget surplus turns to a $4.8 billion deficit in 2023/24. In 2024/25, Alberta’s projected budget surplus ($2.1 billion) turns to a $5.8 billion deficit, and in 2025/26, Alberta’s projected budget surplus ($2.8 billion) turns to a $4.8 billion deficit. Moreover, Alberta would accumulate an additional $25.9 billion in net debt by 2025/26. In other words, provincial net debt in real ($2023) terms would be $12,166 per Albertan, compared to $7,166 per Albertan under the provincial government’s projections—an increase of 69.8 percent.

- To avoid deficits and debt accumulation, the provincial government must more closely align spending to ongoing, stable levels of revenue.

Authors:

Associate Director, Alberta Policy, Fraser Institute

Director, Addington Centre for Measurement, Fraser Institute

More from this study

Share This: