Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Plugin sales continued to grow in December, even reaching a new record, 54,413 units. That’s mostly thanks to BEVs. In December, their sales were up an amazing 50% year over year (YoY), to a record 37,355 units. Though, PHEVs also contributed to the party, by growing some 17% YoY (17,056 registrations). That allowed BEVs to have 69% share among plugin vehicles in December, increasing the current BEV-friendly trend. Year to date (YTD), pure electrics ended with 65% share, a 3% increase over the 62% share of 2022. With a new wave of small, affordable BEVs landing in 2024, expect this trend to continue throughout the year, with BEVs possibly ending 2024 at over 70% of all plugin sales.

So, the good news is that December saw 30% plugin share (21% for BEVs alone), and 2023 ended at 26% (17% BEV), a 4 percentage point improvement over the 22% plugin share (13% BEV) of 2022. Interestingly, 4 percentage points was also the share increase from 2022 over the 2021 result of 18% (10% BEV). This growth rate may seem low — if the plugin share continues to grow at this pace, the 2035 ICE ban will be in danger — but the truth is that the French market in 2024 should grow much faster, possibly to the tune of 2020 (it jumped from 3% in 2019 to 11% in 2020) or 2021 (when it jumped from 11% to 18%).

A jump to 33–35% share seems feasible in 2024, but it will depend on a number of factors, especially how fast local OEMs will ramp up their upcoming affordable EVs, like the Citroen e-C3 EV and the Renault 5. It will also depend on policies — if both the regular EV incentive and the new electric leasing scheme will remain until the end of the year. If these policies remain strong, then we should see a significant increase in EV adoption.

Interestingly, current market disruption is also benefiting plug-less hybrids (HEVs), as they were up this year from 22% to 24% market share. All in all, 2023 ended with 50% of all auto sales coming from electrified models, up from 44% in 2022. That’s an important progression, meaning that electrified models became the majority of the overall market in 2023. Meanwhile, 100% diesel-powered vehicles lost 6% share in the last 12 months, to just 10% at the end of 2023. A couple more years, and diesel will be saying adieu to the new car market in France….

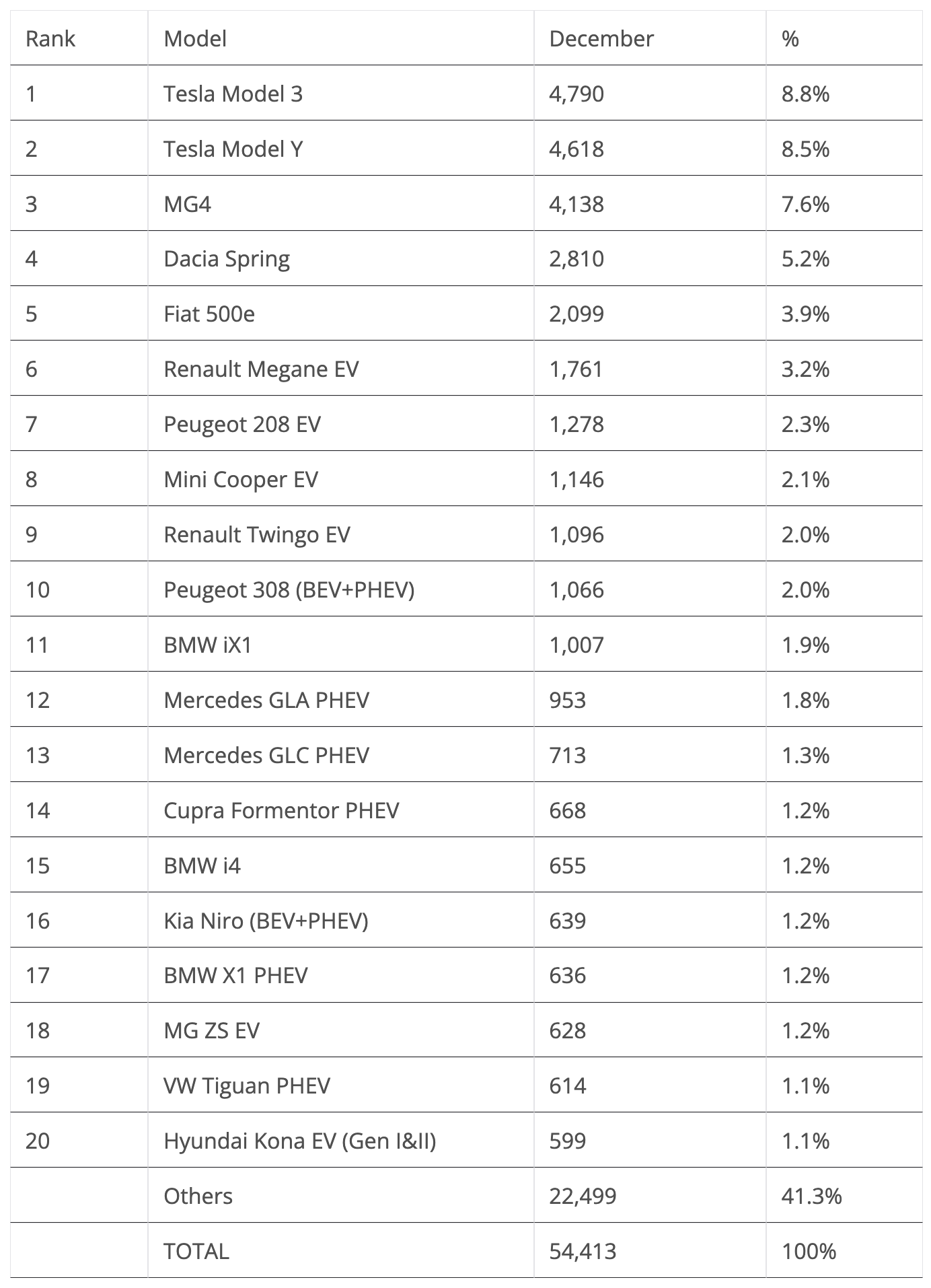

Looking at December’s best sellers, the expectation was that there was going to be a rush of China-made EVs in the last month of the year, as, starting on January 1st, 2024, they would no longer be eligible for the EV incentive.

And that expectation had mostly materialized, with the Tesla Model 3 beating the competition and winning the December best seller trophy. With 4,790 registrations, the Model 3 ended the month in 4th overall. The also China-made MG4 ended in 3rd, with a record 4,138 registrations, putting it in 6th overall.

The main surprise was finding the China-made Dacia Spring off the podium, in 4th, with a rather meh performance of 2,810 registrations. The benefactor of this rather average performance from the Sino-Romanian EV was the Tesla Model Y, which ended the month with a strong 4,618 registrations, allowing it to end in 2nd among plugins (making another #1 plus #2 win for Tesla in December). The Model Y was 5th in the overall auto market.

Off the podium, the highlight was BMW Group, with four record performances on the table, starting with the veteran Mini Cooper EV, which is preparing itself for retirement in grand style. The Mini Cooper EV scored a record 1,146 registrations in December. With the new generation coming from China, and therefore losing access to subsidies, maybe buyers preferred to save a few thousand euros by buying the old model instead of waiting for the new generation?

Still in the Mini stable, the also runout mode Countryman PHEV had a positive month, thanks to a year-best score of 457 registrations. As for the mothership, BMW, three models hit record scores, and while both the twin #11 iX1 (1,007 registrations) and #17 X1 PHEV (636 registrations) records weren’t that surprising (after all, they are still ramping up production), the 15th placed BMW i4, with a record 655 registrations, was unexpected. The midsize BMW so far was having a discreet career in France. With the liftback EV experiencing record results in a number of markets recently, it does seem that BMW has found a way to spike demand for its midsize EV. That or they just bought more batteries…. Whatever it is, and I do not say this frequently, kudos BMW, for being one of the good surprises of late 2023.

Elsewhere, the Renault Twingo EV was #9 in December, with 1,096 registrations, its best score in over a year. The #10 Peugeot 308 had a somewhat average score of 1,066 units, but the good news is that the BEV version finally reached three digits, with 108 registrations in December.

On the PHEV side, last month’s best seller was the #12 Mercedes GLA PHEV, with a record 953 registrations, followed by its sibling the #13 Mercedes GLC PHEV, while the #14 Cupra Formentor PHEV completed the podium with 668 registrations, a new record for the Spanish crossover. In fact, that was more registrations that it had collected during the whole year of 2022…. Cupra is rising across Europe, and France is no exception. (Note: the fully electric Cupra Born hot hatch registered 404 units, in what was another positive result for Cupra).

Still on the top 20 table, a mention is due for the delivery ramp-up of the new Hyundai Kona EV, 20th with 599 registrations. Keep a close eye on this model, as this could be one of the winners of 2024 thanks the new subsidies rules (since it is made in Nosovice, Czech Republic, unlike some of its competitors, it will not lose access to subsidies).

Off the table, and highlighting the growth of BMW, the BMW X3 PHEV scored 497 sales in December, its best result in 19 months, while the larger X5 PHEV had 472 sales, its best score in three years.

The Volkswagen brand had a positive month, with both the ID.3 and ID.4 hitting year-best performances, with 466 and 532 sales, respectively, and even the VW Golf PHEV helped the tally, with 378 sales, its best result since March 2021. (Stock clearance?) Meanwhile, another MG benefitted from the year-end subsidies rush, as the HS PHEV scored 517 deliveries, the SUV’s best result since November 2021.

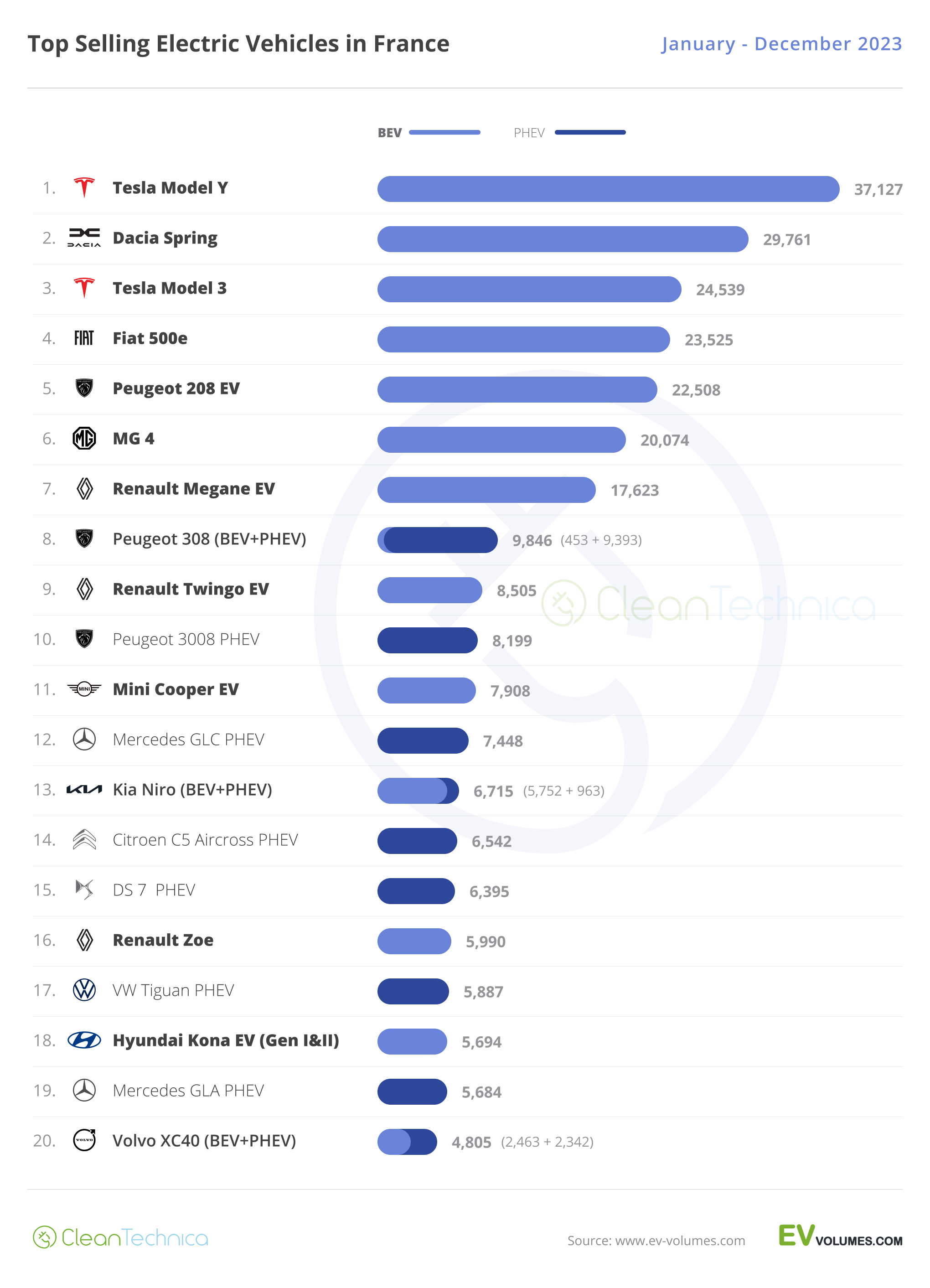

Looking at the 2023 ranking, following the Tesla Model 3 breaking the Renault Zoe’s long winning streak in 2021 and then the Peugeot e-208’s 2022 best seller title, 2023 crowned the Tesla Model Y as the best selling EV in France — a first for the crossover. At the same time, the 37,000-plus units allowed it to be #8 in the overall ranking and gave it the title of best selling midsize model in the overall ranking, ahead of the runner-up … Tesla Model 3. Yep, the two best selling midsize models in France, all powertrains included, were two Teslas. So, it’s disruption, you say?

Congrats to the winner, and it should remain the main candidate for the 2024 title. With the Made-in-China (and 2023 bronze medalist) Tesla Model 3 losing access to subsidies, its sales will probably drop, to the benefit of its Made-in-Germany sibling, the Model Y, so I can see the crossover reach some 40,000–45,000 sales in 2024.

And what about the other candidates for the 2024 title? Regarding the existing models, there’s the runner-up Dacia Spring (2nd silver medal in a row). It is expected that a deeply refreshed Spring will debut in the second half of the year, with the crucial factor that production will likely be transferred to Novo Mesto, Slovenia. That will probably push sales to record levels. However, the expected low results in the first half of this year (old version, no subsidies) will prevent the model from increasing significantly on its current 30,000 units a year score.

The recently refreshed Peugeot e-208, 5th in 2023, will also not be a strong contender for the 2024 title, as part of its demand will be stolen by the fresher and cheaper models that will land in 2024.

And here is where things get interesting. Stellantis, and Citroen in particular, is betting heavily on its new e-C3 supermini (subcompact). With a 44 kWh LFP battery, 100 kW charging, and a price starting at less than 24,000 euros, this is a model that should reach 30,000 units in 2024 … if the production ramp up goes smoothly, something that is not a given. With the first units set to land in April, by June we should already have an idea of how much of a contender this model will be. Also by that time, Renault is hoping that France will be under a Renault 5 fever, with ‘70s retro-tastic hatchback marketing probably showing up everywhere in The Hexagon. But with deliveries said to only start during the second half of 2024, do not expect it to be podium material for this year.

In 2025, however … if all goes well, the Renault 5 will be the best selling EV and, dare I say it, will also be podium material for the overall ranking!

Back to the 2023 ranking, the bronze medal went to the Tesla Model 3, which went up two spots compared to November, profiting from a slow month from the Peugeot e-208. The Fiat 500e also profited from the e-208’s slow month, pushing the French hatchback down to 5th.

The Renault Twingo EV ended the year on the way up, climbing one position to #9, while the Kia Niro was also up one spot, in this case to #13. With the Niro EV said to lose access to subsidies in 2024, expect the Korean crossover to disappear from France’s table.

We should also mention the VW ID.3, which ended the year at #21, with 4,791 sales. That’s a disappointing position for the model, especially considering that last year it ended in 18th place, in 2021 it was 12th, and in 2020 it was 9th!

Looking by size categories, the city car category saw the Dacia Spring win the race again, beating the runner-up Fiat 500e by some 6,000 units. It was also interesting to realize that, with the Renault Twingo EV in 9th, we have three city EVs in the top 10. And what do you know — city EVs do sell in Europe!

Looking at the 2023 best selling full size model, the honor went again to the BMW X5 PHEV. With 3,032 deliveries, it beat the Mercedes GLE PHEV (1,967 units) by a significant margin. The category’s best selling BEV was once again the Audi Q8 e-tron — with its highest score ever (872 units vs. 804 units in 2020).

In the remaining categories, the Peugeot e-208 once again comfortably beat the competition, and the Mini Cooper EV beat the Renault Zoe(!) for the runner-up spot. The Renault Megane EV lost the compact category title to the MG4(!) and has seen its rival, the Peugeot 308, getting closer. In the midsize category, it was a Tesla fest, with the US automaker taking 1st and 2nd place (the Model Y won the upper hand).

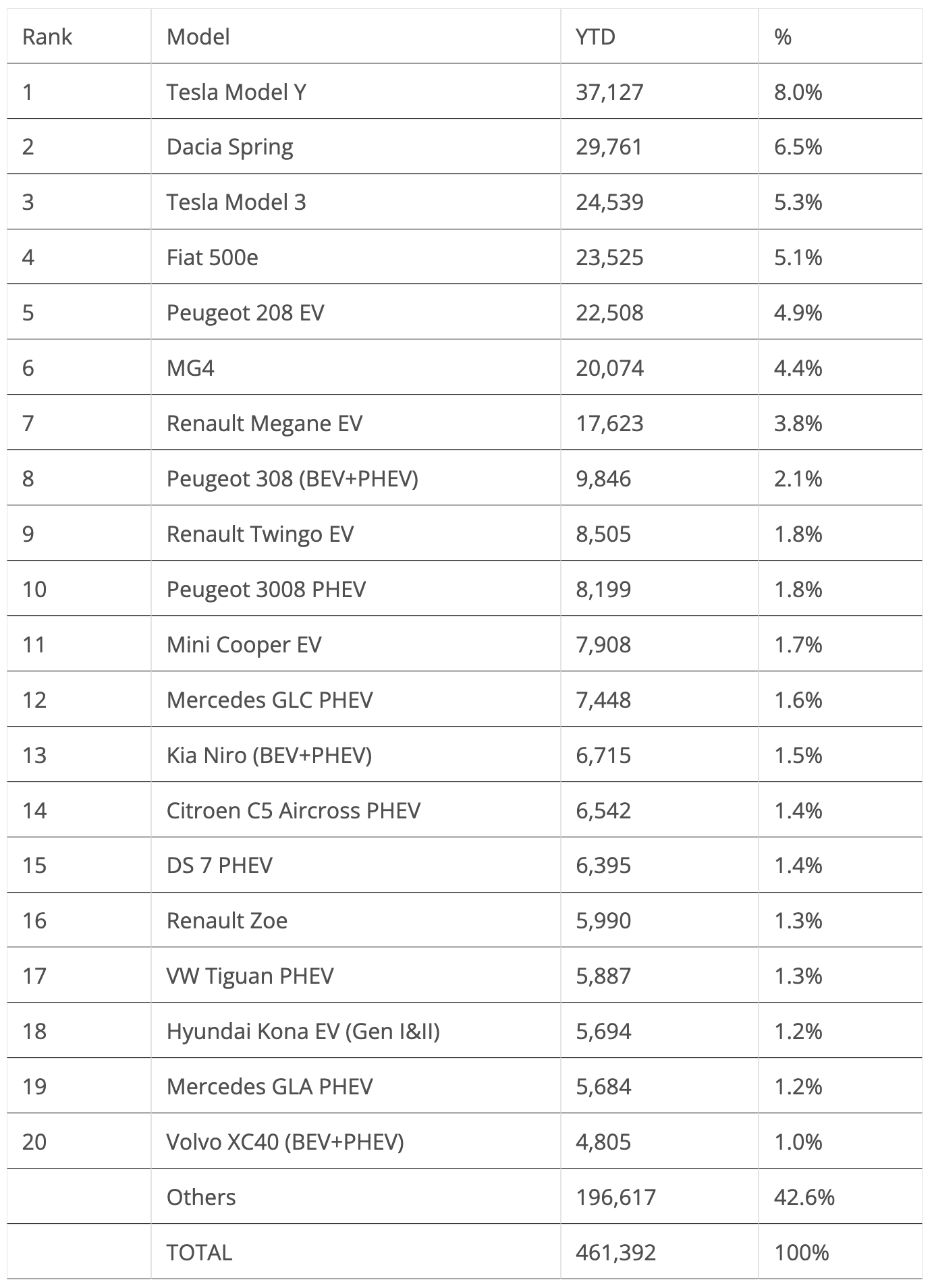

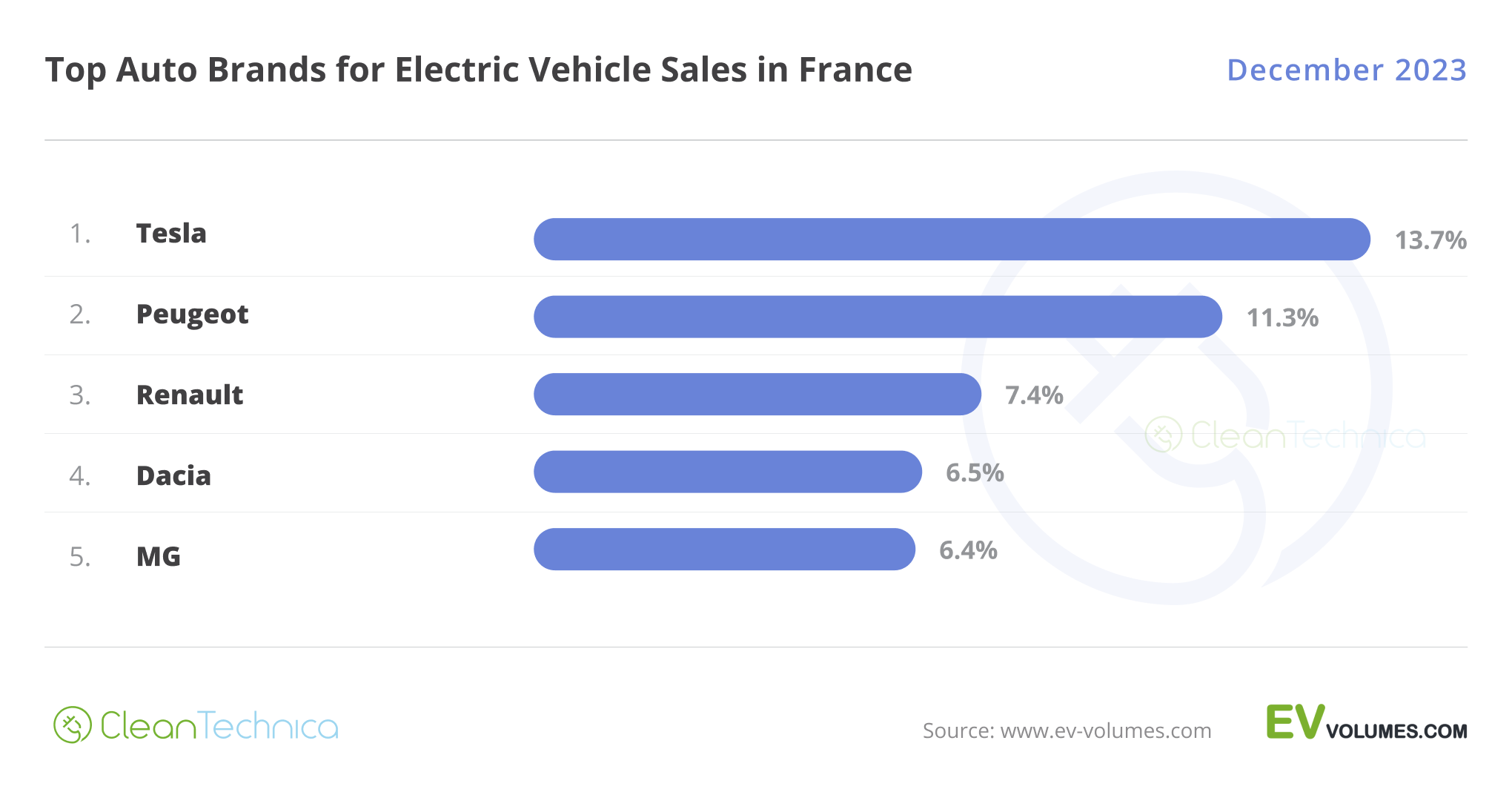

Looking at the brand ranking, disruption has also drawn blood. Tesla (13.7%, up from 13.1%) won the 2023 title, which is a historical moment, as it is the first time a foreign brand earned the trophy in France!

This left Peugeot (11.3%, down from 11.9%) the silver medal after earning the title in the previous year. Blame it on their weak end of the year, which in turn coincided with a stronger than usual Q4 from Tesla.

Renault (7.4%) was the 2023 bronze medalist, followed by #4 Dacia (6.5%) and …#5 MG (6.4%)!

Below the top 5, a reference is due for a rising BMW (5.6%, up from 5.4%), which surpassed Fiat in December and ended in 6th. With MG losing access to subsidies, expect BMW to return to the top 5 in 2024.

Looking at sales by OEM, Stellantis had a horrible December (25.7%, down from 27%), but it was still the kingpin thanks to a strong, and long, lineup. It was followed by Renault–Nissan–Mitsubishi (14.4%) and then Tesla in 3rd (13.7%).

Off the podium, we have Volkswagen Group (11.7%) and then BMW Group (8.1%).

With Tesla probably losing some share in 2024, due to the expected sales drop of the Model 3, Volkswagen Group will have the opportunity to recover the bronze medal in the French EV market, but the 2nd spot of the Alliance will likely be off-limits, as Renault will probably have sales rebound significantly in 2024, pushing the Franco-Japanese OEM market share upwards.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica TV Video

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

CleanTechnica uses affiliate links. See our policy here.