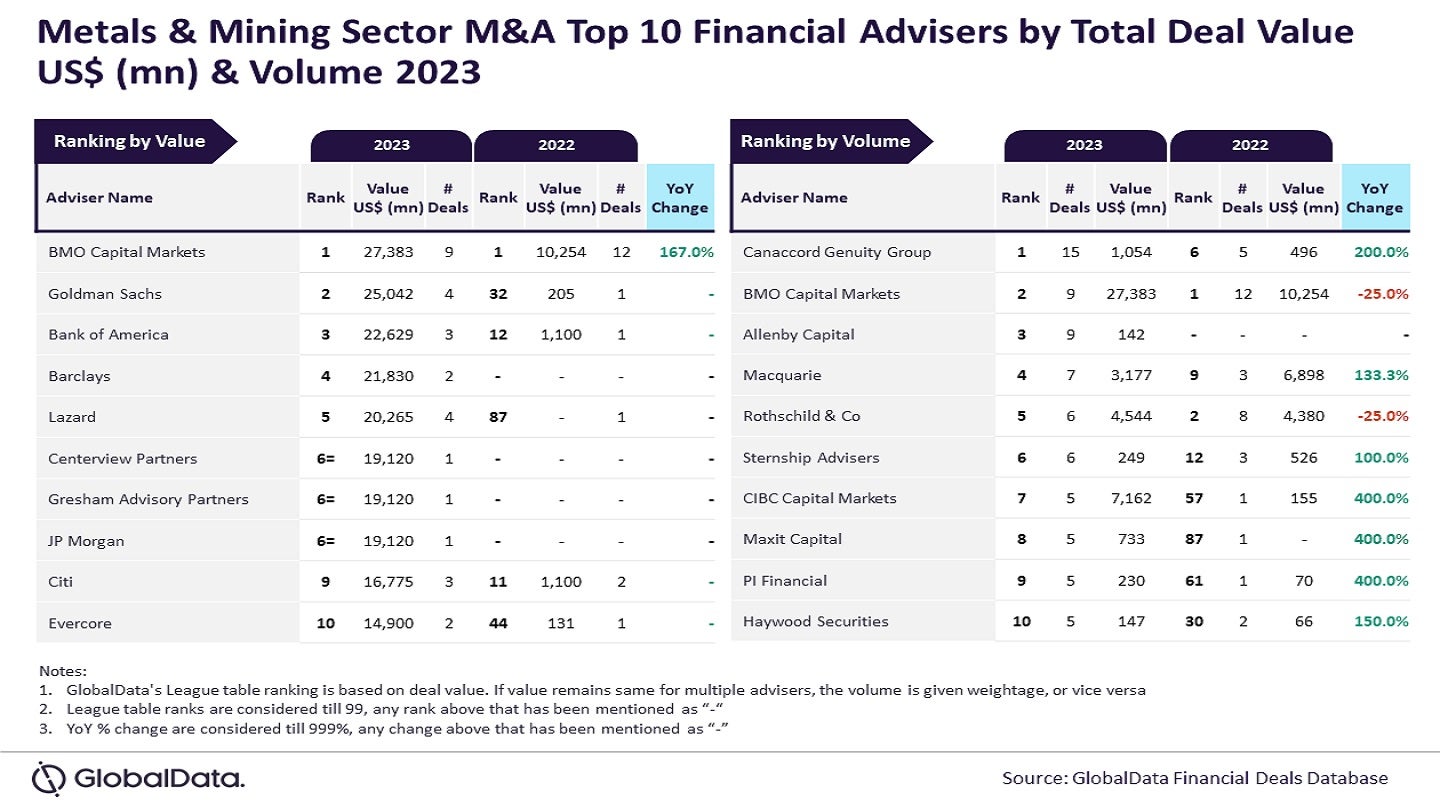

BMO Capital Markets and Canaccord Genuity Group have emerged as the leading financial advisers for mergers and acquisitions (M&A) in the metals and mining sector in 2023 by deal value and volume, respectively, according to GlobalData’s latest financial advisers league table.

An analysis of the data and analytics company’s Deals Database reveals that BMO Capital Markets advised on transactions worth $27.4bn, positioning it at the forefront of significant industry consolidations.

Canaccord Genuity Group advised on 15 deals throughout the year, leading the sector in terms of deal volume.

BMO Capital Markets secured second place by deal volume with nine transactions, while Allenby Capital matched this volume with nine deals of its own.

Macquarie followed closely with seven deals and Rothschild & Co with six.

In terms of deal value, Goldman Sachs took second spot, advising on deals amounting to $25bn.

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Your download email will arrive shortly

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Bank of America was not far behind with advisory deals totalling $22.6bn. Barclays and Lazard also featured prominently, advising on deals worth $21.8bn and $20.3bn, respectively.

GlobalData lead analyst Aurojyoti Bose said: “Canaccord Genuity Group registered significant growth in the volume of deals advised and ranking by this metric in 2023 compared with the previous year.

“In fact, it was the only adviser to hit the double-digit deal volume in 2023.

“Meanwhile, BMO Capital Markets was the top adviser by value in 2022 and managed to retain its leadership position in 2023 as well. The total value of deals advised by it jumped by more than double-fold in 2023 compared with 2022. Apart from leading by value, BMO Capital Markets also occupied the second position by volume during the year.”

Sign up for our daily news round-up!

Give your business an edge with our leading industry insights.