Get the latest from Chris Varcoe, Calgary Herald straight to your inboxSign Up

Author of the article:

Chris Varcoe • Calgary Herald

It’s gone through more peaks and valleys than the terrain it is traversing, but the Trans Mountain expansion project is now 98 per cent complete and targeting to begin operating in the coming weeks.

“Upon mechanical completion of the expansion project, we have several regulatory steps . . . and then we will begin line-fill and then in-service,” officials with the federal Crown corporation that owns the pipeline said in a statement.

“We are working toward our in-service date planned for the near end of (the first quarter) 2024.”

While it’s not a guarantee of timing, it’s a strong signal the project is advancing and could be operating in a matter of weeks or months — not years.

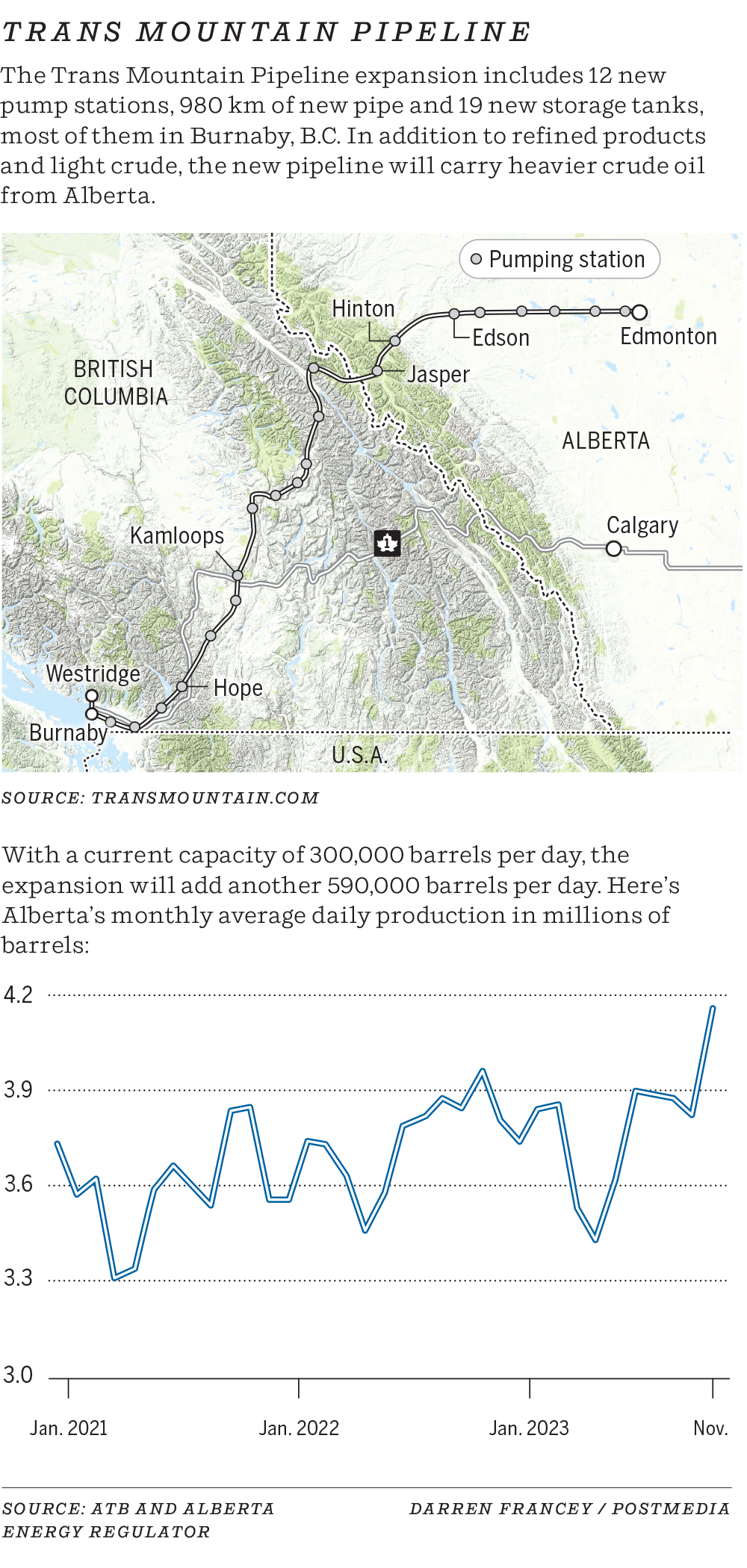

After construction wraps up, the line will be filled with about 4.5 million barrels of oil. The project will move crude and refined products from the Edmonton area to a terminal in Burnaby, B.C.

“It’s great for the people of Alberta that own the resource in the ground,” Alberta Energy Minister Brian Jean said Monday.

“We will have the opportunity of saying to the world, ‘See, we can do this.’ We can build capacity to tidewater, and we can feed the insatiable thirst of Asia and other areas of the globe with our products, our natural resources.”

The 1,150-kilometre project will almost triple the existing capacity of the pipeline, with TMX moving 890,000 barrels per day to the Pacific coast for export.

Completing the expansion has been viewed as essential to getting more Canadian oil to export markets, after years of pipeline bottlenecks in the region.

Experts say the federally owned project will help reduce the discount on western Canadian oil, opening up new export markets for producers — potentially to customers in Asia — and allowing the sector to continue growing output.

Critics have assailed its rising costs for a taxpayer-owned entity.

Earlier this month, the Canada Energy Regulator gave Trans Mountain Corp. approval for a variance application, allowing it to install a smaller 30-inch pipe in the final 2.3-kilometre segment in B.C., instead of the initially planned 36-inch pipe, as it faced construction challenges.

If the project had been sidetracked further, Trans Mountain Corp. had warned a long interruption could lead to about $200 million a month in delayed revenues and $190 million in carrying charges.

“The decision is a huge relief, not only for TMX . . . but also producers and shippers on the pipeline, who desperately need incremental takeaway out of the basin,” said a note last week from analysts at Tudor, Pickering, Holt & Co.

In November, Alberta oil production exceeded 4.1 million barrels per day, up 4.9 per cent — or more than 300,000 barrels — from the previous month’s level and reaching a new high.Analysts say the project will narrow the price differential between benchmark U.S. crude and Western Canadian Select heavy oil, which recently hovered around US$19 a barrel.Rob Broen, CEO of oilsands producer Athabasca Oil Corp., said the additional transportation capacity will help oil producers in Western Canada.

Analysts say the project will narrow the price differential between benchmark U.S. crude and Western Canadian Select heavy oil, which recently hovered around US$19 a barrel.

Rob Broen, CEO of oilsands producer Athabasca Oil Corp., said the additional transportation capacity will help oil producers in Western Canada.

Once the expanded line is operating, it’s assumed oil-price differentials will narrow into the $12 to $13 a barrel range, which is essentially the cost of transporting the product to the U.S. Gulf Coast, he said.

“It’s a long time coming. It is really good for Canadian producers. Obviously, we don’t want to be constrained by egress,” Broen said Monday.

“Honestly, it will be hundreds of thousands of barrels contracted that access world markets through a location other than the United States . . . Overall, it’s really good for differentials in Western Canada.”

Athabasca Oil Corp. CEO Rob Broen was photographed on April 24, 2015. Colleen De Neve/Postmedia

Athabasca hasn’t committed to move oil on Trans Mountain, but more transportation capacity out of the oilsands region should open up capacity and demand for its production through other pipelines.

Similarly, Cenovus Energy, one of the country’s largest oilsands producers and a shipper on Trans Mountain, welcomed the project increasing access to additional markets.

“Completing the Trans Mountain expansion project will benefit all Canadians by opening up global markets and allowing us to capture higher global pricing,” the company said in a statement.

But it has taken a herculean effort, a decade of planning and more than $30 billion to get to this point.

The initial regulatory application for the project was made in 2013. Since then, the price tag has jumped to $30.9 billion (announced last March), up from $5.4 billion.

The project has faced opposition from environmental critics and the B.C. government of former premier John Horgan.

In 2018, the federal government bought the pipeline from Kinder Morgan Canada for $4.4 billion.

Analyst Jeremy McCrea of Raymond James called the regulator’s decision encouraging for the western Canadian oil sector after years of delay on the project.

“There is going to be a sigh of relief once it is on,” McCrea said.

“If it comes on at the end of March, I think that’s a win. If it gets delayed by one to two months, that is notionally where everyone has hedged their opinion. But if it takes longer than that, it could start to frustrate.”

The extended timeline and cost also underscore how complex this project has been to finish.

Jean hopes that lower oil-price differentials and additional pipeline capacity encourage future oilsands investment in growth projects, but says it’s also important that Canada streamline its regulatory process for new energy infrastructure in the future.

“This particular project has seen a huge number of obstacles and a huge cost overrun,” he said.

“I’m hoping that the federal government has learned its lesson on this.”

Chris Varcoe is a Calgary Herald columnist.

Share This: