Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

The Rocky Mountain Institute is a respected organization that has done great work since its founding in 1982. Amory Lovins, its founder and long its leader, is a tremendous thought leader who was ahead of his time. He’s been proven right on many things. And he’s been proven wrong on a couple.

In 2003 he was strongly supportive of hydrogen as the next major carrier of energy and fuel cell cars as a clear winning solution. For his proposed ultra-efficient Hypercar, he made it clear that in the medium to long-term, hydrogen was the best choice. The complete failure of hydrogen fuel cell vehicles and the continued failure of hydrogen for energy plays have proven Lovins wrong in this case. He missed, as many did at the time, the radical improvements in battery energy density and plummeting costs per kWh of capacity. His hybrid drive train didn’t even have a battery, just a fueled generator to power electric motors.

Tesla, founded in the same year, got it right. They realized that trying to get people to buy hair-shirt cars wasn’t going to work because of human nature, and that the battery energy density curves were clearly favoring purely electric cars. They built cars people wanted to own and drive and forced the automotive and now the trucking industry to electrify more rapidly than they would have otherwise. They proved with the release of the Model S in 2012, only nine years later, that pure battery electric was the right pathway.

Is this to besmirch Lovins? No, of course not. He got a lot more right in his long career as an energy thought leader than he got wrong. His soft vs hard energy paths influences my thinking to this day, albeit like Jane Jacobs’ work on urbanization with significant nuances and alternative solutions that achieve similar value propositions.

Lovins is no longer involved with the day to day or even the governance of RMI, and hasn’t been for long enough that the current RMI strategy cannot be laid at his feet. I hope that Lovins, given his great ability to accept reality and see it clearly, wouldn’t be supportive of much of what RMI is now saying on the subject. But it’s possible he would. To be transparent, I never had the privilege of working with Lovins, something many people I know have, so outside of his published works, I can’t really comment on his positions or personality.

A note on this discussion. RMI is doing a lot of apparently good work and I fully support most of its initiatives, from what I understand of them. This is not a blanket critique. My concerns are solely with their hydrogen and related carbon capture efforts.

Cognitive traps of hydrogen for energy

As I’ve noted over the past weeks, many organizations and well-qualified, thoughtful, caring people who should know better have fallen into one of several cognitive traps around hydrogen for energy. The International Council on Clean Transportation realized five years ago that green hydrogen would be very expensive, and then accepted future burnable fuel demand requirement projections that don’t stand up to scrutiny. That led them to the belief, commonly held, that biomass couldn’t possibly meet requirements. That led them to try to find ways to square the circle that hydrogen can be green but it can’t be cheap. This has impacted very negatively the quality of their trucking, aviation and maritime shipping research and publications as a result, with several glaring errors and quality issues, and they have a lot of credibility to regain.

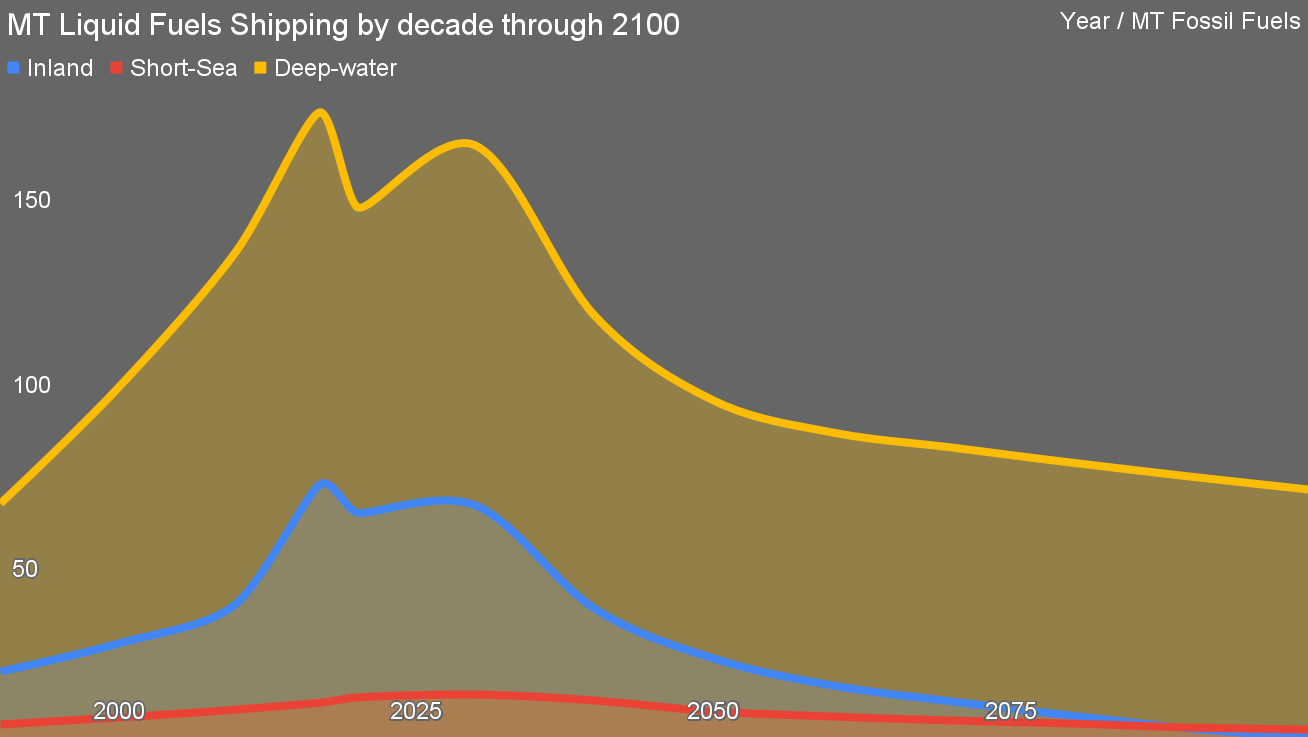

The International Maritime Organization accepted a vast growth of maritime shipping tonnages projection from researchers with no maritime industry depth because it met their cognitive biases that shipping would continue to expand, especially bulks. However, 40% of bulks are fossil fuels today and that’s going away. Another 15% is raw iron ore, and that will be processed closer to mines. And low-carbon shipping fuels will be more expensive, changing demand projections downward again. These are things the original researchers several years ago just didn’t know or think through as they were generalists who didn’t get specific enough. But it aligned with the IMO’s predispositions to believe them.

The Science Based Targets Initiative, which does great work and should be applauded for it, accepted the IMO’s blessed projections, leading to bad choices and guidance on their part.

Meanwhile, in Germany a major industry, academic and governmental working group series started with the assumption that there would be retail hydrogen gas pipelines everywhere, so truck stops would get it as cheaply as it is possible to get. That was based on the flawed assumption that hydrogen would replace natural gas for commercial and residential heating, which 54 independent studies and counting have put a stake in. Even then, battery electric won out in the working group specifically tasked with trucking, but not in the working group tasked with synthetic fuels which was dominated by engine manufacturers who would go out of business if reality intruded.

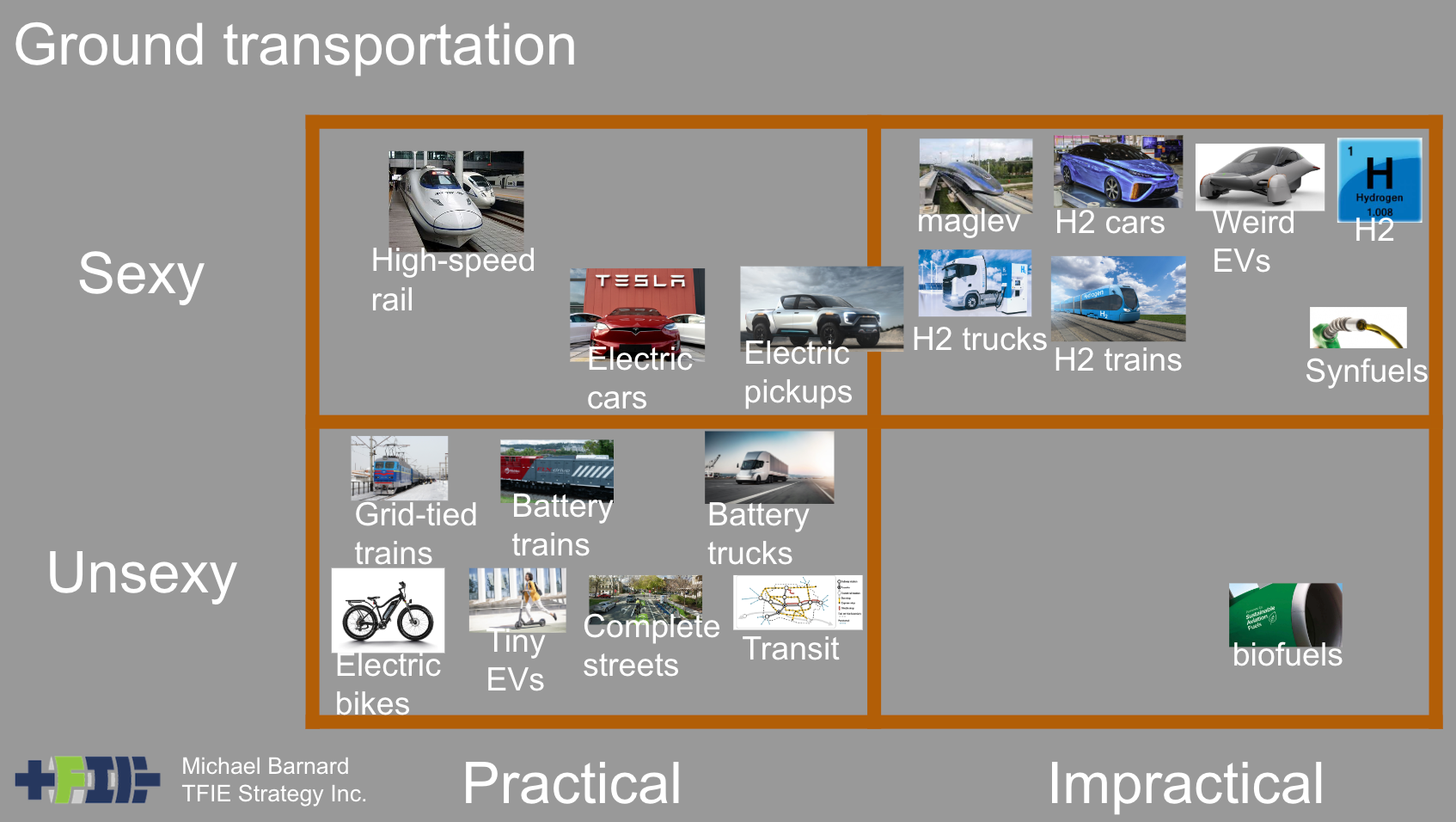

Hydrogen for energy is not even a plurality

And what is reality? All ground transportation will electrify, including cars, light trucks, buses, trains, farm equipment, mining equipment and construction equipment. It’s already starting in all of those segments, with only North America lagging on rail electrification. When mining giants Rio Tinto, BHP and Fortescue call the coin toss for battery electric mining equipment in electrified mines with no hydrogen, the heavy duty ground question is settled.

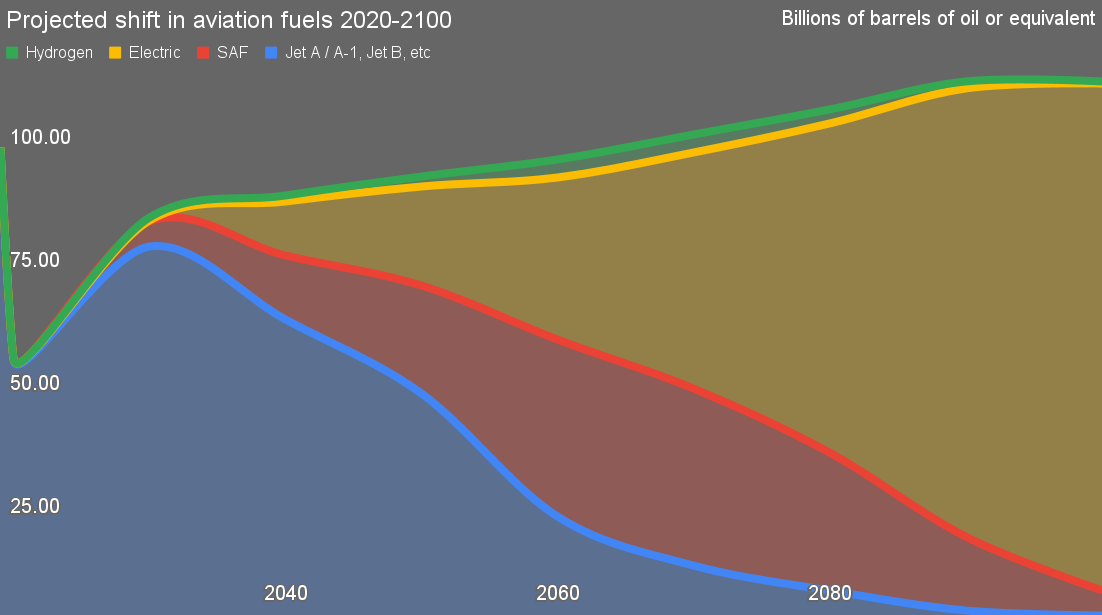

All inland shipping will electrify. Most short sea shipping will electrify. Transoceanic shipping tonnage will drop as noted, will continue to apply efficiency measures and will still require burnable fuels, just vastly lower amounts. Most flights within continents will electrify. Aviation growth will not be 4% CAGR as IATA and Boeing would love to believe. Higher low-carbon fuel costs, flat flight demand in the west, declining population growth with a likely peak between 2050 and 2070, slower growth of affluence in the developing world than experienced in China for the past 40 years, and massive diversion of potential aviation miles to high speed rail means projections of massive growth are simply wrong. Maritime shipping energy demand falls, aviation demand rises, but very slowly.

All commercial and residential heat electrifies. The vast majority of industrial heat electrifies too. Steel shifts to scrap, electrically powered EAF furnaces, electric process heat and biomethane for direct reduction of iron (DRI) and electric process heat, green electricity and green hydrogen for new steel. That last is the only potential growth area for green hydrogen, and it’s not guaranteed.

Vastly more energy is generated regionally with renewables with vastly lower requirements for importing energy, and the imported energy will be much more with two-way HVDC transmission which allows peak demand in one geography to be met in part by excess generation in another, switching back and forth up to four times a day. Electrification of energy services with renewables providing the electricity more than halves primary energy requirements for the same economic outputs and comforts, as I showed with my US workup against LLNL energy flows and many others have demonstrated much more rigorously.

While the UN’s Global Energy Interconnection Development and Cooperation Organization (GEIDCO), driven by China, with Premier Xi headlining its launch and led by China’s head of electricity grid is barely known in North America or Europe, it has 141 member countries which overlap heavily with China’s Belt & Road Initiative. This is all very much in line with Lovins’ soft energy pathways, by the way. Lots of renewables all over the place, much more efficient electrified economy and transmitting much lower amounts of energy as electrons between regions.

Energy storage is met mostly by pumped hydro, redox-flow batteries and cell-based batteries. As a data point on this, China already has about 50 GW of power capacity of pumped hydro in operation representing 500 to 1,000 GWh of energy capacity. It is building or has firm plans to build 365 GW of additional power capacity of pumped hydro with potentially 4 to 8 TWh of energy storage. As the Australia National University’s pumped hydro global atlas makes clear, there is 100 times the resource capacity as the energy storage requirement in paired, closed-loop, off river sites with 400 meter or higher head heights that are close to transmission and not on protected lands. Only end game occasional seasonal lulls —the 10 year UK dunkelflaute per Sir Chris Llewellyn Smith’s modeling — require strategic energy reserves beyond this, and that’s a very different requirement than the 99% case.

In this world, the world that is actually emerging, the demand for burnable fuels is restricted to very specific use cases: long haul aviation, long haul maritime shipping and some edge cases in chemical processing. Biomass requirements for those uses cases to create the fuels is sufficient and diverts waste biomass which is a very large source of methane emissions to carbon-neutral or carbon-negative biofuels. They will continue to cost more than current fossil fuels, two to three times as much.

As manufacturing green hydrogen has turned out to be expensive, not cheap which is something people with STEM and business casing competence who looked at saw a long time ago, and manufacturing synthetic fuels from the green hydrogen adds more costs, hydrogen and synthetic fuels are turning out to be four to six times as expensive as fossil fuels in the best case scenario, so will be uncompetitive with biofuels.

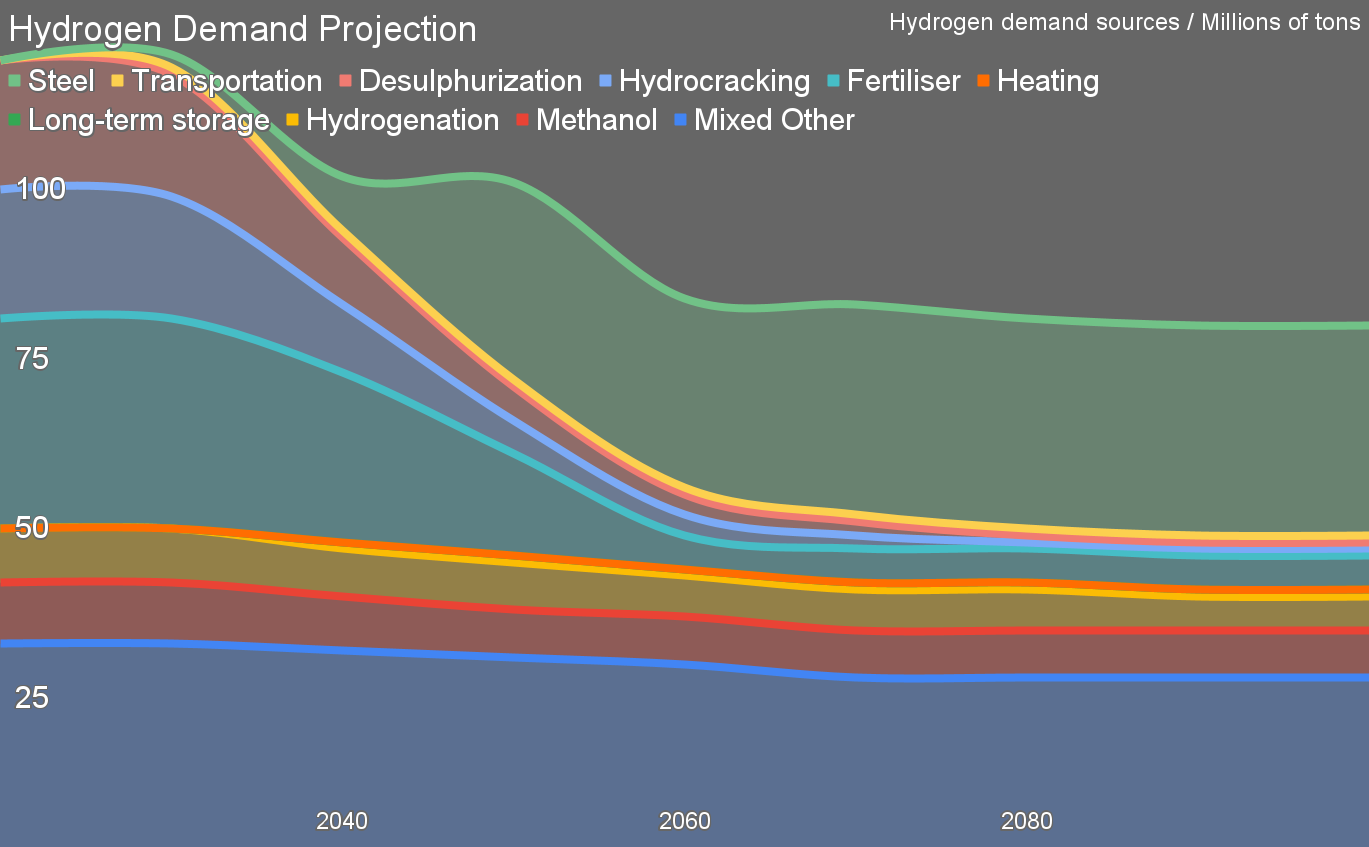

For clarity, I’ve done the math, often multiple times, on all of this. I’ve looked at all the major and many minor purported solutions. I’ve assessed them on the required trifecta: will they work technically, will they be economically viable compared to alternatives and will human beings accept them. I’ve created projections through 2060 or 2100 in most cases for the solutions I expect to dominate based on that assessment, including for aviation, maritime shipping, steel, grid storage and vehicle to grid potential. I’ve projected decarbonization of energy and inputs across those. I’ve projected carbon emissions from these major segments using those metrics in most cases. That’s all informed my hydrogen demand projection through 2100, which is in its third or fourth version.

And I’ve spent time discussing this with very STEM literate groups and individuals globally, both via client engagements with maritime shipping firms, aviation firms, electrochemistry firms and investment funds, but also through often pro bono discussions with professional and academic groups globally. I’ve spent a lot of time looking at hydrogen for transportation studies from multiple groups, working hard to get to the bottom of assumptions which are often scattered across multiple reports. I’ve looked at agricultural decarbonization pathways as well. Am I an expert in any of these things? No, but I’m a STEM, economics and cognitive science basics literate analyst who tries to get close enough to each domain to avoid most of the traps many generalists fall into.

Does this mean I’m right? No, as I keep saying, I’m just pretty sure I’m less wrong than most. My projections are based on a lot of things, but there are always gaps in my knowledge and the future has a way of surprising all of us. While natural gas increasing in price and volatility was obvious to me five years ago, the invasion of Ukraine and its impacts surprised me. While I called electric scooters and skateboards as dominating small personal rideables, I missed scooter sharing entirely. (As a note, BNEF pointed out that small electric two- and three-wheeled vehicles dominate petroleum avoidance and have been since 2015, hence my attention to the one-person electric vehicle space a few years ago.)

What is the market saying?

Is there any independent data that makes this perspective on green hydrogen being expensive and hydrogen for energy not being viable an accurate assessment? There sure is.

In September of 2023, the Boston Consulting Group published a white paper with over 1,300 hydrogen proposed deals worth of data categorized into whether they were proposed, had reached final investment decision or were in operation. Only 0.2% of the deals by tonnage had reached operation. The bottom end of those deals was minuscule in terms of tonnage as well. In November of 2023, BNEF reported on the 149 hydrogen deals in their data set, finding only 10% of the deals had any offtake agreements, and of that 10%, only 13% were firm. The deal bottom end was bigger, but the total BNEF tonnage was only 7.9 million tons, so only 0.1 million tons have guaranteed buyers. Clearly the in-operation deals between the data sets overlapped.

In both cases, the organizations tried to put positive spins on this remarkably dismal performance and lack of buyers. BCG went as far as to say that it showed significant momentum instead of being a deeply cautionary tale for green hydrogen.

In January of 2024, the International Energy Agency reported that renewables and biofuels had showed massive gains in the previous year, but hydrogen was barely moving, clearly looking at data sets which showed the same things the BCG and BNEF data showed. And recently the EU has backed away from their hydrogen backbone scheme, delaying tenders for a couple of years and making it clear that they were looking for non-governmental money to fund the majority of it, in part because the projected costs had risen sharply.

In another IEA publication on the potential for synthetic fuels in transportation, they put the cost of alkaline electrolyzers at US$400 per kW of capacity but with balance of plant at $1,700 per kW, while the comparable numbers for PEM electrolysis was $800 and $2,000. I discussed this with Paul Martin, chemical engineer, expert in hydrogen, designer for his career of modular chemical process engineering plants including ones that worked with hydrogen and biofuels, and co-founder of the Hydrogen Science Coalition. He and I had tended to use a 1:1 ratio between elecrolyzers and balance of plant in our cost workups, and fully agreed that as electrolyzers got somewhat cheaper, balance of plant wouldn’t.

There are problems with the IEA report, in that they have very optimistic costs for low-carbon electricity of about $30 per MWh with about 60% availability for a custom e-fuel plant built in the US Midwest with both wind and solar plants built near by and zero grid or utility requirement, and as such they came in still low on hydrogen costs, but it was still well above the $1.40 that many hydrogen for energy proponents had been accepting as likely. And to be clear, the IEA got integrating hydrogen manufacturing directly with the industrial process that consumes it at the same site right. 85% of hydrogen is manufactured at point of use in the quantities required just-in-time for the process because the costs of storage and distribution are so high.

The Boston Consulting Group published an assessment of the likely cost of green hydrogen in Europe, finding that the illusory consensus among hopeful hydrogen proponents of €3 per kilogram wouldn’t be reached by 2030, and that even getting down to €5 per kilogram was unlikely. That was explicitly the wholesale price as better specificity about that point is sinking in, but it’s also still undelivered hydrogen without distribution, retail and profit adders. As a reminder, gray hydrogen is the cheapest form of hydrogen that exists with a wholesale price of $1-$2 per kilogram, and in the USA and Europe at retail pumps it costs $15 to $35 per kilogram because of the costs of distribution, pumping stations and the requirement for profits.

There are also the cautionary stories of PlugPower, Ballard and FuelCell Energy, all three of which had peak stock valuation in 2000, and are off by around 98% in 2023. Ballard especially has been losing money on failed pilots for decades, with an average of $55 million in losses every year since 2000 and a claim of having fuel cells in only 3,700 trucks and buses after 44 years in business. The list of hydrogen for transportation projects which have been abandoned after massive governmental subsidies is much longer than the list of projects which are still running, and almost all of the ones currently running require massive governmental subsidies.

Hydrogen forklifts, which hydrogen advocates love to talk about, have a total of 50,000 in operation worldwide since being introduced over 60 years ago while 1.2 million electric forklifts were sold in 2021 alone, almost all of the hydrogen forklifts are operating in firms where the US Department of Energy subsidized the refueling facility and initial purchases, and the first facility to get non-fossil hydrogen is running an electrolyzer off of Colorado’s grid electricity which results in much higher carbon intensity hydrogen than fossil hydrogen.

As I’ve said more than once, every time a spread sheet jockey is engaged to put a real business case together, hydrogen for energy proposals fall apart unless governments are picking up the bill. The launch of projects gets press and hydrogen for energy types have their biases confirmed, but they never do the hard work of looking at the list of failures.

RMI are less wrong than some but not right

And so, back to RMI. Let’s be clear. They aren’t all wrong. But for the past five years they’ve been wrong a fair amount of the time about hydrogen. In 2019, they were accepting the US$1.40 per kilogram green hydrogen illusions that became common with baseless assumptions about free renewable electricity and dirt cheap electrolyzers that existed without balance of plant, distribution costs or profits for anyone involved. This was clearly wrong then, and subsequent more robust studies and actual attempts to build business cases have proven it.

An unfortunate thread in hydrogen for energy discourse is to first low-ball hydrogen manufacturing costs substantially, then mistake manufacturing costs for wholesale costs, distributed costs or even retail costs. That’s demonstrated in the linked RMI material, where the low-balled manufactured cost for hydrogen is compared to the retail cost for diesel. This lack of clarity and precision is so regular that it’s fairly clear that they don’t even realize that they are doing it or that it’s a defect not a feature.

That low-ball cost assumption is undoubtedly part of what led the new RMI CEO, Jon Creyts, to establish a hydrogen lead, Oleksiy Tatarenko, and hydrogen team in the past couple of years. No flies on Creyts, including a PhD of mechanical engineering. He has the STEM chops to know better but hasn’t applied them to hydrogen for energy. He does know how to grow an organization, taking RMI from a 50 person think tank to a 600 person global organization in his decade with the organization before putting the CEO hat on, and now, according to LinkedIn, over 1,200 affiliated people. That transformation isn’t something I’d paid attention to, but explains why Canary Media was so easily scooped up by RMI when Wood Mackenzie cut them loose.

No flies on Taterenko either, with a PhD in economics and educational top ups in Oxford and Cambridge, none of them STEM credentials but the science of hydrogen isn’t particularly hard or outside of the ability of lay people who work at it a bit. He is a molecules for energy guy with 13 years at Shell, five of them or so involving hydrogen and carbon capture — another mostly dead end technology —, before joining RMI on the hydrogen file and then taking leadership of their hydrogen team. He’s not an electrification guy or a biofuels guy, but someone whose background predisposes him to think that molecules for energy are much more required than they are, that carbon capture is a thing, that industry claims related to blue hydrogen are reliable and that biofuels have more problems than they do. He’s not an electrochemistry, manufacturing, electrical generation or a transportation guy for that matter.

This is nothing he can’t overcome with rigorous Kahneman System 2 thinking, but that’s challenging when so many of his circle are inside the hydrogen for energy bubble. He can get independent voices for the STEM work that’s not his skill set, as long as he realizes he needs to and prioritizes it. If asked, I’m sure he’d insist that he has avoided all cognitive traps and is fully aware of and accounts for his predispositions. From the outside looking in, he hasn’t. The only judgment I’m making is that he’s human, just like all of us.

None of this would matter if Tatarenko weren’t a senior person in the organization that still has one of the must trusted and influential independent energy think tank brands, RMI. But Creyts and Tatarenko have a place to stand, and especially with Creyts’ massive expansion of RMI, a lever long enough to move the world. Actually, that’s not quite true. In the case of hydrogen as an energy carrier’s inevitable failure, they have lever long enough to slow the movement of the world a bit, but the situation is urgent. We can’t afford to be slowed.

This isn’t to say that Taterenko isn’t a rock solid and rigorous analyst with a strong focus on decarbonization, a strong moral and ethical sense, or that he isn’t absolutely committed to attacking the problem of climate change. I know lots of ex-fossil fuel industry types who bring excellent skills and energy to decarbonization in multiple domains. It’s not saying he’s the wrong choice for RMI’s hydrogen lead, although the optics are a bit wonky. This is simply saying that everyone has baggage that they have to handle in any role, and his baggage requires different handling than others.

Personally, I’d have preferred to see an industrial feedstocks expert in the role, just as I would have preferred to have the US hydrogen strategy run out of the Department of Commerce rather than the Department of Energy. Starting with the majority case and extending is much better than starting with the almost non-existent case and trying to ensure coverage of the majority case. The US hydrogen strategy problem was mandated by Congress, but RMI didn’t have a Congressional mandate and could have made a different choice.

To be clear, the Congressional mandate explicitly states that the hydrogen strategy must focus on making hydrogen from coal and gas, maintaining as much fossil fuel infrastructure as possible, and put the hydrogen strategy into the wrong Department. The US DOE was handed a steaming pile, and has has been iteratively trying to make it somewhat better, but their hands are tied. The results of the strategy, the IRA and 45V are clear, as the biggest hydrogen expenditure under construction by an order of magnitude is the $2 billion blue hydrogen facility in West Virginia, Joe Manchin’s state.

As a note, while RMI has a green hydrogen lead, they don’t have a biofuels lead as far as I can tell, despite there being a 100 million ton annual global market which is growing rapidly for biofuels today, and a virtually nonexistent green hydrogen market at present. If I were Creyts or the Board, I’d be rethinking that. What’s so special about hydrogen that it gets a lead and a full team, and the massive existing biofuels market doesn’t get equivalent senior level attention in the organization? For that matter, I couldn’t identify anyone with “transmission” or “HVDC” in their titles either, and that’s a much bigger energy wedge than hydrogen will be. I don’t have RMI’s org charts, just LinkedIn, so it’s possible I’m missing someone.

And there’s a good question about what RMI’s actual activities are now that it’s 600 or 1,200 people spread across a bunch of US offices and one in Beijing. Clearly it’s not just a think tank doing researching and putting out solid publications anymore. In fact, many of the more substantive RMI reports I’ve found around hydrogen are years old and haven’t been updated. As far as I can tell, they are much more engaged in specific projects with organizations which engage them to find systemic change opportunities.

They are working with a lot of oil and gas companies to reduce methane emissions, a laudable goal, but as noted the best solution for oil and gas industry emissions is to cut their business out from under them as rapidly as possible. It’s quite probable that Tatarenko spends a significant part of his time and organizational resources on blue hydrogen for refineries, a space that RMI has made a priority.

RMI is doing something related to building efficiency with free market solutions. They are working on mobility as a service solutions with public and private partners, which translates to me into helping Uber and Bird get into cities with less friction (which I fully support, by the way). They have a fuel efficiency program for trucking and maritime shipping. They are facilitating renewables to displace diesel on islands. They are working with federal buildings in some form of strategic contracting relationship to advise on efficiency programs. They are doing a lot of work with US cities related to efficiency and health.

In other words, they have a lot of people doing a lot of work, most of it aligned well. They aren’t a think tank, but a funded organization of organizers, doers and enablers. They have goals for impact intended to reduce greenhouse gas emissions, and they are organized around that.

But on hydrogen vs alternatives for energy right now, RMI is slowing the necessary movement, confusing the discussion and advocating for a poor solution in places it no longer has a place to stand. At that, they aren’t nearly as bad as out and out hydrogen boosters like Hydrogen Europe, Cadent and the like. They get a bunch of stuff right. It’s the stuff that they get wrong that’s problematic.

What does RMI get right and wrong?

So what do they get right, to give them their due. Well, let’s go back to a June 2022 RMI publication — not authored by Taterenko and before he took leadership of the team — and parse the list:

there are several no-regret, high-priority applications of hydrogen that should be a core focus of policies and investment today: fertilizer production, petrochemicals and refining, steel production, maritime shipping, and, in some markets, long-distance heavy-duty transport via both rail and trucks.

They get fertilizer right. About 150 million tons of ammonia are manufactured today, almost entirely for fertilizer, and it’s a significant global warming problem. It’s made from black or gray hydrogen derived from natural gas or coal leaving it with a carbon debt between methane emissions and CO2 creation of two to six tons of CO2e per ton of ammonia. When applied to fields, nitrous oxides are released for an average of another three tons of CO2e. Five to nine tons times 150 million tons means that the current carbon debt of ammonia we use today is 750 to 1,350 million tons of CO2e. Job one is fixing that, and they acknowledge that.

But the three tons of CO2e in the form of nitrous oxides needs fixing as well. With precision agriculture, agrigenetics and better crop management techniques like low-tillage agriculture, along with the peaking population, total ammonia demand is going to decline somewhat. We still need to decarbonize it with actually low-carbon hydrogen, which mostly means blue hydrogen is not part of the solution due to upstream methane emissions, parasitic energy requirements for carbon capture, distribution and storage, and less than 100% carbon capture.

Among other things, carbon sequestration requires 90 kWh per ton of CO2 to push it into a supercritical state. Complaints in both Europe and the USA from the fossil fuel industry about not being able to meet required carbon intensities with blue hydrogen and demands for money to subsidize carbon capture and sequestration are very loud right now.

RMI gets petrochemicals and refining as a demand area right, but I haven’t found evidence that the ramifications of massive hydrogen demand reductions in that space are clear to them. Refineries are the biggest consumers of hydrogen, about 40 million of the 120 million tons today. It’s used for removing excess water from crude (hydrotreating), removing sulfur from crude (desulfurization) and separating crude into lighter and heavier components (hydrocracking). The more sulfur and impurities in the crude and the heavier the crude, the more hydrogen is required. As peak oil demand is upon us and refineries have to pay much more for low-carbon hydrogen, the first crude off the market will be the heaviest and most sour ones, so hydrogen demand for refineries is going to plummet in the coming decades. Further, the petrochemical industry which remains at the end of the transformation will mostly be running on the lightest, sweetest crude closest to water, so not much hydrogen will be required.

In other words, the best way to address hydrogen carbon emissions for refineries is to accelerate deployment of renewables and electrification of the economy, not to waste money on a rapidly declining demand sector where the money might only have a 20 year value span. RMI rarely makes this clear statement, but instead has a tendency to focus on how refineries can decarbonize their operations.

Steel too is a place where new green hydrogen has strong potential, and the only growth area in my projections. The 2019 RMI paper on the subject is quite reasonable, only missing MIDREX-technology gas direct reduction where biomethane and electric process heat can be substituted. As such, they overstate the demand for new steel and green hydrogen, but they are more correct on this point than not. They do note the direct reduction with electrification pathway, but to be clear, that’s an outstanding lever in my projections, and I make it clear that the 31 million additional tons of hydrogen I project for this demand area is not guaranteed. The market will decide which pathway is most efficient, and there are multiple TRL 9 solutions between green hydrogen and direct electric reduction now.

They missed methanol from this list. Like ammonia, it’s an industrial feedstock, not an energy carrier today, and we manufacture about 110 to 120 million tons of it a year from natural gas, coal gas and other fossil gases. That has a carbon debt of about 500 million tons of CO2e per year, a very significant amount that must be decarbonized. As it can be substituted with other industrial feedstocks in many cases, as its price increases due to decarbonization, cheaper alternatives will be found and overall demand will decline. Methanol does show up later however.

They also miss hydrogenation of vegetable oils into edible oil products like margarine, the primary use case. Once again, as the price of hydrogen increases, demand will shift and I project a slight decline.

That’s the top of Michael Liebreich’s hydrogen ladder, the only portion of the use cases likely to persist. The couple of missing ones are fine, as the document I drew the quote from was not attempting to be complete, merely informative. Up to that point, RMI hasn’t gone wrong, although it’s seemingly unaware of the likely decline in demand, a very substantial one in the case of oil refineries and petrochemicals.

As a note, hydrogenation and hydrotreating are also used in biofuels processing, and I added four million tons of year demand to my projections to account for this.

What else do they get right? They appear to have accepted the memo on light vehicles and on commercial and residential heat. All electrification, all the time. More use cases of Liebreich’s ladder knocked off.

But there are many places where they get it wrong.

How does RMI do on maritime shipping?

They posit a role for hydrogen in maritime shipping, either directly or in the form of synthetic ammonia or methanol. A 2021 publication does note that maritime energy requirements will be declining due to reductions in fossil fuels, but does not appear to have factored that into their calculations. Further, they posit no role for biofuels in maritime shipping, asserting that all biofuels would have to be diverted to aviation. This despite the best case costs for green ammonia and green methanol being double the price of biofuels that are plug compatible. That plug compatibility matters, as it means that ships can have a single set of tanks and a less expensive engine, and it means ports are spending less money bunkering more molecules.

Higher capital costs, higher operating costs and in the case of ammonia, higher safety engineering and emergency preparedness costs, means the maritime industry is mostly going to buy biofuels. Who, exactly, is going to tell them no when they are a customer competing for product? Yet RMI’s position is that by some unknown mechanism, biofuels will be preserved for aviation and the maritime industry will be required to pay much higher prices for fuels.

This is one of the places where Taterenko’s predispositions come to the fore. He asserted that biofuels would be reserved for aviation in online discussions with me and that the purchase orders for ships powered by hydrogen proved me wrong. However, the ships in question are dual- and tri-energy ships — methanol or ammonia, diesel and batteries — with only methanol and ammonia being potentially made from green hydrogen, and Maersk’s — by far the biggest buyer and operator in this category — methanol purchases being almost entirely biomethanol.

That’s right, methanol can be a biofuel. It doesn’t have to be a synthetic fuel. Taking biologically created methane and turning it into methanol in the same plants that create the product today is completely reasonable. The first Maersk ships journey from South Korea to northern Europe was powered by methanol manufactured from methane emitted from a landfill, diverting an anthropogenic biomethane problem into a low-carbon fuel. Biomethanol isn’t, however, likely to be much less expensive than synthetic methanol on a distance for dollar basis.

The shipping industry is in a quandary, trying to sort through the morass of lobbying from various groups. The fossil fuel industry is pushing hard for hydrogen and hydrogen derivatives as energy carriers so they can sell a lot of blue hydrogen. The methanol and ammonia industries see a global market potential that multiplies demand and at a higher price point, so they’ve been playing fast and loose with the truth and pushing hard for their products.

Maersk has made a big bet on low-carbon, cheap methanol — one unlikely to pay off — and bought mid-sized container ships for a 15% markup, $115 vs $100 million for 9,000 unit container ships. Others have followed. As I discussed with Sahar Rashidbeigi, Maersk subsidiary APM Terminals’ head of decarbonization, last year, Maersk can move the market just by committing itself. They own 7-8% of the container ports and are the second biggest — now after more than two decades of being the biggest — container shipping firm on the planet. They moved the market on methanol, and it’s great that they made a bet. It woke the industry up.

But as I told a Stena Line audience of 60 or 70 maritime engineering, design and architecture professionals last year in Glasgow, I consider biomethanol to be the best of the also ran maritime decarbonization solutions. If actual biomethanol made with existing anthropogenic biomethane emissions becomes the de facto shipping fuel of the future, I’ll be just fine with that, although I consider the economics of that unlikely.

My projection for maritime shipping shipping fuels in the end game is about 70 million tons of diesel equivalent a year. We already manufacture 70 million tons of biodiesel a year, we just waste most of it on ground transportation.

What about aviation?

RMI acknowledges at least a bit that electrified conventional take off and landing aircraft are a thing. That’s better than many organizations.

But they have tended to accept IATA projections of massive growth of aviation. This isn’t realistic. As noted above, there is massive diversion to electrified rail in increasingly affluent China and lower growth of affluence in the rest of the developed world. Also there is flat aviation passenger demand in the developed world, and COVID kicked the business passenger aviation’s legs out from under the segment. As I’ve discussed with national consulting executives I know, clients aren’t going to pay for consultants to fly in every week when employees aren’t in the office much of the time. That’s 20% of the passenger aviation business that’s not coming back.

Then there’s the reality that fuel prices which are 19% of airlines expenses are going to increase a lot. That’s going to be passed on to passengers, and so the cut off income level for regular flights will go up in real dollars. This too is going to suppress passenger miles in the segment.

Is this borne out by data? So far, yes. Business travel has rebounded by only 50%. Private travel bounced up with suppressed demand and declined. Major hubs are struggling to find staff and secondary hubs are struggling with lack of passengers. It’s still early days post-COVID, but by the data I have so far, the bloom is off of passenger and cargo aviation. I’m waiting another year or two before updating my projection of civil aviation demand through 2100 and related repowering and decarbonization curves to get better post-COVID data as the signal is still messy.

The combination makes the 4% CAGR something that is clearly more motivated by stock valuation and debt financing requirements than by reality. That’s not something RMI appears to accept. The combination means that they, like many other organizations, think that there isn’t nearly enough waste biomass and that hydrogen and derivatives are the only options.

What about trucking?

RMI holds out hope for hydrogen for trucking, at least in some markets. It’s not clear why, I haven’t been able to figure out what markets, and they don’t assert the size of those markets that I’ve been able to discover.

However, as this increasingly long assessment of their positions has pointed out, I’ve looked at a lot of organizations’ defense of the need for hydrogen for trucking and have found exactly zero use cases that make the slightest sense compared to alternatives.

I’ve discussed this at length with Professor David Cebon, PhD of mechanical engineering, professor of mechanical engineering at Cambridge for approaching 40 years, road freight expert, founder of the Center for Sustainable Road Freight over a decade ago and founding member of the Hydrogen Science Coalition, and we agree, battery electrification for the win. Lower capex and much lower opex now and forever.

Cebon sees some transitional edge cases with range extending biodiesel generators and overhead catenary lines, while I see battery energy density improvements making those very short term propositions. We both see the question as one of where charging goes, not that charging is the answer.

And to be clear, other groups within the 1,200 staff member RMI organization clearly have the same opinion. Not the hydrogen centric portions of RMI, however.

And then there are railroads

I’ve published a relatively complete assessment of global rail decarbonization, just looking at what major jurisdictions are actually doing. I’ve assessed several rail hydrogen pilots and found tiny, short-lived passenger and often tourist rail. Canadian National Railroad was one of my clients, and I’ve clambered over a diesel electric locomotive as part of an introductory rail operations course they offered so that I would better understand their business, part of delivering a North American map-based KPI and asset tracking solution for them.

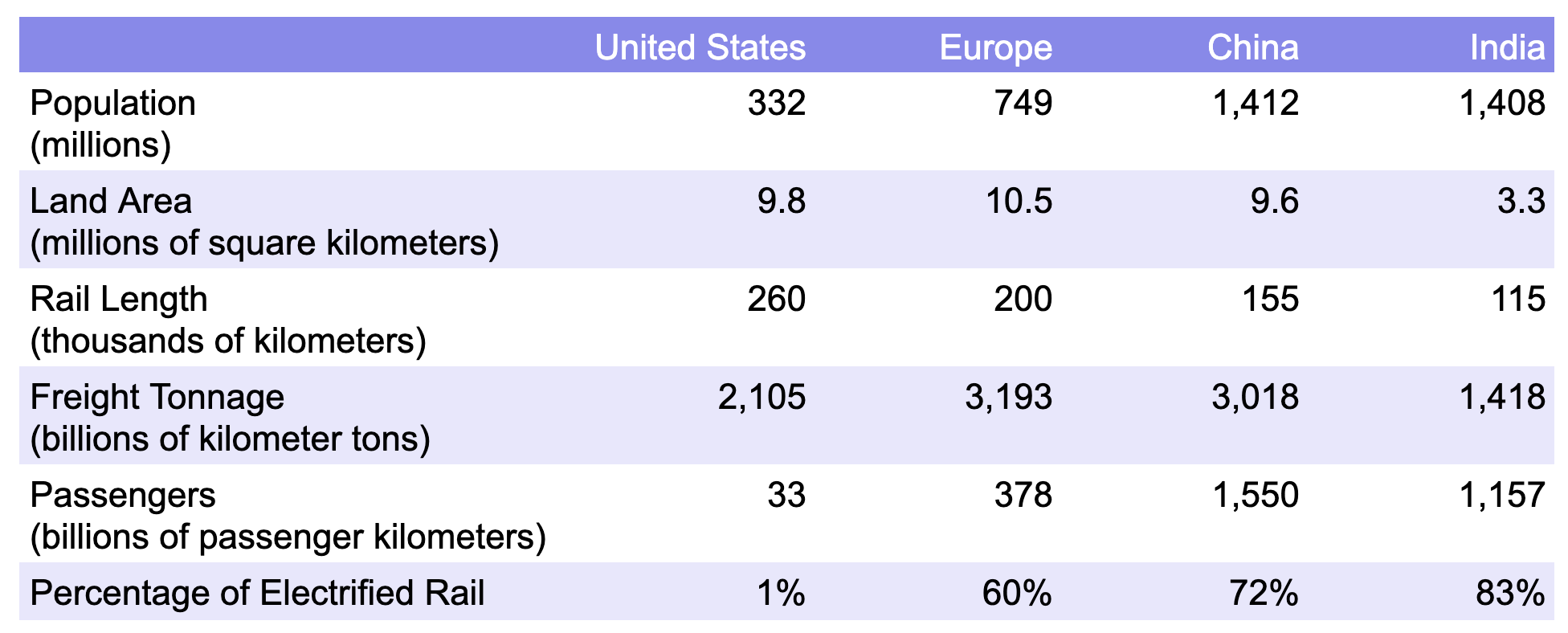

The world is just putting up overhead catenary lines above railroad tracks that don’t already have them. They are adding battery cars to get past bridges and tunnels where the expensive of adding wires is too high. They aren’t passing Go. They aren’t collecting $200. India will likely be finished with heavy rail electrification this year.

Only North America is resisting this, and North American railroads are pushing themselves into an uncompetitive corner. Four million rail cars a year of coal are going away. Seventy thousand cars of oil a year are going away. Road freight will electrify and reduce labor costs with more autonomous highway trucking. Rail tonnage will drop substantially as they become less competitive and bulks disappear.

The USA has a lot more rail track miles than makes sense given their low tons per mile ratio by global standards. RMI is a US-based organization that’s expanded. Biases on rail to North American patterns are understandable. As a note, I also couldn’t find a railroad leader at RMI at the equivalent level of the hydrogen leader either.

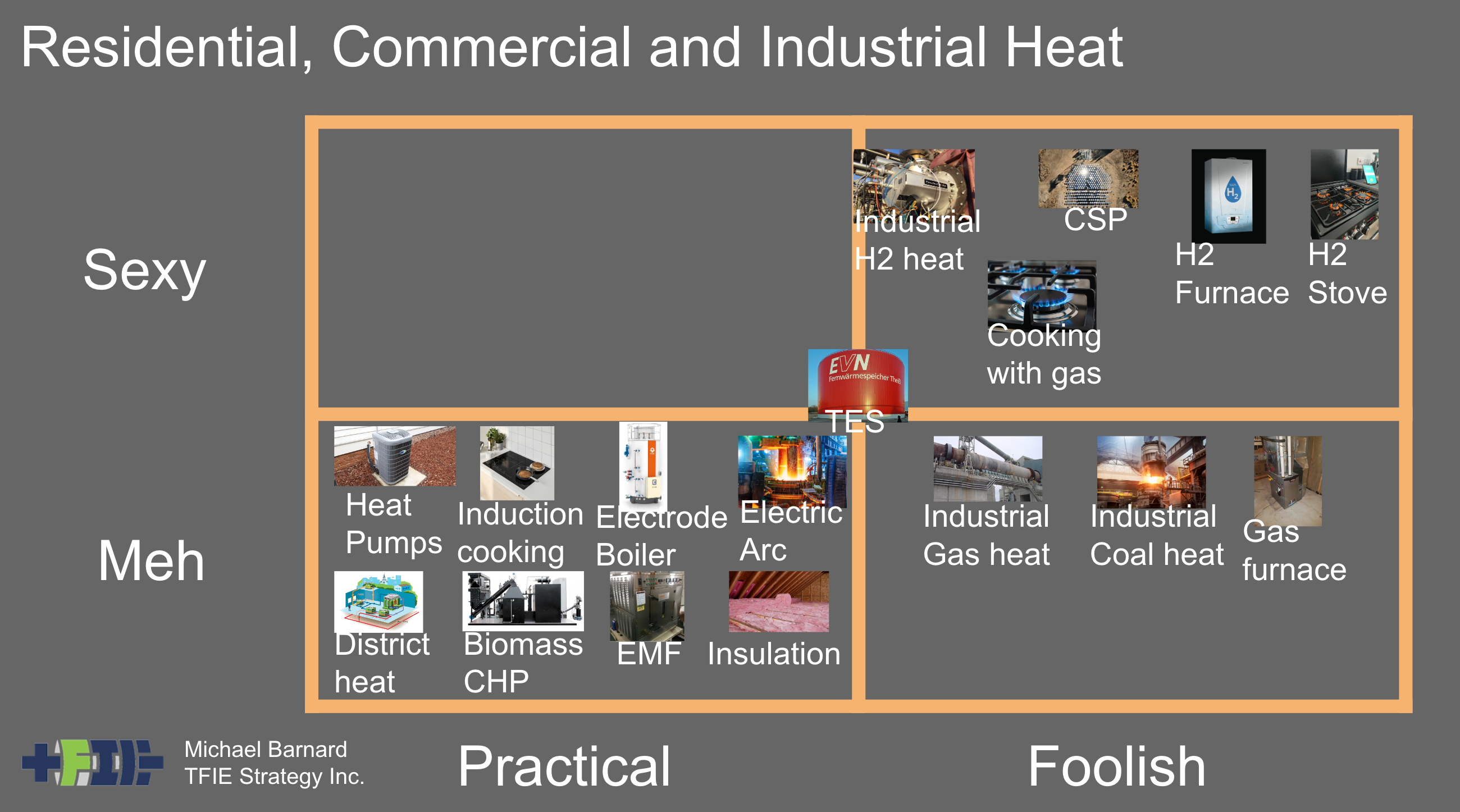

What about industrial heat?

The industrial processes used in the production of things like steel, cement, glass, and chemicals all require high-temperature heat. Currently, this heat is produced by burning fossil fuels. For these hard-to-abate sectors, there is essentially no way to reach net-zero emissions at the scale required without using hydrogen.

That’s a remarkable statement from a 2020 publication, an opinion that they appear to continue to hold, at least in parts of the now massive, 1,200-person, multiple-office, remote-working organization.

But as the RMI steel assessment from last decade made clear, steel doesn’t need hydrogen for heat. Electric arc furnaces run at 1,500° Celsius to 3,000° Celsius already as they melt steel. That RMI publications on the left hand ignore this and assert hydrogen is the only answer while on the right hand accept high temperature, efficient, electric heat is par for the course for hydrogen for energy groups.

What about cement? Electric limestone kilns have existed, on and off, for a century. The problem is economics, not heat, and electricity is always going to be cheaper than hydrogen for heat. Hydrogen is not the answer here either.

Glass? What are they smoking? Pure electric glass furnaces are bog standard.

Chemicals? As Paul Martin, chemical engineer, lifelong designer of modular chemical plants and co-founder of the Hydrogen Science Coalition has made to clear to me multiple times, virtually all heat in chemical plants can be electric, it’s only economics that drives it to fossil fuels, and electricity will always be cheaper and more efficient than hydrogen. When he designs chemical processing plants, all early work is with electric sources of heat and only the end business case drives burnable fuels.

There is a rounding error of industrial heat where the characteristics of burnt gas are required, but it’s a rounding error.

I’ve spent a lot of time looking at industrial heat and speaking with global industrial heat experts in different countries. I’ve assisted a major green infrastructure fund to refine their investment theses in the space and reviewed multiple existing and new technologies. I’ve done cost workup comparisons in a few cases.

In every case, while electricity might be more expensive for high-temperature heat than fossil fuels, there is no world in which the per Btu cost of hydrogen for heat is lower than the cost of electricity. For blue hydrogen, where 45% of the energy that is in the natural gas is thrown away, leaving only the hydrogen behind at significant carbon capture and sequestration cost, the cost per Btu is at minimum double fossil fuels and usually triple. Green hydrogen is even more expensive on a Btu multiplier basis.

As I noted at length, there are capital expenditure concerns, operational expense increases and disruptive technologies which make retrofitting existing plants challenging, and favor new build competitors who start with electrification. And there are a lot of cognitive challenges that abound in the space as well, with current fossil heating fuel vendors lobbying hard to assert that electrification won’t work, will be too expensive and that hydrogen will be cheap.

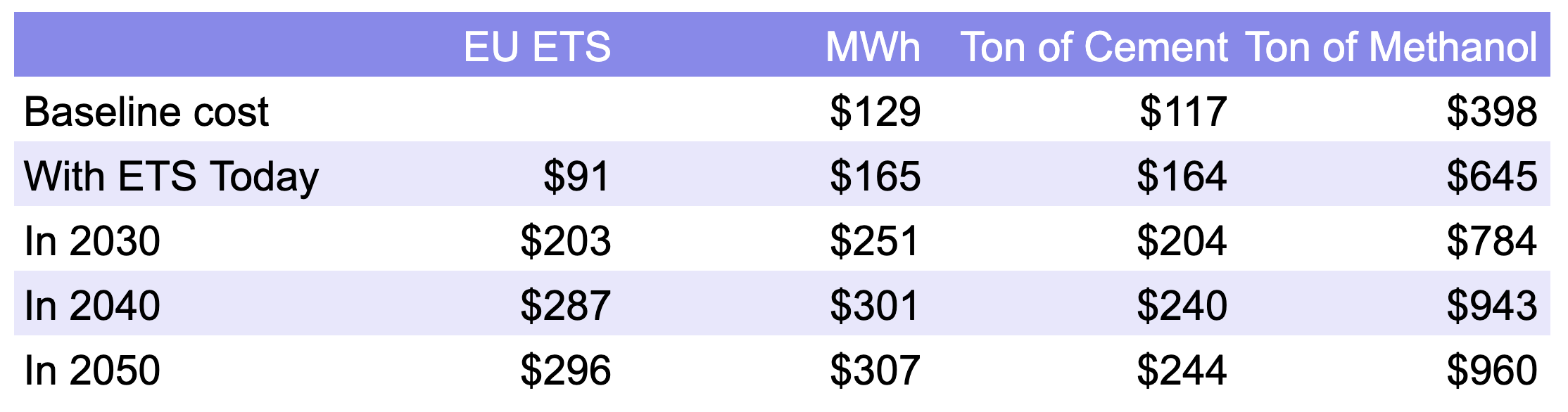

But as I also assessed, the EU’s carbon border adjustment mechanism, based on their emissions trading scheme, will apply to all greenhouse gas emissions of imports to the third largest economy in the world. Their budgetary guidance for business cases is strongly aligned with the harmonized social cost of carbon that the US EPA and Canada share, with only minor differences each year through 2050, and a 2040 expectation of $287 per ton of CO2e.

This has significant cost implications for companies inside the EU and those outside of the EU wishing to export to the block. As I noted, the only industry can’t survive without fossil fuels, and that’s the fossil fuels industry. Any firm which has fossil fuels in its value chain that is exporting to the EU will have significant competitive disadvantages.

I had this discussion with Chinese business executives as part of a seminar via the China Business Executives Academy, Dalian (CBEAD) last year, and China has some significant advantages in this regard. First, they have the purchase powering parity and Wright’s Law advantages which means that they can sell products including solar panels, electric vehicles and wind turbines at a profit for prices that western companies often can’t meet. Further, China already has an emissions trading scheme similar to Europe’s, albeit at a lower price point at present, so firms will be able to apply for and receive a discount, one which will increase as China’s ETS notches up. Finally, China is pivoting fast on decarbonization, with peak gasoline in 2023 per Sinopec, peak coal this year per Asian analysis firms like the Lantau Group, vastly more wind, solar, hydro, pumped hydro and transmission than any other country, and vastly faster electrification of transportation.

Other countries will be hard pressed to compete unless they decarbonize industrial heat rapidly and at the lowest cost. And that’s often going to be modern processes and technologies that are electrified in new plants. Hydrogen is not the lowest cost source of heat in any real comparison, as its heat and flame characteristics mean any industrial process that used it would require significant capital costs to adapt for it and its operational costs are multiples of electricity.

The RMI clearly shares the false perspective of the US hydrogen strategy that industrial heat requires hydrogen. It’s a US cognitive problem it seems.

What about blue hydrogen and hydrogen’s GWP?

Over the past few years it’s become clear that there’s a dark greenhouse gas side to hydrogen. It’s not directly a greenhouse gas like carbon dioxide, methane or nitrous oxides. But it it interacts with airborne molecules called hydroxyl radicals to prolong the lifetime of atmospheric methane, which is a very potent greenhouse gas, and one that most hydrogen is made from. Further, hydrogen is close to the leakiest molecule in the universe. It’s tiny and is a Houdini of escape artists.

What does RMI say about hydrogen’s greenhouse gas problem? It downplays it significantly, saying explicitly as a key message that “Hydrogen Is Not a Significant Warming Risk”.

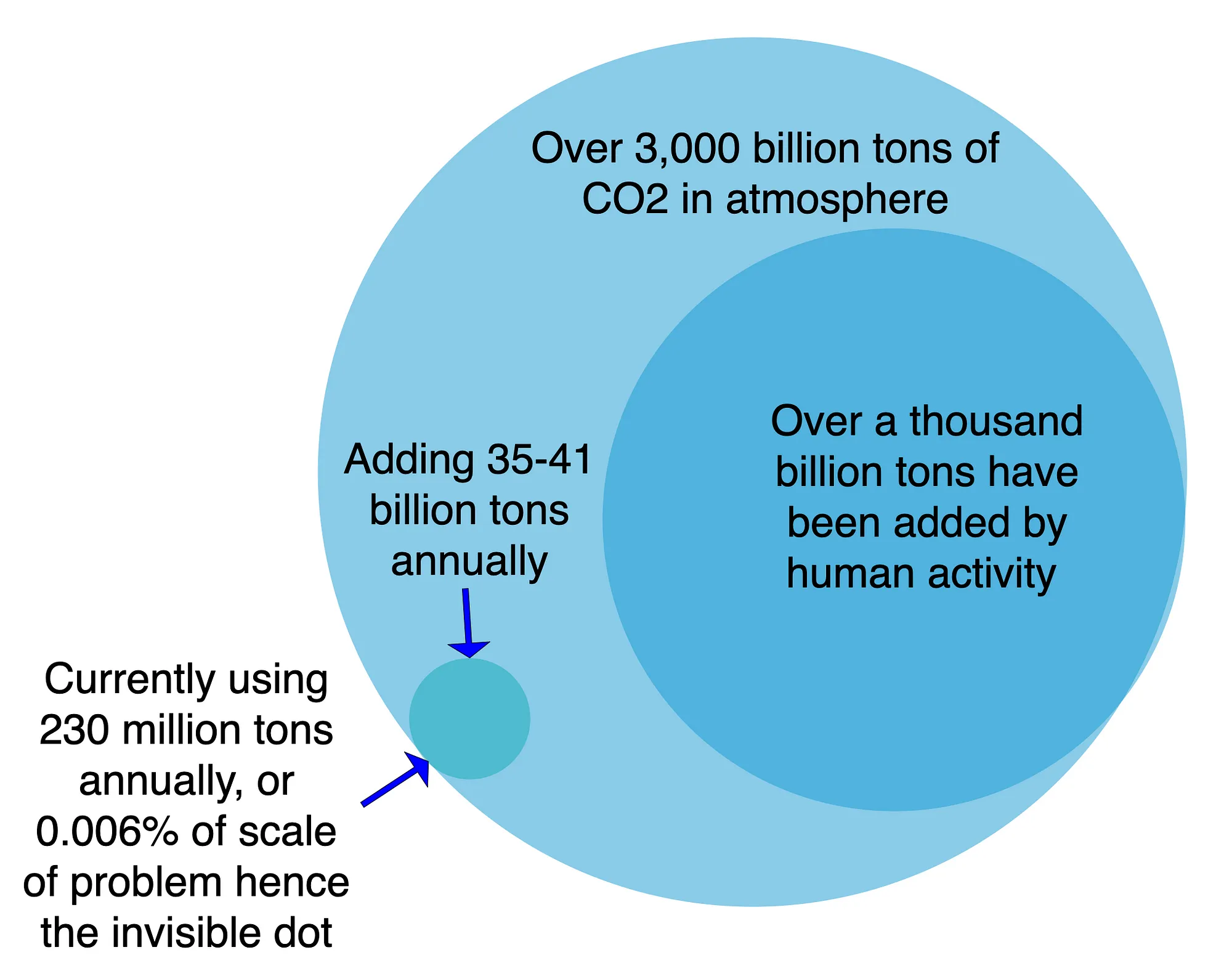

Bluntly, hydrogen’s current manufacturing is a global warming problem on the scale of all of aviation. Methane emissions from hydrogen and coal gas are big problems. Green hydrogen multiplies whatever carbon debt remains in electricity by three to six times, depending on hydrogen use case. Hydrogen leaks. Hydrogen in the atmosphere has an indirect global warming potential twelve times more potent than carbon dioxide.

For RMI to so completely downplay hydrogen as a global warming problem is remarkable and remarkably wrong. It’s apologetics, not a clear eyed assessment.

On the blue hydrogen side, they are quite honest that it barely exists today, it sucks with the USA’s upstream methane emissions problems and that green hydrogen from renewables will always be better. But they hold out a lot of hope for blue hydrogen where it isn’t merited.

What are the biggest blue hydrogen projects in operation and planned? Subsidized oil refinery efforts for hydrogen for refining heavy, sour crude. Remember, that’s a market that’s going away rapidly.

And blue hydrogen depends on carbon capture and sequestration. I’ve assessed every CCS facility with greater than a million tons of claimed capture per year, read the technical reports, looked at the cost adders, looked at the performance numbers and found the following. For carbon capture, it’s always uneconomic. It never performs as promised, always falling far short of intended capture. For sequestration, virtually all of it is actually extracting fossil CO2 from underground in one place, piping it a few tens or hundreds of kilometers and injecting it in tapped out oil fields for enhanced oil recovery.

All of the money spent on the space since the 1970s would have achieved much greater atmospheric carbon benefits if it had been spent on wind and solar plants instead.

Further, any significant carbon sequestration expansion requires carbon dioxide pipelines running through heavily populated areas. That’s a very significant risk as pipelines do rupture. Due to the nature of CO2, it must be liquified or even put into supercritical phase in order to be piped anywhere, which means that when a rupture occurs, massive volumes of CO2 gas immediately emerge from the higher density liquid. As CO2 is a heavier gas than the oxygen and nitrogen mix in the atmosphere, CO2 pools on the ground and in low spots until it diffuses.

This is a lethal combination. Current CO2 pipelines are used almost entirely for enhanced oil removal and run through barely populated rural areas. Yet even with this low penetration, one ruptured in the tiny town of Satartia, Mississippi in 2020, causing dozens to fall unconscious in convulsions on the ground, hundreds to be evacuated and preventing internal combustion emergency and evacuation vehicles from working. CO2 poisoning can be fatal, so it was mere luck that no one died, but it includes brain damage and organ damage, so lifelong health impacts are undoubtedly being felt.

Given the lack of CO2 sequestration sites near most places where blue hydrogen might be manufactured, pipelines would be required to run through lots of much more heavily populated areas, creating a massive, expensive and unnecessary risk. There’s no reason to believe that any city or region would provide permits for this.

The entire space is thermodynamic nonsense in any event, attempting to reverse entropy at great expense instead of just leaving already sequestered carbon alone and as rapidly as possible getting off of fossil fuels.

Every carbon capture effort is really another subsidy to the fossil fuel industry.

Despite this, RMI has created an entire carbon capture competency and is working closely with the fossil fuel industry on efforts, something critical to its perspective that blue hydrogen might be viable.

Unrelated to hydrogen, but another place where RMI has fallen off of the pass of sensible soft energy paths and systems thinking is that RMI also lots of direct air capture staff and supports initiatives in the space. This is even worse entropy-defying nonsense that they really should shut down in favor of their actually useful programs to reduce fossil emissions more rapidly.

And yes, I’ve published extensively on multiple direct air capture solutions including proposals for manufacturing synthetic fuels, with chemical engineering, cost and carbon debt workups. Most extensively, I did an entire series on Carbon Engineering’s claims, pointing out that its only natural market was enhanced oil recovery on tapped out oil fields with unmarketable volumes of natural gas to power it, with costs borne by governmental funding. And, indeed, that’s exactly what they did with Oxy, aiming for $250 per ton of CO2 injected to bring up oil which when burned would produce much more CO2. Oxy, of course, bought Carbon Engineering outright last year.

As part of that journey, I’ve spoken with many people working in the space including David Keith, Graciela Chichilniski, Peter Eisenberger and the CEO of a UK firm whose name escapes me, as well as well as many analysts like me who have done the math and science and are equally clear that it makes no sense.

That RMI has a full carbon capture team that includes direct air capture and speaks positively about it is indicative that it’s not Amory Lovins’ organization any more. He was clear multiple times that ditching fossil fuels and nature-based drawdown approaches were the solution, and he was right.

The carbon capture and direct air capture missteps are much like RMI’s hydrogen for energy misstep.

What about hydrogen or derivatives as an energy carrier?

This is clearly another place where RMI has bought into the concept that the current practice of moving massive tonnages of energy containing molecules is required.

They aren’t alone in this, but reality is biting this place hard. First of all, 85% of the current roughly 120 million tons of current hydrogen is manufactured at the point of consumption in the volumes required because transmitting and distributing it is so expensive. That’s what’s going to happen in the decarbonized future as well.

As noted extensively, hydrogen of any color is going to be multiples of the cost of natural gas in the best possible case scenario, and more expensive than just using electricity directly. But transmission of hydrogen?

Hydrogen pipelines barely exist, with a few hundred kilometer industrial network in a chemical industry heavy portion of Germany which is fed by steam reformation gray hydrogen and about 2,600 kilometers in the USA, mostly feeding refineries. By contrast, there are over five million kilometers of almost entirely fossil fuel pipelines in the USA alone. For the most part, pipelines can’t be repurposed easily or cheaply, although it’s in some cases less expensive than building entirely new pipelines.

Hydrogen, being much less dense than natural gas, requires three times the compression to deliver the same units of energy. That requires all new compressors. Hydrogen embrittles steel, especially at weld seams, and that degrades pipelines rapidly with the pressure drops and rises as well as thermal expansion and contraction. German studies have found that repurposing pipelines would actually require a fraction of the volume of natural gas to be transmitted to prevent rapid end of life.

In addition to compressors, all sensors would have to be replaced, as hydrogen is much more reactive with electronics than natural gas. Typically, lining the interior of pipelines would be required.

Those larger compressors or vastly lower volumes upend the economics of the pipeline, meaning that the cost per unit of energy delivered goes up substantially. I’ve assessed the potential for repurposing of the Maghreb Europe pipeline as part of an engagement to assess European efforts to turn northern Africa into a hydrogen for energy exporter, and the cost increases are grim, on top of the much higher cost of blue or green hydrogen.

Despite the lack of an actual requirement, RMI’s formal published opinion is that there’s an urgent need for a massive hydrogen pipeline infrastructure program. They point to Europe’s more-stalled-than-not hydrogen backbone as if it’s a working exemplar of what needs to be done in the USA.

Is there an alternative to pipelines? Yes, HVDC delivering green electrons from where they are created to where they are needed at incredibly high efficiencies and power levels. There’s a bunch of often self-serving studies that claim that HVDC delivers vastly less energy than pipelines that fail basic assessments of system boundaries and knowledge of HVDC.

I’ve assessed and published critiques of many of them, including DNV’s study, funded by the European pipeline industry association, that found that hydrogen manufactured offshore at wind farms in the North Sea and piped to major demand centers would be €3.24 in the best possible scenario in 2050 with all sorts of thumbs on the scale but only at the end of transmission without further distribution, pumping, compression, wholesale profits or retail profits. Even that manufactured and transmitted price point is ten times the cost per unit of energy of LNG imports, the most expensive form of energy countries use today. It’s completely uneconomic, but they don’t point that out in this deeply self-serving study funded by the only people it would benefit, the pipeline manufacturers and operators whose entire business model is dissolving.

The Oxford Institute for Energy Studies released a study I assessed late in 2023 which only gets somewhat better, but still manages to get several things wrong with the comparison. They still fell over badly on systems boundaries.

And this is only hydrogen transmission, not local hydrogen distribution. Gas utilities have been claiming that they will repurpose the pipes under urban streets, but rapidly found what anyone who knows what those pipes are made of and the characteristics of hydrogen found, that entirely new pipes were required. The one hydrogen for home heating and cooking trial that is foolishly going ahead in the UK is getting completely new infrastructure at great expense. There is no hydrogen distribution reuse.

Trucking hydrogen is vastly expensive, with even the hydrogen friendly US DOE publicly stating that it takes 14 tanker trucks of hydrogen to deliver the same energy as in a single truck of diesel. That number isn’t going down much due to the risks of trucking even more heavily pressurized or liquid hydrogen over busy routes.

Going back to the EU, one of the proposed hydrogen pipelines is from the port of Rotterdam to the industrial and population hubs of more central Europe. But that assumes massive ships carrying hydrogen would be steaming into Rotterdam from parts of Africa.

Once again, I’ve done the math on the costs of hydrogen shipping compared to LNG shipping. The characteristics of liquid hydrogen mean that it takes a full third of the energy in the hydrogen to liquify it and hydrogen boil off during journey is much higher. This is much more problematic than already expensive LNG. My 2021 assessment of a Namibian proposed green hydrogen manufacturing scheme with shipping to Europe found that shipping hydrogen would cost five times as much as shipping LNG.

When all forms of hydrogen for energy are multiple times the cost per unit of energy as natural gas and distribution is vastly more expensive, moving a lot of hydrogen around in a future world as an energy carrier would be economic suicide for any country which settled on it as a premise.

I’ve assessed this for multiple countries, including Australia and Japan, two geographies which are in the throes of figuring out how to wean themselves off of coal exports and imports, part of my habit at looking globally for examplars of the future of decarbonization.

Tatarenko himself is lead author on an RMI report extolling the virtues of the EU importing hydrogen. Clearly the RMI under his watch have never looked at the actual costs in any realistic way and compared it to alternatives.

What’s really happening globally? Lots more regional renewables reducing the requirement for energy imports. Lots more electrification driving down primary energy requirements and once again reducing the requirement for energy imports. Lots of HVDC interconnects spanning regions to share electricity.

For Europe alone, the Tunisia to Italy HVDC interconnector and the Georgia to Romania HVDC interconnector were greenlit last year, the Greece to Israel HVDC interconnector is being built, something like eight interconnects between Europe and the UK are in operation or under construction, the Morocco to UK Xlinks project is well on its way and MEDGrid is proceeding.

In Africa, a Chinese-African group of researchers using European modeling software designed and simulated a 12 country, 10,000 km HVDC interconnect from western Africa to South Africa, with drop offs, storage and renewables in every country sharing electricity, and all those sub-Saharan countries are part of China’s Belt & Road Initiative making actual deployment much more probable. Australia’s Sun Cable to Singapore is back in motion having ditched the hydrogen for energy obsessed Andrew Forrester, whose own mining firm has decided to ignore hydrogen for energy.

I’ve been assessing and following the growth of HVDC for seven years, published multiple assessments including the critiques linked above and spoken to developers and power engineering experts globally.

HVDC is the new pipeline. Molecule filled pipelines are buggy whips. RMI doesn’t seem to realize that, part and parcel of its problem with hydrogen for energy.

And RMI apparently believes that as hydrogen is hard and expensive to ship, then taking massively more energy to convert it to liquids and gases like methanol, ammonia and other hydrogen carriers, then shipping those will be actually cost beneficial.

As a reminder, green ammonia and methanol in the best possible case scenario are four to six times the cost of diesel, which is vastly more expensive per unit of energy than natural gas and absurdly more so than electricity.

Other parts of RMI appear to get this. But they hydrogen focused team are way out over their skis, not even realizing what they don’t know.

What does this RMI assessment net out to?

The strong-brand value Rocky Mountain Institute has been turned into the aggressive growth and influence RMI organization with much less focus on Lovins’ excellent insights and a bunch of strong action programs. It’s hired fossil fuel hydrogen for energy experts and aligned itself with fossil fuel firms far more than it should have, clearly. It’s expanded to the point of lacking any coherent perspective. It’s doing a lot of contradictory things these days that aren’t aligned with systems thinking Lovins would recognize.

Does this mean that RMI is not a productive organization? No, it means it contradicts itself and the hydrogen for energy perspective — and the carbon capture perspective — is both poorly aligned with a lot of the rest of RMI and at least the hydrogen for energy aspect is elevated too far in the organization. This is likely due to political considerations given the US subsidies for hydrogen under the IRA and 45V, the similar carbon capture subsidies in the country, the hard push back from regressive rail and trucking organizations around the reality of electrification, the Congressional mandate for fossil hydrogen and the four of seven blue hydrogen hubs.

Is this Amory Lovins’ RMI? Not a chance. RMI has become a very different beast, vastly less iconoclastic and visionary, vastly less of a thought leadership organization, but nonetheless leaning heavily on what Lovins created. It’s become much more active with programs which is good. It certainly maintains Lovins in its branding, including Lovins’ home as one of its office locations even though he’s not involved day to day or in governance at all any more.

Am I right about RMI’s hydrogen (and carbon capture) challenges? Maybe. I noticed that RMI was starting to be quoted about hydrogen for energy in odd ways a couple of years ago. It’s been increasingly highlighted in recent months. As I’d dug through the odd positions and mistakes of the ICCT, the German working groups on transportation, the SBTi material and the IMO material, along with much else, I’ve been debating whether to dig into RMI. Clearly I decided to, and clearly it was necessary.

To be transparent, this was somewhat triggered by Tatarenko. Three weeks ago I published a Forbes article introducing the various options for remaining maritime shipping energy that would be required after diminishing volumes and massive electrification. It was part of a series of ten where I analysed the requirement, every energy pathway and articulated in the last piece why it was efficiency, batteries and biofuels for the win. I posted a gloss on LinkedIn, and Taterenko leapt in with a comment assuming that I’d finally come down in favor of synthetic methanol and ammonia as fuels, which wasn’t what I had said in the article or in the LinkedIn post. To be clear, I didn’t recognize the name, and only realized he was with RMI when I checked his profile. Him knowing who I was and my position on maritime shipping is a supposition on my part. I don’t assume anyone knows who I am until proven otherwise.

A few days ago, I stumbled across RMI’s odd defense of the high global warming potential for hydrogen and its acceptance of the potential for blue hydrogen to have a significant role. I posted a brief LinkedIn post saying that it was unfortunate that RMI had fallen into the hydrogen for energy trap. Tatarenko leapt to the RMI’s defense and arguably his own given his leadership position on the file. Basically it amounted to telling me that what I’d posted was false and then stating a bunch of things which are from my perspective false. Tatarenko, as far as I know, did not engage with my rather voluminous publications on the subject to start a nuanced and informed discussion, he just stated unequivocally that I was wrong.

And to be clear, he did that from a position not as a maritime shipping, aviation, pipeline, electrical generation, grid storage or ground transportation expert, but as a molecules for energy expert.

Tatarenko and I have exchanged a few comments online which provided more indications that RMI is off track. My assessment of what I found over a few hours of poking at the question has exposed a bunch of problems with RMI’s hydrogen and related carbon capture perspective. But I’m one analyst looking at the work of an organization that seems to have turned into a 1,200 person bureaucratic juggernaut while I wasn’t paying attention. I’m undoubtedly missing a lot of good stuff because I’m looking at a wedge. The apparent lack of a biofuels or transmission leader is concerning, but that could be generic title misses.

Is RMI still doing good? Yes, but it’s muddied by its hydrogen perspective and maybe others I’m unaware of. While not having assessed the work of all 1,200 affiliated people in all of their teams and offices, I assume many other groups have lost the conceptual framework of soft energy paths and actually beneficial energy solutions as well. I would bet that at least half and likely much more of the employees haven’t read Soft Energy Paths: Towards a Durable Peace. It’s an imperfect and early take on the transition, but it is still much more right than the hydrogen for energy nonsense including blue hydrogen that the RMI now supports.

What should RMI do?

Pointing out a major problem and not suggesting a solution is bad form, so I’m going to offer a suggestion for free, which is worth every penny as a result. In my opinion, ignoring weird US hydrogen politics, the RMI needs a reset on this file and the associated carbon capture file.

I frequently go back to Richard Rumelt’s Good Strategy Bad Strategy: The Difference and Why It Matters for these types of things. His kernel of good strategy consists of only three things — reality, policy, actions —, which is why it’s surprising that so few good strategies exist. A good strategy, which RMI clearly does not have on the hydrogen front would look roughly like this.

Diagnosis

Hydrogen is an industrial feedstock with annual green house gas emissions in the scale of all of aviation globally, one to 1.5 billion tons of CO2e. The biggest single consumer is the fossil fuel industry and that demand segment will plummet. Other major demand segments like ammonia fertilizer, methanol manufacturing and hydrogenation of food products will persist but at lower volumes. While hydrogen has been considered to be a replacement for fossil fuels either directly or as derivatives, those models are clearly uneconomic compared to alternatives. RMI’s efforts to date have not been well aligned with this reality.

Policy

RMI will focus on persisting demand segments for hydrogen as an industrial feedstock, pouring its resources into fertilizer, methanol as an industrial feedstock and vegetable oil hydrogenation efforts. As with other decarbonization areas, RMI will create targets and review success on an ongoing basis. RMI will resist attempts by the fossil fuel industry and others to sway us from this policy.

Actions

- Create and publish targets for this reality and policy.

- Determine what human and other resources are required to create detailed plans and achieve the targets.

- Assign resources and gain additional funding for the scope required.

- Identify high-value collaborators in industry and government focused on the segments in question.

- Create detailed action plans to achieve the goals.

- Establish governance to ensure that inappropriate misalignment of hydrogen efforts does not recur.

- Establish cross-RMI knowledge sharing with the goal that any use case for hydrogen is contextualized fully against alternatives.

Is Tatarenko the right person to lead this reset? I doubt it, given his reaction to me and clear investment in a perspective on hydrogen that’s not based on empirical reality. But he might be. That’s for him and Creyts to figure out, if either of them reads this far and takes it seriously. If he wasn’t incumbent, it’s deeply unlikely that a talent search would put him top of the list.

RMI might take it seriously. They certainly should do so.

What are my motivations in writing this?

It’s a valid and reasonable question. Few people wake up one morning, dig through years of a major organization’s publications and write a 13,000 word assessment for fun.

First off, that’s the kind of thing I do do for fun. I do my own number crunching on the major files of climate change and compare and contrast it to other research and studies as a major part of every year, and have done so for about fifteen years. I publish constantly, with the most frequent adjective I hear being ‘prolific’. In other words, I’m optimized for this and it’s easy for me. I’ve done multi-part analyses of the ICCT’s publications on trucking, maritime shipping, aviation and hydrogen because that’s something I do. RMI is in the same space.

But it took time and attention and editing. Why did I bother?

Because RMI matters. Because Amory Lovins matters. He was one of the first energy theorists I read in the 1980s who clearly was original, and further less wrong than most, although it took a long time for me to realize the ways in which he was less right. He’s as important as Jane Jacobs in understanding urbanization or Kishore Mahbubani in understanding Chinese-USA relationships. Anyone purporting to have well founded opinions on any of those subjects who hasn’t engaged deeply with their work is unlikely to have actually well founded opinions.

And on hydrogen for energy, RMI is much more wrong than right. They are pushing for hard energy paths with molecular flows, which is pretty much the antithesis of Lovins’ perspective. Lots of the rest of RMI is still recognizable, but this bit and carbon capture? No, this part of RMI has been captured by the fossil fuel industry, and that’s not something that shouldn’t be called out and corrected if possible.

Is this the most effective way to address this? Quite possibly not, but you use the tools at hand. Tatarenko had offered to debate me as LinkedIn comment exchanges are necessarily limited, but as I suspect this material shows, it’s unclear what we would find it fruitful to discuss. I’m not going to learn anything from him about hydrogen that I don’t know better than he does as I’ve actually done the chemical workups and cost workups for multiple use cases and manufacturing instances. I know more about costs of distribution since I’ve actually done the cost and physics work ups for that multiple times for multiple use cases as well.

He has much less depth and breadth on most of the subjects covered in this document because his depth is in the fossil fuel industry, big fossil fuel deals, fossil fuel policy and for the past few years, trying to push the string of hydrogen for energy uphill. He’s not positioned to usefully discuss ground transportation, maritime shipping or aviation decarbonization, industrial heat electrification, power generation, energy generation, grid storage or transmission with me. I wouldn’t learn anything from him, and for a discussion to be useful, both parties have to learn. I’ve spent a lot of time learning from those more knowledgeable than me on all of those subjects. I know all Tatarenko’s sources and have discussed them with experts.

This isn’t to say that he’s in any way inadequate, he’s just deeply focused in a single legacy industry which necessary has to die out, and has a frame that prevents him from understanding that replacing one molecule with another isn’t a solution for the vast majority of energy, or that his preferred form of molecule isn’t the best choice for creating the limited amount of molecules for energy we need in a decarbonized world. This isn’t unusual, but it’s just not that interesting either.

An actual debate would have RMI’s hydrogen team go through every single domain above and all my analyses to try to refute them. They aren’t well positioned to do so by themselves, as they have been looking narrowly at hydrogen to solve problems. They would need to engage lots of other people from the better aligned groups within RMI to assist them. That would be a useful exercise, one that would rapidly shrink the remaining use cases further, eliminating most of the hydrogen for energy ones. It’s part of my recommended strategic action plan above as a result.

I offer this assessment freely. If RMI wants to engage with it, great. If they want my assistance in resetting this file, I’m happy to engage, but it won’t be pro bono. They have a lot of money, one of Creyts’ legacies, and I don’t come particularly cheap.

A few words on credentials, authority and bias.

It’s pretty easy to find reasons to consider the RMI’s publications and positions more credible than mine, and to consider my critique of the RMI’s position on hydrogen as slight. That would probably be a mistake, but it’s an understandable and forgivable one. Let’s explore this a bit.

On credentials, RMI has a lot PhDs including Tatarenko, even if not directly relevant to their RMI publications. I have a couple of years of undergraduate science and math, a computers and business degree and a bachelor of literature. It’s easy to assume from that their publications and opinions are more credible. I do the same credibility calculus.

That said, none of the analyses I do or the critiques I offer require PhD levels of science or math. Everything I point out is something that a first year science and math or even grade 12 science and math student could figure out. This isn’t rocket science. It’s basic stuff. No one who wants to check the numbers or science requires a PhD to rework the basics. A PhD extends human knowledge, but none of the RMI material extends human knowledge, it just analyses what is known. At best it’s Masters level work. Frankly, a disciplined person with a 100 IQ and the internet could do what I do, albeit likely more slowly. Does this mean I am right and they are wrong? Of course not, but it does mean that their credentials are only somewhat relevant.

On authority, the researchers have a bigger place to stand and a lever longer than mine. They are members of a much respected energy think tank with multiple offices that’s been around since 1982. They have Amory Lovins’ name and reputation behind them. I’m one guy with my one-person think tank and consultancy.

They write reports and papers typically with multiple authors and presumably reviewers prior to publication. I do research, crunch numbers and write articles that get retracted or corrected when I make embarrassing mistakes, articles that occasionally get bundled into reports, pulled into peer-reviewed journals at other’s request or added to other people’s books as chapters or specific data points. They have decent budgets for formatting and graphics. I use Google Sheets charts and generative AI image tools.

It’s quite easy and not wrong at all to assume that RMI is more authoritative than I am. I wouldn’t begin to disagree. If readers choose to lean on RMI’s material and positions instead of my assessments and critiques, that’s completely reasonable. That doesn’t make them right. The appeal to false authority might be a logical fallacy in either direction.

On bias, neither the RMI or I have a venal predisposition to fossil fuels and hence hydrogen for energy for those reasons. We share a predisposition away from fossil fuels and for climate action. But the hydrogen team leader is a fossil fuel industry insider and long term hydrogen for energy guy. That shows in much of his positions and the publications and positions RMI has taken since he assumed the role.

Does this mean that my independence is necessarily less biased? Of course not. There are innumerable independent cranks out there who make it clear that iconoclastic independence isn’t remotely a precursor to rational, empirical analysis. And it doesn’t make me immune to the group think which has clearly caught the RMI hydrogen team in its web. I have my own networks of people who agree with me, even if the ties are more ephemeral. I’m as subject to the challenges of confirmation bias and bubbles, just a little less so than than the RMI hydrogen staff appear to be.

And I’m subject to specific criticisms related to bias. I am or have been on the advisory boards of two electrified aviation start ups. I’ve been a strategic advisor to a battery electrochemistry startup. It’s easy to point at those details and say I’m selling a perspective. Except, of course, that I came to my conclusions on batteries and aviation before taking those positions. Those positions were offered to me by deep professionals including electrochemistry PhDs because I’d done and published the hard analysis work from the fundamentals of science, math and economics, not because I was willing to pitch their perspective. I’ve turned down far more advisory roles than I’ve accepted. Does this make me a perfect and virtuous Spock-like creature? Of course not. It just counter balances an obvious criticism.