London, 11 January 2024, (Oilandgaspress): – In 2024, global growth is expected to slow slightly to 2.9% from 3.0% in 2023 as tight monetary policy continues to weigh on demand and investment, particularly in the first half of the year. This scenario is consistent with softer demand for oil, particularly in the advanced economies, and oil GDP growth in the GCC will remain a drag on headline GDP growth in 2024. We expect oil prices to average USD 82.5/b this year, similar to 2023.- Emirates NBD

BHP has signed an agreement with China’s HBIS Group Co., Ltd (HBIS), one of the world’s largest steelmakers, to trial direct reduced iron (DRI) production and utilisation of BHP iron ores in blends and progress a separate enhanced lump stage 2 trial aimed at lowering blast furnace (BF) carbon emissions. To support the development of alternate electrified pathways of steel production for a wider range of iron ores, under this new agreement, the parties aim to trial commercial-scale DRI production using BHP iron ores in blends at HBIS’s newly commissioned DRI plant and then evaluate the performance of the DRI in downstream steelmaking steps. The DRI plant uses hydrogen-rich gas byproducts in the steelworks to convert ore into a metallic iron product that is further refined for steel. Read full article

U.S. Department of Energy (DOE) Solar Energy Technologies Office (SETO) announced five winners of the American-Made Solar Data Bounty Prize, a competition designed to increase the accessibility of high-quality time-series datasets for photovoltaic (PV) systems. These types of datasets can be used to build, train, and optimize models designed for PV system simulation, which can provide more accurate performance estimates and better system designs. Improving the accuracy of PV system modeling lowers the risk of developing and operating those assets, which can attract more capital for deployment of PV power plants.

In the second and final stage of the prize, data owners submitted their entire datasets. Researchers at the National Renewable Energy Laboratory (NREL) analyzed more than 4 billion performance data points and scored the datasets according to a pre-defined rubric to select the following winners:

Grand Prize Winners

• Southern Power Company (Large PV System): $130,000

• Silicon Ranch Corporation (Medium PV System): $80,000

Runner-Up Winners

• Silicon Ranch Corporation (Large PV System): $50,000

• Island Way Technology, LLC (Medium PV System): $30,000

• Wexus Technologies Inc. (Medium PV System): $30,000 Read full article

Hydro moves to decarbonize casthouses by testing plasma technology with global potential

With the testing of emission-free plasma technology in the casthouse at Sunndal, Hydro is pursuing its goal to achieve zero CO2 emissions in aluminium production. Hydro has been granted soft funding from the Norwegian Government for a project that could have global impact on hard-to-abate industries.Re-melting aluminium into new products requires extremely high temperatures, an energy intensive process which is hard to achieve without fossil energy in the form of natural gas. However, new plasma technology will enable electrification of the process, using the same renewable energy that powers Hydro’s primary smelters. Read More

Norwegian parliament endorsed the Government’s proposal to open parts of the Norwegian continental shelf for exploration for and production of seabed minerals.

A final resolution will be made in the form of a Royal Decree. The Norwegian Offshore Directorate has contributed to the opening process, among other things by coordinating work on the impact assessment and preparing a resource assessment. We’ve mapped vast areas in the northern Norwegian Sea since 2017. We’ve taken samples and collected data about minerals and metals found on the seabed. We’ve done this by means of our own expeditions, and also in cooperation with expert communities at the universities in Tromsø and Bergen. Read full article

2023 was an active year on the Norwegian shelf. 92 fields were in operation at year-end, 27 projects were under development and many exploration wells were drilled.

Production was somewhat lower in 2023 than was expected a year ago. This is largely due to unplanned and extended maintenance shutdowns at multiple onshore facilities and fields.

The consequences for gas production were greatest during the summer months, when demand was lower. Production resumed full force starting from early autumn, with November and December being particularly good months for gas export.

Preliminary figures for December indicate a new export record for a single month, with just under 12 billion standard cubic metres gas.

The high activity level seen in 2023 will continue through 2024.

The Norwegian shelf will continue to play an extremely important role for energy security in Europe for many years to come.34 exploration wells were spudded in 2023. 23 of these were wildcat wells, where 14 discoveries were made.

It’s important that exploration be conducted around existing infrastructure so discoveries can be tied back and create value while the fields are still in operation.

Nevertheless, the Norwegian Offshore Directorate would like to see companies exploring actively in more frontier areas. In order to realise more of the resource potential, companies must to a greater degree commit to testing new ideas in frontier areas. Read More

GDP growth in Saudi Arabia slowed sharply in the first three quarters of 2023 to just 0.2% y/y, down from 10.0% y/y in the same period 2022. This was largely due to a -6.5% y/y contraction in hydrocarbon GDP on the back of oil production cuts, but non-oil GDP growth also slowed to average 3.5% in January -September. Trade and hospitality, and transport and storage sectors saw the fastest growth in the first three quarters of 2023, along with construction and social and personal services. For the year as a whole, we estimate non-oil growth of 4.0%, which was likely offset by a -8.5% contraction in oil and gas GDP, resulting in headline GDP contracting by around -1.3% in 2023. The expenditure breakdown of GDP shows private consumption spending grew 5.3% y/y in the first three quarters of 2023, slightly stronger than in the same period the previous year, while government consumption spending grew 6.3% y/y over the same period. Investment was also a key driver of non-oil growth with GFCF up 6.2% y/y in Jan-Sep, although this was much slower than investment growth over the same period in 2022. Net exports were the main drag on GDP last year, as exports contracted -5.5% while imports grew 7.8%. Read full article

The UAE economy proved remarkably resilient to weaker global growth and higher interest rates in 2023. While GDP growth did slow from the 7.9% recorded in 2022, both oil and non-oil GDP likely came in ahead of our forecasts. We had pencilled in a -2% contraction in oil and gas GDP in 2023, but Bloomberg oil production data shows the UAE produced 3.15mn b/d on average last year, almost unchanged from 2022, so we have revised our estimate for oil and gas GDP growth up to zero in 2023.

Non-oil sector growth came in at 5.9% y/y for the whole UAE in H1 2023, driven by growth of 9.2% y/y in Abu Dhabi’s non-oil sectors compared with Dubai’s 3.2% first half growth. Preliminary data for Q3 showed non-oil growth in Abu Dhabi slowed only slightly to 7.7% y/y, with average January-September growth of 8.7% in the emirate. PMI data point to an acceleration in activity in Q4 across the UAE, and there is likely upside risk to our 5.0% UAE non-oil GDP growth estimate for 2023. We estimate headline GDP growth of 3.6% last year. Read full article

Global growth slowed in 2023 off the post-pandemic rebound of 2022 and central banks continued to tighten monetary policy. The GCC was not immune to this weaker global backdrop, with headline GDP estimated at just 0.5% in 2023 from 7.6% in 2022. However, this largely reflected significant cuts to oil production over the course of last year, particularly from Saudi Arabia, and non-oil growth was much more resilient at 3.7% for the region in 2023, down from 5.3% in 2022.Non-oil growth in 2023 was underpinned by looser fiscal policy, with Saudi Arabia and the UAE increasing government spending by an estimated 9.5% y/y and 7.9% y/y respectively, even as budget revenues declined on lower oil prices and production. Population growth likely supported aggregate consumer spending, offsetting the impact of higher interest rates and cost of living pressures, while a continued rebound in tourism also boosted activity in transport and logistics, hospitality and retail sectors. Investment was likely also a key driver of growth across the region, with both government and private sector investment in strategic sectors and mega projects. Saudi GDP data showed gross fixed capital formation growth (GFCF) of 6.2% in the year to September, although this was front-loaded in H1 with GFCF contracting on a y/y basis in Q3. Read full article

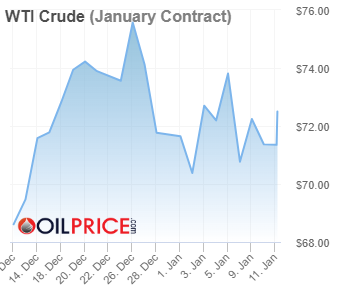

The U.S. Energy Information Administration (EIA) expects solar electric generation will account for 7% of total U.S. electricity generation in 2025, up from 4% in 2023, according to its January Short-Term Energy Outlook (STEO). U.S. crude oil production. Our forecast of crude oil production in the United States reaches 13.2 million barrels per day (b/d) in 2024 and more than 13.4 million b/d in 2025, both of which would be new records. Production growth continues over the next two years driven by increases in well efficiency. However, growth slows because of fewer active drilling rigs.

Crude oil prices. We forecast that the Brent crude oil price will average $82 per barrel (b) in 2024, about the same as in 2023, and then fall to $79/b in 2025, when we expect production growth will slightly outpace demand growth, allowing inventories to build modestly and place some downward pressure on crude oil prices. Recent developments in the Middle East increase the risk for supply disruptions over the forecast, which could result in higher and more volatile prices we currently forecast. One of this month’s Between the Lines articles takes a closer look at our 2024 and 2025 Brent crude oil price forecast.

Natural gas prices. We expect the spot price of natural gas to average $2.70 per million British thermal units (MMBtu) in 2024 and rise to an average of about $3.00/MMBtu in 2025, up from an average of $2.54/MMBtu in 2023. Prices increase because of slowing growth in natural gas production and increasing U.S. liquefied natural gas exports, particularly in 2025 following the addition of new export capacity in late 2024. However, we expect upward price pressures will be limited by relatively flat consumption of natural gas in the electric power sector and persistently high inventories. Read More

Offshore Oil & Gas Vessel Market Day Rates Approaching All-Time Highs

Full year 2023 data points for the offshore oil and gas vessel markets have been released by Clarksons Research onto Offshore Intelligence Network. Reviewing the data, Steve Gordon, Managing Director of Clarksons Research commented:

• Offshore oil & gas markets continued to strengthen in 2023, with the Clarksons Offshore Index (tracking rig, OSV and subsea dayrates) rising by a further 27% to a multi-year high of 106 points (2017: 45, 2008: 114, 2013: 101). Our projections suggest the Clarksons Offshore Index will reach all-time highs in 2024.

• Continuation of the supportive project investment environment, with $116bn of CAPEX for offshore oil and gas projects reaching FID (up 49% on the 10-year trend); we are projecting $125bn for 2024.

• Energy security focus supportive in short and medium term (offshore oil and gas provides 16% of global energy supply), energy transition trends to impact longer term.

• Offshore production reached 25.5m bpd of oil (up 3.0% y-o-y, 27% of global oil output) and 129bn cfd of gas (up 1.9% y-o-y, 32% of global gas supply).

• Rig, OSV and Subsea markets remain very strong, with rates now higher than 2014 levels in the majority of sectors/regions.

• Activity remains particularly robust in the Middle East, Brazilian and West Africa sectors.

• Supply side constraints continue, with limited newbuilding orders (only a handful of orders but increased interest) and ageing fleet dynamics.

• Trends across the major offshore oil and gas fleet segments:

o Rigs: Rig markets strengthened further, with demand growing by an additional 4% (Jack-Up: +2%, Floater: +11%) to stand at 540 units (JU: 395, FL: 145), now up 20% (91 units – JU: +56, FL:+35) since Q1-21. With supply constrained (612 units – JU: 450, FL: 162) at end-23, still 24% below 2014), overall rig utilisation firmed to a strong 88% (JU: 88%, FL: 90%). In turn, rig rates continued to strengthen; ‘leading edge’ floater rates surpassed the $500,000/day mark in Q4, while high-spec jack-up awards of >$160,000/day are becoming common. We estimate that the JU/FL newbuild orderbook has fallen to 16/19 units. Projections for Rig Supply/Demand and utilisation through to 2026 are available on request / Offshore Intelligence Network.

o OSV: The OSV sector enjoyed another firm year. Demand growth continued, with the number of active units (AHTS >4,000 BHP, PSV >1,000 dwt) rising to 2,452 by end-23, up 26% (~500 units) since 2020. OSV utilisation firmed to 73%, while PSV utilisation peaked at 78% in Q4. Our OSV Rate Index rose by a further 30% to stand at 180 points at end-23, a 15-year high and, given the short orderbook (79 boats, 2% of the fleet) and the increased time/cost intensity of reactivating long-term lay-ups, previous market peaks are in sight (2008: 199). Projections for OSV Supply/Demand and utilisation through 2026 are available on request.

o Subsea: Another strong year; our MSV Rate Index firmed to a seasonal peak of 104 points, a 10-year high.

o MOPU: 2023 saw further steady progress (11 awards of $6.5bn), with 2024 set to see a further step-up in activity (17 awards currently projected, including 8 FPSOs and 6 FLNGs). Read More

U.S. and British naval forces shot down 21 drones and missiles fired by Yemen-based Houthis on Tuesday towards the southern Red Sea, the United States said, with Britain hinting at further measures to protect international shipping lanes.(Reuters) Read More

Offshore Wind In 2023: Navigating Turbulence

Full year 2023 statistics for the offshore wind sector have today been released by Clarksons Research onto Renewables Intelligence Network. Reviewing the data, Steve Gordon, Managing Director of Clarksons Research commented:

• Despite offshore wind facing clear inflationary challenges in 2023, the sector showed some resilience as newly sanctioned project investment reached a record high globally ($59bn; 19.8 GW).

• While inflation added to the project CAPEX levels, firm investment was driven primarily by large FIDs in Europe, where a record $33bn (9.2 GW) was committed (+33% and +24% on the previous high of 2020 respectively).

• Active offshore wind capacity grew by 10% across 2023 to reach 68 GW globally at the end of the year; 6.2 GW of capacity was fully commissioned last year, while 48 GW was in the construction phase at the end of 2023 representing the highest total on record.

• Internationalisation continues, with 19 countries having active offshore wind capacity at the end of 2023 (projected to rise to 29 by 2030); Spain produced its first power from offshore wind last year, while the first offshore wind auction in Lithuania was held.

• Newbuild ordering diverged between ‘wind’ vessel sectors in 2023; ordering continued in the C/SOV sector, with 23 orders placed globally (following a record 24 in 2022), while WTIV ordering eased back (only 5 (1 International spec) WTIV orders were reported globally in 2023, following 30 (4 International spec) in 2022) amid a large orderbook intended for the Chinese domestic market and some uncertainty over increasing turbine sizes and project delays in Europe and the US.

• C/SOV owners continued to support charterers to be ‘green through the supply chain’; all 53 C/SOVs currently on order will be equipped with battery packs, while 13 will be alternative fuel capable (including 8 methanol dual fuelled units).

• Wind vessel markets strengthened in 2023:

o WTIVs: The European WTIV market enjoyed a firm year in 2023. European WTIV utilisation averaged a robust 93% during the peak season (and the fleet was fully utilised in Aug-23), while several charterers booked 4th generation WTIVs (currently on order) for upcoming projects at rates reportedly >€300,000/day (~30% above start-2023) with the International / European spec WTIV market expected to remain tight in 2024.

o C/SOVs: The ‘W2W’ market remained very tight across 2023. European ‘W2W’ rates (SPS coded, >40 Pax) peaked at a firm €56,000/day during Q2-23 (up 27% y-o-y) on the back of firm demand and limited available supply as some MSVs with temporary gangways returned to the oil and gas sector.

• The long-term outlook for growth of the offshore wind sector remains positive, and offshore wind looks set to play a vital role in the ‘Energy Transition’; by 2030, ~250 GW (~30,000 turbines, 720 farms) is projected to be active globally, and offshore wind could account for between 7-10% of the global energy mix by 2050 (up from just 0.4% today). Read More

BMW (BMWG.DE) is investing 650 million euros ($711 million) to convert its main plant in Munich to exclusively produce EVs from the end of 2027, the carmaker said on Wednesday, a major stepping stone in the transition to the electric age. Read More

Lamborghini presents Telemetry X, an innovative ‘track connectivity’ concept that can be applied to the future range of super sports cars produced in Sant’Agata Bolognese. The unveiling took place at the Las Vegas Consumer Electronics Show (CES) at the Accenture Innovation Hub, where Stephan Winkelmann, Chairman and CEO of Automobili Lamborghini, commented: “Innovation is at the core of our DNA, as we have recently demonstrated with the Revuelto[1], a super sports car that is groundbreaking in every way, and the Lanzador fully-electric concept car. In the near future, our supercars will increasingly offer not just thrills but truly immersive driving experiences. Telemetry X is a perfect preview of the connected services our customers will be able to experience in the coming years.”

The application of racing-derived digital technologies coincided with the 2020 debut of the Huracán STO, the first Lamborghini super sports car equipped with a telemetry system that can be used via the Unica app. With Telemetry X, Lamborghini anticipates a future immersive track driving experience based on the synergy of three systems developed in collaboration with Accenture: the Real Time Remote Garage (remote coaching), the Biometric Data System, and the Digital Co-Pilot.

“Telemetry X is a clear demonstration of how experience gained in motorsport can find applications for road-going super sports cars, with the aim of maximizing our customers’ experience on the track as well,” commented Rouven Mohr, Lamborghini Chief Technical Officer. It’s no coincidence that we chose the Revuelto as the testbed for this technological demonstrator, a car that is totally unique precisely because of the introduction of breakthrough technologies.”

The Remote Garage is a web application that, thanks to 5G technology, enables drivers to have real-time video recordings of their on-track performance and telemetry available at all times. Images and data can be monitored live by a coach, who can be anywhere in the world, to give the customer-driver feedback and suggestions not only after but also during the driving session. Thus the Remote Garage philosophy is to provide an even more complete and engaging track experience while enhancing the driver’s performance, ensuring fun driving based on a user-friendly approach.

The Biometric Data System captures certain of the driver’s biometric data, including heart rate and stress level, to allow more in-depth performance monitoring and provide useful references on how they can refine their training.

Both systems work in synergy with the Digital Co-Pilot, the proactive voice assistant that compares both biometric and vehicle data to give feedback to the pilot while driving on the track. For example, the Digital Co-Pilot analyzes lap times and provides useful pointers for improving racing lines and braking points, as well as information on the performance of the car on the track. Read More

| Oil and Gas Blends | Units | Oil Price US$/bbl | Change |

| Crude Oil (WTI) | USD/bbl | $72.11 | Up |

| Crude Oil (Brent) | USD/bbl | $77.56 | Up |

| Bonny Light | USD/bbl | $77.99 | Down |

| Saharan Blend | USD/bbl | $78.99 | Down |

| Natural Gas | USD/MMBtu | $2.99 | Down |

| OPEC basket 10/01/24 | USD/bbl | $78.28 | Down |

Vestas wants to become a leader in offshore wind, supporting Europe’s build-out of offshore wind parks, and we are excited to announce our plans to establish a new blade factory in Szczecin, Poland. The factory is planned to produce blades for Vestas’ flagship offshore wind turbine, the V236-15.0 MW, and is expected to start operations in 2026, creating more than 1,000 direct jobs. Together with Vestas’ previously announced plans to establish an assembly factory for offshore nacelles in Szczecin, Vestas’ manufacturing footprint could increase with more than 1,700 direct jobs by 2026.

“Vestas intends to lead the development of a sustainable supply chain in Europe that can deliver the scale needed to meet the expected growth in demand for offshore wind. Our plans for two new offshore factories in Poland underline that Europe can spur wind industry investments and green jobs with the right long-term policy commitments for offshore wind projects,” says Tommy Rahbek Nielsen, Vestas COO.

“Poland is transforming its energy system and is a promising wind energy market with good wind conditions both onshore and offshore. Poland has a highly skilled labour force and growing wind industry that can become an offshore hub for the Baltic Region and the rest of Europe. We have been a market leader in Poland for more than 20 years, and I am honoured to announce our next investment plans in Szczecin,” says Nils de Baar, President of Vestas Northern & Central Europe.

The new offshore blade factory is planned to be located at a site in northern Szczecin, which Vestas acquired in February 2023. The site is close to the Ostrów Brdowski Island in Szczecin where Vestas’ planned nacelle assembly factory would be located. The assembly factory is expected to start operations in 2025 and create 700 direct jobs.

The new factories are planned to support European and to some extent global demand, playing a crucial role in supporting Poland and the European offshore wind market and industry. With the two new factories in Szczecin together with Vestas’ already existing footprint, Vestas is expected to soon employ more than 2,500 people in Poland.

Vestas’ manufacturing footprint strategy is to prioritise markets where there’s long-term certainty around market conditions and we have secured a sustainable order volume. Other locations where those conditions are met are also being considered for new capacity. Read full article

Mandatory Notification of Trade – Exercise of existing Restricted Share Units (RSUs)

Under BW Energy’s Long Term Incentive Plan (LTIP), 171,995 RSUs from the prior years’ grants have been vested and exercised. In accordance with the terms and conditions of the RSUs, the Board of Directors have decided to settle the RSUs in cash. The cash settlement is equal to the number of vested restricted share units multiplied by the closing share price of the share on the stock exchange on which the shares are traded as of the Settlement Date. The share price for each of the exercised RSU is NOK 26.90 (the Settlement price).

The total settlement of the cash amount is allocated as follows:

• Carl K. Arnet, Chief Executive Officer has exercised 86,333 RSUs and will receive NOK 2,322,385 in cash settlement at Settlement Price. Following this, Mr. Arnet controls 3,821,127 shares in the Company and holds 43,167 RSUs and 2,350,000 options.

• Knut R. Sæthre, Chief Financial Officer has exercised 28,554 RSUs and will receive NOK 768,103 in cash settlement at Settlement Price. Following this, Mr. Sæthre controls 100,763 shares in the Company and holds 14,277 RSUs and 446,500 options.

• Thomas Kolanski, Chief Commercial Officer, has exercised 28,554 RSUs and will receive NOK 768,103 in cash settlement at Settlement Price. Following this, Mr. Kolanski controls 873 shares in the Company and holds 14,277 RSUs and 446,500 options.

• Thomas Young, Chief Strategy Officer has exercised 28,554 RSUs and will receive NOK 768,103 in cash settlement at Settlement Price. Following this, Mr. Young controls 37,855 shares in the Company and holds 14,277 RSUs and 446,500 options.

Following this settlement, the Company will have a total of 85,998 outstanding RSUs and 4,670,400 options. Read full article

Woodside Energy Group Ltd (Woodside) welcomed the opportunity to contribute to the Australian

Government’s development of a Future Gas Strategy (the Strategy). With more than 200 submissions made to the Australian Department of Industry, Science and Resources (DISR)’s consultation process, there is a growing recognition in the community of the pivotal role of gas at a time when access to secure, affordable and reliable energy supply is becoming increasingly challenged in a volatile and uncertain world. As many submissions identified, gas will play a key role in a responsible energy transition. This was acknowledged by local and state governments, manufacturers, regional customers, power generators, think tanks and policy experts, business and industry groups, and unions. Woodside supports all four objectives of the Strategy and sees them as interrelated goals: providing affordable and reliable energy for Australians; maintaining strategic partnerships and energy security in our region; and simultaneously progressing decarbonisation of our trading partners and decarbonisation in Australia. Australia has the natural resources to support both the renewable and non-renewable energy developments which will be needed as populations increase and energy consumption rises. These natural endowments provide Australia with an opportunity to be a regional and global leader in the energy transition. But we must get the policy settings right to embrace the opportunities presented by a strong Australian gas industry. The industry needs fiscal and regulatory stability if it is to continue to take investment risks and develop Australia’s resources. Government must also provide certainty to workers and businesses, including the Australian manufacturing sector, on the medium- and long-term role of gas so they can make decisions and invest with confidence. Woodside’s submission has put forward practical and constructive short- and medium-term recommendations that address this and other issues impacting the gas industry. Read full article

Toyota would like to express our deepest condolences and sympathies to all those affected by the Noto Peninsula Earthquake.

In response to the situation, Toyota Motor Corporation has decided to provide the following emergency aid.

Provision of supplies to disaster-affected municipalities, lending of vehicles, etc.

In cooperation with vehicle dealers, Toyota Rental & Leasing stores, and Toyota Mobility Parts, we will provide relief supplies, vehicle loans, and disaster relief volunteers to the affected municipalities etc. We will work to provide appropriate support while carefully identifying what sort of aid is needed the most.

Donations and relief funds

A total of 50 million yen will be donated to the Japanese Red Cross Society, the Central Community Chest of Japan, and Japan Platform, a specified nonprofit organization.

In addition, we will also donate the amount of money raised through our employees’ fundraising activities to support the disaster-affected areas. We will continue to provide aid that is needed by consulting with the government, local governments, and support groups, as well as carefully confirming the local situation. We sincerely hope for the earliest possible restoration of the affected areas. Read full article

U.S. Rig Count is down 1 from last week to 621 with oil rigs up 1 to 501, gas rigs down 2 to 118 and miscellaneous rigs unchanged at 2.

Canada Rig Count is up 39 from last week to 125, with oil rigs up 31 to 58, and gas rigs up 8 to 67.

International Rig Count is down 23 rigs from last month to 955 with land rigs down 23 to 735, offshore rigs unchanged at 220.

The Worldwide Rig Count for December was 1,739, down 55 from the 1,794 counted in November 2023, and down 95, from the 1,834 counted in December 2022.

| Region | Period | Rig Count | Change |

| U.S.A | 05 January 2024 | 621 | -1 |

| Canada | 05 January 2024 | 125 | +39 |

| International | December 2023 | 955 | -25 |

Golar LNG Limited announces that FLNG Gimi arrived at the GTA field offshore Mauritania and Senegal on January 10, 2024. Golar has notified bp of FLNG Gimi’s arrival. Following completion of all preparatory activities FLNG Gimi will be maneuvered to her berth at the hub and for her subsequent connection to the feed gas pipeline. Golar and bp have agreed that FLNG Gimi will proceed to moor offshore Tenerife while awaiting completion of the necessary preparatory activities.

Golar CEO Karl-Fredrik Staubo commented: “Golar is pleased to see that the FLNG Gimi has arrived at the GTA field offshore Mauritania and Senegal, her home for the next 20 years. We are excited to integrate the Golar FLNG Facility with the GTA hub, and starting the next phase of our long-term relationship with bp and the GTA partners into LNG production.” Rahman Rahmanov, bp’s vice president projects for Mauritania & Senegal commented: “This is a major step forward for overall delivery of the GTA1 project in Mauritania and Senegal. Safely achieving this milestone is a result of great teamwork.” Read More

Oil and Gas News Undiluted !!! �The squeaky wheel gets the oil�

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas,

Subscribe to Oil, Gas, Energy News Release Service