Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Following up on my detailed report on the top electric vehicle models in the world, let’s look now at the top auto brands and OEMs in terms of EV sales.

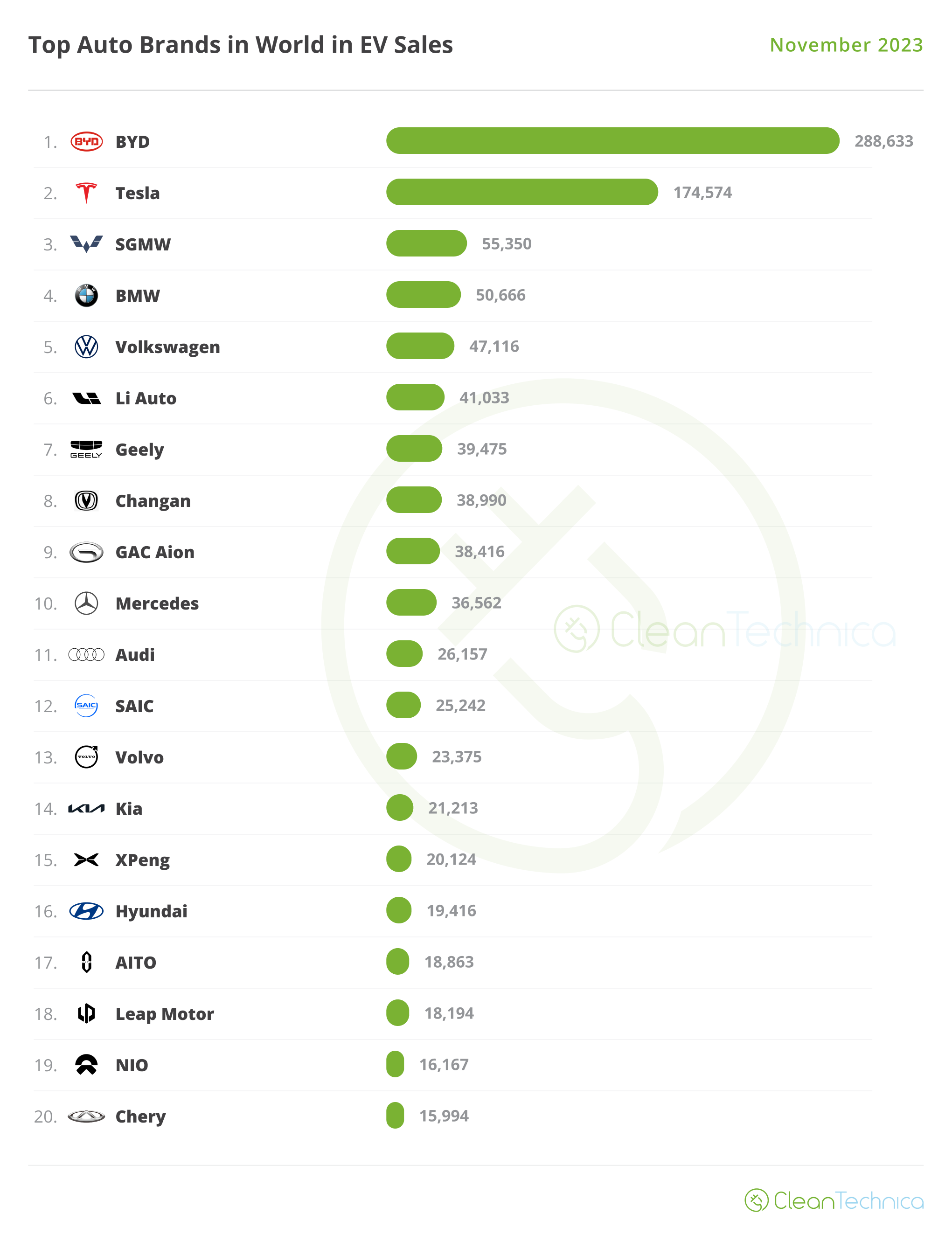

Top Selling Brands

In November, BYD continued at record levels, thanks to a 289,000-unit performance. Tesla went back to its normal self, delivering 174,000 units. That was 14% above the same period in 2022.

Below the top two galactics, we have the SGMW JV ending the month in 3rd, banking on the newfound success of its dynamic duo (Wuling Mini EV & Bingo) to end ahead of the competition.

Both #4 BMW and #5 Volkswagen had year best results, with 50,666 units and 47,116 units, respectively, which could be an indicator of record results in December for the two German makes.

#6 Li Auto continues to go from strength to strength, with yet another record month, its 8th in a row. Li Auto had over 41,000 registrations thanks to record results across the lineup. With the startup brand still supply constrained, expect the high-end company to continue beating records regularly in the foreseeable future. Especially when the midsized L6 SUV and L5 sedan land sometime next year. Oh, and the cherry on top of Li Auto’s cake is a certain bullet train Mega MPV … with mega specs.

Just below it, #8 Changan again hit a record month, around 39,000 units, much thanks to the success of the little cutesy Lumin and the Deepal S7 SUV. Another record performer was #7 Geely. Thanks to great results across the board, not the least the record score of the Panda Mini, and also the 8,473 units of the Galaxy L7, Geely delivered over 39,000 units!

Still on Geely’s galaxy of brands, Zeekr’s performance hasn’t gone unnoticed. Its record 13,124 registrations haven’t quite allowed it to have a top 20 presence, but once the 007 secret agent lands, that will become just a matter of time.

While the 007’s design is something of an acquired taste, just like vodka martini (shaken, not stirred…), its specs offer no doubt that they have a license to kill anything in the model’s segment — Teslas included. (Okay, I promise to stop with the James Bond analogies now….) The base version has 688 km CLTC range (606 km for the base Model 3) and charging can add 500 km in 15 minutes, while the Long Range version has 870 km CLTC range (713 km for the Model 3 AWD). The base version starts out at RMB 209,000 (260,000 for the base Model 3). Expect the new Zeekr model to sit firmly in the 2024 edition of the top 20, with a top 10 presence not to be excluded from possibility.

Volkswagen’s premium brand, Audi, scored a year-best result, 26,157 registrations. But in the private race between the Three Marys (BMW, Audi, & Mercedes), the four-ring brand is still in last place, and far below leader BMW. BMW scored an extra 24,000 units in the same period. The reason? While Audi has only three EV models, of which only the Q4 e-tron and Q8 e-tron can be considered volume models, BMW has twice as many volume models on sale (iX1, iX3, i4, iX, and don’t forget the Chinese i3). Even if BMW doesn’t have a star player like the Audi Q4, the combination of those models is enough to easily outsell Audi. The upcoming Audi A6 e-tron and Q6 e-tron are badly needed….

Two big surprises were #15 XPeng, which had its 2nd record result in a row, 20,124 registrations. The company saw its SUVs, the midsize G6 and fullsize G9, shine. Seemingly coming out of nowhere, AITO jumped into #17, thanks to a record 18,863 registrations, and while 81% of that result came from the M7 model, with the XXL-SUV M9 starting its career soon and a deep refresh announced to the midsize M5 sometime in the first half of 2024, expect this Huwaei-backed EV brand to become something big. As the current 100,000 orders for the M7 model prove, the Chinese tech company has more than enough muscle to make AITO essentially a second Li Auto. Expect this brand to be one of the surprises of 2024….

Another OEM on the rise was Chery, one of the EV pioneers in China. Thanks to the good result of its QQ Ice Cream model, the brand scored 15,994 registrations, its best result in over a year. That provided it with a table presence, after a long absence in the top 20. Notably, Chery was the 12th Chinese brand in this top 20.

But some of the more interesting stories in this ranking lie just below Chery. While #21 Ford lost a ranking presence by just 51 units, it was still the USA’s best selling legacy brand, ending ahead of #2 … Buick. Yep, despite GM’s best efforts in the USA, from Chevrolet and Cadillac, it is Buick, thanks to its Chinese operations, that is the only relevant GM brand globally. That’s thanks to the aforementioned Velite 6 compact wagon (a model that contradicts EVERYTHING that GM stands for in the USA), a record result, and the good result of the recent Buick Electra E5 (5,915 registrations) in China. The Electra E5 is a model that is related to the American-made Chevrolet Equinox EV. If General Motors will have any relevance in a future EV-based automotive market, it will be thanks to its Chinese operations. Just food for thought….

Finally, besides Geely’s and Zeekr record results, there is another brand from the Chinese OEM that deserves a mention. The singular Lynk & Co brand also scored a record result, 14,647 registrations, contributing to the current rise of Geely Group. But more on that later….

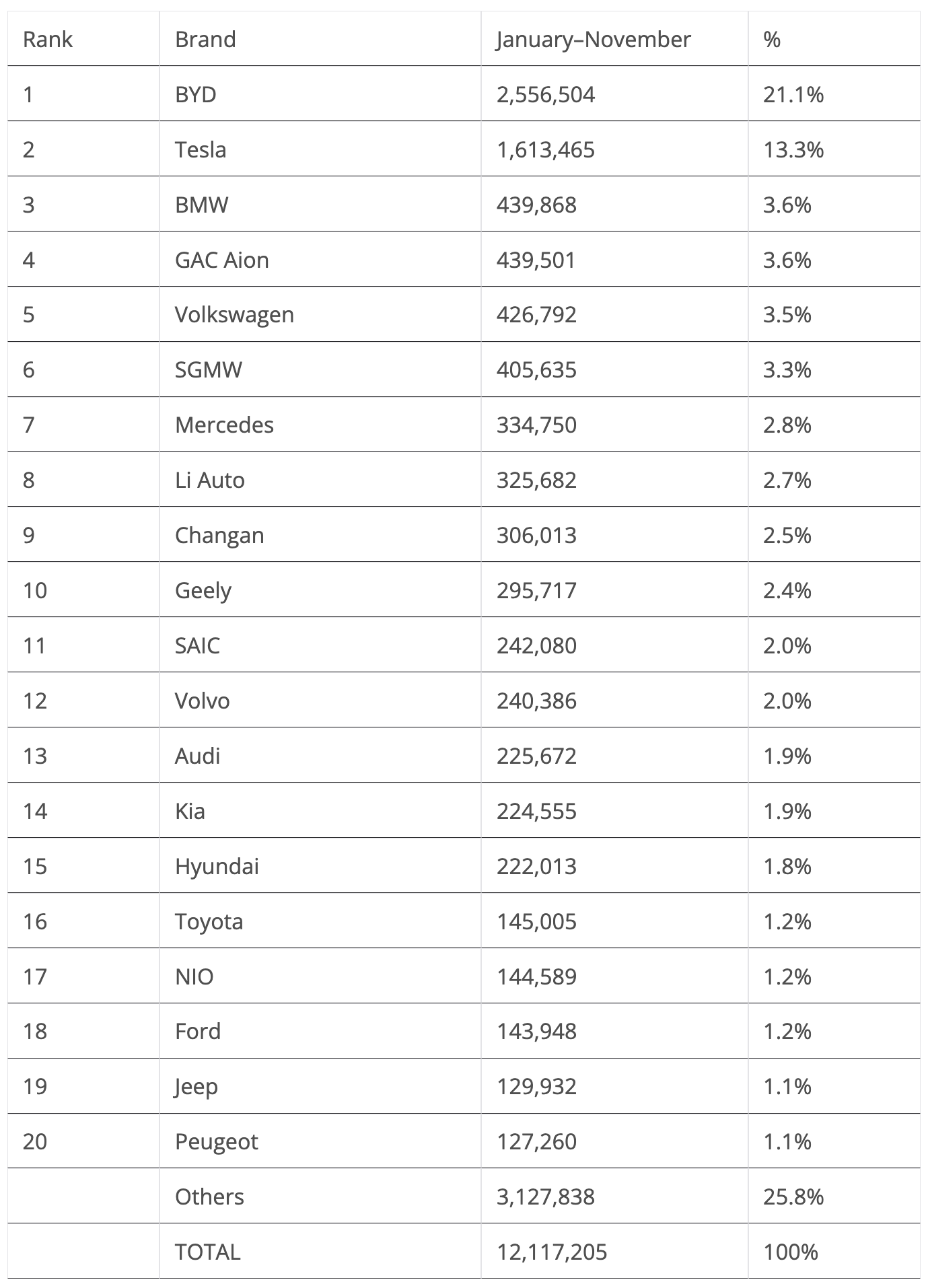

In the YTD table, there isn’t much to report regarding the top two positions. BYD is well ahead of Tesla, and both are in a galaxy of their own. The two makes together are responsible for more than one third of the global plugin vehicle market.

Far below these two, which are really in a league of their own, there was a position change in the NTNB (not Tesla, not BYD) leadership. Thanks to a year-best score in November and also a below-expectations result from GAC Aion, BMW returned to the 3rd position and is now the favorite to take bronze in the 2023 edition of the manufacturer race. That would be the Bavarian’s second podium presence ever, after its 2016 bronze medal.

But with only 300 units separating BMW from #4 GAC Aion, anything can still happen and the Chinese brand can still celebrate its first podium presence. It just needs to beat the German make in December….

Coming back to November, the first half of the table does not have a lot to talk about, with the main point of interest being the #7 spot, where Mercedes could be pressured in December by a rising Li Auto. The Chinese startup is breaking records every single month, so it could end up surpassing the German make in the last days of the year.

The remaining position change also came from Germany, where Audi surpassed both Koreans, Hyundai and Kia, to take the 13th spot. This also serves a sort of warning to Hyundai–Kia. Besides having good EVs, you need to produce them at a large scale and with competitive pricing, or else someone will steal your cake.

While there weren’t that many changes in November, the last month of the year should have more fluctuations, especially down below, where #17 NIO is close to surpassing Toyota. The Japanese make will possibly be surpassed by #18 Ford, too. The last two positions on the table should also have changes, as both #19 Jeep and #20 Peugeot could be surpassed by a rising Leap Motor, currently in #21 with 127,245 units, which is just 15 units behind the French brand. Interestingly, Leap Motor recently partnered with Stellantis, Jeep’s and Peugeot’s Mothership. Interesting coincidence, isn’t it?

We can’t also exclude #22 XPeng from joining the race. Despite being 5,000 units behind #20 Peugeot, it is on the rise. The startup brand could also create a last-minute surprise.

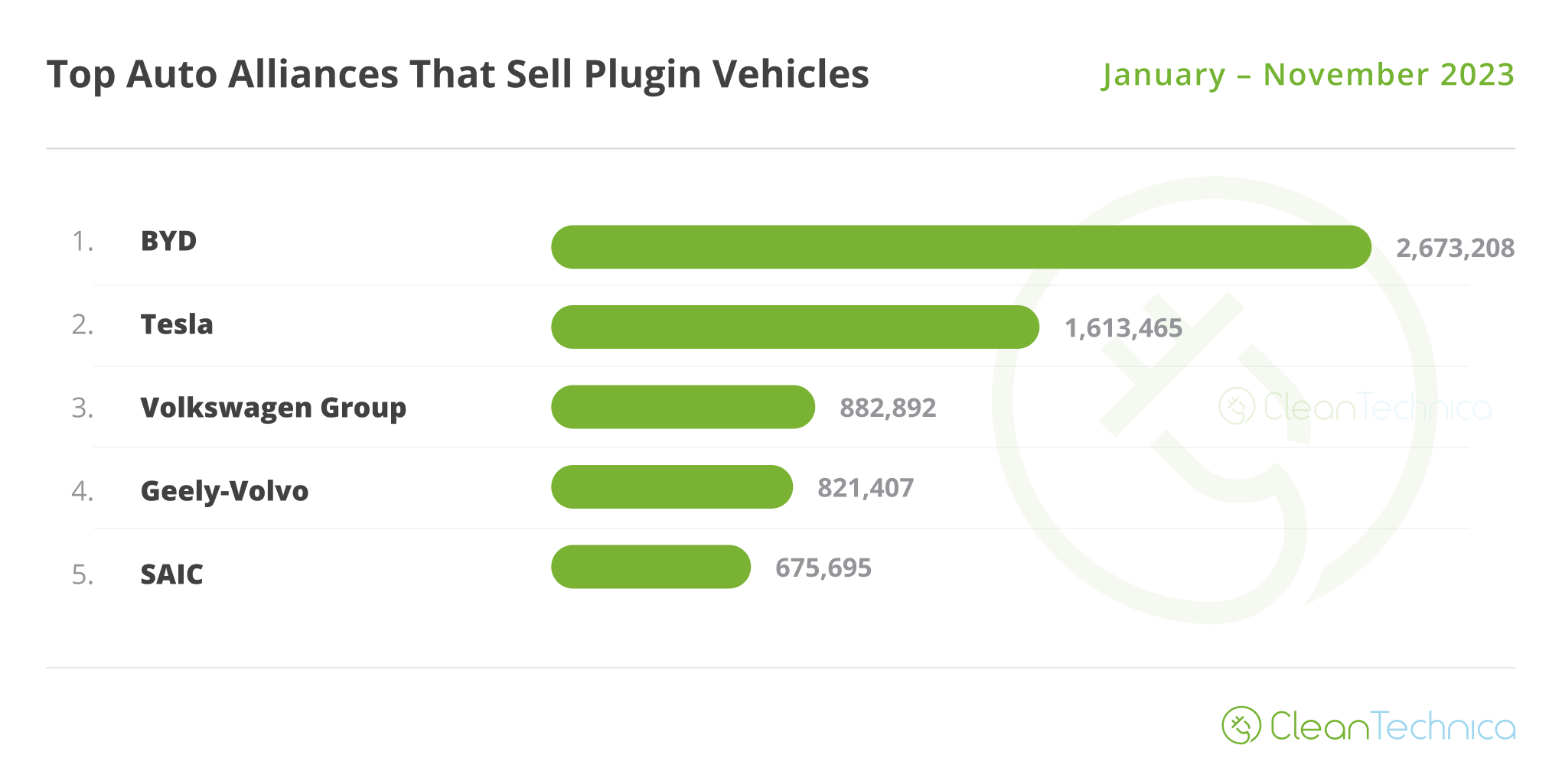

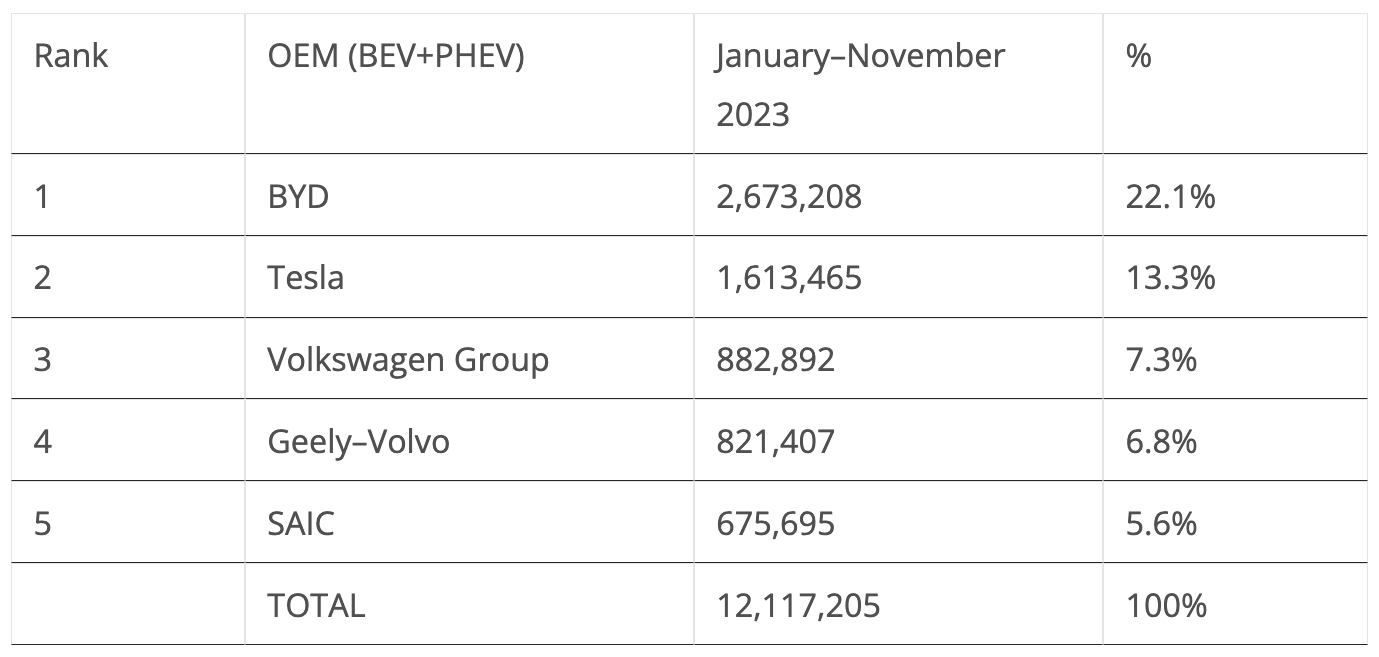

Looking at registrations by OEM, leader BYD was stable at 22.1% share, while Tesla was down by 0.q%, to 13.3% share.

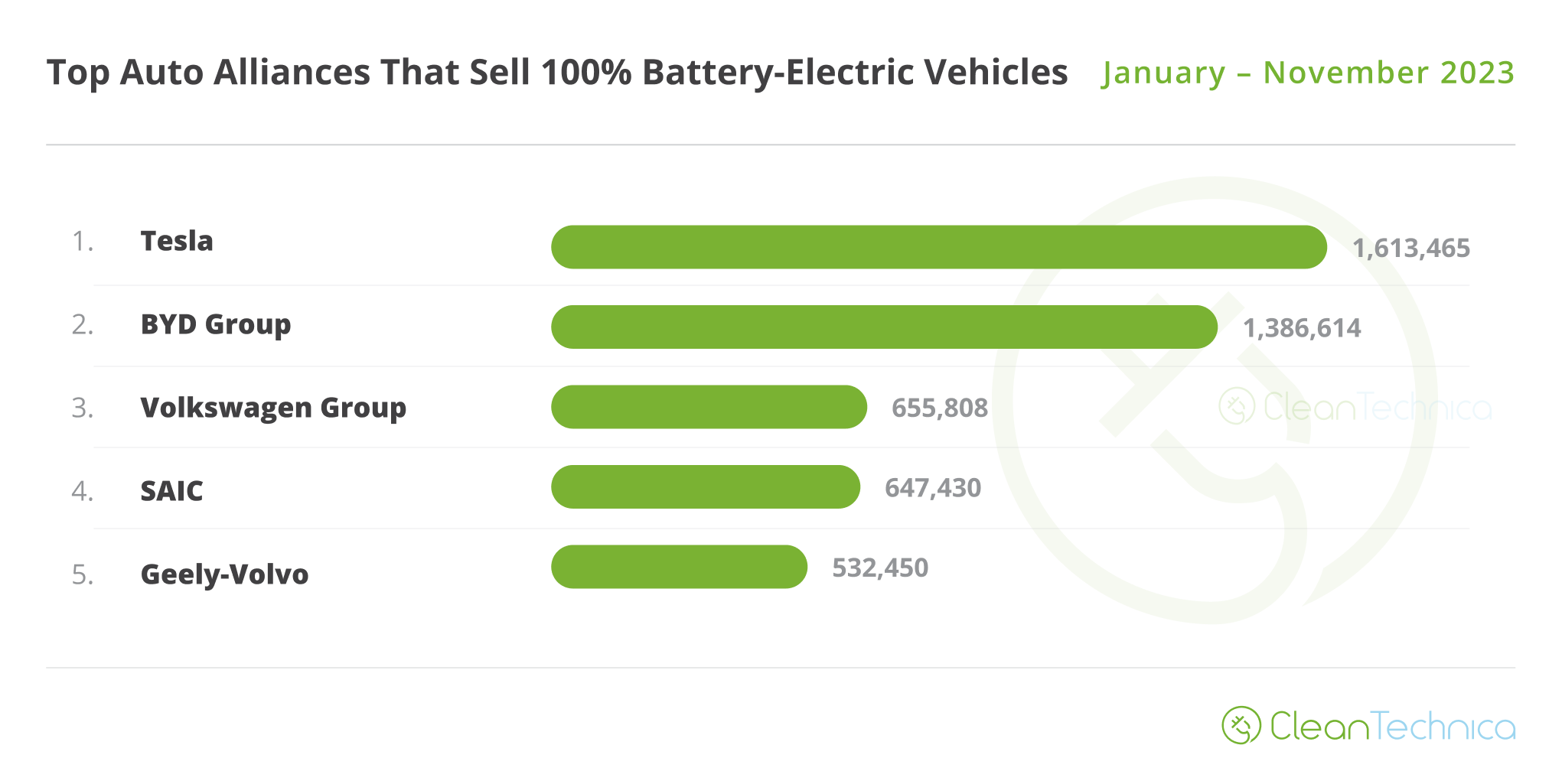

3rd place is in the hands of Volkswagen Group (7.3%), which is keeping itself a good distance ahead of rising #4 Geely–Volvo (6.8%, up from 6.7%). The Chinese OEM profited from great performances with several of its brands, starting at Geely, passing by Lynk & Co, and ending at Zeekr.

While we are too close to the end of 2023 to see the Chinese conglomerate pressure #3 Volkswagen Group, the 2024 race should see an interesting duel between these two in the race for the NTNB title.

As for #5 SAIC (5.6%, up from 5.5% in October), the share drop stopped and seems to be reversing. That was not the case for Stellantis, which is stable in 6th position but saw its share drop by 0.1% to 4.3%.

Below the multinational conglomerate, things are more interesting. #7 BMW Group (4.1% share) kept its position, and even gained ground over #8 GAC (3.9%, down 0.1%) and #9 Hyundai–Kia (3.8%, down from 3.9%).

Looking at where the ranking was a year ago, we can see that both of the top two brands gained share, 3.7% in the case of BYD and 0.3% in the case of Tesla. The other beneficiary was Geely–Volvo, which added 0.7% of share on the way.

On the losers side, Volkswagen lost 0.7% share year over year (YoY), while SAIC dropped 1.8 points in share, from 7.4% a year ago to its current 5.6%.

Comparing the YTD share in the 2nd month of the current quarter (November), with the second month of the 3rd quarter (August), the main winner in these last three months was Geely, that gained 0.7% share, from 6.1% to the current 6.8%, while the biggest loser was Tesla, that lost 1.1% share, from 14.4% in August, to the present 13.3%.

Looking just at BEVs, Tesla remained in the lead with 19.2%, down from 19.3% in October. The US make still has a comfortable lead over BYD (16.5%, up from 16.3%) thanks to the US automaker gaining a significant lead in the first half of the year.

Next year, however … it isn’t much a question of if, but more of when. I do not expect it to happen in Q1, as the Chinese market will have new year festivities that will surely slow down BYD’s sales, but Q2 should probably signal the inflection point where BYD surpasses Tesla in the BEV race. (Editor’s note: BYD passed Tesla in BEV sales in the 4th quarter, but just for the quarter. Tesla ended the year at #1 across the 12-month period. Jose’s comments here presumably concern leadership in a YTD ranking.)

In the last place on the podium, Volkswagen Group (7.8%) lost precious ground to SAIC (7.7%, up from 7.6%). Expect an entertaining race between these two in the last stage of the race.

In 5th, Geely–Volvo consolidated its position, growing from 6.2% share to its current 6.3% share, all while #6 GAC lost share, from 5.6% in November to its current 5.4%.

Finally, comparing the current picture with what happened a year ago, Tesla’s rise is evident (+1.1% share), but not as impressive as BYD’s — the Chinese EV giant gained a relevant 3.8% market share. Geely–Volvo’s market share grab (+1.2%) is also impressive, especially since it started from a much smaller base.

What about 2024?

BYD and Tesla will continue to grow, albeit moderately:

- The Chinese brand is already reaching its natural limits in China, and it is harder to add significant volumes in export markets than it is to do so in one’s domestic market. I guess BYD’s main goal for 2024 is to grow without decreasing margins, hence the recent bets on high-end brands.

- Tesla is limited by an aging/maturing lineup, without many growth prospects. The only recently introduced model, the Cybertruck, is still deep in Production Hell. Even if it adds some 100,000–200,000 units in 2024 to the OEM’s sales, that will be less than 10% of the company’s total sales volume, so is hardly enough to move the needle. Significant growth should only come in 2025 once the compact model is said to land.

Volkswagen Group and SAIC will probably remain close to each other, but will likely be competing for 4th position, not 3rd anymore. That’s because, right now, Geely–Volvo seems unstoppable. With growth prospects from almost every brand they have (Geely’s expanding Galaxy sub-brand, Volvo’s EX30 and EX90, Zeekr’s 007, Lynk & Co’s upcoming BEV models, and Polestar’s 3 & 4, just to name a few), expect it to become one of the winners of 2024, placing it as a comfortable bronze medalist in the BEV ranking.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Our Latest EVObsession Video

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

CleanTechnica uses affiliate links. See our policy here.