Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

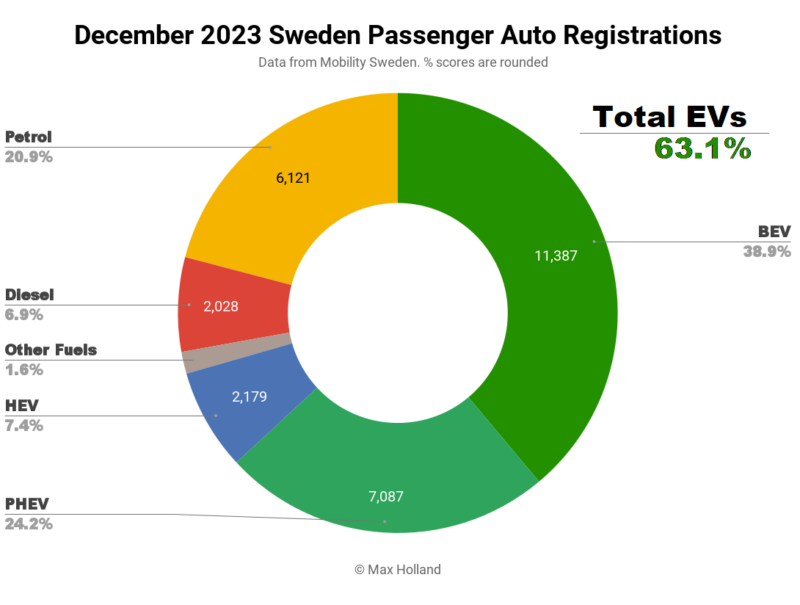

December saw plugin EVs take 63.1% share in Sweden, down YoY from the record 74.7% of December 2022, which was boosted by a pull forward ahead of January incentive cuts. BEV volumes in full year 2023 were up 17.9% compared to 2022, though PHEV volumes fell. December’s overall auto volume was 29,274 units, down some 17% from the December 2022 pull forward. The Volkswagen ID.4 was the bestselling BEV in December, the Tesla Model Y was 2023’s bestseller.

December saw combined EVs take 63.1% share in Sweden, with full battery electrics (BEVs) at 38.9%, and plugin hybrids (PHEVs) at 24.2%. These figures compare against 74.7% combined, with 51.4% BEV, and 23.3% PHEV, year on year.

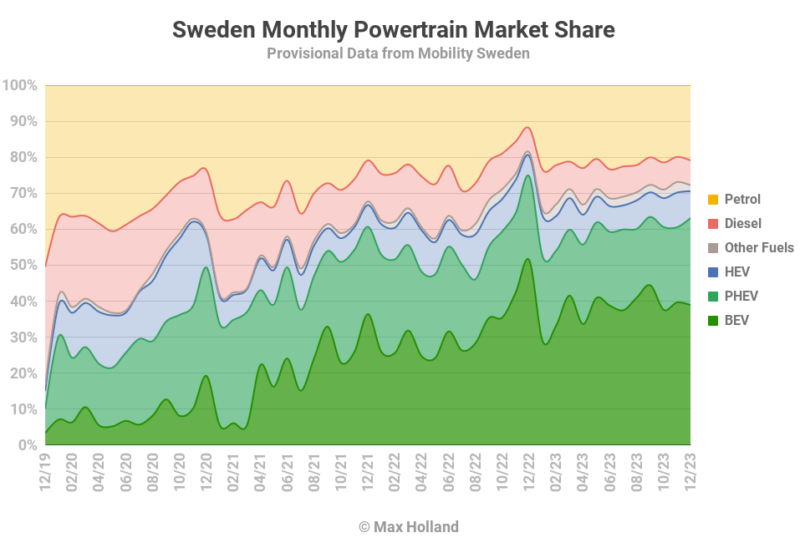

The year on year comparison seems unfavourable, until we remember that December 2022 saw a huge pull forward ahead of a planned 33% reduction in the BEV bonus from January 1st 2023. This also created a hangover in the early months of 2023, impacting 2023’s totals. Nevertheless 2023’s full year BEV sales summed to 112,084 units, a growth of 17.9% over 2022’s 95,035 total (and almost double 2021’s 57,466 total). This is against the background of 2023’s flat overall auto market (up just 0.6% compared to 2022), at 289,610 units. The BEV growth came despite Sweden’s economic recession in 2023, and despite average BEVs still costing more than their plugless peers.

If we set aside the Q4 2022 and Q1 2023 numbers, which were distorted by the pull-forward and hangover, the Q2 and Q3 total for 2023 was 70,889 BEVs, up almost 50% from the 47,450 units sold during the same period in 2022. Then again, it could be argued that the 2022 figures were still suppressed by supply chain delays, so weigh this comparison for yourself. In my view, the underlying trend of the EV transition in Sweden is tracking to continue “as normal” despite the various recent disruptions to incentives. The arrival of several more affordable BEVs models in 2024 should keep sales strong.

Full year Diesel-only sales fell by almost a 30% compared to 2022, to under 24,000 units, and are tracking to reduce to only single-digit thousand sales (and under 3% share) by 2026. Petrol-only sales were flatter, down just 1% compared to 2022, but this should change with 2024’s arrival of more affordable BEVs. Most of Sweden’s top 30 petrol-only vehicles are towards the compact/value end of the market – and need similar BEV options in order to displace them.

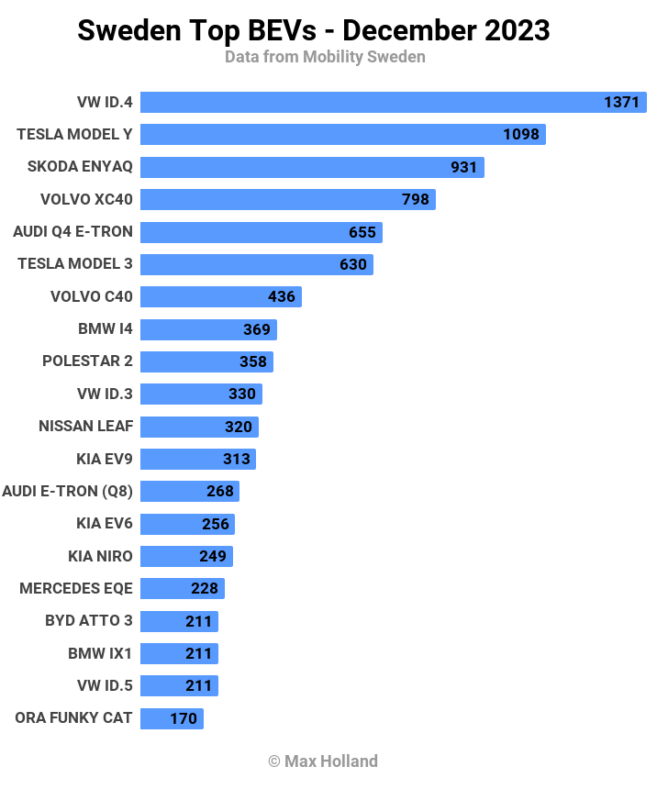

Best Selling BEVs

December saw the Volkswagen ID.4 once again take the top sales spot, ahead of the Tesla Model Y, and Skoda Enyaq. The members of the top 5 have been fairly stable over the past few months, albeit with some shuffling in their rankings.

In the top 20, a relative push was seen by the Tesla Model 3, with volume almost equal to the sum of its past 5 months. The Volvo C40 also saw a decent push, and its highest volume since May.

Down in 12th, the new Kia EV9 continues to impress, with a second month above 300 sales, having debuted only in October. Outside the top 20, the new VW ID.7, which debuted in November with 72 units, had a more modest month in December, with 44 units. The Xpeng G9 continued to slowly ramp from its September debut, with 69 units in December.

There were two all new model debuts in December. The Volvo EX30 started strong, with 81 initial units. This is a premium compact SUV of 4,233 mm length (close to the Hyundai Kona or VW T-Roc), starting from SEK 429,000 (€38,400) in Sweden. That entry price gets you a 49 kWh (usable) LFP battery with a range of 344 km (WLTP).

If you want more range, you can step up to a 64 kWh (usable) NMC battery with 475 km (WLTP), though that one starts from SEK 489,000 (€43,700). DC charging on all variants is good, at 26 minutes 10-80%, and all are speedy, with 0-100 km/h in under 6 seconds. For comparison, the very popular Kia Niro (64 kWh usable) costs from SEK 479,000, though is a bit larger (4,420 mm), with less performance, and much slower charging (41 minutes 10-80%). Let’s see how the new EX30 gets on in its home market. I expect it will enter the top 10 as soon as supply volume is available, and perhaps challenge for the top 5.

The other new debut in December is the BYD Seal, which saw an initial 12 units delivered. The Seal is a mid-large (4,800 mm) sedan, with pricing and performance roughly similar to the Tesla Model 3. The Seal has slower recharging times, but the base version has a larger battery and longer WLTP range, than the base Tesla (570 km vs 515 km). The interior is also more traditionally equipped, buttoned, and furnished than the Tesla. The BYD LFP “Blade” battery is famously robust, and should last for over 3,000 cycles (over 1.5 million km in this vehicle). Let’s see how the Seal gets on in Sweden.

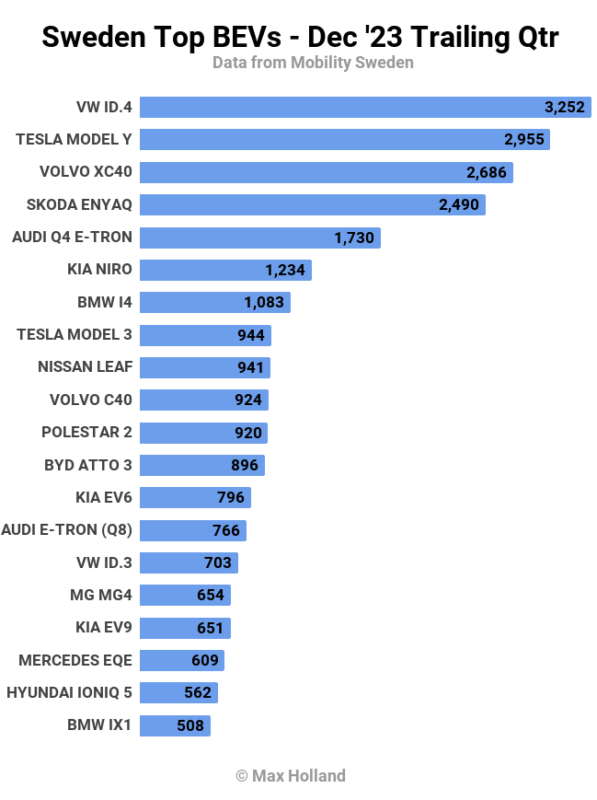

Let’s now turn to the trailing 3 months chart:

Here, the top 4 spots are all closely competed, more so than in most other European markets. The Volkswagen ID.4 and Tesla Model Y have swapped positions from the previous period (July to September). Most of the top 5 is similar to previously, though the BYD Atto 3 has left the chat, and the Audi Q4 e-tron has joined.

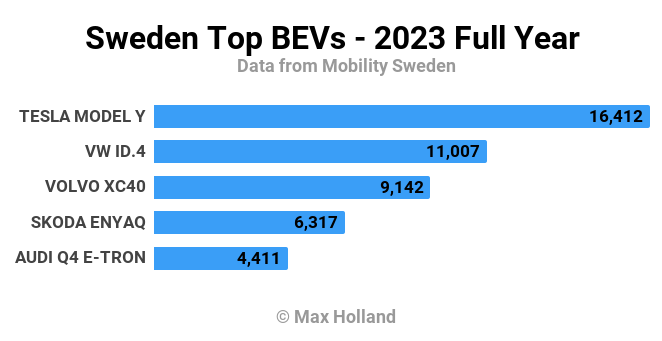

The full year top 5 ranks have the same names, with different positions:

Here, the Tesla Model Y is much more dominant over the others, and the spacing between the leaders is much more pronounced. For more details on the 2023 top sellers, check out some of my other posts.

Outlook

Despite the 0.6% annual growth in auto sales, the broader Swedish economy is still in recession. Latest quarterly figures show a negative 1.4% YoY growth in Q3, from negative 0.4% in Q2. Inflation has lowered, now at 5.8%, though interest rates are flat at 4%. Manufacturing PMI fell to 48.8 points in December, from 49.0 points in November.

Mobility Sweden, the country’s auto industry association, remains pessimistic about the outlook for the EV transition in the coming year. They continue to emphasise that the private consumer market has weakened considerably:

“All the growth in electric cars took place on the corporate side, while the private market has been cold throughout the year as a result of the economic situation and the removed climate bonus. In 2022, private customers drove the electrification, with 56 percent of the new electric cars. In 2023, the share of private customers is down to 33 percent and it is again the business side that is driving the electrification.” (Mobility Sweden, machine translation).

They believe that the BEV share of the market will actually decline in 2024 over 2023, saying “Mobility Sweden’s assessment is also that electrification will stop during the year and that the share of electric cars will decrease and land at 35 percent [from 35.9% in 2023], which is a worrying trend break. This is based on a very weak demand among private customers and the share of electric cars in the total order book together with the absence of control instruments.” (Machine translation).

Much will depend on the prospects for an improving consumer economy. However, I don’t believe that the BEV market share will decline in 2024. For those who still have deep enough pockets for new car purchases, BEV remains the most cost-effective purchase in the long term. With more affordable models arriving, I suggest that BEV share will continue to grow though perhaps at a more modest trajectory. Let’s wait and see.

What do you think about Sweden’s transition to EVs? Please join in the discussion below.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Our Latest EVObsession Video

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

CleanTechnica uses affiliate links. See our policy here.