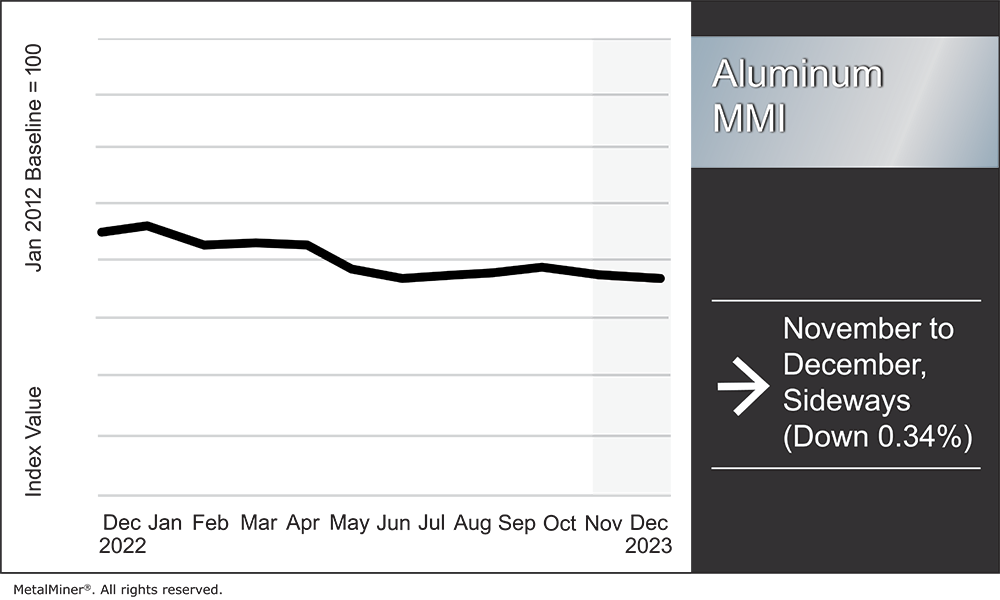

Aluminum prices continued to trade sideways during November and the first three weeks of December. Amid the long-term consolidation, prices sit only 6% beneath where they stood at the start of the year.

Overall, the Aluminum Monthly Metals Index (MMI) remained sideways, with a modest 0.34% decline from November to December.

MetalMiner’s 2024 Annual Metals Outlook – December update just released this month. Want to get a forecast of where aluminum prices are heading in 2024? Get a sample copy.

UK Sanctions Raise New Questions About Russian Aluminum

In early December, the UK launched a new round of sanctions on Russian metals, including aluminum, nickel, copper lead, zinc, tin, and cobalt. According to the document, British companies and citizens are barred from trading Russian metals, as they “must not directly or indirectly acquire metals which originate in Russia or are located in Russia.” The move follows a growing list of policies targeted at harming the Russian economy and war machine amid the ongoing conflict in Ukraine.

The latest sanctions met with market uncertainty regarding how they would impact certain companies as well as aluminum prices. While not headquartered in the UK, many banks and trading companies are still incorporated there. This includes major trader Glencore, which is among the largest buyers of Russian metal. Meanwhile, plenty of other metal companies have a significant presence in the UK marketplace.

The LME stated that “the recent sanctions in respect of Russian metal is (among other things) to prevent UK Persons acquiring physical Russian metal. However, the intention is also to continue to allow the trading of metal (including Russian metal), and ability for UK Persons to trade, on global metal exchanges including the LME.” In short, LME trading will continue, although “UK Persons will (under certain circumstances) not be able to cancel and take delivery of Russian metal warrants, because this could provide a route by which UK Persons could circumvent the sanctions.”

Will the Russian-Origin LME Supply Glut Expand?

The UK was never a major buyer of Russian aluminum, especially after the various other sanctions leveled since the start of the Russia-Ukraine conflict. However, the latest move appeared to reignite the debate over whether the LME should and would institute its own ban on Russian-origin material.

Following a build-up throughout the first half of 2023, Russian-origin stocks within LME inventories held relatively steady around the 80% mark. Indeed, the most recent November data showed Russian aluminum accounted for just under 78% of total stocks. Meanwhile, the UK’s new sanctions have the potential to see that quantity increase even further.

Citigroup, a U.S. bank with multiple UK entities that hold its LME membership, was a leading buyer of Russian material throughout the year. However, the most recent sanctions could potentially prevent that going forward. In a recent note, a Citigroup researcher raised concerns that the sanctions “may result in significant Russian inflows and spread weakness on the LME and eventually lead to the LME delisting Russian metal.”

Although December’s Country of Origin data has yet to be released by the LME, a recent spike in inventories could be due to the loss of certain buyers and their potential rush to offload affected holdings.

Get visual input into where 2024 aluminum costs are projected to land with MetalMiner Insights’ comprehensive short and long-term price forecasts. Chat with us.

LME, CME Aluminum Prices Correlation Holds Steady

Despite market concern that a glut of Russian supply could distort aluminum prices, the LME has thus far allowed the continued trade of Russian aluminum on the grounds that many participants continue to support demand for the material. Indeed, because of both self- and government-imposed sanctions, Russian aluminum trades at a discount from material sourced elsewhere, which remains a downside risk to LME aluminum prices overall.

More specifically, the UK’s latest move could lead to a breakdown in the correlation between LME prices and that of other exchanges like the CME. While the CME’s aluminum contract continued to gain market share throughout the year, prices remained in line with those of the LME. That said, a significant delta between the two prices has yet to become apparent, and the correlation between them remains nearly perfect at 99.59%. Therefore, a meaningful breakdown could trigger the LME to revisit its decision to continually accept Russian-origin metals.

Meanwhile, problems for the LME could mount should others opt to join the UK in trade sanctions. While the U.S. already boasts a 200% tariff on Russian material, effectively a ban, EU industry groups continue to lobby for additional restrictions. The press release from the UK government seemed to suggest this might happen, noting it “plans to proceed with a prohibition on ancillary services relating to metals when this can be done in concert with international partners.”

Elevate your aluminum procurement IQ. The Monthly Metals Outlook report is your brainpower booster for strategic sourcing with monthly purchasing and sourcing strategies. Get a sample report sneak and subscribe for an aluminum procurement upgrade.

Biggest Aluminum Price Moves

- Chinese aluminum bar prices rose 4.77% to $3,012 per metric ton as of December 1.

- Korean commercial 1050 aluminum sheet prices rose 3.8% to $3.85 per kilogram.

- The Korean 3003 aluminum coil premium over 1050 sheet also saw a 3.8% increase to $3.88 per kilogram.

- Chinese aluminum scrap prices fell 6.84% to $2,144 per metric ton.

- European commercial 1050 aluminum sheet prices once again saw the largest decline of the index, with an 18.51% drop to $3,023 per metric ton.