Once a bastion of sound reporting, the Wall Street Journal’s economy desk is slowly descending into incoherence. The latest confusion is Paul Hannon’s article about inflation. His opening sentence is a whopper: “Extraordinary corporate profits were a driving force in last year’s surge in inflation, a pressure that is now easing rapidly as customers push back.”

Let me put this as clearly as I can: No.

Mr. Hannon offers the usual evidence: Profits went up as prices went up, hence higher profits drove prices higher. It is hard to believe this naive correlation-causation conflation appears in America’s largest newspaper by circulation. He also claims “a broad consensus among economists that the role of profits in fueling inflation,” which is news to many of us. Yes, you can find a few economists — usually those with a political ax to grind — making this claim. But, by and large, economists recognize this argument is facile.

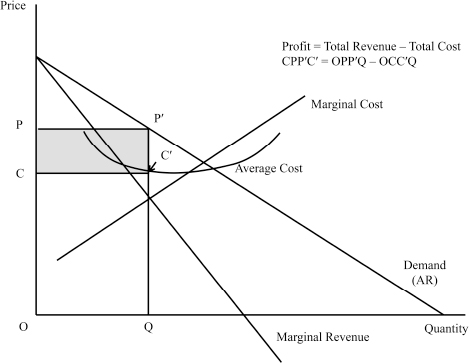

Simple economics demonstrates why the inflationary-profits hypothesis is bunk. Assume firms have some control over the price their products command in the marketplace, which they exercise by choosing how much to produce. Profit maximization means picking the quantity of output that makes additional revenues equal to additional costs. Firms produce and sell that quantity, charging a price in excess of additional cost. The below graph from Alchian and Allen’s excellent text, Universal Economics, shows the setup.

Source: Alchian and Allen, “Universal Economics,” chapter 19

By assumption, firms charge profit-maximizing prices. (Everyone agrees with this, even the inflationary-profit pushers. They are the most likely to lambast firms as “greedy.” And what does greed mean, if not profit maximization?) Something must be causing the price that profit-maximizing firms charge to rise all across the economy. There are two candidates: cost increases or demand increases.

Consider costs first. It is true that as costs rise the prices firms charge rise. But wait: When costs go up in the above diagram, the firm’s “markup” (the amount by which price exceeds additional cost) shrinks, and so do the firm’s profits! Data from Mr. Hannon’s article show profits rose with inflation, rather than falling with inflation. So cost increases cannot be the driver of real-world price increases.

That leaves rising demand. This makes much more sense: Demand growth yields higher prices and profits, provided it exceeds cost growth. But we have merely pushed the explanation back a stage. What caused demand growth? Clearly this is not just a demand increase for one or two products. It is the demand for everything. That is why virtually all prices are rising. Hence the ultimate cause of inflation must be whatever is driving economy-wide demand increases. Firms are responding to this condition according to their self-interest, but they are not causing it. Profits are epiphenomenal. The real action is whatever is pushing up total demand. The most likely culprit remains some combination of expansionary fiscal and monetary policy.

Remember, output prices are usually more flexible than input prices. This is not an ad hoc “sticky price” assumption. It reflects the fact that businesses care a great deal about keeping their costs predictable. Firms usually contract for their input prices on a long-term basis. Think salaried workers or the purchase of raw materials. But output prices, especially in retail sectors, respond quicker to market forces. Hence it makes sense that profits rose: Revenues increased while costs followed only sluggishly.

Our story also helps explain disinflation. Mr. Hannon thinks that consumers are simply done putting up with price increases. (Why did they not resist even sooner?) In reality, contractionary monetary policy ensured a slowdown in economy-wide spending. Also, after more than two years of inflation growing faster than wages, it is likely that consumers’ ability to afford higher prices is petering out. (Consider the surge in credit-driven holiday spending.) Mr. Hanon’s preference-based explanation makes much less sense than a constraints-based one.

It is frustrating to encounter pervasive economic ignorance in prominent organs of public opinion. That makes learning good economics even more important for responsible citizenship and an examined life.

Courtesy of AIER.org and originally published here.

********