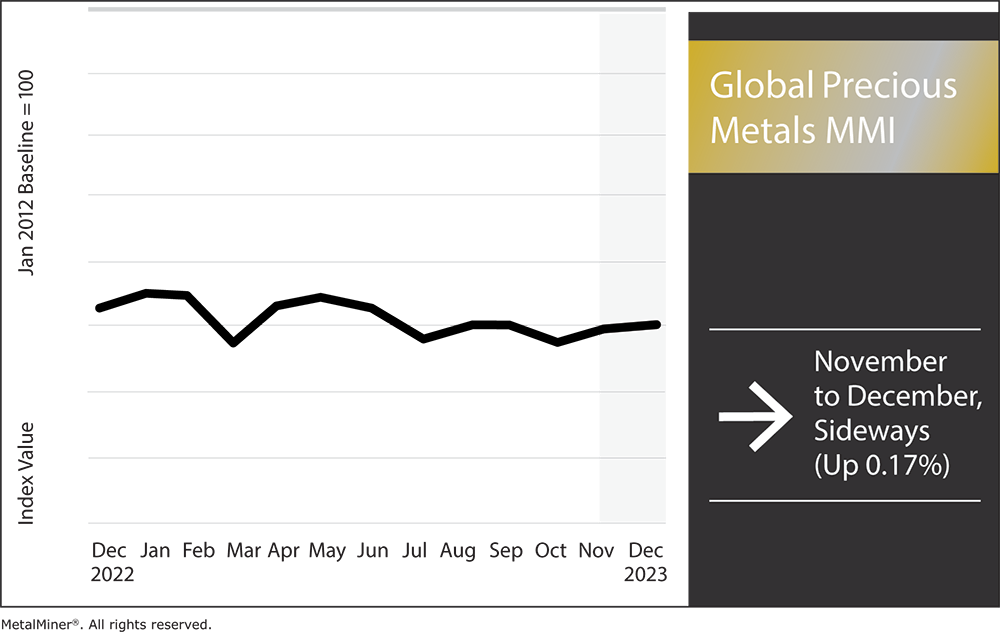

The Global Precious Metals MMI (Monthly Metals Index) narrowly missed trading flat, only inching up a slight 0.17%. During the period from November 1 to December 1, precious metals prices, specifically gold and silver, surged significantly. For instance, the price of gold increased from $1,839.01 per troy ounce to $2,037.74, marking a substantial 10.81% uptick.

On December 1, 2023, the Multi Commodity Exchange (MCX) witnessed an increase in the prices of both gold and silver. Gold futures traded at Rs 62,786 per 10 grams, and silver futures reached Rs 77,777 per kilogram. A range of factors, including subdued inflation levels and strong international demand, contributed to gold and silver’s rise. Despite this, it remains questionable if these trends will continue.

Subscribe to MetalMiner’s free Monthly Metals Index report and leverage it as a valuable resource for tracking and predicting trends in precious metals prices.

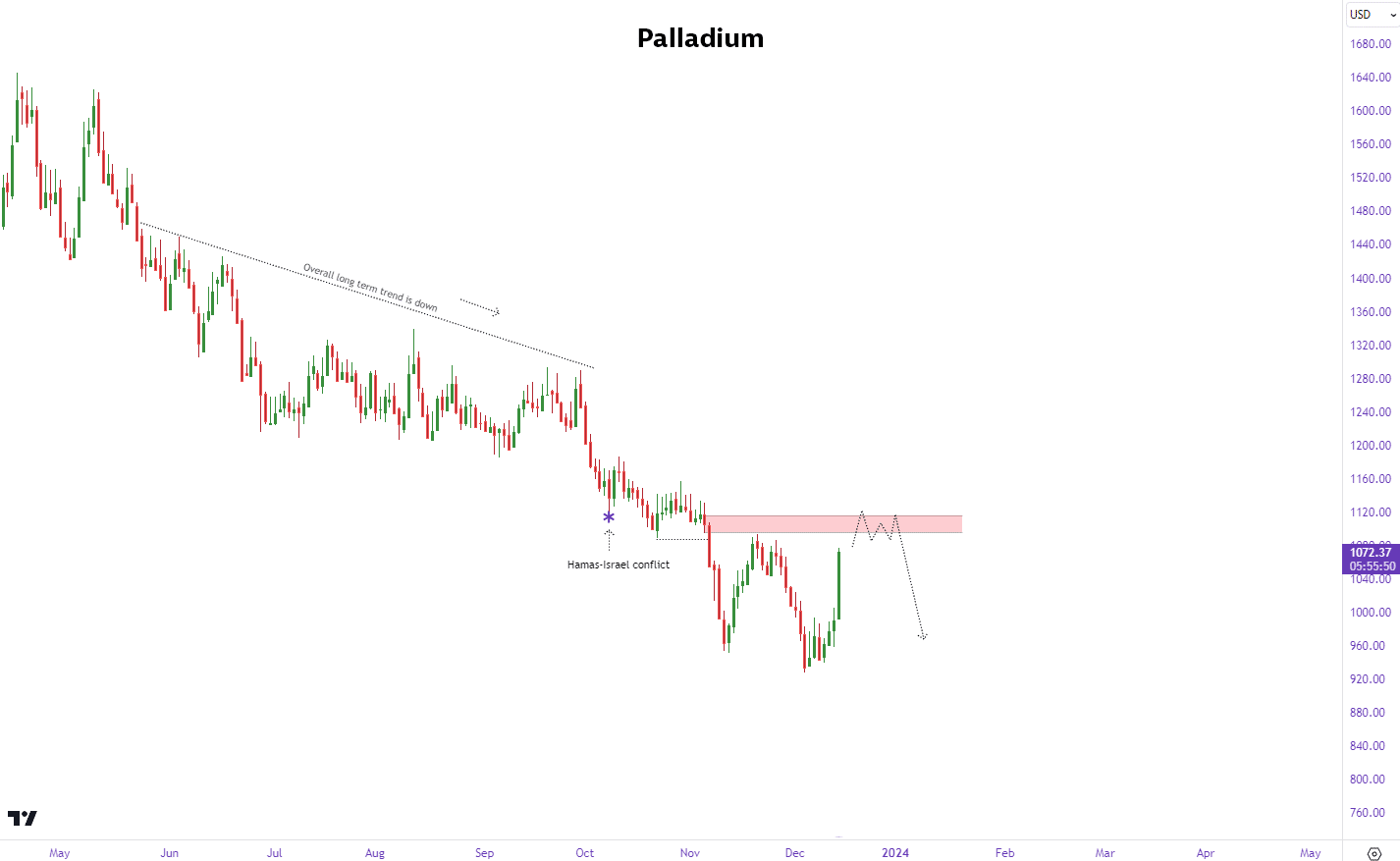

Palladium Remains the Outlier

Unlike all other precious metals, palladium prices continue to trade bearish. Although prices increased in December, the overall trend is still down as no new highs or lows have formed. It also remains unclear whether or not reversal patterns will drive prices back up, as no real bullish momentum is currently present within the Palladium trend.

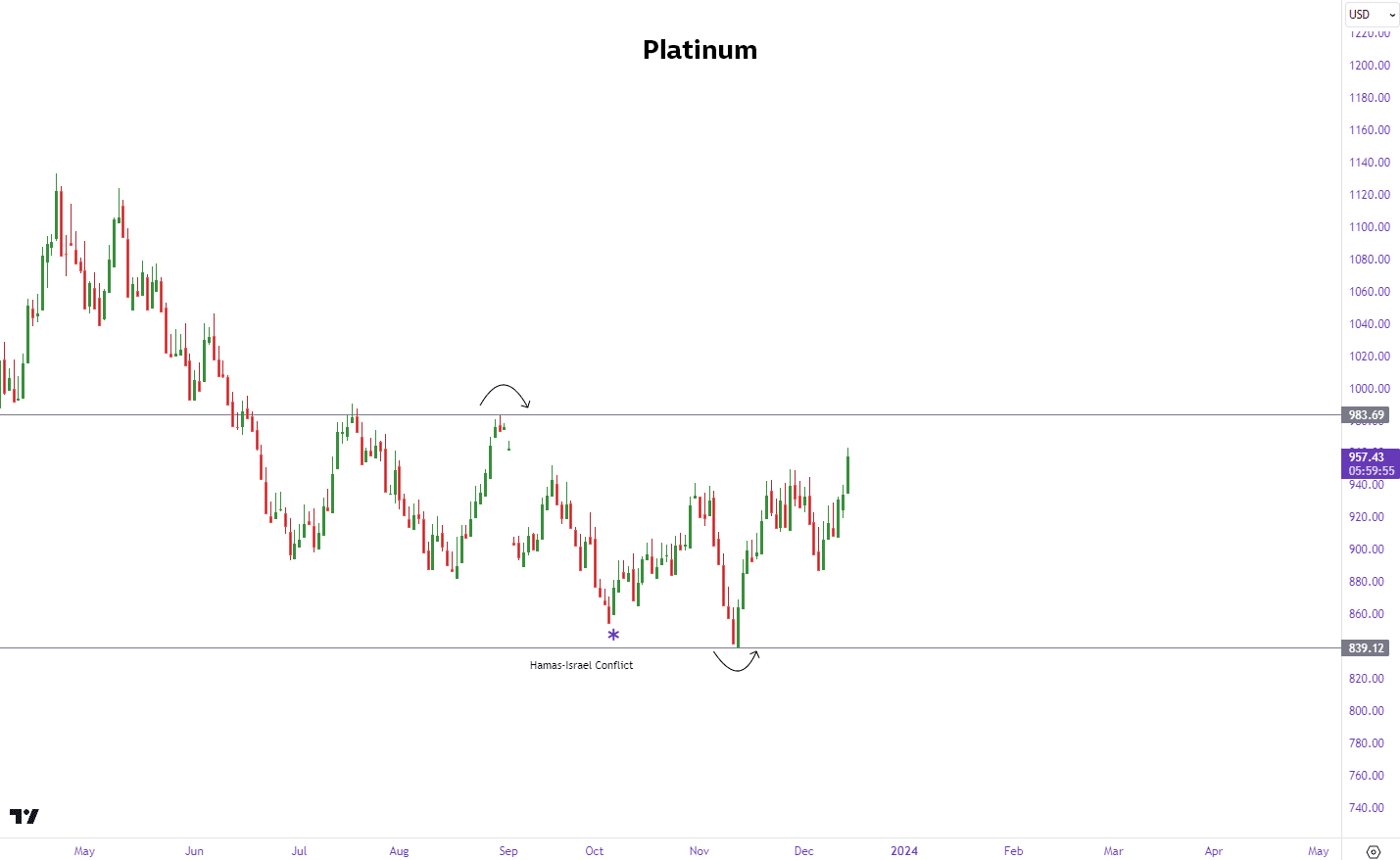

Precious Metals Prices: Platinum

Platinum prices continue to trade within range, indicating an uncertain market environment for buyers and other participants. Platinum prices also remain largely unaffected by the conflict in the Middle East, typically trading between the August 2023 high and the November 2023 low.

Get valuable precious metals insights, price alerts, and other commodity news, supporting your business in mitigating the impact of increasing metal prices. Register for MetalMiner’s free weekly newsletter.

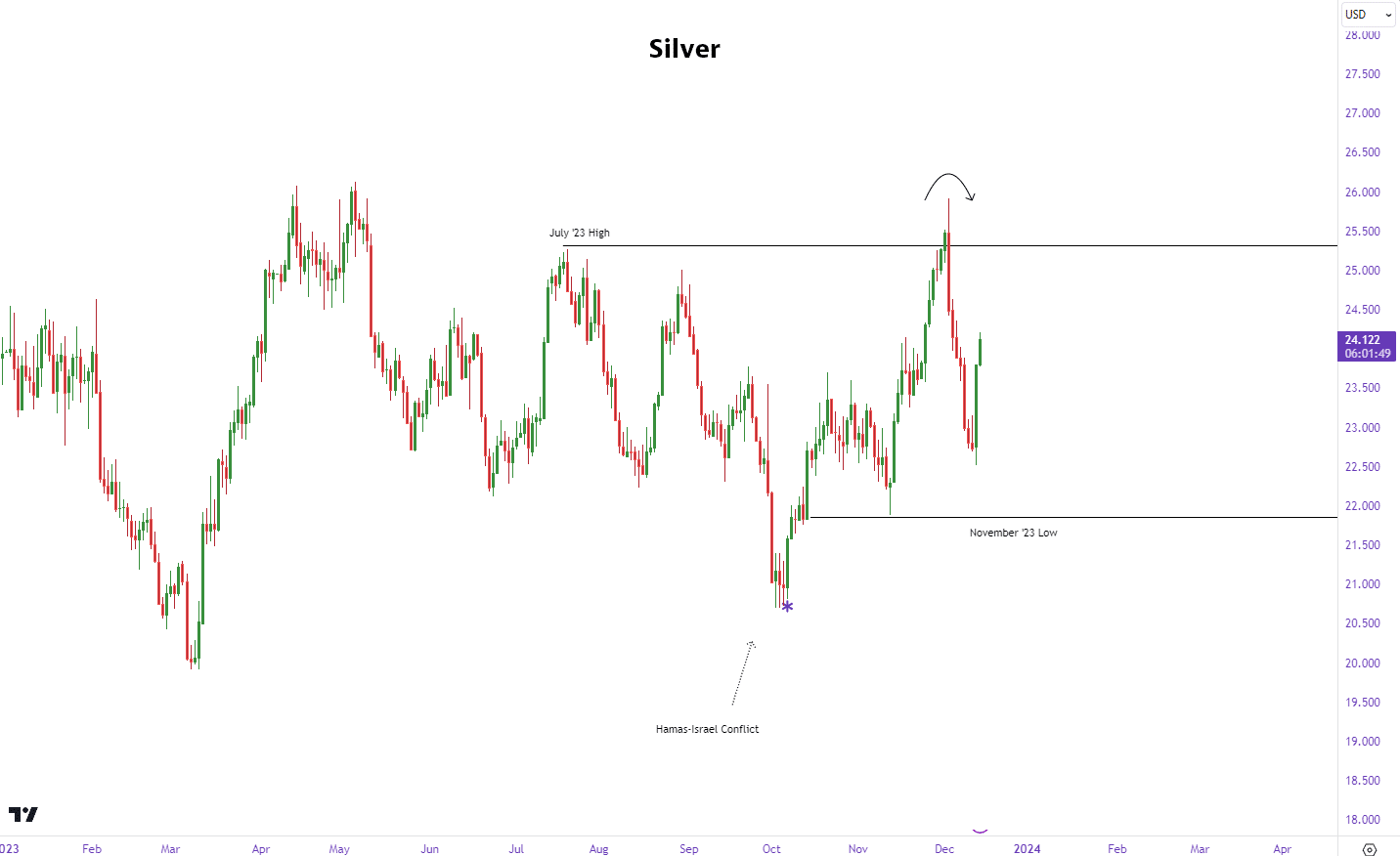

Silver Not at All-Time High

Unlike gold prices, silver has not quite formed a new all-time high. However, prices recently rallied and formed a high on December 3, 2023. Silver price action will need to breach either side of the range with strength to establish a clear trend. However, for now, silver prices appear uncertain.

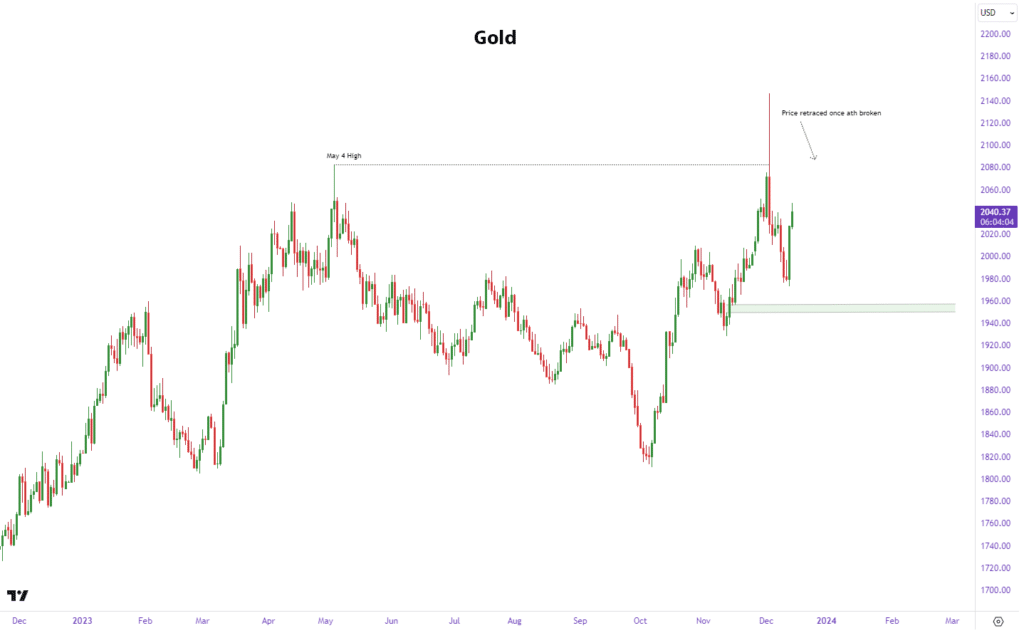

Precious Metals Prices: Gold

Earlier this month, gold prices sought new all-time highs, with price action trading above $2,100/oz. However, gold prices quickly retraced back down towards $2,000/oz. Analysts anticipate prices will continue their bullish heading into the new year. However, as historical resistance levels pressure prices, gold may retrace. This could indicate uncertainty.

Notable Shifts in Global Precious Metals Prices

- Palladium bar increased by 12.56%, leaving prices at $1,112 per ounce

- Platinum moved sideways, increasing a slight 0.76% to put prices at $934 per ounce

- Silver ingot dropped 7.76%, bringing prices to $23.30 per ounce

- Finally, gold bullion moved sideways, decreasing by a mere 2%. This left prices at $1995.50 per ounce

Most metal-purchasing organizations understand the power of data science but struggle with implementation. We’re changing that. Read our free resource Data Science: The Key to Cost Savings.