Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

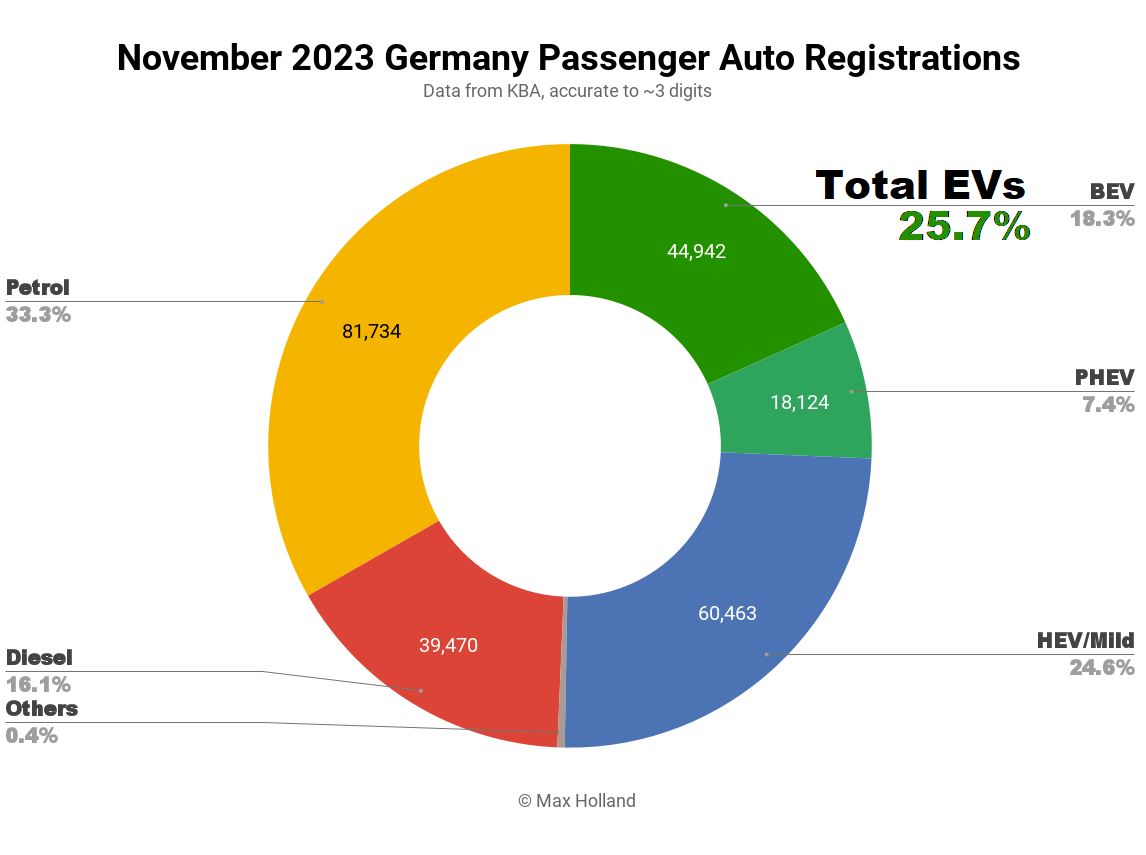

November saw plugin EVs take 25.7% share in Germany, down from an (anomalous pull-forward) 39.4%, year on year, and in the midst of ongoing incentive changes. Overall auto volume was 245,698 units, down some 6% YoY, and down from pre-2020 norms (~280,000). The Skoda Enyaq was the best selling EV in November.

November’s combined plugin results saw EVs take 25.7% share in Germany, with full electrics (BEVs) at 18.3%, and plugin hybrids (PHEVs) at 7.4%.

These compare with YoY figures of 39.4%, with 22.3% BEV, and 17.1% PHEV. We can see that the YoY comparison is strongly down, especially for PHEVs. Why? Recall that November (and December) 2022 saw record plugin sales resulting from a large pull-forward effect. This came ahead of a January 1st incentive trimming for BEVs — worth roughly €1,500 to €2,000 — and an outright cancellation of PHEV incentives (worth around €4,000). For more detail on that policy change, see last December’s report.

Against the baseline of this peculiar pull forward, the year on year comparison for November 2023 was going to look weaker.

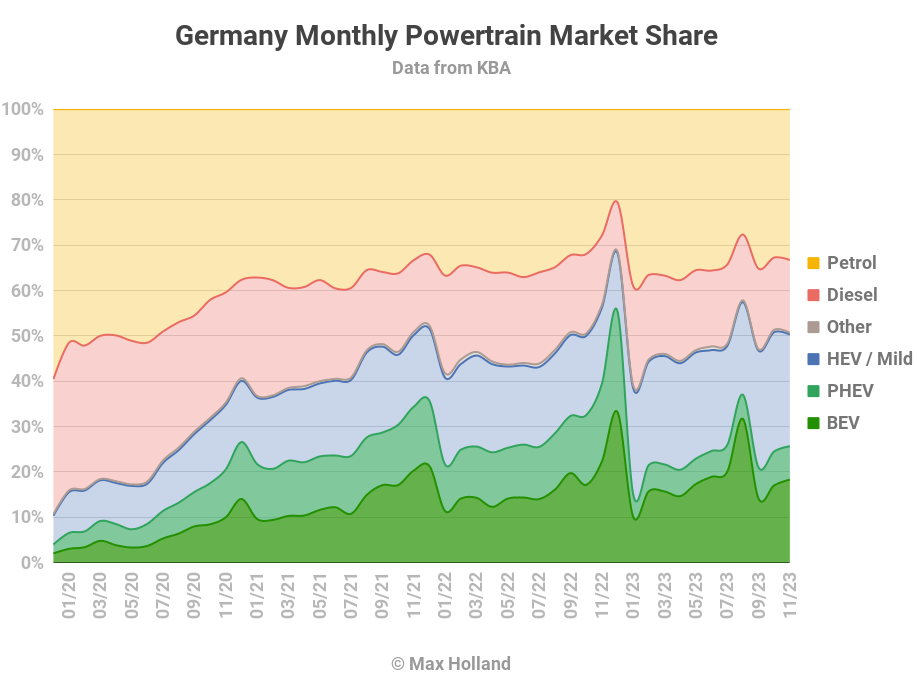

Recall also that there was another cut to BEV incentives at the start of September 2023 (this time cancelling any incentives for businesses, fleets, or other organisations), which caused a similar pattern of pull-forward, and subsequent hang-over. PHEVs had already lost their incentives in January so their share remained stable through the August-September change.

Both of these disjuncture periods are visible on the historical chart below.

January 1st 2024 will see yet another incentive trim for BEVs. This will lower the BEV eligibility price ceiling from €65,000 to €45,000, and will reduce the bonus amount from €4,500 to €3,000. In principle, this change should also lead to a pull-forward in December (and a January hangover), especially for models priced between €45,000 and €65,000, which stand to lose all of their current €3,000 incentive. How this new change will interact with the recent (and ongoing?) hangover from the September cut is hard to say. More on this below.

We will have to wait and see what emerges (let us know in the comments if you have thoughts).

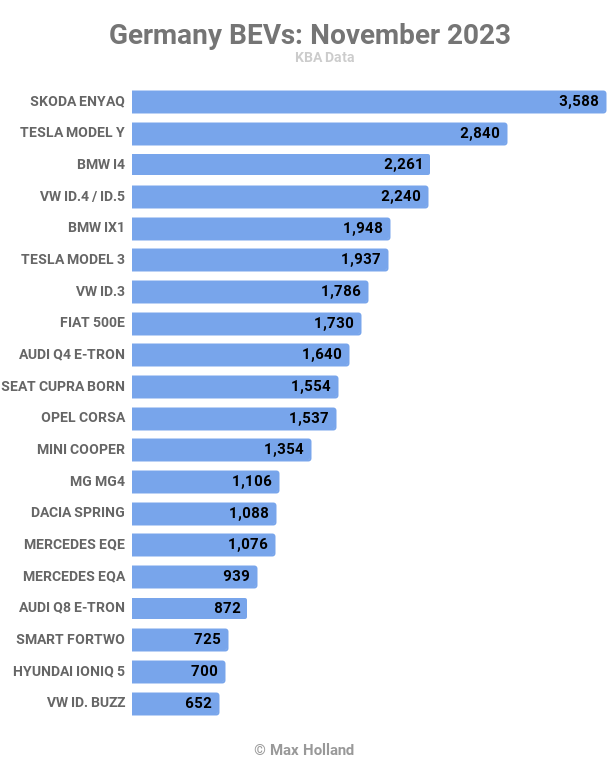

Best Selling BEVs

November saw the Skoda Enyaq take the top spot in the BEV sales charts, ahead of the Tesla Model Y, and the BMW i4.

A strong performance came from the BMW iX1, which jumped up to 5th from 12th in October.

There was a lot of shuffling in the top 20. Given all the incentive changes, we will have to wait until mid 2024 to see what (if any) stable pattern of favourites might emerge.

Far outside the top 20, November saw a few German debuts for new BEV models, and a ramp up for some recently released models. Looking at the most affordable BEVs first:

The BYD Dolphin debuted with 17 units, and as a great value BEV, has potential to reach hundreds or thousands of sales per month.

The Volvo EX30, a close competitor of the Dolphin, also debuted, at 6 initial units, and also has potential for very large volumes.

The Fiat 600e, which debuted in October with 7 units, stepped up considerably, to 158 units in November.

At a higher price point, the new BMW iX2 has started volume sales, with 44 units in November. This is yet another BEV option from BMW, which now offers 4 different SUV BEVs, and 3 different sedan BEVs*. Is any non-Chinese brand currently offering a wider BEV model spread than BMW? I can’t think of one (unless we combine Mercedes’ passenger and commercial vehicles). Let us know in the comments.

[*Plus the BMW i3 sedan (based on the 3 Series) in the Chinese market.]

Further up the size scale, the Volkswagen ID.7 sedan, which debuted back in August, continues to ramp up very impressively, having reached 564 units in November (ranked 23rd for the month).

Finally the Kia EV9, which debuted in October, quickly ramped up to an impressive 313 units in November, and probably has a good bit further to climb.

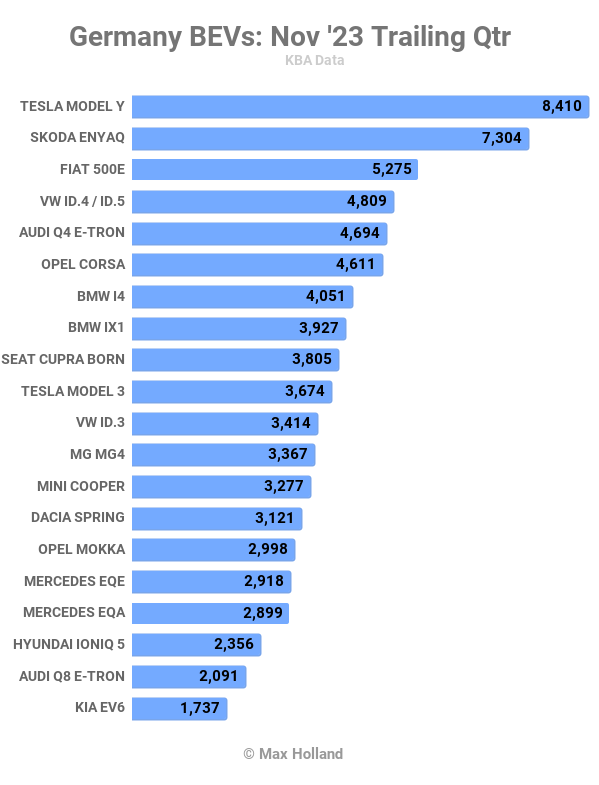

Let’s now check up on the 3 month performance:

The Tesla Model Y leads, from the Skoda Enyaq, and Fiat 500e. The Volkswagen ID.4/ID.5, which led in the previous period (June to August) has fallen back to 4th position, and under a third of its previous volume!

Of the well established models in the top 50 spots, only the BMW i4, and Mercedes EQE have increased their volume compared to the prior period. Almost all others have fallen in volume, some substantially, whilst just a couple have remained roughly flat.

This pattern is in large part due to the continuing hangover from the August pull-forward ahead of September BEV incentive cuts. Recall that models priced above €65,000 (most BMW i4, and all Mercedes EQEs) already had subsidies removed (January 1st 2023), so weren’t affected by the September cuts. The same pattern — of BEVs priced above €65,000 being largely unchanged in volume — is visible throughout the top 100.

As mentioned above, it’s an open question how much the continuing post-September hangover will shape December’s result, compared to the potential pull-forward ahead of more BEV incentive trims from January 1st 2024.

I certainly expect models priced between €45,000 and €65,000 (about to lose €3,000 incentive) to see some pull forward in December, and some movement also for the models under €40,000 (facing €1,500 trim). Oddly enough, models priced between €40,000 and €45,000 face no change (if I’ve understood the rules correctly). What the sum effect of this, in combination with the post-September hangover, will be… let’s wait and see.

Outlook

Beyond the auto sector, Germany’s overall economy saw Q3 at a negative 0.4% YoY. Interest rates remain at 4.5%, and inflation has further reduced, to 3.2%, from 3.8% in October. Manufacturing PMI improved slightly, to 42.6 points in November, from to 40.8 points in October, though remains weak.

In terms of EV outlook, obviously the wider economic pressures are already squeezing the volume of new vehicle purchases, including the volume of EVs. This then combines with the current perturbations coming from the ongoing series of incentive changes, which will only work themselves through by sometime around the end of Q2 2024.

In the medium to long term, with BEV battery prices again coming down in cost, the BEV market moving towards stand-alone health (without subsidies), and more models, at a spread of prices, coming available — all signs point to continued growth in BEV market share. This will happen regardless of what we see in terms of overall market volumes.

What are your thoughts on Germany’s journey towards EV transport? Please join in the discussion below.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

CleanTechnica Holiday Wish Book

Our Latest EVObsession Video

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

CleanTechnica uses affiliate links. See our policy here.