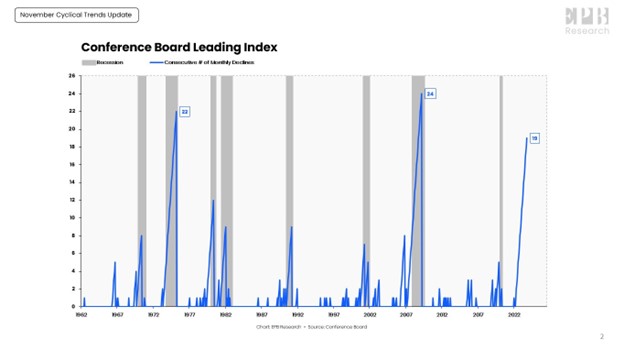

Leading Economic Indicators

Leading Economic Indicators

In October, the Conference Board LEI experienced its 19th consecutive monthly decline. This prolonged downturn, only surpassed during the 2008 and 1974 bear markets, strongly signals an impending recession.

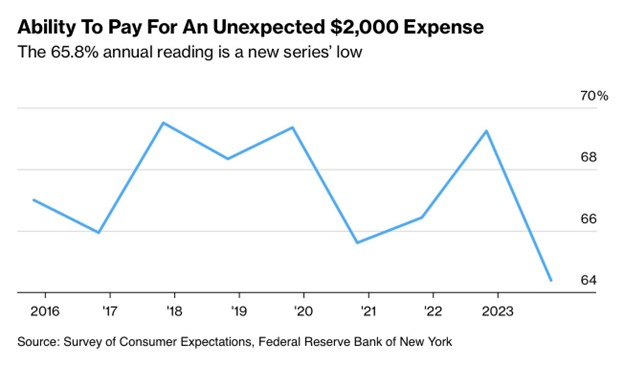

Financial Preparedness for US Households

A mere 65.8% of American households express confidence in handling an unforeseen $2000 expense, marking the lowest level since the inception of the survey in 2013, as reported by the Federal Reserve Bank of New York.

Banks Stocks vs. S&P 500

Major US banks, according to Moody’s, are grappling with over $650 billion in unrealized losses. These bank stocks, unable to recover from the regional banking crisis, currently languish at record lows relative to the S&P 500.

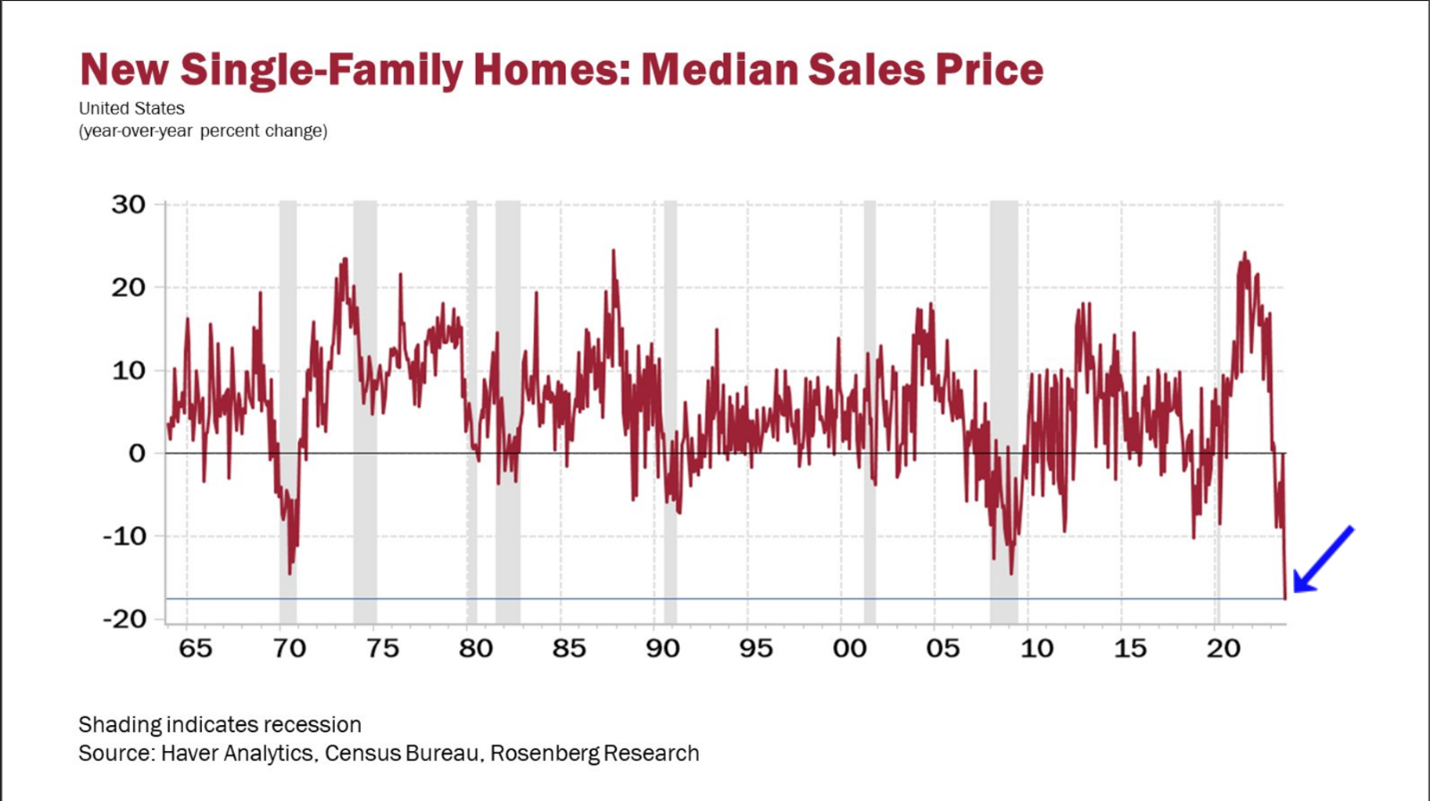

Plummeting Home Prices

In October, the median price of new homes experienced a historic year-over-year decline of -18%, surpassing the lowest point (-15%) observed during the Great Recession and exceeding any downturn witnessed in the 1970s. This serves as another stark indicator of an impending recession.

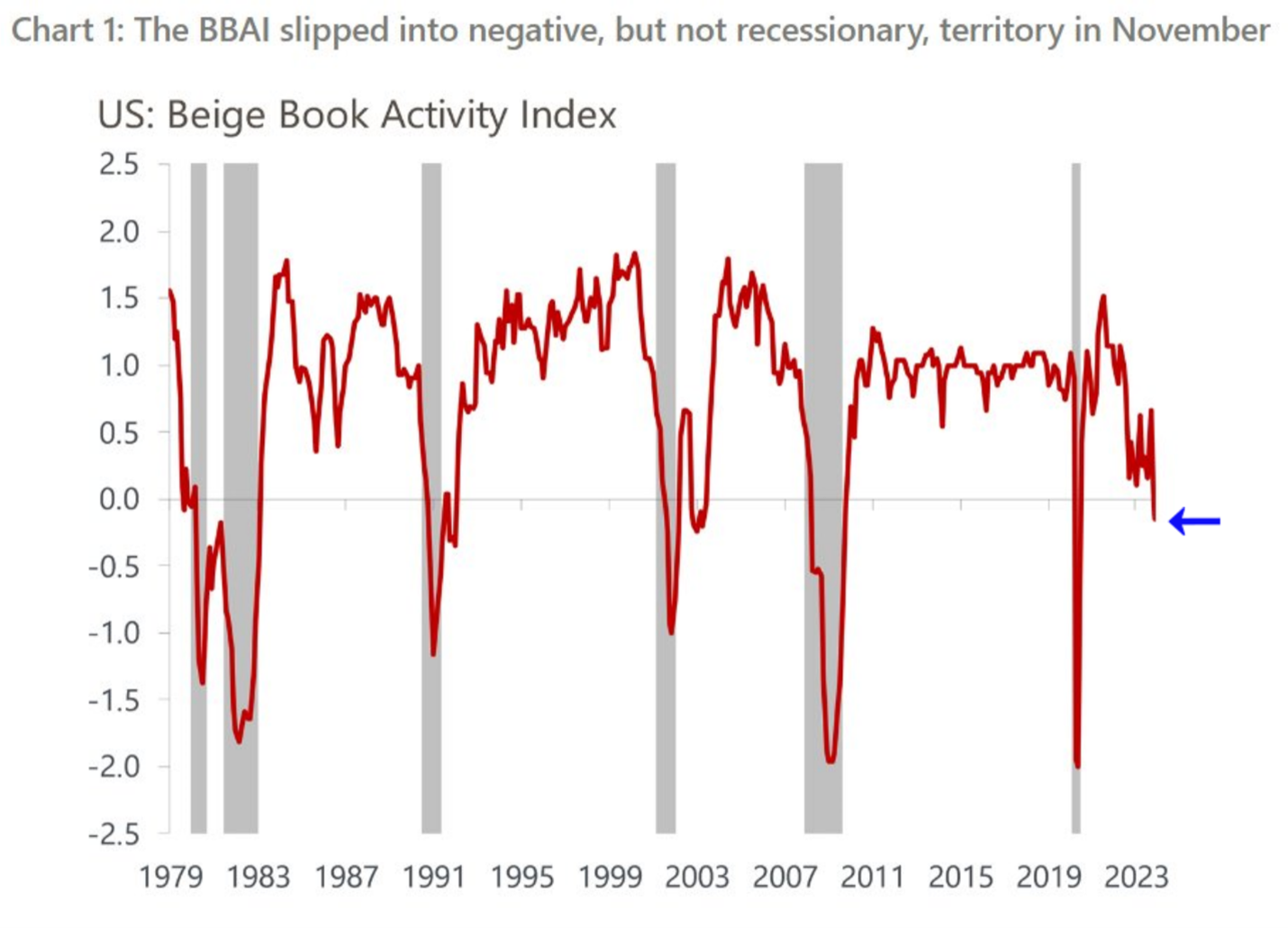

Beige Book Activity

Capital Economics warns of a loss of economic momentum, stating that the economy is “poised to slow sharply in 2024.” The firm’s Beige Book Activity Index has slipped into negative territory, though not yet indicative of a recession, marking the first occurrence since the onset of the pandemic.

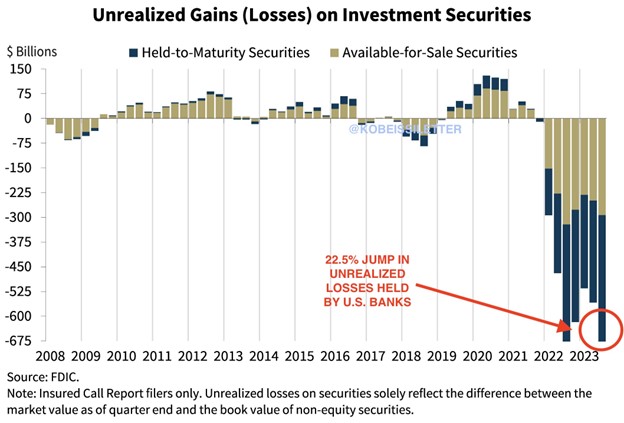

Unrealized Losses

The third quarter witnessed a substantial 22.5% year-over-year surge in unrealized losses for US banks, totaling $684 billion. While the FDIC assures that banks remain well-capitalized, concerns arise as the utilization of the Fed’s emergency funding facility hits a record high of $114 billion, prompting questions about the stability of the banking sector.

PRECIOUS METLAS UPDATE

GOLD- Gold is within striking distance of new all-time highs. Prices may consolidate as we head into the December 13th Fed meeting. I think we are close to a historic breakout, but anticipating the exact timing is difficult.

SILVER- Silver is testing the 3-year trendline. Upside follow-through above $26.00 would support an immediate bullish breakout. Failing to conquer $26.00 quickly would promote sideways consolidation.

PLATINUM- Platinum is the last holdout – prices need strong closes above $950 to signal a bullish breakout.

GDX- Miners are holding firm after the recent breakout. The next significant level to challenge is $33.00.

GDXJ- Gold juniors are holding the ground gained on Tuesday; prices continue to inch higher. The next significant level to challenge is $40.00.

SILJ- Progressive closes above the 200-day MA supports a bottom. Overall, this looks like the start of a new uptrend.

S&P 500- The rally in stocks could last through year-end. Overall, I expect a nasty 2024, but the bear (currently) remains in hibernation.

Conclusion

Gold is very close to a historic breakout and sub-$2000 prices will be a distant memory. Gold miners are undervalued and could be the best performing asset in 2024.

Click here to read our article on $10,000 gold and $300 silver

********