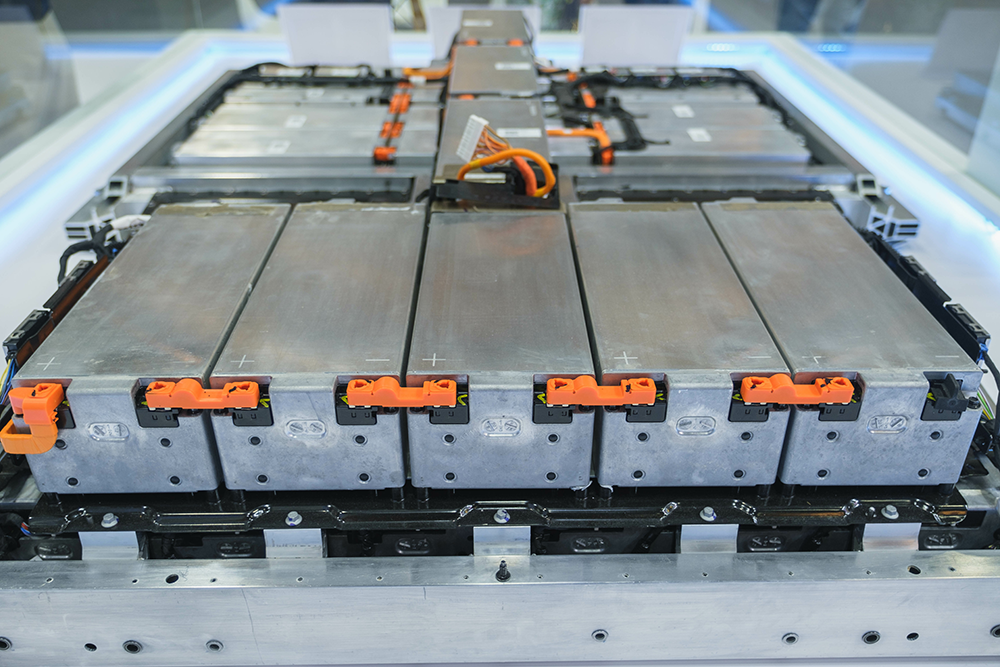

According to new reports, China exports of graphite may be in for some major changes. Graphite, that unassuming mineral often relegated to the humble pencil, is actually a superstar in the high-stakes world of battery production. This dark horse of the mineral kingdom is crucial in all types of batteries, strutting its stuff across various chemistries. It could be it lithium iron phosphate, nickel cobalt aluminum, or any other battery blend you can think of. It’s like the Swiss Army knife of the battery world, an indispensable component ensuring the smooth operation of every battery cell.

Now, let’s talk about China. When it comes to graphite, China isn’t just playing in the big leagues; it’s the league commissioner. The nation is the heavyweight champion of the world’s graphite production and knows all too well the enormous leverage it wields in this realm. Much of the world, including the U.S., continues to dance to the tune set by China exports.

The U.S. is almost entirely reliant on imported graphite, with China being the DJ spinning a third of these imports. If you think that’s high, just look at Japan and South Korea. They’re practically doing the conga line, with over 90% of their graphite needs coming from China.

Need to know last-minute 2024 steel procurement strategies? Join MetalMiner’s December fireside chat: Metal Contracting Goldmine: Last-Minute 2024 Market Intel & Strategies

Trade War Looming?

Amidst the easing tensions between the U.S. and China, thanks to the recent Biden-Xi meet-and-greet in San Francisco, a trade war looms on the horizon. It seems graphite may potentially become next casualty. Earlier this year, the U.S. decided playing hardball by cutting off China’s access to advanced semiconductors. China, not one to shy away from a challenge, flexed its muscles by tightening the tap on rare earth elements and, you guessed it, graphite.

Restricted China Exports of Graphite Could be a “Blessing in Disguise”

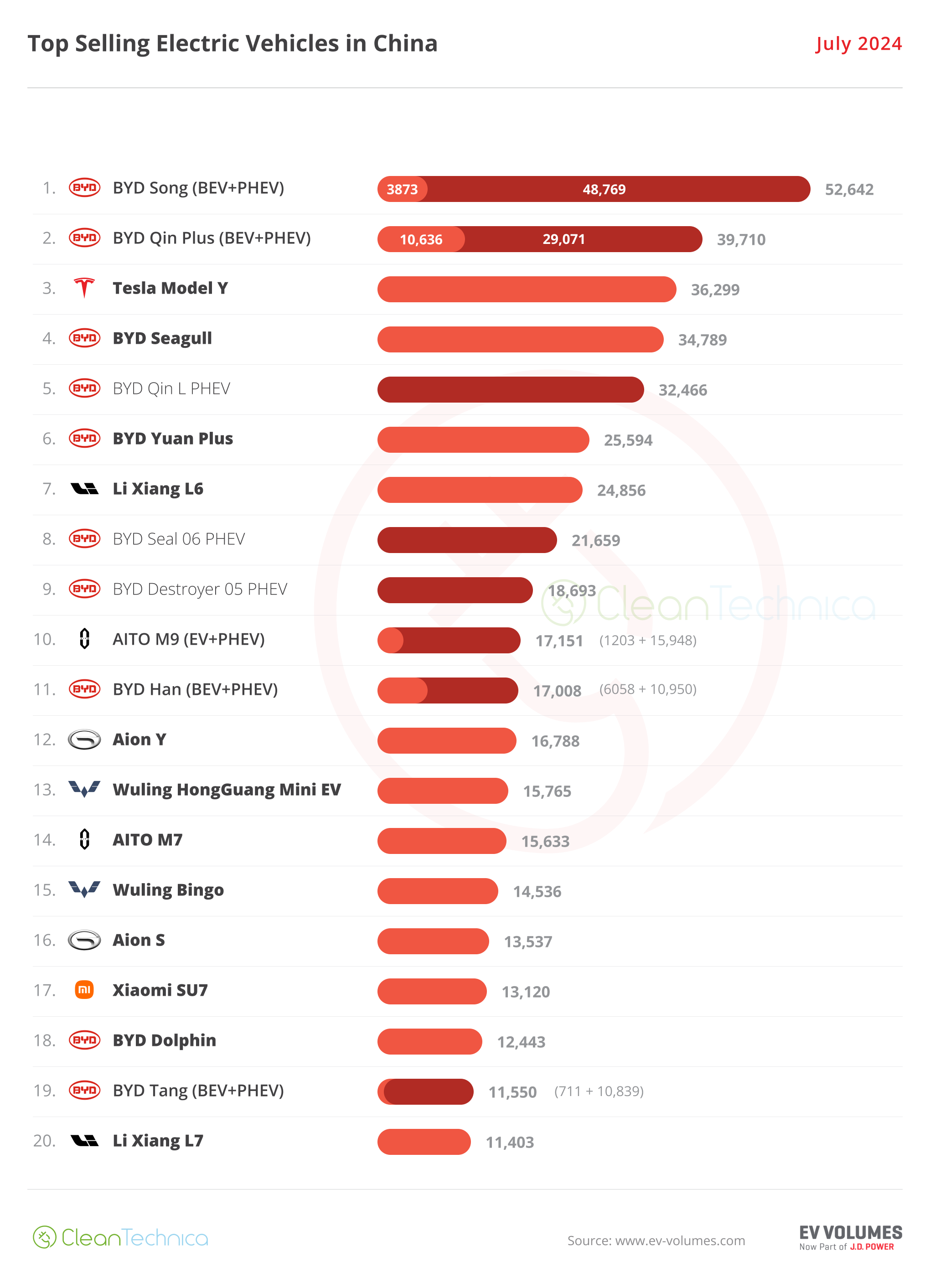

But here’s the twist: China’s move to restrict graphite exports isn’t just a game of international tit-for-tat. The speculation in the air is that China is using these restrictions to give its domestic companies a leg up. The plan? Transition from exporting raw materials like graphite to shipping out high-value finished goods – think batteries, electric vehicles, solar panels, and wind turbines. It’s like moving from selling flour and eggs to baking and selling gourmet cakes.

Meanwhile, across the Pacific, the United States isn’t just sitting on its hands. In a move reminiscent of a chess grandmaster, the U.S. International Development Finance Corporation’s board of directors approved a whopping $150 million loan to kick-start a graphite mining operation in Mozambique, an East African nation. The U.S. is currently scouring the globe for similar projects, determined not to let China’s graphite grip tighten any further.

China exports like graphite impact dozens of major commodities. Subscribe to MetalMiner’s free weekly newsletter now and make sure you stay informed.

Catalyst for U.S. Innovation and Global Influence?

Some economists view China’s graphite export restrictions through rose-colored glasses, calling it a blessing in disguise for the U.S. They argue that this short-term sting is actually a wake-up call, prodding the U.S. to invest in sustainable, non-CCP-controlled critical mineral production. It’s like being forced to eat your vegetables and realizing they’re actually not that bad. And, hey, they’re making you stronger.

In the grand scheme of things, graphite, often overlooked and under-appreciated, continues to prove itself a key player in the global economic and political arena. However, the battle over this unassuming mineral is not just about batteries and electric cars. In reality, it’s a chess game of economic strategies, international relations, and the quest for technological dominance. So, the next time you pick up a pencil, remember that you’re holding a piece of a global power struggle right in your hand.

Maximize your budget and minimize spending risk with MetalMiner’s sourcing/buying solutions. View MetalMiner’s track record of price forecasting.