Support CleanTechnica’s work through a Substack subscription or on Stripe.

Cheap Chinese battery electric heavy trucks are no longer a rumor. They are real machines with real price tags that are so low that they force a reassessment of what the global freight industry is willing to pay for electrification. Standing in a commercial vehicle hall in Wuhan and seeing a 400 kWh or 600 kWh truck priced between €58,000 and €85,000, as my European freight trucking electrification contact Johnny Nijenhuis recently did, changes the frame of the entire conversation. These are not diesel frames with a battery box welded underneath. They are purpose built electric trucks built around LFP packs, integrated e-axles and the simplified chassis architecture that becomes possible when the engine bay, gearbox, diesel tank, emissions controls and half of the mechanical complexity of a truck disappear. Anyone who has worked with heavy vehicles knows the cost structure of diesel powertrains. Removing that entire system while building at very large scale produces numbers that do not match Western experience.

China’s low price electric trucks do not arrive as finished products for Europe or North America. They need work. Western short haul freight fleets expect certain features that Chinese domestic buyers usually skip. Tires need to carry E-mark or FMVSS certification. Electronic stability controls must meet UNECE R13 or FMVSS 121. Cab structures need to meet R29 or similar requirements. Crash protection for battery packs needs to satisfy R100 or FMVSS 305. European drivers expect better seats, quieter cabs and stronger HVAC. Even in short haul work, fleets expect well understood advanced driver assistance (ADAS) features to handle traffic and depot work. However, inexpensive Chinese leaf springs are just fine for short haul trucking given the serious upgrade to driver comfort and truck performance of battery electric drivetrains.

When these adjustments are added into the bill of materials and spread across a production run, the upgrades land in the €20,000 to €40,000 range for short haul duty, per my rough estimate. That moves the landed price up to roughly €80,000 to €120,000. The comparison with Western OEM offerings is stark because Western battery electric trucks today often start near €250,000 and can move far higher once options and charging hardware are included. A short haul operator looking at the difference between a €100,000 truck and a €300,000 truck will ask which one meets the actual duty cycle. For operators with depot charging and predictable delivery routes, the cheaper truck is credible in a way that few expected even three years ago.

The long haul story is different. European and North American long haul operators require far more from a truck than a Chinese domestic short range tractor offers. Axle loads need to support 40 to 44 ton gross combined weight. Suspension needs to manage high speed stability for many hours a day on roads built for 80 to 100 km/h cruising. Cab structures must handle fatigue and cross winds on long corridors. Drivers spend nights sleeping in the cab and expect western comfort standards. Trailer interfaces require specific electrical and pneumatic systems that have to meet long established norms. Battery safety systems need to be built for high speed impacts and rollover events. All of that requires a larger budget. The gap between a domestic Chinese tractor and a European or North American long haul tractor is roughly €80,000 to €120,000 once all mechanical, safety and comfort systems are brought to the required levels per my estimate. That does not erase the cost advantage, because even a €180,000 Chinese based long haul electric truck is cheaper than many Western models, but it does shift the choice from simple purchase price to service expectations and lifetime durability.

Most freight is not long haul. French and German economic councils have both looked at freight movements through national data and concluded that the majority of truck trips and ton kilometers occur in short haul service. This includes urban deliveries, regional distribution, logistics shuttles between depots and ports, construction supply and waste collection. These trips are usually under 250 km, begin and end at the same depot and involve repeated stop-start movement where electric drivetrains perform well. The idea that the heavy trucking problem is a long haul problem has shaped Western investment priorities for a decade, but national economic councils in Europe now argue that solving short haul electrification first delivers most of the benefit. The fact that low cost Chinese battery electric trucks map almost perfectly onto these duty cycles suggests that they will find receptive markets once import pathways are established.

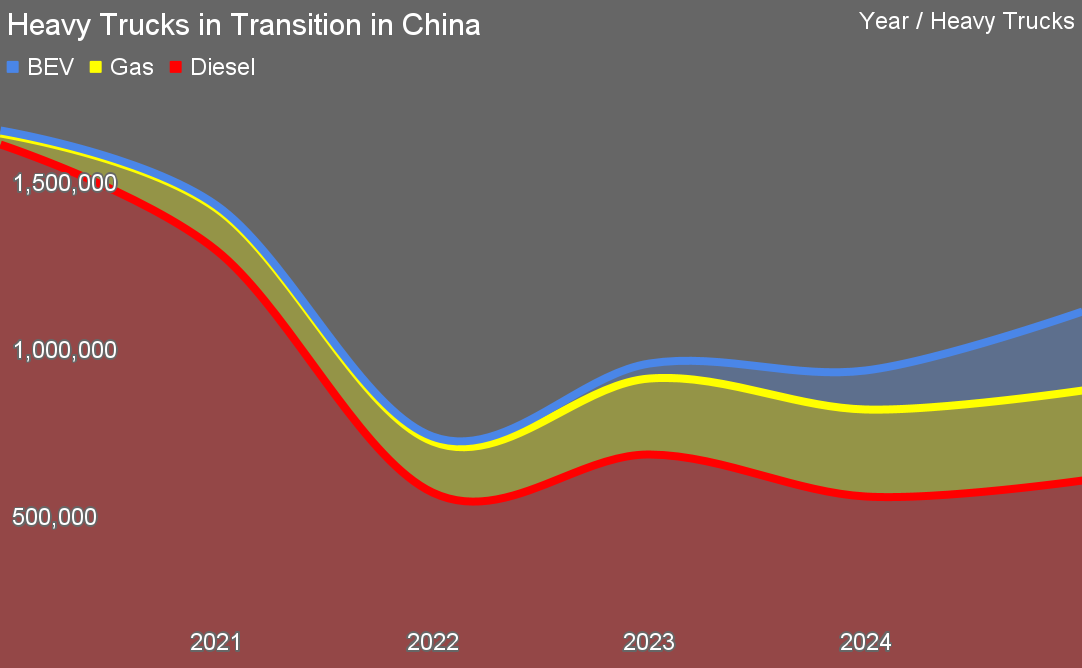

China’s shift away from diesel in the heavy truck segment is dramatic. The country sold more than 900,000 heavy trucks in 2024. Diesel’s share fell to about 57% that year. Natural gas trucks rose to around 29%. Battery electric trucks reached 13%. Early 2025 data points to battery electric share rising again to about 22% of new heavy truck sales, with diesel falling close to the 50% mark. These shifts are large movements inside a very conservative sector. Natural gas trucks saw a rapid rise between 2022 and 2024 as operators chased lower fuel prices and simpler emissions compliance, but the price war in battery electric trucks has made electric freight attractive for many of the same operators. Gas trucks still fill some niches, but the pattern suggests that they may face the same pressure that diesel trucks face. Electric trucks with low running costs and high cycle life begin to look compelling to operators once the purchase price falls into a familiar range.

Western OEMs entered China with hopes of capturing a share of the largest truck market in the world, but the results have been mixed. Joint ventures like Foton Daimler once offered a bridge into domestic heavy trucking, yet the rapid rise of low cost local manufacturers in both diesel and electric segments has eroded that position. Western models arrived with higher prices and platforms optimized for different regulations and freight conditions. As domestic OEMs expanded capacity and cut costs, the market shifted toward local brands in every drivetrain category. The impact is clear. Western firms now face reduced market share, weaker margins and strategic uncertainty about long term participation in China’s truck sector.

Underlying these drivetrain transitions is a heavy truck market that is smaller and more complicated than it was five years ago. The peak in 2020, with roughly 1.6 million heavy trucks sold, was not a normal year. It was driven by a large regulatory pre-buy that pulled forward sales before tighter emissions rules arrived. The freight economy was also stronger at that time and the construction sector had not yet entered its recent slowdown. As those drivers faded, the market returned to what looks like a long term equilibrium between 800,000 and one million trucks per year. Several confounding factors overlap in this period. Freight volumes shifted. Rail took a larger share of bulk transport as China achieved what North America and Europe have only talked about, mode shifting. Replacement cycles grew longer. Real estate and construction slowed. Diesel’s loss of share is partly driven by these economic factors and partly driven by the arrival of cheaper alternatives. It is difficult to separate the exact contribution of each. The net result is a natural market size that is much lower than the 2020 peak and a much more competitive fight inside the remaining market.

Hydrogen heavy truck sales in China show a pattern of stalling growth followed by early signs of decline in 2025. Registration data and industry reports indicate that fuel cell heavy trucks were less than 1% of the heavy truck market in 2024, amounting to low single digit thousands of vehicles, and most of these were tied to provincial demonstration subsidies rather than broad fleet adoption. In the first half of 2025 the number of registered hydrogen trucks rose slightly on paper, but analysts inside China noted that real world operation rates were low and that several local programs were winding down as subsidies tightened. At the same time battery electric heavy trucks climbed from 13% of new sales in 2024 to 22% in early 2025. Hydrogen heavy trucks are losing ground inside a market that is moving quickly toward lower cost electric models, and operators are stepping away from fuel cell platforms as more credible electric options appear. I didn’t bother to include hydrogen on the truck statistics chart as it’s a rounding error and not increasing.

One indicator that connects these pieces is diesel consumption. China’s diesel use dropped by about 11% year over year at one point in 2024, which is not a small shift in a country with heavy commercial transport. Part of the drop was due to economic slowing in trucking dominant sectors, but the rise of LNG trucks and electric trucks also contributed. When a truck that once burned diesel every day is replaced by a gas or battery electric truck, national fuel consumption reacts quickly. The fuel market sees these changes earlier than the headline truck sales numbers because thousands of trucks operating every day create a measurable signal in fuel demand. The data is consistent with a freight system that is changing in composition and technology at a pace that would have seemed unlikely a few years earlier.

Western operators have to look at this landscape with practical questions in mind. The leading electric bus manufacturer in Europe is Chinese because it built functional electric buses at lower prices before Western firms did. There is no reason the same pattern will not repeat in trucks. Once the cost of a short haul electric truck falls near the cost of a diesel truck, operators will start to buy them. If the imported option is much cheaper than the domestic option, early fleets will run the numbers and make decisions based on cash flow and reliability. Western OEMs face challenges in this environment because their legacy designs and cost structures are not tuned for the kind of price war that emerged in China. They need to match cost while preserving safety and service expectations, which is difficult while shifting from a century of diesel design to a new electric architecture.

Western OEMs entered the electric truck market with the platforms they already understood. Most began by taking a diesel tractor frame, removing the engine and gearbox and adding batteries, motors and the associated power electronics. This approach kept production lines moving and reduced near term engineering risk, but it produced electric trucks that carried the compromises of diesel architecture. Battery boxes hung from ladder frames, wiring loops wound through spaces never designed for high voltage systems and weight distribution was optimized for a drivetrain that no longer existed. Several OEMs even explored hydrogen drivetrains inside the same basic frames, which locked in the limitations of a platform built around an internal combustion engine. The results were heavier trucks with less space for batteries, higher costs and lower overall efficiency.

The shift toward purpose built electric tractors is only now underway among the major Western OEMs. Volvo’s FH Electric and FM Electric, Daimler’s eActros 300 and 600, Scania’s new battery electric regional tractor and MAN’s eTruck all represent clean sheet or near clean sheet electric designs with integrated drivetrains and optimized battery packaging. These models move Western OEMs closer to the design philosophy that Chinese manufacturers adopted earlier, where the entire platform is built around the electric driveline from the start.

China has moved faster toward battery electric heavy trucks than any other major market. It built supply chains for motors, inverters, LFP cells, structural packs and integrated e-axles. It created standard designs and cut costs through volume. It encouraged competition. It is now exporting electric trucks into Asia, Latin America and Africa. Europe and North America are watching this unfold while debating the right charging standards and duty cycle models. The arrival of low cost electric trucks from China raises uncomfortable questions for Western OEMs and policymakers, but it also provides an opportunity. If freight electrification can happen at one third the expected cost, then the pace of decarbonization can be much faster. The challenge is deciding how to integrate or respond to the cost structure that China has already built.

The story of heavy trucking is no longer a slow migration from diesel to a distant alternative. The transition is already underway at scale inside the world’s largest heavy truck market. It does not look like the long haul hydrogen scenario that dominated Western modelling for the last decade. It looks like battery electric trucks built cheaply and deployed quickly into short haul service. The economic logic is straightforward. The operational fit is strong. The supply chain is built. The lesson for Western operators and policymakers is that the cost curve has shifted. The decisions that made sense even in 2024 do not match the realities of 2025. The market is moving toward electric freight because it is becoming cheaper than diesel across the majority of real world duty cycles. From the short haul electric trucks will come the new generation of long haul trucks, as night follows day. The arrival of low cost battery trucks from China marks the beginning of a new phase in freight decarbonization.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy