A recent study unveiled last week shed light on Canadians’ attitudes towards the mining industry, revealing both support and concerns that could shape the sector’s future. The Social Acceptability Barometer for Canada’s Mining Sector, conducted by Montreal-based Transfert Environnement et Société and Voconiq, surveyed over 4,800 respondents across the country.

Transert is listed as a consultancy firm with services including engagement, consultation, risk analysis, and environmental communication, particularly in the mining sector. Their intended clients are businesses and organizations seeking to enhance their ‘social acceptability’ and community relations. Voconiq is a global data and technology company headquartered in Australia.

Canadians strongly supported mining critical minerals for renewable energy technologies, with about 70 percent favoring domestic production over imports. However, they showed more caution towards new local gold mines, despite valuing gold highly. This highlighted a nuanced stance: strategic support nationally, but local wariness. Canadians demanded strong environmental management, site restoration, and respect for workers’ rights.

Most respondents recognized mining’s importance to Canada’s prosperity, with over three-quarters viewing it as crucial for employment, regional development, and energy transition. More than 60 percent believed its benefits outweighed costs. Yet, confidence in mining companies lagged behind acceptability, reflecting a perception that companies prioritized profits over community wellbeing.

Participants acknowledged a robust regulatory framework but questioned oversight effectiveness. Confidence varied significantly by region, with Saskatchewan and Newfoundland and Labrador showing higher trust, while Yukon and Quebec displayed lower confidence.

The study identified procedural fairness as a weak point. Only one-third of respondents felt they could meaningfully participate in mining decisions. This perceived lack of involvement undermined public trust, emphasizing that social acceptability depended on both outcomes and process quality.

Environmental concerns remained central to social acceptability. About 70 percent of respondents believed mining contributed to climate change, and nearly half worried about water quality and site restoration. While acknowledging the sector’s role in energy transition, Canadians expected concrete actions to protect biodiversity and natural resources.

Indigenous respondents, particularly from First Nations, expressed higher levels of trust and acceptability, possibly due to formal agreements like impact benefit agreements. However, 44 percent of the general public believed Indigenous peoples still lacked sufficient influence in mining decisions, underscoring the need for stronger Indigenous leadership in resource governance.

“The mineral wealth of Canada includes gold, copper, high-purity iron, potash, uranium, lithium and rare earth elements. This positions the country as a key global supplier of the technologies driving the transition to clean energy and supporting both our national interests and those of our allies,” Marc-Olivier Fortin, co-author of the report, said, emphasizing Canada’s strategic position.

The study’s findings came as the federal government announced a $2-billion Critical Minerals Sovereign Fund, demonstrating a commitment to bolstering Canada’s role in the global critical minerals market.

For the mining industry, the Barometer offered a roadmap for enhancing public trust and social acceptance. It emphasized the need for transparent communication, community engagement, and demonstrable commitment to sustainable practices. As Canada aims to lead in critical minerals supply for clean energy transition, the sector faces both opportunities and challenges in aligning with public expectations and national priorities.

The full report, available at www.TransfertConsult.ca/en/barometer, provided detailed analysis and recommendations for the mining sector to navigate the complex landscape of public opinion and regulatory expectations in the years ahead.

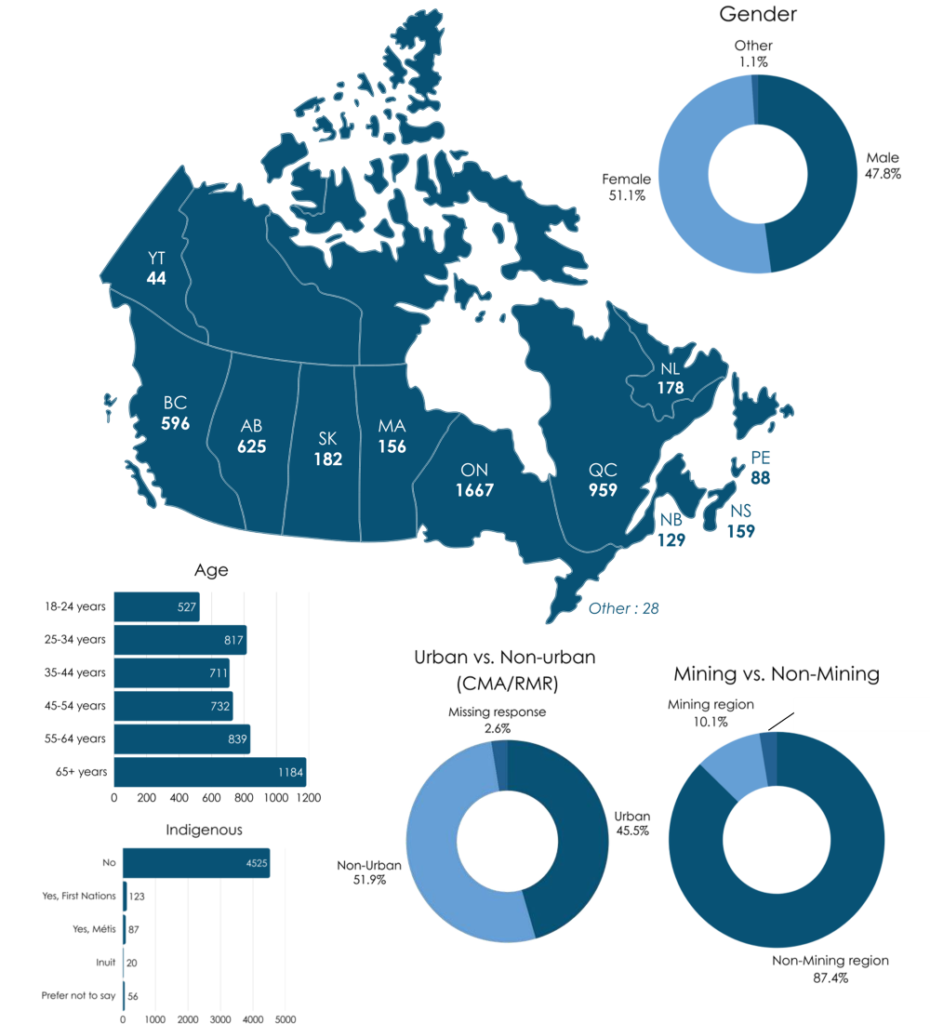

Researchers employed a specialized national research panel to gather data, revealing the survey topic only after participants opted in. They completed 5,490 surveys, retaining 4,811 after data cleaning for analysis. All respondents were adults aged 18 or older from across Canadian provinces.

The study targeted samples from major mining provinces like British Columbia and Quebec, specifically including both mining and non-mining regions. This approach allowed for meaningful comparisons within and across provinces.