Support CleanTechnica’s work through a Substack subscription or on Stripe.

Through the last few months, we’ve been working on a project for a Latin American Zero-Emission Observatory (ZEMO). And by “we,” I mean myself and the team at FIER Automotive, a company committed to build a more sustainable future that currently operates the European Alternative Fuels Observatory (EAFO).

ZEMO is now online and has detailed information on 13 Latin American countries, and a webinar on its launch will take place on November 18th. You’re all kindly invited to check the website and participate on the webinar.

A big part of the work has been to collect and organize comprehensive regional data, and with that, a new possibility has come up: to write large-scale reports about the Latin American region! This is why, starting now, we will be publishing a new report for Latin America every quarter, bringing the latest news and a general overview on how the regional market is developing.

The Scope of ZEMO

As of October 2025, ZEMO has detailed information on 13 countries in the region: Argentina, Brazil, Chile, Colombia, Costa Rica, Ecuador, El Salvador, Guatemala, México, Panamá, Paraguay, Perú, and Uruguay, as seen in the following map:

Despite still missing a few Latin American countries (and all of the Caribbean), the countries accounted for represent more than 98% of the total regional market (including ICEVs and EVs). This means that we can be pretty certain that the trends reported here are representative through the whole of Latin America:

A small comment here: PHEV data is incomplete, since we lack numbers for Costa Rica, Ecuador, El Salvador, Guatemala, Panama, and Uruguay (which merge all hybrids in one category). However, we know that outside of Ecuador, sales are very sparse (all hybrids account for less than 5% market share in both Uruguay and Costa Rica), and even in Ecuador, they are unlikely to add more than 500 units a month (and probably many fewer), so the discrepancies shouldn’t be too high.

ZEMO’s objective goes beyond EV sales data, aiming to further research charging infrastructure, compile public policy, and become a hub for regional cooperation in the search for cleaner, more sustainable transportation. For now, only EV sales data is publicly available, but remain attentive for new things to come!

Regional Market Overview

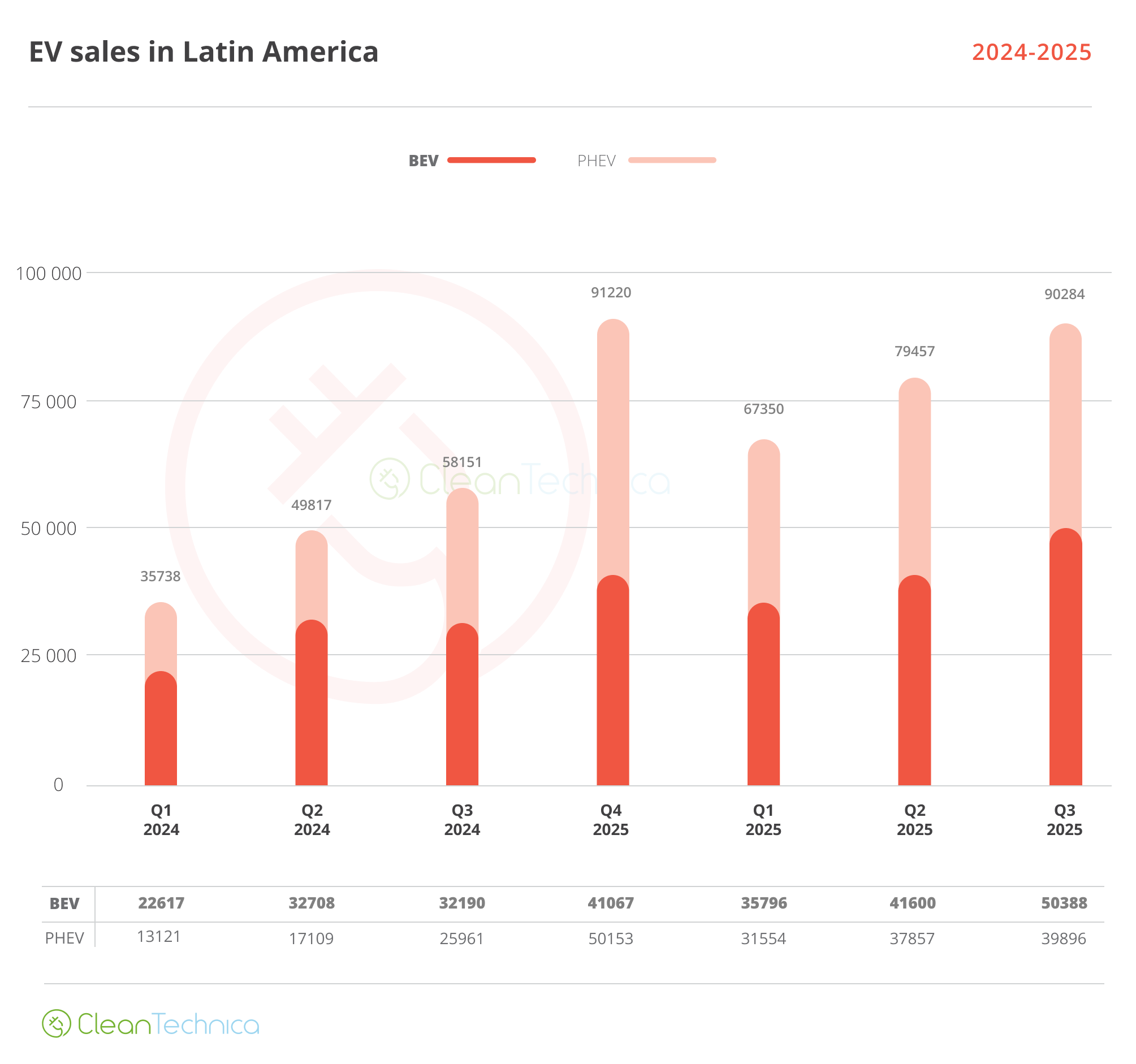

EV sales in Latin America have been rising steadily. Every single market with available information has shown growth through this year. Q3 2025 represents a 55% increase over the same period last year, whereas year-to-date sales have increased by 65%. Both EVs and PHEVs show growth, but PHEVs are growing slightly faster, probably a result of the size of Brazil’s PHEV-friendly market.

(Just in case, PHEV data include EREVs.)

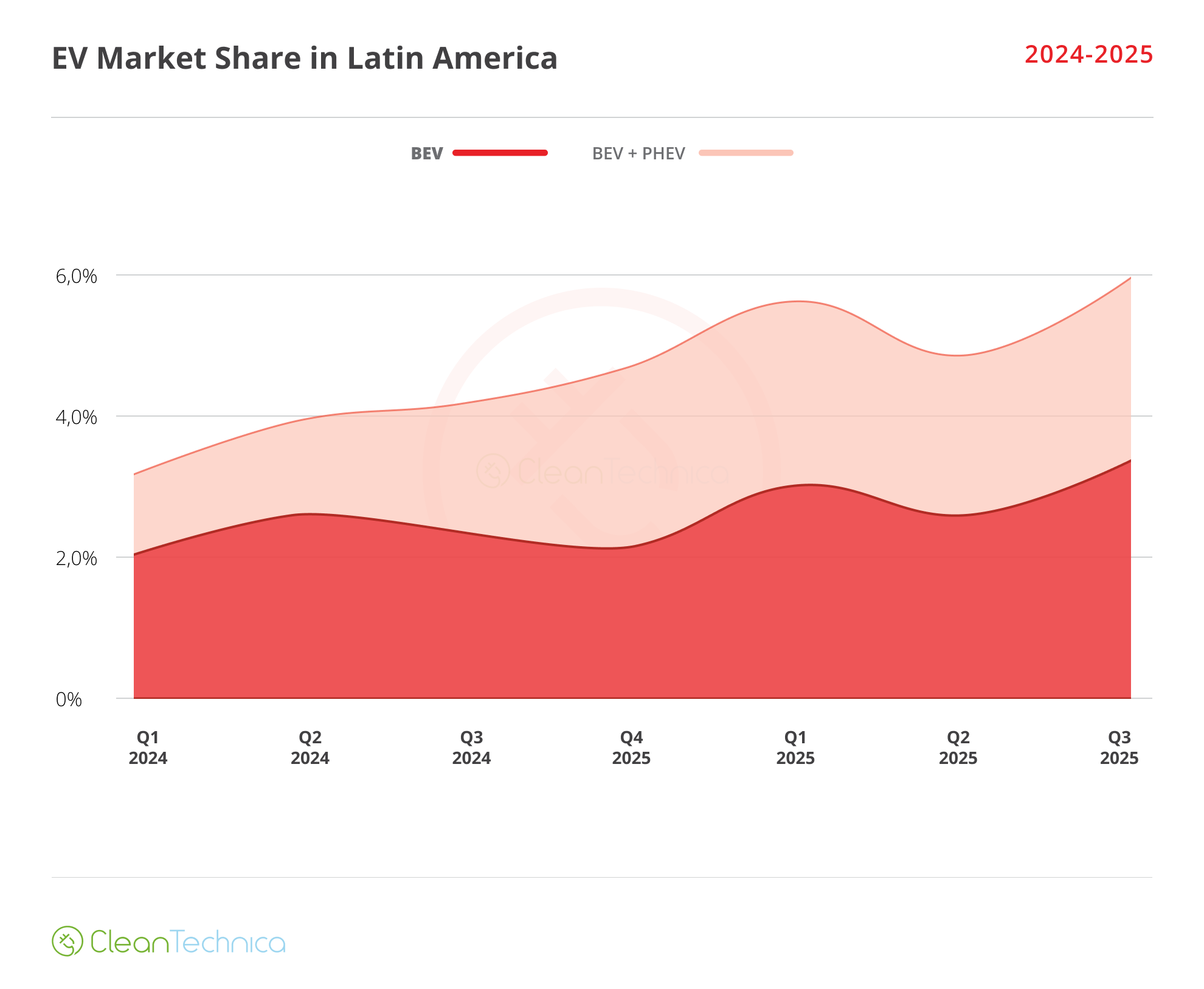

Market share has also grown, going from 4.2% in Q3 2024 to 6% in Q3 2025. The market is pretty balanced between BEVs and PHEVs, with 55% for the former and 45% for the latter. Though, it’s good to take into account that Brazil and Mexico remain significantly more friendly towards PHEVs, whereas most smaller countries tend to prefer BEVs. However, there’s a recent offensive with long-range EREVs, normally available with 100 to 150 km of range, and at a very similar price to both BEV and ICEV equivalent models, so their numbers could increase in the coming months.

At 6% market share (3.3% BEV), Latin America remains far behind Europe, China, and Oceania, and likely also behind Southeast Asia (given the size of Thailand, Vietnam, and Indonesia). However, the region remains a growing market for EVs, ahead of India (which counts as a region by itself), Japan, and perhaps not too far from the US once we see the hangover from the end of the tax discount for EVs.

Country Comparison

Of course, not all countries run at the same speed. Latin America has massive differences within, the leaders (Uruguay and Costa Rica) boasting a market share more than 100 times higher than the laggards (Argentina and El Salvador). Argentina in particular remains the only medium-sized market without significant electrification, bringing the regional average down.

Given the size of their respective markets, Brazil and Mexico unsurprisingly lead the region in overall EV sales, followed by Colombia, Uruguay, and Costa Rica — that these two very small countries can stand in the top 5 is a testament to their very high market shares. Meanwhile, on the other side of the chart, Argentina is the only large country with the dubious honor of remaining below 1000 quarterly sales, with even Ecuador (a market 1/5th the size) surpassing that amount.

Overall, the discrepancies are immense. The two leaders (Uruguay and Costa Rica) stand well above 15% market share and are in a league of their own. Following, Colombia and Brazil are getting close to 10% EV share, though in the case of Brazil largely thanks to PHEVs. Ecuador, Mexico, and Chile hover around 5% EV/3% BEV market share, making them the “middle of the pack” countries, whereas the laggards can be divided into those at least trying (Paraguay, Guatemala) and those with only a symbolic EV presence.

Notable Mentions & Final Thoughts

Costa Rica and Uruguay both warrant a notable mention. These small countries have shown that EV adoption can be spearheaded by means of societal support and a bit of taxes on fuel: neither of them (or any other Latin American country, for that matter) has subsidies on EVs that serve to promote the technology, making their transitions all the more impressive as well as fiscally sustainable. In Costa Rica in particular, a local association of EV owners (ASOMOVE) has been key to promoting EV adoption with very little public funding, based only upon the country’s known preference for environmental solutions.

I’ve written in the past few months on how Uruguay has surpassed Costa Rica to become the new EV leader. Well, it seems that Costa Rica won’t go down without a fight, as the two countries had very similar market shares in October (~25%), and due to Uruguay’s lower market share in the first semester, their yearly totals are also close. The race for Latin America’s EV leadership position in 2025 will be a close one.

Both Colombia and Brazil have shown significant EV growth, placing record after record in recent months. However, because the overall market is booming in both countries, market share has been slow to rise, struggling to reach 8% in Brazil and 10% in Colombia. However, the momentum is good and EVs are getting more competitive by the day, so next year, if the overall market ends its boom (which is likely), EV market share should rise rapidly.

Brazil and Mexico remain the industrial powerhouses of Latin America, but whereas Brazil’s strategy (to attract Chinese investment into its heavily protected market) has largely succeeded, Mexico’s strategy (to serve as Legacy Auto’s EV hub to enter the US market) has collapsed under Trump-enacted tariffs. Claudia Sheinbaum, Mexico’s president, has pivoted to a different route: building a locally developed platform for affordable, mass market EVs (Olinia), which should enter production next year, so we’ll see how that goes. Meanwhile, Brazil’s Seagull has been a success and BYD’s plant in the country is developing a subcompact pickup truck based upon the BYD Song to compete in the same segment as the Ford Maverick. Though, for now, there are no details on the specifications.

Several countries with low market share, including Guatemala, El Salvador, Peru, and Panama, present tepid growth rates, meaning they’re unlikely to close the gap with their neighbours anytime soon. Peru and Chile both are affected by the relative affordability of ICEVs in their respective markets, and in Peru EVs are also more expensive than in other countries in the region, but still, Peru’s market conditions should be good enough for market share to be well over 1%, and not stuck at 0.5%.

Speaking about Chile, the country may remain relatively low on personal EV sales, but electric buses are crushing it, getting around 40% market share through the first three quarters of 2023. Chile is advancing faster than any other country in the region in the electrification of its public transportation, and one city (Copiapó) already owns a 100% electric bus fleet.

Argentina remains the ultimate frontier for EVs, sharing an abysmal 0.15% market share with El Salvador despite having a decently sized market of around half a million yearly units. However, the main factor that has previously depressed EV sales — high tariffs on imported vehicles — seems to matter less in 2025, as Argentina President Javier Milei has reduced tariffs on imports into the country, and also since a BYD factory in Brazil has started local production of the Seagull (and Argentina allows Brazilian imports through the Mercosur). We still have to wait to see if this will have a significant impact in the country in the short term, but, hey, at least they’re finally above 0.1% market share.

At last, there’s one country that I’m really interested in but which I have found no recent data for: Bolivia. I mentioned previously that the country is facing a severe gasoline crisis, which has continued through 2025. The crisis means that EV sales are booming just as ICEV sales are cratering, but we have no idea by how much. Bolivia closed 2024 at 0.5% BEV market share, and surpassed 3% already in the first two months of 2025, but since then we don’t know how high it has risen. Fuel crisis can cause significant pain and will no doubt provide a much higher motivation for switching to an EV than environmental concerns or fuel costs, so I expect Bolivia to rise fast, perhaps enough to gain a place on the podium in 2026 … if we manage to find data about EV sales in the country, of course.

Overall, Latin America remains a region of EV growth, and even if some markets present lackluster growth, others are booming and will remain interesting to focus on in the future. I expect that the schism between leaders and laggards will increase over the next few years, as some countries in the region fully embrace new technologies whereas others remain stuck in the past. It’s important to note that this transition has largely happened without public support (other than previously existing environmental restrictions on traffic), meaning it is largely an organic transition that should not face the hurdles other regions have had, including China in 2019, Europe in 2023–2025, and the US nowadays.

Still, there’s a very real opportunity here to build joint knowledge in the region based upon the very diverse experiences I’ve outlined above. In this sense, we propose ZEMO as a platform for regional collaboration and cooperation so that Latin America may be able to better organize and promote a transition to cleaner, more sustainable transportation.

And remember, November 18th. Save the date.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy