Support CleanTechnica’s work through a Substack subscription or on Stripe.

Overall, to me, Tesla’s financial trends don’t look good. However, there were some clear positives in Tesla’s 3rd quarter report as well. Additionally, even though Tesla’s financial trends look bad, the company does still have $41 billion in the bank, so there is no risk of bankruptcy or anything like that. It’s just that several key trends are in the wrong direction, and certainly don’t seem to justify Tesla being a massive “growth stock.”

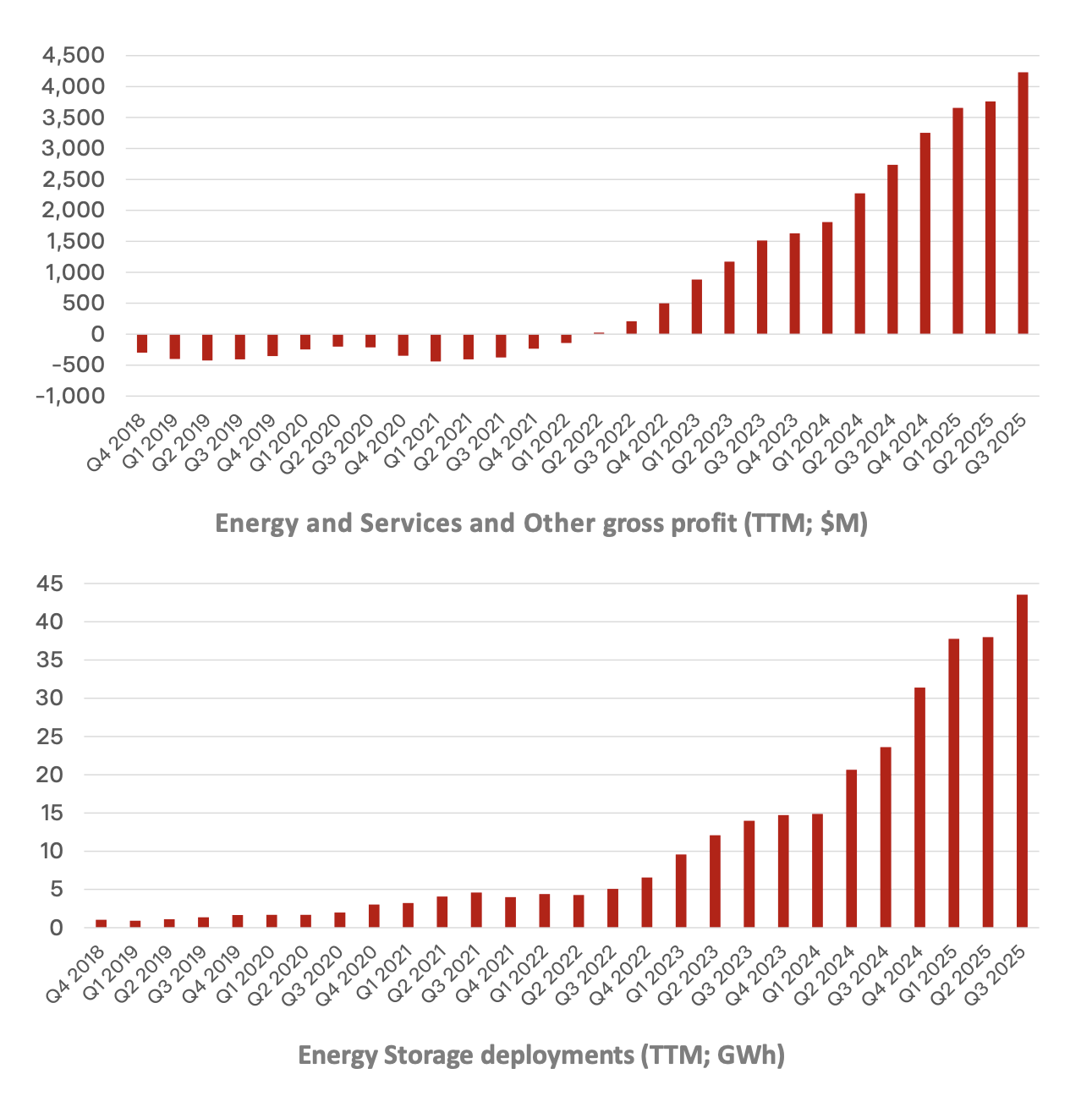

- Tesla’s biggest growth percentage in its financial and operational summaries was the 81% growth of energy storage deployed in the 3rd quarter year over year. Deployment rose from 6.9 GWh in Q3 2024 to 12.5 GWh in Q3 2025. On a related note, “energy generation and storage revenue” was up 44% year over year. This is all due in part to the growing role of energy storage on the grid, and that’s expected to continue. Notably, while the solar energy tax credit was also axed by Republicans, there’s a much longer phaseout period than there was for EVs. So, one could expect a continued boom for energy storage deployment in the next few quarters.

- The biggest percentage growth in the financial summary was year-over-year free cash flow growth. It was up 46% from $2.742 billion in Q3 2024 to $3.99 billion in Q3 2025. That was after two quarters of well under a billion of free cash flow. One big note here is that capital expenditures were down a lot, by about $1.3 billion, year over year. “Free cash flow (FCF) is the amount of cash that a company has left after accounting for spending on operations and capital asset maintenance. Investors and analysts rely on it as one measurement of a company’s profitability,” as Investopedia summarizes. Making almost $4 billion in free cash flow is clearly a positive thing.

- Adding on to #1, another part of the business that was up year over year was “services and other revenue.” This rose by 25% compared to Q3 2204. So, like an auto dealership, it seems Tesla is making more and more of its money on service. But what about “other” — what’s that?

- One thing that “other” must be is Supercharging revenue. Despite the big kerfuffle about Elon Musk briefly wiping out Tesla’s Supercharger team and halting Supercharging station expansion, Supercharger deployment has steadily grown. In Q3 2025, the number of active supercharging stations grew by 16%, from 6,706 a year prior to 7,753. That’s significant growth in one of the key areas of Tesla’s business that it still holds a strong competitive advantage in. Supercharger connectors themselves grew from 62,421 in Q3 2024 to 73,817 in Q4 2025, an 18% increase.

- For that matter, Tesla also continue to grow its number of locations worldwide, going from 1,306 in Q3 2024 to 1,498 in Q3 2025, a 15% increase.

- Tesla’s “cash, cash equivalents and investments” were up 24% year over year, strongly boosted by Bitcoin’s rising price. However, one need not say that if Bitcoin goes strongly in the other direction, this figure will suffer.

- Lastly, total revenue was up 12% year over year, to a record $28.095 billion, partly on the back of that surge in vehicle sales as the US tax credit came to an end, but also due to the aforementioned increase in storage deployment. Automotive revenues were up 6%, but on a slightly lower average selling price, as vehicle deliveries were up 7%.

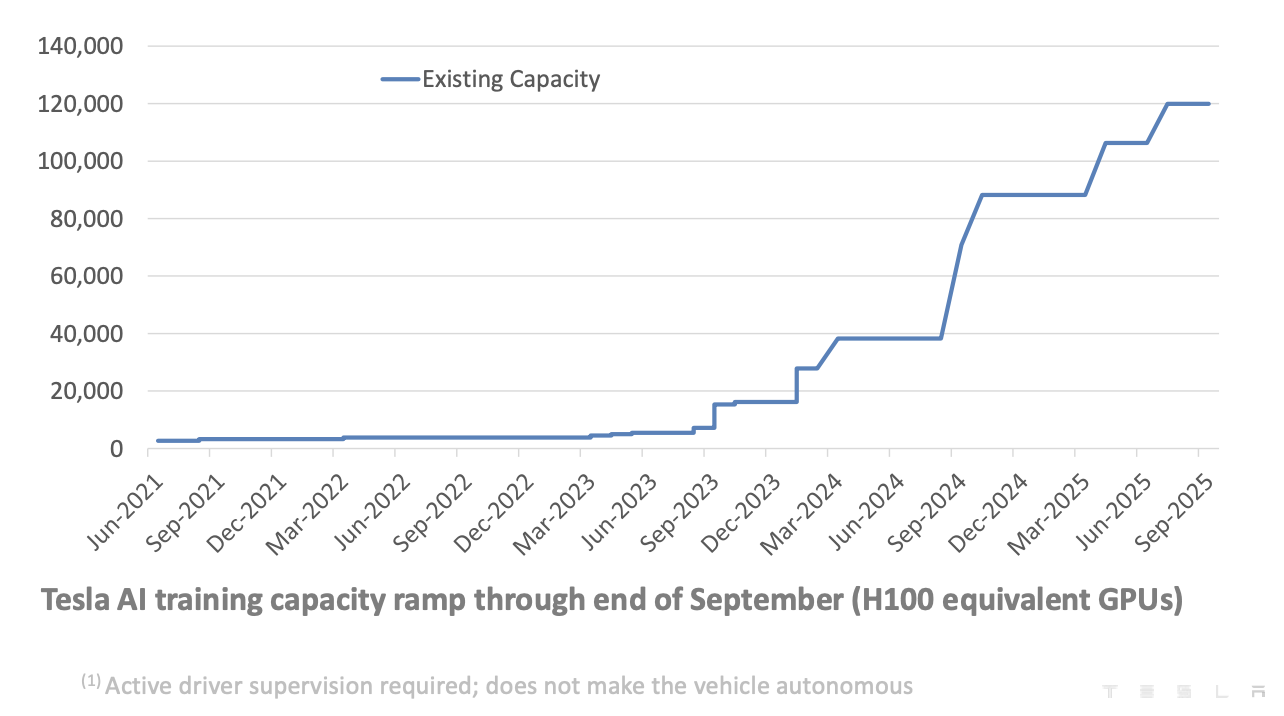

Is there anything else I missed? Tesla also highlighted its AI training capacity growth, but from my perspective, that can be seen as a positive or a negative. If you believe Tesla is going in the right direction here, it’s a positive. However, for the time being, it’s a growing money suck, and that is a problem if it ends up not delivering on the hype.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy